Did you know that companies have an alternative to IPOs for raising capital? Have you heard about the term ‘OFS in the stock market? It involves the sale of existing shares by promoters or large shareholders without raising new capital. IPOs, on the other hand, represent a company’s first stock sale to the public. While both present investment opportunities, they come with distinct characteristics. OFS vs IPO, how do they actually differ and which is better?

Let us take a look!

What is OFS in the Stock Market?

OFS full form- Offer for Sale

An Offer for Sale (OFS) is a method used by promoters or existing shareholders of a listed company to sell their shares to the public.

Introduced by India’s securities market regulator SEBI in 2012, it’s a simpler and faster alternative to a Follow-on Public Offer (FPO).

OFS in the stock market is when existing shareholders/ promoters sell their shares directly to the public.

They’re not creating new shares but offering the ones they already own.

It’s like selling something you own to someone else, but in this case, it’s shares of a company.

So, when you hear about OFS in the stock market, it means current shareholders are selling their shares to investors like you.

Here’s how it works:

- Eligibility

Only promoters or shareholders holding more than 10% of the share capital can initiate an OFS.

- Process

NSE and BSE stock exchange platforms conduct OFS in stock market. This allows for a transparent sale process.

- Allocation

A portion of the shares is often reserved for retail investors and sometimes offered at a discount.

- Duration

The OFS window is open for just one trading day, making it a quick process compared to FPOs.

- Pricing

The floor price for the OFS is usually set at a discount to the current market price to attract investors.

The OFS method is particularly favoured for its efficiency and ability to quickly adjust the promoter’s holding to meet regulatory requirements.

Key highlights of the Offer for Sale- OFS in stock market, as outlined in the SEBI circular

- Eligibility:

- OFS facility is available on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE).

- Size of Offer:

- Minimum offer size of ₹25 crores, but can be less to achieve minimum public shareholding.

- Advertisement and offer expenses:

- The seller bears all expenses related to OFS.

- Risk Management:

- The clearinghouse collects 100% of the order value in cash from non-institutional investors.

- An upfront margin is required for bid modification/cancellation.

- Allocation

- A minimum of 25% of shares are reserved for mutual funds and insurance companies.

- No single bidder (excluding mutual funds and insurance companies) allocated more than 25% of the offer size.

What is an IPO?

An Initial Public Offering (IPO) is when a company decides to sell its shares to the public for the first time.

It is the process by which a private company becomes publicly traded by offering its shares to the public for the first time.

This transition allows the company to raise capital from public investors, which can be used for expansion, paying off debt, or other corporate purposes.

It’s like a company’s debut on the stock market.

Here’s how it works:

- When a company wants to grow and needs money to do so, it might decide to go public through an IPO.

- They hire investment banks to help them determine the value of their shares and sell those shares to investors.

- Investors like us can buy these shares during the IPO. It’s a chance for us to own a piece of the company.

- Once the IPO is done, the company’s shares start trading on the stock market.

That means they can go up or down in value based on how well the company is doing.

So, an IPO is like a big event where a company invites everyone to become part-owners by buying its shares for the first time.

What is the Key Difference Between IPO and OFS?

An IPO involves a private company issuing new shares to the public to raise fresh capital. OFS in the stock market involves existing shareholders selling their shares without raising new capital for the company.

Offer for Sale (OFS)

- Existing shareholders or promoters sell their shares directly to the public.

- OFS is all about selling existing ones.

- It’s like selling something you already own, such as shares of a company, to someone else.

- The company doesn’t directly benefit financially; it’s the shareholders who receive the proceeds from the sale.

- OFS is typically faster and simpler compared to IPOs since there’s no need to go through the process of creating new shares.

Initial Public Offering (IPO)

- A company offers its shares to the public for the first time.

- New shares are sold to investors, which means the company raises capital.

- IPO represents the company’s big debut on the stock market. Here, where investors have the chance to buy shares and become part-owners.

- IPOs involve a more complex process. This includes determining the value of the shares and complying with regulatory requirements.

- The company directly benefits by raising funds. It can use IPO proceeds for various purposes like expansion, paying off debts, or research and development.

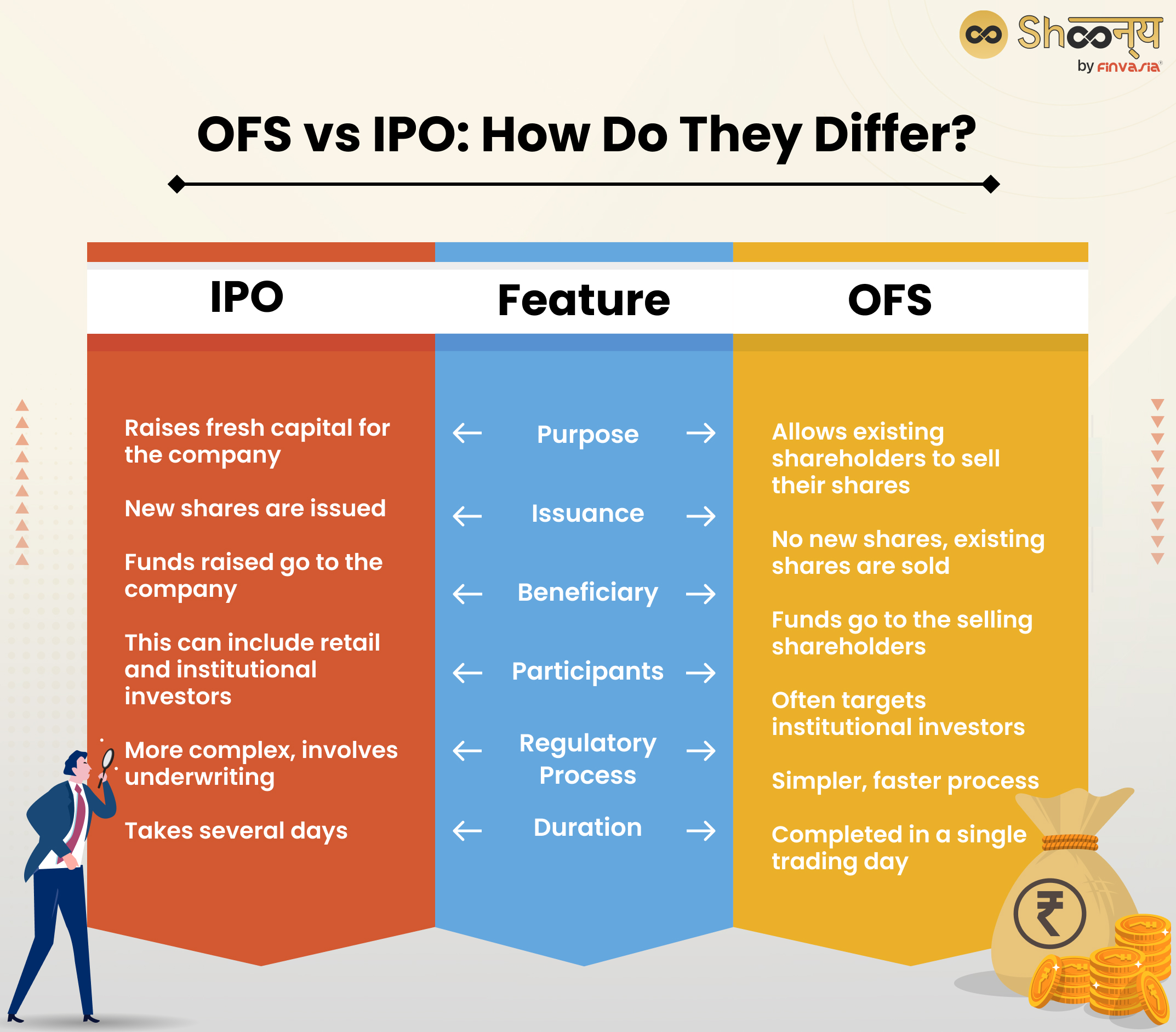

OFS vs IPO: How Do They Differ?

| Feature | IPO | OFS |

| Purpose | Raises fresh capital for the company | Allows existing shareholders to sell their shares |

| Issuance | New shares are issued | No new shares, existing shares are sold |

| Beneficiary | Funds raised go to the company | Funds go to the selling shareholders |

| Participants | This can include retail and institutional investors | Often targets institutional investors |

| Regulatory Process | More complex, involves underwriting | Simpler, faster process |

| Duration | Takes several days | Completed in a single trading day |

This table effectively summarises the key differences between Initial Public Offerings (IPOs) and Offer for Sale (OFS).

OFS vs IPO: Which is Better?

IPOs offer the chance to be part of a potentially growing company from an early stage. On the other hand, OFS provides an opportunity to invest in a company with established market performance. Both have merits and risks, and the better option depends on individual investment strategies and market conditions.

FAQs| OFS vs IPO

An IPO is a company’s first sale of stock to the public, an FPO is an additional stock issued by a public company, and an OFS is the sale of shares by existing shareholders.

An OFS can potentially reduce the share price if the market perceives it as a negative signal or if it increases the supply of shares without changing demand.

Investing in IPOs can be beneficial if the company has strong fundamentals and growth potential, but it also carries risks due to limited historical data and potential market volatility.

Source- sebi.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.