Income Tax for Salaried Employees: Tax Slabs, Forms & Deductions – 2025

Are you paying more taxes than necessary? Income tax for salaried employees is full of opportunities to save. However, most of the salaried employees miss out on valuable tax-saving opportunities simply because they don’t know where to look.

When it comes to income tax for salaried classes, there is so much to know—HRA, 80C, 80D, and more. Understanding these components can help you save taxes effectively.

But how do you choose the best tax regime? How do you determine your income tax slab? And are you using those income tax deductions for salaried employees, right?

In this article, we’ll walk you through everything you need to know about filing your taxes in 2025.

You’ll learn about the latest updates for the assessment year 2025-26, choose the right ITR form for a salaried person, and use an income tax calculator to estimate your tax liability.

Let’s begin!

The Importance of Tax Planning for Salaried Employees

Tax planning is something every salaried employee should pay attention to. It’s more than just filling out ITR forms—it’s about ensuring you’re not paying more than you need to. By understanding how income tax for salaried employees works, you can certainly take advantage of income tax deductions.

But knowing the income tax slab for salaried class is the first thing. The tax slab you fall under will determine how much you owe, and with the new changes coming for FY 2025-26, it’s essential to stay updated.

It could save you a lot more than you think!

Latest Updates for the AY 2026-27: Income Tax for Salaried Employees

If you’re a salaried employee, the latest changes in income tax slabs for FY 2025-26 are already here. The finance minister, Nirmala Sitharaman, has made some key updates to the Union Budget for 2025. These changes apply to the new tax regime, which will begin on April 1, 2025.

Here’s what you need to know about the new income tax slabs and the tax-saving options for salaried class!

What Are the New Tax Slabs?

Under the new tax regime, the tax slabs for IR filing for salaried employees for FY 2025-26 have completely changed:

- Rs 0 to Rs 4 lakh: No tax

- Rs 4 lakh to Rs 8 lakh: 5% tax

- Rs 8 lakh to Rs 12 lakh: 10% tax

- Rs 12 lakh to Rs 16 lakh: 15% tax

- Rs 16 lakh to Rs 20 lakh: 20% tax

- Rs 20 lakh to Rs 24 lakh: 25% tax

- Above Rs 24 lakh: 30% tax

The biggest benefit?

You can now save up to Rs 1.14 lakh in taxes during the financial year.

Tax Rebates (ITR for Salaried Class) in AY 2026-27

The tax rebate under Section 87A has also increased to Rs 60,000. This means if your income is up to Rs 12 lakh, you could pay zero taxes!

Previously, the limit for zero tax was only Rs 7 lakh, with a rebate of Rs 25,000.

Additionally, the basic exemption limit for taxes has been raised from Rs 3 lakh to Rs 4 lakh, meaning you won’t have to pay tax on incomes up to Rs 4 lakh.

The deduction for salaried persons that you could claim under the new tax regime, like the standard deduction of Rs 75,000 from your salary and 14% of basic salary for NPS contribution, remain unchanged.

Also, there are no changes in the surcharge applied to income tax under the new tax regime.

Tax Slabs for AY 2025-26- Old Tax Regime vs. New Tax Regime

The key difference between the old and new tax regimes is the availability of tax deductions. Under the new tax regime, you cannot claim common deductions for salaried classes like those for health insurance or savings account interest.

In the old tax regime, the basic exemption limit depends on your age:

- Below 60 years: Rs 2.5 lakh

- 60 years and above: Rs 3 lakh

- 80 years and above: Rs 5 lakh

You must choose between the two regimes when you file your Income Tax Return (ITR).

If you have business income, the new tax regime is the default, but you can opt for the old tax regime by filling out a specific form (Form 10-IEA).

Old Tax Regime vs New Tax Regime:

Old Tax Regime: Allows you to claim various tax deductions and exemptions.

New Tax Regime: This does not allow these deductions but offers simpler tax slabs.

How to Switch:

If you’re a non-business taxpayer, you can choose your tax regime each year when filing your tax return.

Tax Slabs for Salaried Employees Below 60 Years

Income Range | Old Tax Regime | New Tax Regime |

| Up to ₹2,50,000 | No Tax | No Tax (Up to ₹3,00,000) |

| ₹2,50,001 – ₹5,00,000 | 5% | 5% above ₹3,00,000 |

| ₹5,00,001 – ₹7,00,000 | 20% | 5% above ₹3,00,000 (Rebate available) |

| ₹7,00,001 – ₹10,00,000 | 20% | 10% above ₹7,00,000 |

| ₹10,00,001 – ₹15,00,000 | 30% | 15% above ₹10,00,000 |

| Above ₹15,00,000 | 30% | 30% |

- Surcharge applies for income above ₹50 lakh.

- Rebate under section 87A makes income up to ₹7 lakh tax-free in the new regime.

Tax Slabs for Salaried Employees- Senior Citizens (60-79 Years)

| Income Range | Old Tax Regime | New Tax Regime |

| Up to ₹3,00,000 | No Tax | No Tax |

| ₹3,00,001 – ₹5,00,000 | 5% | 5% above ₹3,00,000 |

| ₹5,00,001 – ₹7,00,000 | 20% | 5% above ₹3,00,000 (Rebate available) |

| ₹7,00,001 – ₹10,00,000 | 20% | 10% above ₹7,00,000 |

| ₹10,00,001 – ₹15,00,000 | 30% | 15% above ₹10,00,000 |

| Above ₹15,00,000 | 30% | 30% |

Tax Slabs for Salaried Employees- Super Senior Citizens (80+ Years)

| Income Range | Old Tax Regime | New Tax Regime |

| Up to ₹5,00,000 | No Tax | No Tax |

| ₹5,00,001 – ₹7,00,000 | 5% | 5% above ₹3,00,000 |

| ₹7,00,001 – ₹10,00,000 | 20% | 5% above ₹3,00,000 (Rebate available) |

| ₹10,00,001 – ₹15,00,000 | 20% | 10% above ₹7,00,000 |

| Above ₹15,00,000 | 30% | 15% above ₹10,00,000 |

| Above ₹15,00,000 | 30% | 30% |

Income Tax Deductions for Salaried Class You Might Be Missing

If you are a taxpayer in India, you can claim tax deductions on certain investments, payments, and incomes.

Here are the deductions available for the salaried class under both the New and Old Tax Regimes.

Income Tax Deductions for Salaried Employees- New Tax Regime (Section 115BAC)

1. Home Loan Interest (Section 24(b))

If you have taken a loan for buying or constructing a house that is rented out, you can claim a deduction on the entire interest amount paid. There is no upper limit.

2. Pension Contribution (Section 80CCD(2))

If your employer contributes to the Central Government Pension Scheme on your behalf, you can claim:

- 14% of salary (for Central/State Govt. employees)

- 10% of salary (for private-sector employees)

3. Agnipath Scheme (Section 80CCH)

If you are enrolled in the Agnipath Scheme and contribute to the Agniveer Corpus Fund, you can claim:

- Full deduction of the amount you contribute.

- Full deduction of the amount contributed by the Central Government.

Income Tax Deductions for Salaried Employees- Old Tax Regime

Home Loan Interest (Section 24(b))

- Deduction up to ₹ 2,00,000 for self-occupied properties (if loan taken after April 1, 1999).

- ₹ 30,000 deduction for self-occupied property loans taken before April 1, 1999.

Deductions under Chapter VIA

- Section 80C, 80CCC, 80CCD(1): ₹ 1,50,000 deduction for investments in Life Insurance, PPF, NSC, ELSS, tuition fees, and home loan principal repayment.

- Section 80CCD(1B): Additional ₹ 50,000 deduction for contributions to the National Pension Scheme (NPS).

- Section 80CCD(2): Employer’s NPS contribution deductible (10% for private, 14% for government employees).

- Section 80CCH: Deduction for contributions to Agniveer Corpus Fund under the Agnipath Scheme.

Health Insurance (Section 80D)

- ₹ 25,000 deduction for self/spouse/children (₹ 50,000 for senior citizens).

- ₹ 25,000 deduction for parents’ health insurance (₹ 50,000 if parents are senior citizens).

- Preventive health check-up included (₹ 5,000 limit).

- ₹ 50,000 deduction for senior citizen medical expenses (if no health insurance).

Medical Expenses for Disability & Diseases

- Section 80DD: ₹ 75,000 deduction for medical expenses of disabled dependents (₹ 1,25,000 for severe disability).

- Section 80DDB: ₹ 40,000 deduction for treatment of specified diseases (₹ 1,00,000 for senior citizens).

Education Loan (Section 80E)

- Deduction on interest paid on education loans (for self/spouse/children).

Additional Home Loan Interest Deductions

- Section 80EE: ₹ 50,000 deduction on home loan interest (for loans sanctioned between FY 2016-17).

- Section 80EEA: ₹ 1,50,000 deduction for first-time homebuyers (for loans sanctioned between FY 2019-22).

Electric Vehicle Loan (Section 80EEB)

- ₹ 1,50,000 deduction on interest paid for EV loans (loan sanctioned between FY 2019-23).

Donations (Section 80G)

- 100% or 50% deduction for donations to prescribed funds/charities.

- Donations to research/social organizations eligible for 100% deduction.

- Cash donations above ₹ 2,000 are not eligible for deduction.

Rent Paid (Section 80GG)

- For individuals without HRA: Deduction is the least of the following:

- Rent paid – 10% of total income

- ₹ 5,000 per month

- 25% of total income

- Form 10BA must be submitted to claim this deduction.

Interest Income Deductions

- Section 80TTA: ₹ 10,000 deduction on savings bank interest (for non-senior citizens).

- Section 80TTB: ₹ 50,000 deduction on deposit interest (for senior citizens).

Political Party Donations (Section 80GGC)

- 100% deduction for donations made to political parties or electoral trusts.

Disability Benefits (Section 80U)

- ₹ 75,000 deduction for disabled taxpayers.

- ₹ 1,25,000 deduction for severe disability (80% or more).

- Form 10-IA is recommended for filing.

Tax Saving Options for Salaried

- Section 80C: You can claim deductions up to ₹1,50,000 for investments in savings schemes like the Public Provident Fund (PPF), Life Insurance Premiums (LIC), and more.

- Section 80D: Up to ₹25,000 for health insurance premiums. (₹50,000 for senior citizens)

- Section 80TTA: Up to ₹10,000 deductions on interest earned from savings accounts.

- Section 80CCD(1B): Additional ₹50,000 deduction on contributions to the National Pension Scheme (NPS).

If your taxable income is up to ₹5,00,000, you can also get a rebate under Section 87A, meaning you don’t have to pay any tax.

ITR Forms for Salaried Individuals for AY 2026-27

How to Choose the Right ITR Form & File Taxes Easily?

| Form | Who Can Use It? | Applicable Conditions |

| ITR-1 (SAHAJ) | Resident Individual (other than Not Ordinarily Resident) | No Tax |

| ITR-2 | Individual & HUF | 5% above ₹3,00,000 |

| ITR-3 | Individual & HUF | 5% above ₹3,00,000 (Rebate available) |

| ITR-4 (SUGAM) | Resident Individual, HUF, or Firm (other than LLP) | 10% above ₹7,00,000 |

Other ITR Form for Salaried Person

| Form | Provided By | Details Provided |

| Form 12BB | Employee to Employer | Evidence of HRA, LTC, Interest on Home Loan, and Tax Saving Investments for TDS calculation. |

| Form 16 | Employer to Employee | Salary details, deductions, exemptions, and TDS certificate. |

| Form 16A | Deductor to Deductee | Quarterly TDS Certificate for Income other than Salary. |

| Form 67 | Taxpayer | Details of foreign income and Foreign Tax Credit claim. |

| Form 26AS | Income Tax Department | Tax Deducted/Collected at Source, Advance Tax, Refund details. |

| AIS (Annual Information Statement) | Income Tax Department | Tax payments, SFT transactions, GST details, foreign government information, etc. |

| Form 15G | Resident Individual (below 60 years) / HUF / Other Entities | Declaration to avoid TDS on Interest Income if income is below the basic exemption limit. |

| Form 15H | Resident Individual (60 years or more) | Declaration to avoid TDS on Interest Income for senior citizens. |

| Form 10E | Employee to Income Tax Department | For claiming tax relief u/s 89(1) on Salary paid in arrears or advance, Gratuity, Pension, etc. |

You can download these ITR forms for salaried classes from https://www.incometax.gov.in.

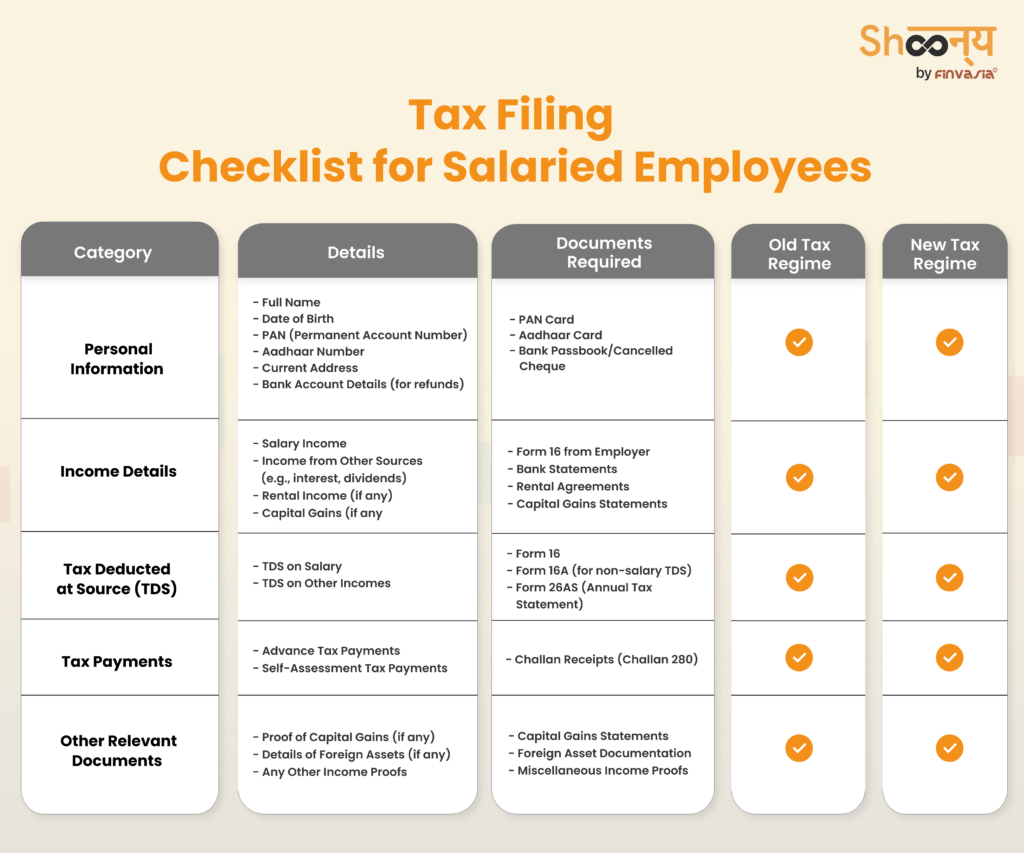

ITR Filing Checklist for Salaried Employees

Before you begin filing your ITR, make sure you have all the necessary documents and details ready. Here’s a quick checklist to help you stay organised and avoid mistakes.

How to File ITR for Salaried Employees

Here’s a simple step-by-step guide on how to file income tax return online for salaried employees to help you through the process:

1. Register on the e-Filing Portal

You need to visit the Income Tax Department’s e-filing portal (https://incometaxindiaefiling.gov.in) and create an account. All you need is your PAN, email, and mobile number.

2. Log In

Once you’re registered, log in with your credentials—your User ID, password, and captcha code.

3. Choose the Right ITR Form for Salaried Person

The form you need depends on your income and tax situation.

- ITR-1 (Sahaj): For salaried individuals or those with one house property, agricultural income (up to ₹5,000), and income from other sources like interest.

- ITR-4 (Sugam): For those with business income under presumptive taxation schemes (sections 44AD, 44ADA, or 44AE).

4. Pre-fill Data

The portal can help by pre-filling details like your salary, TDS, and interest income from Form 26AS. Make sure to review and update this information if needed.

5. Fill in Any Extra Details

If you have deductions for salaried employees, class under sections like 80C (e.g., PPF, life insurance), 80D (health insurance), or others, make sure to add them.

6. Review and Validate

Before submitting your ITRs, take a moment to double-check everything. Ensure your income and deduction details are correct.

7. Calculate and Pay Tax

Once all details are filled, the portal will automatically calculate your tax. If you owe any, pay it online using net banking or other available options.

8. Submit Your Return

After checking everything, submit your return. Don’t forget to e-verify it through Aadhaar OTP, net banking, or a digital signature.

9. Get Your Acknowledgment

Once you submit, the portal will generate an ITR-V acknowledgement. You need to e-verify it to complete the process.

Common Mistakes to Avoid While Filing ITR for Salaried Employees

The right tax strategy can put more money in your pocket—are you making the most of it?

Here are some common mistakes that people usually make, and you can avoid them while filing your ITR online!

- Filing the Wrong ITR Form for Salaried Person

Choosing the right ITR form for salaried persons is crucial. If you have only salary income, ITR-1 is usually the right choice. However, if you have business income or multiple income sources, you may need ITR-2 or ITR-4.

- Forgetting Income Sources

Make sure to include all income sources when filing your ITR for a salaried person. Apart from your salary, income from fixed deposits, stocks, or side businesses should be reported. Missing any income can lead to penalties.

- Wrongly Claiming Deductions

Claiming income tax deductions for salaried employees incorrectly can cause issues with your tax return. Ensure that deductions under sections 80C, 80D, and other tax-saving options for salaried employees are applied correctly.

- Not Matching with Form 26AS

Always cross-check your income details and TDS with Form 26AS. Also, don’t forget to download Form 16 for salaried employees, as it contains important tax details needed for filing your return.

- Missing the Deadline

Delaying your tax filing can result in penalties. If you’re wondering how to file an ITR for a salaried person, you should explore the steps mentioned above. You must use an income tax calculator to estimate your tax liability before submission.

Filing on time ensures compliance and lets you enjoy the benefits of filing ITR for salaried employees like easier loan approvals and refund claims.

Things to Keep in Mind While Filing ITR for Salaried Person

- Don’t wait until the last minute to gather documents like Form 16, Form 26AS, and any proof for deductions. The more prepared you are, the smoother the process will be.

- Always double-check everything—especially your income, deductions, and bank details. It’s easy to make a small mistake, and you don’t want that.

- E-verifying your return is quick and easy. Do it right after you submit to complete the process faster.

- The earlier you file, the less stressful it is. Plus, you’ll have more time to correct any mistakes before the deadline.

Just stay organised, avoid rushing, and you’ll be all set!

Assisted Income Tax Return Filing

Do you know?

The Income Tax Department has introduced new features and services on its e-filing portal to make filing ITRs and statutory forms more user-friendly. The portal includes a Wizard to guide users in selecting the correct ITR, pre-filled ITRs, and a new offline utility to ease the compliance burden. Other helpful features include a chatbot and step-by-step guides with user manuals and videos.

Additionally, if you need more assistance, you can add a Chartered Accountant (CA), e-Return Intermediary (ERI), or any authorized representative to help with ITR filing or related services.

Who Can Assist You?

1. Chartered Accountant (CA)

To add a CA:

- Add and assign a CA via the e-filing portal (using the ‘My CA’ service).

- You can also remove or withdraw a CA through the same portal.

2. e-Return Intermediary (ERI)

e-Return Intermediaries (ERIs) are authorised intermediaries who help file income tax returns (ITRs) and perform other services for taxpayers. There are three types of ERIs:

- Type 1 ERIs: Use the Income Tax Department’s utilities for filing ITRs.

- Type 2 ERIs: Use their own software to file returns through the e-filing portal.

- Type 3 ERIs: Develop offline utilities to file ITRs.

To add an ERI:

- Add an ERI via the ee-filingportal (using the ‘My ERI’ service).

- You can activate, deactivate, or remove an ERI.

3. Authorized Representative

An Authorized Representative acts on your behalf when you’re unable to attend to your tax-related matters, such as when you’re abroad or unavailable.

To add an Authorized Representative:

- Add the representative via the e-filing portal using the ‘Authorize/ Register as Representative’ service.

If you’re unable to act for other reasons (e.g., estate management, company liquidation), a designated person can register to act on your behalf.

Conclusion

This ends our detailed guide on how to file income tax return for salaried employees. You now have clarity on tax slabs, deductions for salaried persons, and ITR filing options.

Stay updated, use tax-saving options, and make the most of your hard-earned money.

Income Tax Deductions for Salaried Employees: FAQs

Salaried employees can claim deductions like HRA, standard deduction, 80C, 80D, and home loan interest.

You can download Form 16 from your employer’s portal or request it directly from the HR/payroll department.

Salaried employees can file ITR online through the Income Tax e-filing portal by uploading Form 16 and verifying details.

Salaried individuals typically file ITR-1 (Sahaj) or ITR-2 if they have capital gains or multiple income sources.

They can save tax by investing in 80C instruments, claiming HRA, NPS contributions, home loans, and medical insurance.

You can use an online income tax calculator by entering salary, deductions, and exemptions to estimate payable tax.

Filing ITR helps in tax refunds, availing loans, visa applications, and maintaining financial records.

Source- TheEconomicsTimes , Incometax.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.