Persistent Systems Ltd History, Market Cap & Revenue Insights (2025)

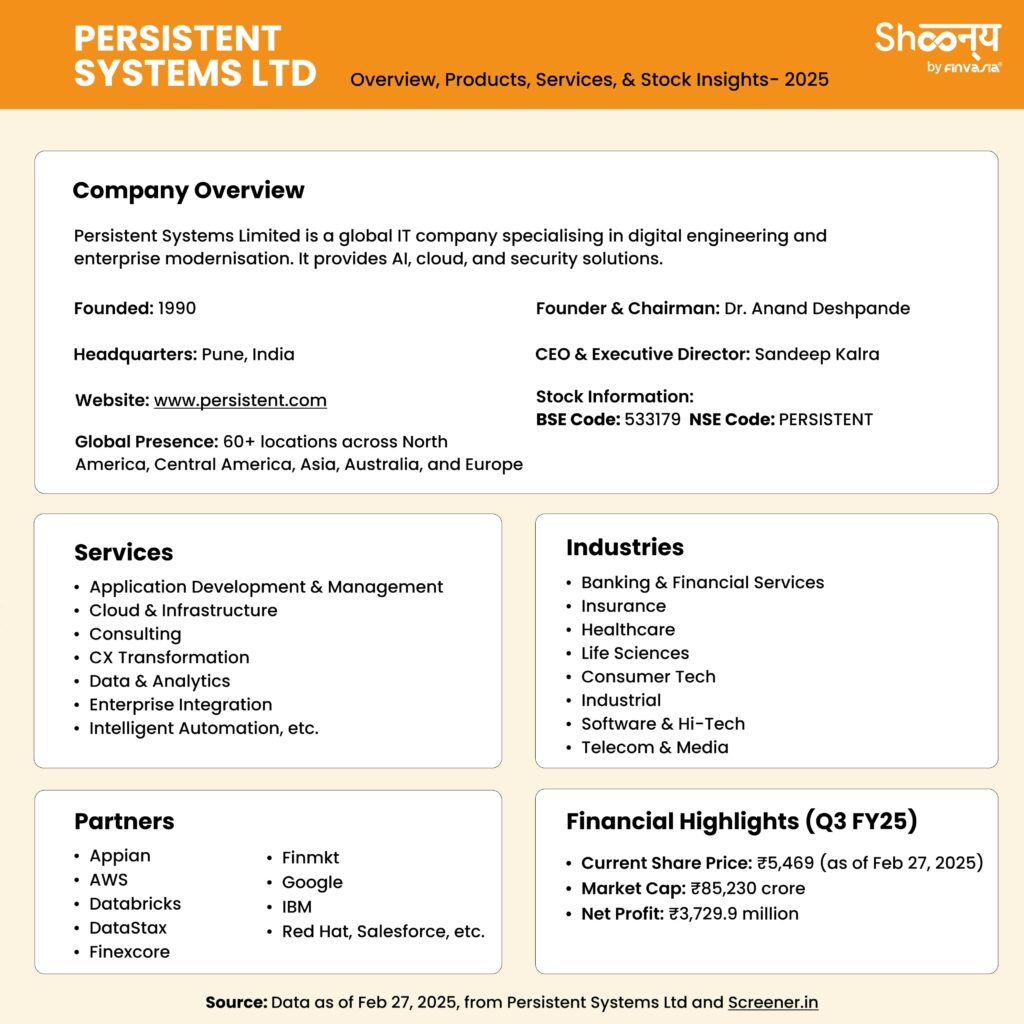

Persistent Systems Ltd. has carved its place among India’s top 10 NIFTY IT companies, ranking 7th with a market cap of ₹85,313.92 crore as of February 27, 2025. With a strong foundation in AI, cloud, and enterprise modernisation, the company continues to drive digital transformation across industries. From a Pune-based startup in 1990 to serving across borders, Persistent Systems Ltd. has built a reputation for excellence. With strong financials and cutting-edge innovation, Persistent IT company remains a name to watch.

Who founded this leading IT company, and how did it all begin? Let’s dive into the fascinating Persistent Systems history today!

Persistent Systems History: From 1990 to 2025

35+ Years of Growth, Innovation, & Global Success!

Inspired by a call from India’s Department of Electronics for individuals working in the U.S. to establish software export companies in India, Anand Deshpande decided to return to India.

While working at HP Labs in the U.S., he asked his father, Dada Deshpande, to incorporate a company on his behalf. Thus, on May 30, 1990, Persistent Systems Ltd. was officially incorporated.

Setting up a software company in India wasn’t easy due to infrastructure challenges. However, in March 1991, Persistent IT company secured its first office—a 350-square-foot space at the Software Technology Park in Pune. It was also the first company to be incorporated as part of STPI (Software Technology Parks of India).

Persistent’s first contract was with Gip Altto Technologies, a French company specialising in object databases. This contract marked the beginning of Persistent Limited history in product development.

A small project from Microsoft in 1992 became a turning point, giving the team confidence to approach other leading technology companies. Many of these early clients remain Persistent’s customers today.

With the internet revolution in the mid-90s, Persistent Sytems Ltd quickly expanded from its initial space to a new office at Senapati Bapat Road, Pune, setting up Kapilvastu in 1994. The company also began hiring fresh graduates from IIT Bombay and top colleges in Pune.

By 1999, Persistent System salesforce reached 100 employees, and the company introduced its ESOP (Employee Stock Ownership Plan).

Towards the end of 1999, Intel 64 Fund became Persistent’s first external investor, helping the company cross ₹10 crore in revenue for the first time.

As the tech industry evolved, Persistent decided to focus on product development and outsourcing rather than traditional IT outsourcing.

Persistent System Limited History- Key milestones during this period:

- 1998: The Panini office became operational.

- 2001: Offices Bhagirath, Aryabhatta, and Pingala were constructed.

- Expansion beyond Pune: Opened centers in Goa and Nagpur.

- Persistent Systems Salesforce growth: Reached 1,000 employees.

- Persistent Systems Revenue milestone: Crossed ₹100 crore.

Persistent’s rapid growth attracted Silicon Valley venture capital firms, Norwest Venture Partners and Gabriel Venture Partners, which invested in the company.

Persistent received the NASSCOM Innovation Award, solidifying its reputation as a leader in software product engineering.

With increasing contributions towards CSR (Corporate Social Responsibility), Persistent set up the Persistent Foundation to focus on education, healthcare, and community development.

The company launched its IPO, becoming one of the first companies to go public in India after the global financial crisis. This established Persistent as a global brand.

By 2010, the Persistent Systems salesforce surpassed 5,000 employees, and revenue crossed ₹1,000 crore.

Want to invest in Persistent Systems Ltd shares? Open a free Demat account today and start trading!

Persistent Systems Ltd- Q3 FY25 Financial Highlights

With businesses worldwide undergoing digital transformation, Persistent is ever-shining!

- Persistent Systems Revenue in INR: ₹30,622.8 million (5.7% Q-o-Q growth, 22.6% Y-o-Y growth)

- EBITDA: ₹5,378.4 million (17.6% margin, 11.9% Q-o-Q growth, 21.7% Y-o-Y growth)

- PAT: ₹3,729.9 million (12.2% margin, 14.8% Q-o-Q growth, 30.4% Y-o-Y growth)

- Interim Dividend: ₹20 per share

Persistent IT company also secured key recognitions in 2025, including:

- 2024 ISG Star of Excellence™ Overall Award

- 20+ new patents filed for SASVA™ (AI-powered software development platform)

- Recognition by Microsoft CEO Satya Nadella for the co-developed ContractAssIst solution

- AA+ (Stable) credit rating by ICRA

- Inclusion in the Dow Jones Sustainability World Index

From its beginnings in 1990 to becoming a global digital transformation leader in 2025, Persistent Systems has continually innovated, evolved, and expanded.

With a strong foundation in software product engineering, AI-driven solutions, and a commitment to sustainability, Persistent is well-positioned.

Today, Persistent Systems Ltd. is a global solutions provider driving digital business acceleration and modernisation for enterprises worldwide.

About Persistent Systems Limited

Persistent Systems Limited is a global Digital Engineering and Enterprise Modernization company. With deep technical expertise and industry experience, the company helps businesses with innovative solutions. It partners with clients across industries like Banking & Financial Services, Insurance, Healthcare, Life Sciences, Software & Hi-Tech, and Telecom & Media.

Persistent Systems Ltd Industries:

Banking & Financial Services, Insurance, Healthcare, Life Sciences, Consumer Tech, Industrial, Software & Hi-Tech, Telecom & Media.

Persistent Systems Ltd Products and Services:

Application Development & Management, Cloud & Infrastructure, Consulting, CX Transformation, Data & Analytics, Enterprise Integration, Enterprise IT Security, Experience Transformation, Global Capability Centers, Intelligent Automation, Persistent.AI, Open Source Hub, Software Product Engineering.

Partners of Persistent Systems Ltd.:

Appian, AWS, Databricks, DataStax, Finexcore, Finmkt, Google, IBM, Mambu, Microsoft, OutSystems, Red Hat, Salesforce, ServiceNow, Snowflake, Software AG, UiPath, Zscaler.

Marketplaces of Persistent Systems Ltd.:

Cloud & Infrastructure, Data & Analytics, Business Applications, CX Transformation, Modernization & Digital Transformation, Enterprise Applications & Integrations, Enterprise IT Security, Internet of Things (IoT).

The Persistent Systems headquarters is located in Pune, India, with operations worldwide.

- Persistent Systems products include proprietary AI-driven platforms, cloud solutions, and automation frameworks.

- The Persistent Systems market cap, as of February 27, 2025, stands at ₹85,230 Cr, reflecting its strong industry position.

- The Persistent Systems Ltd share price, as of February 27, 2025, is ₹5,469, with a 52-week high of ₹6,789.

Persistent Systems Limited: Commitment to ESG and Sustainability

Persistent Systems is dedicated to environmental, social, and governance (ESG) goals, ensuring sustainable growth. The company achieved carbon neutrality ahead of schedule, reducing 42% through wind and solar energy.

With a strong focus on diversity, 29.5% of its workforce are women, and over 29,000 lives have been impacted through CSR initiatives.

Governance remains a key strength, with 7 out of 10 independent directors and 99% compliance in Code of Conduct training. Persistent Systems Limited maintains zero data breaches and a high customer satisfaction score (NPS 69, CSAT 88%).

Recognised for its ESG efforts, Persistent has received awards like the Golden Peacock Award for Corporate Governance and has been named one of India’s Top 50 Most Sustainable Companies by Business World.

Persistent Systems Limited: Commitment to Communities

Persistent Systems actively supports global communities through its Persistent Foundation, focusing on education, healthcare, and community development. During the COVID-19 pandemic, the company pledged over $3 million to relief efforts worldwide.

Persistent also supports sustainability initiatives, achieving ISO certifications for quality, environment, and information security management. Through its global efforts, the company continues to drive social impact and corporate responsibility.

Persistent Systems Ltd: FAQs

Persistent Systems Ltd specialises in AI-driven digital transformation, cloud computing, and enterprise modernisation, serving 260+ clients globally. Its market cap is ₹85,230 Cr as of Feb 27th, 2025.

Persistent Systems share price has seen strong growth, hitting an all-time high of ₹6,788.90 in December 2024. As of February 28, 2025, it trades at ₹5,199.

As of February 27, 2025, Persistent Systems Ltd’s share price stands at ₹5,469, with a 52-week high of ₹6,789. The stock price is driven by revenue growth, new client wins, and advancements in AI-led digital transformation.

Persistent Systems is headquartered in Pune, India.

In Q3 FY25, Persistent reported a revenue of ₹30,622.8 million, marking a 22.6% year-on-year growth.

As of February 27, 2025, Persistent’s market cap stands at ₹85,230 Cr, ranking it among India’s top 10 IT firms.

Persistent offers AI-powered platforms, cloud computing solutions, intelligent automation tools, and enterprise IT security frameworks.

Source: Presistent

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.