Income Tax for Non-Resident Individuals: Slabs, Forms & Deductions: 2025

Did you know that as a Non-Resident Indian (NRI), you might still have tax obligations in India? Many NRIs assume that since they live abroad, Indian tax laws don’t apply to them. However, under the Income Tax for Non Resident rules, if you earn income from Indian sources—whether it’s rent from property, fixed deposits, or capital gains from investments—you may be classified as a Non-Resident Taxable Person and be required to pay taxes. Additionally, there are multiple tax savings options for non residents.

The Non-Resident in Income Tax category follows a different set of rules compared to Indian residents. The applicable Income Tax Slab for Non-Resident individuals varies based on the type of income earned and the duration of stay in India.

Let’s explore the income tax slabs for non resident taxable persons, deduction for non resident along with the benefits of filing ITR for non resident.

Latest Updates for the AY 2026-27: No Changes in NRI Tax Residency Rules in the New Income Tax Bill 2025

The New Income Tax Bill 2025, introduced in Parliament on February 13, keeps the existing tax residency rules unchanged. This is good news for Non-Resident Indians (NRIs), as there were concerns that those earning ₹15 lakh or more in India while not paying taxes abroad might be reclassified as residents instead of “Residents but Not Ordinary Residents” (RNOR). However, the bill confirms that such individuals will continue to be RNOR, meaning only their income from India will be taxed.

Who is Considered a Tax Resident in India?

A person is a tax resident in India if they:

- Stay in India for at least 182 days in a financial year, OR

- Spend at least 60 days in a financial year and have stayed in India for 365 days or more in the last four years.

Special Rules for NRIs:

- NRIs visiting India and Indian citizens going abroad for work or as ship crew are exempt from the 60-day rule.

- If NRIs visiting India earn more than ₹15 lakh (excluding foreign income), the 60-day rule changes to 120 days.

Exceptions:

- For Indian citizens and Persons of Indian Origin (PIOs) visiting India, the 60-day rule is extended to 182 days.

- For Indian citizens leaving India as crew members or for overseas employment, the 60-day rule is extended to 182 days.

- As per Finance Act 2020, for NRIs with total taxable income exceeding ₹15 lakh (excluding foreign income), the 60-day rule is replaced with 120 days.

- If an Indian citizen earns more than ₹15 lakh in India and is not liable to pay tax in any country, they are deemed a Resident in India under Section 6(1A).

With the bill taking effect on April 1, 2026, the government has ensured tax consistency while preventing the misuse of NRI status for tax avoidance.

Ready to Explore the Indian Market? Get Your Free Demat Account!

New Income Tax Slabs for AY 2026-27

As per the new budget declared in February 2025, here are the new tax slabs for FY 2025-26.

- Rs 0 – Rs 4 lakh: Nil tax

- Rs 4 lakh – Rs 8 lakh: 5%

- Rs 8 lakh – Rs 12 lakh: 10%

- Rs 12 lakh – Rs 16 lakh: 15%

- Rs 16 lakh – Rs 20 lakh: 20%

- Rs 20 lakh – Rs 24 lakh: 25%

- Above Rs 24 lakh: 30%

Income Tax Slab for Non Resident AY 2025-26

The Finance Act of 2024 has made the new tax regime the default system for calculating income tax. This applies to individuals, Hindu Undivided Families (HUFs), Associations of Persons (AOPs) (except cooperative societies), Bodies of Individuals (BOIs), and Artificial Juridical Persons.

Tax Slabs for Non-Resident Individuals (NRI)

Tax rates for Non-Resident Individuals vary under the Old Tax Regime and New Tax Regime (u/s 115BAC).

| Income Range (₹) | Old Tax Regime | New Tax Regime (115BAC) |

| Up to 2,50,000 | Nil | – |

| Up to 3,00,000 | – | Nil |

| 2,50,001 – 5,00,000 | 5% above 2,50,000 | – |

| 3,00,001 – 7,00,000 | – | 5% above 3,00,000 |

| 5,00,001 – 10,00,000 | 12,500 + 20% above 5,00,000 | – |

| 7,00,001 – 10,00,000 | – | 20,000 + 10% above 7,00,000 |

| 10,00,001 – 50,00,000 | 1,12,500 + 30% above 10,00,000 | – |

| 10,00,001 – 12,00,000 | – | 50,000 + 15% above 10,00,000 |

| 12,00,001 – 15,00,000 | – | 80,000 + 20% above 12,00,000 |

| Above 15,00,000 | 1,40,000 + 30% above 15,00,000 | – |

Surcharge Details (Applicable on Income Above ₹50 Lakh) Non Resident in Income Tax

| Income Range (₹) | Surcharge Rate |

| 50,00,001 – 1,00,00,000 | 10% |

| 1,00,00,001 – 2,00,00,000 | 15% |

| 2,00,00,001 – 5,00,00,000 | 25% |

| Above 5,00,00,000 | 37% |

Here are a few additional things you need to know about Income tax for non residents:

- Health & Education Cess @ 4% is applicable on tax + surcharge.

- Marginal Relief is available for incomes slightly above ₹50L, ₹1Cr, ₹2Cr & ₹5Cr.

- The enhanced surcharge (25% & 37%) is not applicable on certain capital gains (under sections 111A, 112, 112A) and dividend income.

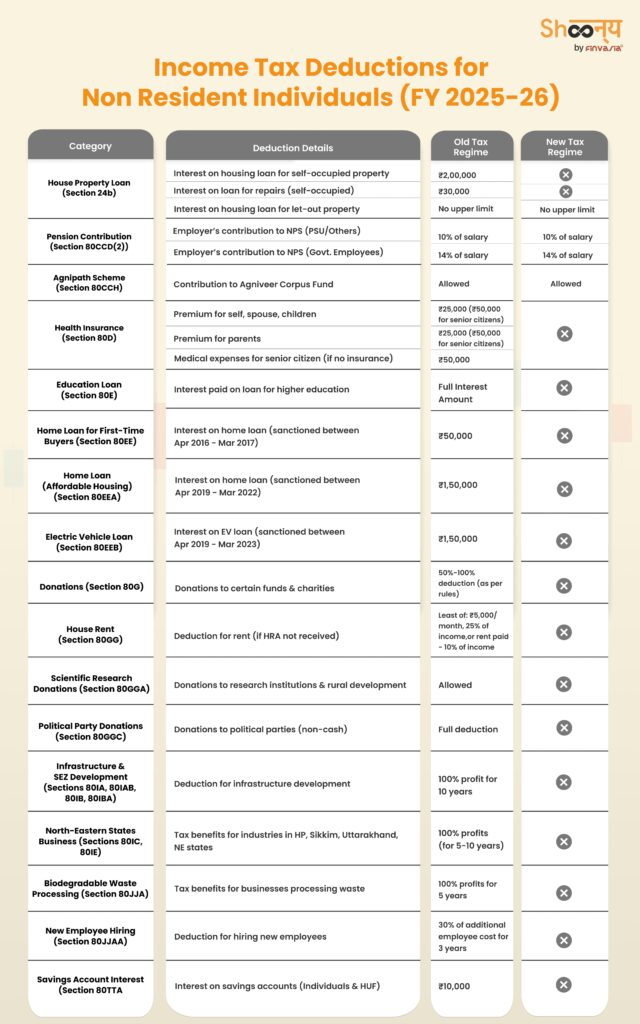

Income Tax Deductions for Non Resident: How to Save More?

Under the Old Tax Regime, non resident Indian taxpayers can claim deductions under various sections like 80C (Life Insurance, PF, Home Loan Principal), 80D (Health Insurance), and 24(b) (Home Loan Interest).

The New Tax Regime offers limited deductions, such as 80CCD(2) (Employer’s Pension Contribution) and 80CCH (Agniveer Corpus Fund). House loan interest under Section 24(b) is deductible for let-out properties without any limit.

Deductions for Non Resident Individual Available Under the New Tax Regime (Section 115BAC)

Here are the details of the deduction for non resident!

- Interest on Housing Loan (Section 24(b))

- For let-out property, the entire interest paid is deductible without any limit.

- Employer’s Contribution to Pension Scheme (Section 80CCD(2))

- Deduction for employer’s contribution to the Pension Scheme of the Central Government:

- 14% of salary (for government employees)

- 10% of salary (for private sector employees)

- Deduction for employer’s contribution to the Pension Scheme of the Central Government:

- Agnipath Scheme Contribution (Section 80CCH)

- Individuals enrolled in the Agnipath Scheme can claim a deduction for:

- Their own contribution to the Agniveer Corpus Fund.

- Central Government’s contribution to their account.

- Individuals enrolled in the Agnipath Scheme can claim a deduction for:

Deductions for Non Resident Individual Available Under the Old Tax Regime

Here are the details of the deduction for non resident under the old tax regime in India!

1. Interest on Housing Loan (Section 24(b))

- Self-Occupied Property:

- Loan taken on or after 1st April 1999:

- ₹2,00,000 (for purchase/construction)

- ₹30,000 (for repairs/renovation)

- Loan taken before 1st April 1999:

- ₹30,000 (for both purchase/construction and repairs)

- Loan taken on or after 1st April 1999:

- Let-Out Property: No limit on deduction.

2. Deductions Under Chapter VIA

- Section 80C, 80CCC, 80CCD(1) (Combined limit of ₹1,50,000)

- 80C: Life Insurance, EPF, PPF, NSC, Tuition Fees, Housing Loan Principal Repayment, etc.

- 80CCC: Annuity plans from LIC or other insurers.

- 80CCD(1): National Pension System (NPS).

- Additional NPS Deduction (Section 80CCD(1B))

- Extra ₹50,000 deduction for NPS contributions (above ₹1.5 lakh limit of 80C).

- Employer’s NPS Contribution (Section 80CCD(2))

- 10% of salary (for PSU and private sector employees).

- 14% of salary (for government employees).

- Agnipath Scheme Contribution (Section 80CCH)

- Deduction for the Agniveer Corpus Fund contribution (both self and government contribution).

- Health Insurance (Section 80D)

- Self, Spouse, Dependent Children:

- ₹25,000 (₹50,000 if any person is a senior citizen).

- Parents:

- ₹25,000 (₹50,000 if senior citizen).

- Preventive Health Checkup: ₹5,000 included within the above limits.

- Medical Expenses for Senior Citizens (If No Insurance) (Section 80D)

- ₹50,000 for self/spouse/dependent children.

- ₹50,000 for parents.

- Education Loan Interest (Section 80E)

- Deduction for interest paid on an education loan (for self or relatives).

- Home Loan Interest for First-Time Buyers (Section 80EE & 80EEA)

- Section 80EE (Loan sanctioned between 1st April 2016 and 31st March 2017): ₹50,000 deduction.

- Section 80EEA (Loan sanctioned between 1st April 2019 and 31st March 2022): ₹1,50,000 deduction.

- Electric Vehicle Loan Interest (Section 80EEB)

- Deduction of ₹1,50,000 for loan taken between 1st April 2019 and 31st March 2023.

- Donations (Section 80G & 80GGA)

- 100% or 50% deduction on donations to approved funds and charities.

- Cash donations exceeding ₹2,000 are NOT eligible.

- House Rent (Section 80GG)

- For individuals not receiving HRA.

- Deduction is least of the following:

- Rent paid – 10% of total income.

- ₹5,000 per month.

- 25% of total income.

- Donations to Political Parties (Section 80GGC)

- Full deduction for donations made via any mode except cash.

Infrastructure and Special Economic Zones (Section 80IA, 80IAB, 80IB)

- Deductions for businesses engaged in infrastructure development, power generation, and SEZs.

- 100% tax exemption for 10 years (subject to conditions).

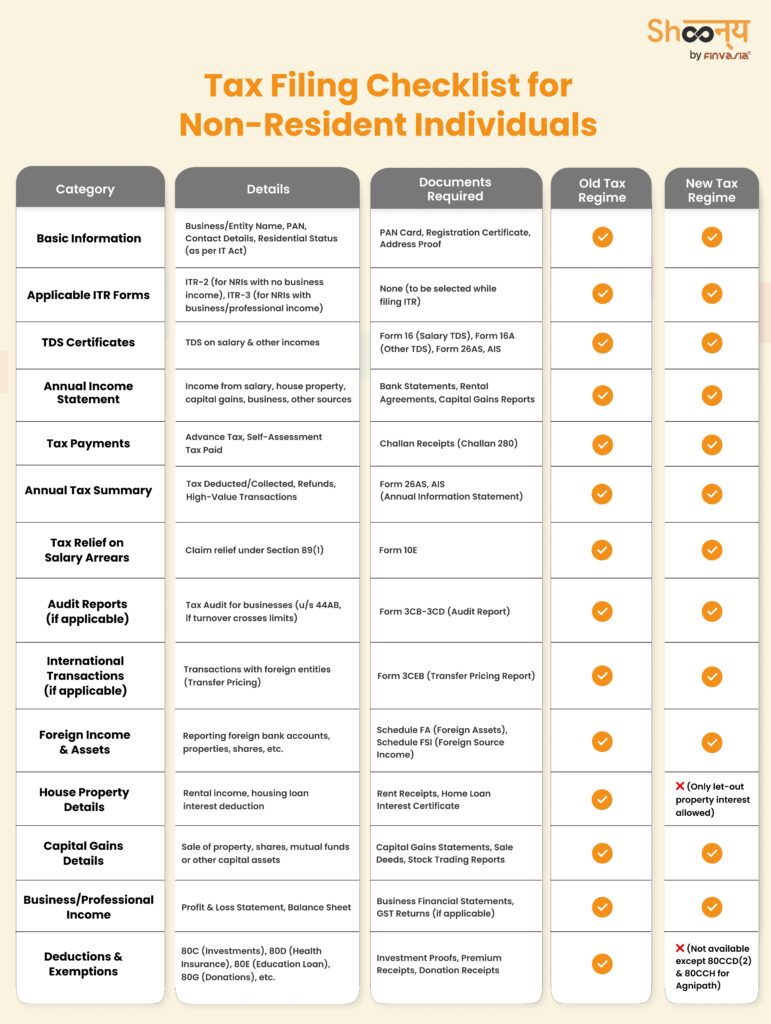

ITR Form for Non Residents: Which One to Use & When?

Forms like Form 12BB, Form 16, Form 26AS, Form 10E, Form 3CB-3CD, and Form 3CEB are essential for salaried individuals and businesses to report income, claim deductions, and comply with tax regulations. These forms help in tax calculations, audit requirements, and reporting foreign or domestic transactions as per the Income Tax Act, 1961.

1. ITR-2

Applicable to:

- NRIs and Hindu Undivided Families (HUFs)

- Individuals without business or professional income

- Those not eligible for ITR-1

2. ITR-3

Applicable to:

- NRIs and Hindu Undivided Families (HUFs)

- Individuals with business or professional income

- Those not eligible for ITR-1, ITR-2, or ITR-4

ITR Forms Applicable for Non-Resident Individuals (AY 2026-27)

Here is a tabular representation of the ITR form for Non resident Indians!

| ITR Form | Applicable For | Key Conditions |

| ITR-2 | Non-Resident Individuals & HUFs | – Not having income under the head “Profits and Gains of Business or Profession” – Not eligible for filing ITR-1 |

| ITR-3 | Non-Resident Individuals & HUFs | – Having income under the head “Profits and Gains of Business or Profession” – Not eligible for filing ITR-1, ITR-2, or ITR-4 |

ITR Form for Non Resident

| Form | Provided By | Details in the Form |

| Form 12BB | Employee to Employer(s) | Evidence or particulars of HRA, LTC, Deduction of Interest on Borrowed Capital, Tax-saving Claims/Deductions for TDS calculation |

| Form 16 | Employer to Employee | Salary paid, Deductions/Exemptions, and Tax Deducted at Source for tax computation |

| Form 16A | Deductor to Deductee | TDS Certificate for non-salary income, issued quarterly with TDS details, nature of payments, and deposited TDS |

Tax Statements

| Form | Provided By | Details in the Form |

| Form 26AS | Income Tax Department (via e-Filing Portal) | Tax Deducted/Collected at Source, Advance Tax, Self-Assessment Tax, Refunds, SFT Transactions, and TDS Defaults |

| AIS (Annual Information Statement) | Income Tax Department (via e-Filing Portal) | Tax Deducted/Collected at Source, SFT Information, Payment of Taxes, Demand/Refund, GST Info, Foreign Govt. Info, Pending/Completed Proceedings |

Note: Information on Advance Tax/SAT, Refunds, SFT Transactions, TDS under sections 194IA, 194IB, 194M, and TDS Defaults previously in Form 26AS is now available in AIS.

Other Tax Forms

| Form | Submitted By | Details in the Form |

| Form 10E | Employee to Income Tax Department | Claim relief under Section 89(1) for Arrears/Advance Salary, Gratuity, Compensation on Termination, Commuted Pension |

| Form 3CB-3CD | Taxpayer requiring audit under Section 44AB | Report of Audit of Accounts and Statement of Particulars under Section 44AB, due one month before ITR filing deadline |

| Form 3CEB | Taxpayer with international/specified domestic transactions | Report from an Accountant for transactions under Section 92E, due one month before the ITR filing deadline |

| Form 3CE | Taxpayer receiving specified income from specified persons | Report from an Accountant under Section 44DA for income by way of royalty or technical fees, due one month before the ITR filing deadline |

ITR Filing Checklist for Non-Resident Individuals

Before you begin filing your ITR for non resident, make sure you have all the necessary documents and details ready.

Here’s a quick checklist for you!

How to File ITR for Non Individual AY 2026-27

Steps to File ITR for non resident!

1 Login to the Income Tax e-Filing portal using your PAN and password.

2 Click on ‘e-File’ > ‘Income Tax Return’ and choose ITR-2 or ITR-3 as applicable.

3 Select the assessment year and mode of filing (Online is recommended).

4. Fill in the required sections:

- Personal Information – Verify your name, PAN, Aadhaar, and bank details.

- Income Details – Add salary, house property, and capital gains/business income details.

- Deductions – Claim tax benefits under Section 80C, 80D, 80G, etc.

- Tax Calculation – Review the tax payable or refund amount.

5. Click Preview & Validate your return.

6. Pay any remaining tax (if applicable).

7. Submit and e-Verify your ITR via Aadhaar OTP, Net Banking, or EVC.

5 Common Tax Mistakes Non Resident Individuals Must Avoid to Save Money

Here are five common mistakes for Non-Resident Individuals that they should avoid while handling their income tax in India:

1. Assuming No Tax Liability in India

Many Non-Resident Individuals believe they don’t have to pay tax in India if they live abroad. However, income earned from Indian sources (e.g., rent, capital gains, fixed deposits) is taxable in India. Failing to report this income can lead to tax penalties.

2. Choosing the Wrong Tax Regime

Non-Resident Individuals have the option to choose between the old and new tax regimes. The new tax regime has lower rates but fewer deductions, while the old one allows tax-saving options like 80C (LIC, PPF), 80D (Health Insurance), and 24(b) (Home Loan Interest). Selecting the wrong regime can lead to higher tax payments.

3. Ignoring the 182-Day Residency Rule

As a Non-Resident Individual, you must check your residency status each financial year. If they spend 182 days or more in India, they may be considered a resident and taxed on global income. Those earning ₹15 lakh+ in India have an adjusted limit of 120 days.

4. Not Filing ITR When Required

Even if TDS (Tax Deducted at Source) is already deducted on income, Non-Resident Individuals should file ITR to:

- Claim TDS refunds (if income is below taxable limits)

- Carry forward capital losses

- Avoid penalties for non-filing (mandatory if Indian income exceeds ₹4 lakh per year)

5. Using an NRE/NRO Account Incorrectly

Non-Resident Individuals should ensure they use the correct bank accounts for transactions:

- NRE Account: Tax-free for foreign earnings; useful for repatriation.

- NRO Account: Taxable; for income earned in India (rent, dividends, etc.).

Mixing transactions can lead to tax complications and issues during repatriation.

How to File ITR for Non Resident: Assisted Filing on the e-Filing Portal

The Income Tax Department has introduced Assisted Filing to make ITR filing easier. This includes features like a wizard to help choose the correct ITR, pre-filled forms, and a user-friendly offline tool. You can also get help from a CA, ERI, or an Authorized Representative.

Who Can Assist You?

- Chartered Accountant (CA)

- A CA is a professional accountant registered with ICAI.

- You can add, assign, or remove a CA through the My CA service on the e-Filing portal.

- A CA can help file statutory forms, verify documents, submit grievances, and more.

- e-Return Intermediaries (ERIs)

- ERIs are authorised to file ITRs on behalf of taxpayers.

- Three types:

- Type 1 & Type 2 use official IT tools or their own software.

- Type 3 creates offline tools for filing ITRs.

- You can add or remove an ERI through My ERI service on the portal.

- Authorised Representatives

- If you cannot handle tax affairs yourself (e.g., living abroad or due to legal issues), you can appoint someone to act on your behalf.

- This can be a resident-authorized person, agent, or company representative, depending on the situation.

How to Get Assistance?

- Use the e-filing portal to add, assign, or remove a CA, ERI, or Representative.

- They can help with ITR filing, document verification, and other tax-related services.

Benefits of Filing ITR for Non Resident

Even if an NRI (Non-Resident Indian) is not required to file an Income Tax Return (ITR) in India, filing it voluntarily comes with several benefits:

1. Claim Tax Refunds

If TDS (Tax Deducted at Source) was deducted on income like FD interest, rent, or capital gains, but your total income is below the taxable limit, filing ITR helps claim a refund.

2. Carry Forward Losses

If an NRI has capital losses (from stocks, property, or other investments), filing ITR allows them to carry forward these losses to offset future gains and reduce tax liability.

3. Easier Loan Approvals

ITR acts as proof of income and is often required when applying for home loans, personal loans, or business loans from Indian banks.

4. Avoid Legal Issues

Filing ITR ensures compliance with Indian tax laws and prevents any notices or penalties from the Income Tax Department.

5. Helps in Visa & Financial Transactions

Many foreign embassies and financial institutions require ITR documents as proof of financial stability when applying for visas, credit cards, or investments.

Non-Resident Taxable Person: FAQs

Yes, non-residents are taxed on income that is earned or accrued in India, such as salary for services rendered in India, rental income from properties in India, or interest from Indian bank accounts.

For NRIs, income earned outside India is not taxable in India. However, residents are taxed on their global income, including foreign earnings.

An NRI must file an ITR in India if their total income earned or accrued in India exceeds ₹4,00,000 in a financial year.

Upon returning to India, NRIs are required to re-designate or convert their Non-Resident External (NRE) and Non-Resident Ordinary (NRO) accounts to resident accounts immediately. The exact timeline may vary.

Yes, income that is earned or accrued in India by non-residents is taxable in India. This includes income from salaries, property, investments, or business operations in India.

Yes, if an NRI’s total income in India exceeds ₹4,00,000 in a financial year, they are required to file an income tax return.

Source: Incometax.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.