What is ASM in the Stock Market, and What Happens When a Stock is Under It?

Have you ever noticed a stock you’re tracking suddenly crash in price or show a message on your trading app saying “ASM applicable”? Or maybe you’re ready to place a trade, and your broker flashes a warning: “This stock is under ASM surveillance.” But what does it actually mean? What is ASM? Should you avoid it or stay invested? And most importantly, how does it affect your trading or investing decisions?

Let’s see!

What is ASM?

ASM full form is Additional Surveillance Measure.

ASM meaning is simple. It is a tool introduced by SEBI and implemented by NSE and BSE to closely monitor stocks that show abnormal price or volume behaviour.

If a stock becomes unusually volatile, shows large price jumps without any reason, or sees suspiciously high trading activity, it is flagged for surveillance under the ASM framework. This is done to alert investors and protect them from possible market manipulation.

When a stock is put under ASM, it is not a penalty or a warning against the company’s business. It is only a sign that the stock’s price movement is not matching its fundamentals or usual trading pattern, and therefore, it needs to be watched more closely.

Why Was ASM Introduced?

In Indian markets, many small-cap or mid-cap stocks often see unpredictable price movements. Sometimes, operators or large investors try to create artificial demand to pump up the price and trap retail investors. This is called a pump and dump scheme.

To stop such manipulation and reduce risk for retail traders, SEBI introduced the ASM mechanism. It works as a caution sign, alerting traders and investors that the stock is behaving abnormally and extra care should be taken.

Now, invest in stocks, bonds, IPOs, and more, with a free demat account!

Stocks Under Additional Surveillance Measures

ASM stocks are put on a watchlist if they exhibit unusual price movements, high volume variances, or other risk indicators. The purpose is to protect retail investors and maintain market integrity by reducing speculation and the potential for market manipulation.

Now, What Happens When a Stock is Under ASM?

When a stock enters the ASM list, certain restrictions are applied to make trading safer and less speculative. These include:

- Stricter trading restrictions apply: No intraday leverage (such as cover/basket orders), and stocks cannot be pledged as collateral.

- 100% margin requirement: After five days on the list, buying or selling the stock requires the full value upfront, effectively preventing margin trading.

- Tighter circuit filters: Price movement is restricted—typically to a 5% daily limit—so the stock cannot move up or down by more than this percentage in a single trading session.

- Lower trading volume likely: Reduced leverage and pledging options may lead to fewer trades, lowering liquidity.

- Normal corporate actions unaffected: Dividends, splits, or bonuses still apply as usual; being on the ASM list does not imply wrongdoing by the company or any penalty.

How Are Stocks Selected for ASM?

Stocks are not picked randomly. Exchanges follow a well-defined set of rules to decide which stocks need to be monitored under ASM.

Some of the common triggers include:

- Sharp price movement over a short period

- There is a large difference in trading volume compared to the past few weeks

- High price-to-earnings ratio compared to similar companies

- Sudden rise in derivative positions or delivery percentage

- Low market capitalisation with high volatility

Once a stock meets one or more of these criteria, it is shortlisted for ASM. A final list is published by NSE and BSE on their respective websites.

Types of ASM You Must Know

There are two primary types of ASM in the stock market: short-term and long-term, each with specific criteria and surveillance actions.

Short-Term ASM

Short-term ASM focuses on securities that show sudden price movements or abnormally high trading volumes over a short period. This kind of behaviour often indicates speculative activity. These surveillance measures are implemented to curb rapid price fluctuations and prevent possible market manipulation within a short timeframe.

Long-Term ASM

Long-term ASM applies to securities that display sustained price changes, unusual trading patterns, or fundamental weaknesses over a longer duration. These may include illiquid stocks or stocks with low market capitalisation and poor fundamentals. The purpose of long-term ASM is to control long-term risks and reduce the chances of manipulation in such counters.

ASM Stages

Both short-term and long-term ASM categories are divided into multiple ASM stages, depending on the stock’s trading behaviour and risk level.

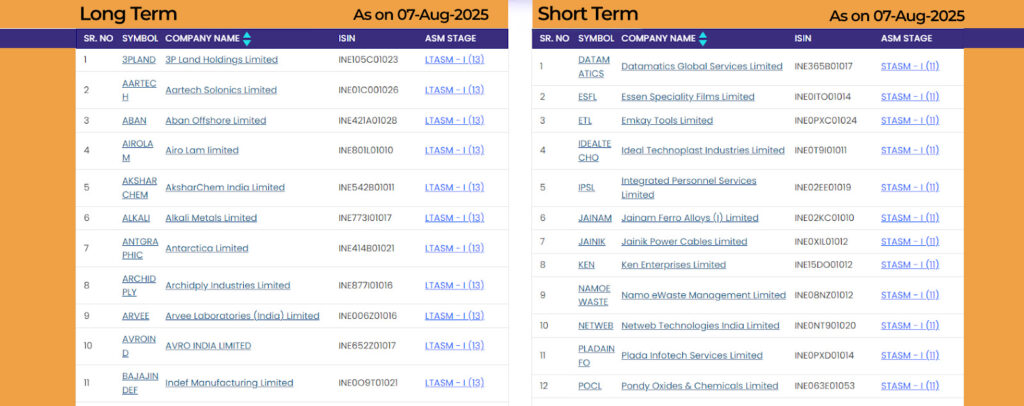

The image shows the NSE ASM list as of 7th August 2025, highlighting stocks under Long-Term and Short-Term surveillance stages.

Long-Term ASM

This is used for stocks that show risky price patterns over a longer time. Here are the stages:

Stage 1: Stocks are picked based on set rules. From the third trading day (T+3), investors must pay 100% margin, meaning they need to pay the full amount upfront to buy or sell these stocks.

Stage 2: The daily price band (how much a stock can move up or down in one day) is made tighter. 100% margin still applies.

Stage 3: The price band is reduced even more to limit sharp movements. The full margin requirement continues.

Stage 4: This is the strictest level. Trades are settled on a gross basis (no netting off, every trade is handled separately). A tight price band, like 5% is set. 100% margin remains in force.

Short-Term ASM

This is used for stocks that show sudden price spikes or heavy trading in a short period.

Stage 1: Stocks are flagged and given a chance to respond or clarify if there’s any news or reason for the movement.

Stage 2: Stocks are further reviewed and may be asked to maintain higher margins, depending on the risk.

These checks ensure that only stocks showing genuine signs of unusual activity are brought under the ASM framework.

Where Can You Find the ASM List?

Both NSE and BSE update the ASM list regularly. You can visit their official websites and look for “ASM List” under their surveillance or circulars section. The list will mention whether the stock is under short-term or long-term ASM and what stage it is in.

Is ASM Good or Bad?

ASM is not a bad thing. It is like a red flag that helps you slow down and re-evaluate. If used wisely, it can save you from making impulsive trades in risky stocks.

A stock under ASM may just be in a temporary phase of volatility or unusual activity. If the fundamentals are good and prices settle, the stock may exit ASM after review.

Through ASM, SEBI aims to maintain market stability by noticing and preventing potential manipulative activities, price distortions, or extreme speculation in identified securities. By imposing these stricter rules and regulations, ASM helps in controlling unreasonable price movements and reducing risks associated with certain company stocks.

Final Thoughts

ASM is an important part of the stock market’s safety system. It protects investors from stocks that are moving without clear reasons. Whether you are a trader or long-term investor, knowing about ASM helps you make smarter, more informed decisions.

Before you invest in any high-priced or low-volume stock, always check if it is under ASM. It could be the difference between a smart trade and a regretful one.

What is ASM | FAQs

Investing in ASM stocks is allowed but comes with restrictions like margin and lower price bands. These measures indicate higher risk and reduced liquidity.

ASM stocks are under regulatory watch for abnormal price or volume patterns. They are not banned, but buying them requires strong risk management and proper research.

ASM acts as a safeguard against speculative trading by imposing stricter norms. It helps protect retail investors from sharp price manipulation and volatility.

ASM maintains market discipline by tracking and controlling irregular stock movements. It creates a more stable and transparent trading environment.

The purpose of ASM is to alert investors about potentially risky stocks and prevent excessive speculation. It ensures fair price discovery and investor safety by SEBI.

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.