Nifty Consumer Durables Index: From Returns to Risks, Investment Process

Consumer durables are one of the most sought-after market segments given the demand for these products. Having said that, the competition is also fierce in the sector, given the numerous players in each segment. So, if anyone is interested in investing in consumer durables stocks, then they need to dig deeper into the market insights, sectoral facts and figures, and more. The first step towards doing so can be tracking the Nifty Consumer Durables index.

This article will cover all the insights about the nifty consumer durables index, its constituents, performances, factors affecting the index, risks, and many such aspects that can help you understand the index and its constituents and the overall sector as a whole.

Nifty Consumer Durables Index – Overview & Constituents

Nifty Consumer Durables Index is a 15-stock equity index which primarily used for tracking the consumer durables sector or consumer sector stocks in India. The constituting stocks from the Nifty 500 Universe that are classified as consumer durables industry stocks as per the NSE industry definitions and classification system. The index was launched on 15 January 2020.

The Nifty Consumer Durables stocks list includes: (As of 16 September 2025)

| Amber Enterprises India Ltd. |

| Bata India Ltd. |

| Blue Star Ltd. |

| Century Plyboards (India) Ltd. |

| Cera Sanitaryware Ltd. |

| Crompton Greaves Consumer Electricals Ltd. |

| Dixon Technologies (India) Ltd. |

| Havells India Ltd. |

| Kajaria Ceramics Ltd. |

| Kalyan Jewellers India Ltd. |

| PG Electroplast Ltd. |

| Titan Company Ltd. |

| V-Guard Industries Ltd. |

| Voltas Ltd. |

| Whirlpool of India Ltd. |

The top ten stocks by weightage –

| Stocks | Weight in the Index (%) |

| Titan Company Ltd. | 32.27 |

| Dixon Technologies (India) Ltd. | 16.78 |

| Havells India Ltd. | 9.94 |

| Voltas Ltd. | 8.08 |

| Blue Star Ltd. | 6.31 |

| Crompton Greaves Consumers Electricals Ltd. | 5.48 |

| Kalyan Jewellers India Ltd. | 5 |

| Amber Enterprises India Ltd. | 3.84 |

| Kajaria Ceramics Ltd. | 2.60 |

| Whirlpool of India Ltd. | 2.08 |

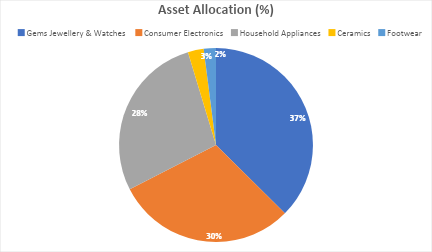

Sub-Sectoral Asset Allocation

| Sub-Sectors | Asset Allocation (%) |

| Gems Jewellery & Watches | 36.63 |

| Consumer Electronics | 29.39 |

| Household Appliances | 27.29 |

| Ceramics | 2.58 |

| Footwear | 1.99 |

Selection Criteria

The eligibility or selection criteria for the constituent stocks of the Nifty Consumer Durables index include –

- The stocks of the Nifty Consumer Durables index have to be from the Nifty 500 universe

- The stocks of the Nifty Consumer Durables index have to be from the consumer durables sector only. It should be according to the Common Industry Classification Structure.

- Free float market capitalisation of the companies will be used for the final selection of the 15 stocks

Factors Affecting the Nifty Consumer Durables Index

The consumer durables industry depends on many factors, which in turn also influence the Nifty Consumer Durables index. Let’s look at the top reasons that can make this index volatile –

- Economic Growth: The primary factor that influences the consumer durables industry is the economic condition of the country. If a nation is growing at a good pace, its consumer durables sector will boom.

- Disposable income level: This takes us to disposable income lying with the people, which determines most of the consumer durable companies’ fate and so of the consumer durables index. If the disposable income is high, then usually the demand for consumer durable products increases, boosting the companies and the overall sector, and vice versa.

- Inflation: Now, disposable income is dependent on inflation to a great extent. Even if you have a good, regular income, if the inflation level is high, you are left with less disposable income. This adversely affects the consumer durables sector. So, if inflation is under control in an economy, it can boost its consumer durables sector and, in turn, the index.

- Seasonal effect: While some consumer durables companies, which mainly cater to the necessary items, may not be affected too much by seasonality however most of the companies in this sector are affected by seasonality. For instance, during festivals, many consumer durable products such as electronics, jewellery, and other companies in the sector have higher demand, which affects their financials, and the consumer sector stocks’ price, which in turn determines the consumer durables index movements.

Nifty Consumer Durables Index Calculation Method

For the Nifty Consumer Durables index, the stocks are selected based on free-float market capitalisation.

For assigning weights, none of the individual stocks can have more than 33% weightage, and the top 3 stocks in the index together can be up to 62% of weightage.

Then, the following formulae are used to derive the index value.

Nifty Consumer Durables Index Value = Index Market Value / Divisor

Performance and Returns (As on 29 August 2025)

Here are the returns for different periods –

| Period | Price Return (%) | Total Return (%) |

| OTD | 0.39 | 0.61 |

| YTD | -7.69 | -7.39 |

| 1 Year | -6.59 | -6.27 |

| 5 Years | 21.27 | 21.81 |

| Since Inception | 19.58 | 20.48 |

Risk and Volatility (As on 29 August 2025)

Here are the ratios that can help you understand the risk quotient of the Nifty Consumer Durables Index –

| Ratios | 1 Year | 5 Years | Since Inception |

| Standard Deviation (Average std. dev. Annualised) | 18.77 | 17.50 | 26.82 |

| Beta (vs. Nifty 50) | 0.98 | 0.83 | 0.81 |

| Correlation with Nifty 50 | 0.68 | 0.69 | 0.71 |

How to Invest in the Nifty Consumer Durables INDEX?

You can invest in the Nifty Consumer Durables Index using ETFs, index funds, or you can trade them on the trading platform. You can also trade Nifty Consumer Durables Index futures and options in the F&O section of Shoonya’s app. To do so, you have to add the index to your watchlist following these steps –

- Open the Shoonya app.

- Head to the “Watchlist” tab located at the bottom of your screen.

- In the search bar, type “NIFTY IN” or “SENSEX IN” and add it to the watch list, and then you will be able to see the indices.

- Once you find your desired index, click on the add option given on the right side.

- Now you can see the index on the watchlist.

Conclusion

Consumer durables are part and parcel of the everyday life of people, and thus, investing in these companies can help you grow your wealth over the long term. However, selecting the right stock for your portfolio or trading in the index itself, via the F&O segment, requires your in-depth understanding of the sector and its constituents. With this article, we hope you can understand how the consumer durables sector works and how you can invest in the Nifty Consumer Durables index or Nifty Consumer Durables companies.

Nifty Consumer Durables Index | FAQs

Nifty Consumer Durables is rebalanced semi-annually on 31 January and 31 July.

The current PE of the Nifty Consumer Durables index is 69.54x.

The current PB of the Nifty Consumer Durables index is 13.6.

The current dividend yield of the Nifty Consumer Durables index is 0.35%.

The Nifty Consumer Durables index was launched on 15 January 2020.

The base value of the Base Healthcare Index is 1000.

Source: NSE

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.