Hindalco Industries Limited: Company Overview, Share Price Insights & Growth Story

Aluminium and copper have been central to India’s industrial progress, from power infrastructure to consumer goods. As global demand for lightweight and high-performance metals grew, India needed a homegrown leader capable of shaping the nation’s presence in this crucial sector.

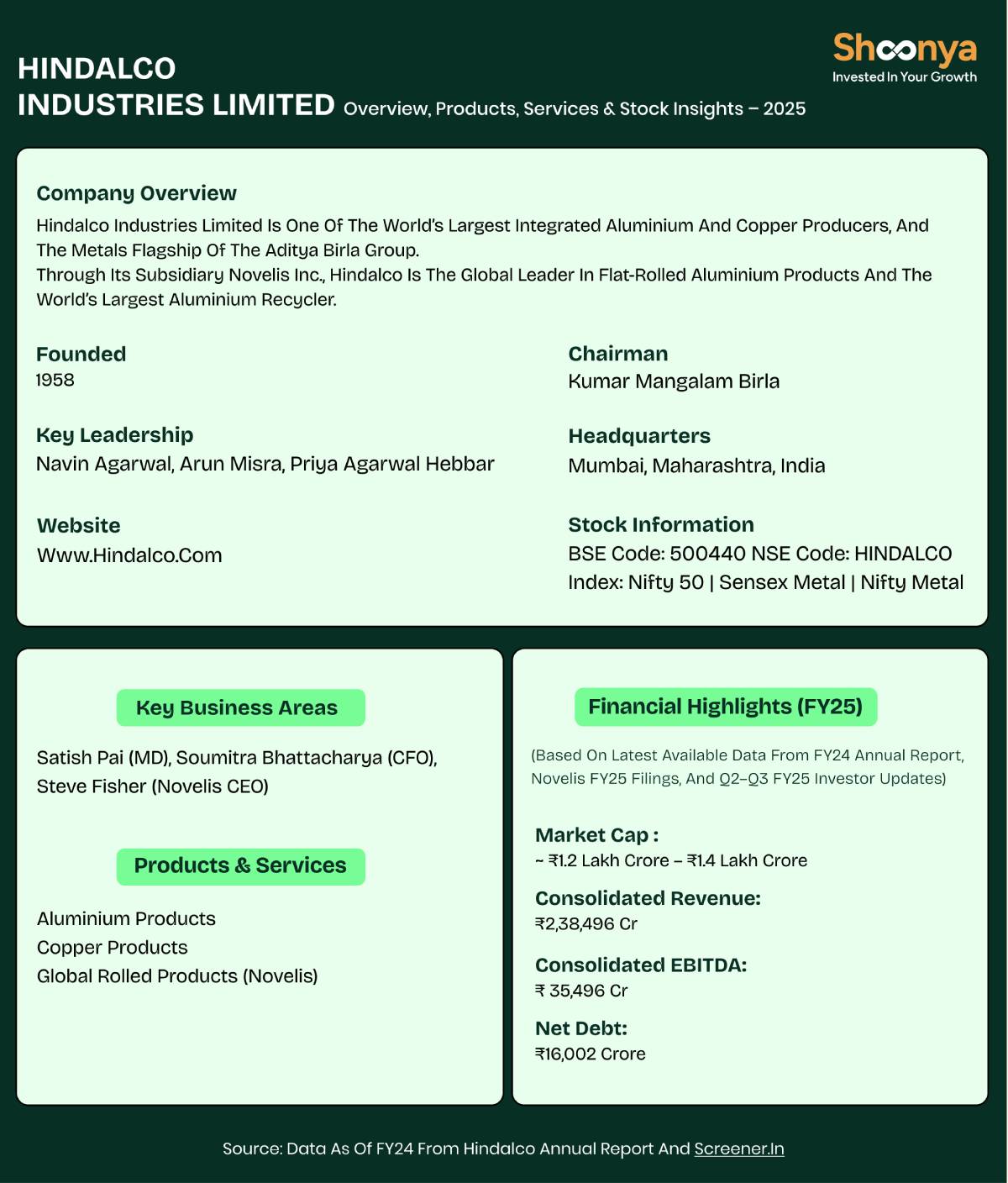

The metals flagship of the Aditya Birla Group, Hindalco Industries, was born.

To grasp Hindalco Industries’s current standing, one must consider how its journey has subtly influenced its place in India’s steel sector and secured its spot among the top 10 Nifty Metal Index constituents.

Hindalco Industries: History and How It All Began

Hindalco Industries was established in 1958. What began as a bold vision by G. D. Birla soon laid the foundation for a legacy in metals.

The company began its journey with the commissioning of its first aluminium facility at Renukoot, Uttar Pradesh, in 1962, which would eventually grow into one of Asia’s largest integrated aluminium plants. Hindalco continued to expand rapidly through the 1960s and 1970s. The Renukoot site grew into a full-fledged complex comprising alumina refining, aluminium smelting, fabrication units, and power generation. Over the decades, the company added new capabilities in downstream products, foil manufacturing, and industrial applications.

Globally, Hindalco Industries’ position strengthened further after its 2007 acquisition of Novelis Inc., making the combined entity a global leader in flat-rolled aluminium products and beverage can recycling.

Today, the name Hindalco reflects decades of expansion and innovation, rooted in its early beginnings at Renukoot that reshaped the global aluminium industry.

Hindalco Industries – Yearly Milestones

| Category | Year / Period | Key Highlights |

| Company formation | 1958 | Hindalco Industries was incorporated as part of the Aditya Birla Group’s venture into India’s metals sector. |

| First major aluminium capacity | 1962 | Renukoot aluminium plant was commissioned, establishing one of India’s most crucial integrated aluminium facilities. |

| Copper business expansion | 1998 | Copper smelting operations launched at Dahej, marking Hindalco’s entry into the copper value chain. |

| Global leadership milestone | 2007 | Acquired Novelis, becoming the world leader in aluminium rolling and a significant recycler globally. |

| Decade of downstream growth | 2010–2020 | Rapid expansion across downstream aluminium, flat-rolled products, automotive sheets and recycling initiatives. |

| Sustainability & capacity expansion | 2021–Present | Transformation focused on low-carbon aluminium, circularity, green energy projects and ongoing capacity upgrades. |

What Does Hindalco Industries Do?

Hindalco’s business spans the entire value chain, from mining and metal extraction to rolling, extrusion, and recycling. It has built an ecosystem that integrates raw materials, smelting, and advanced product development. The acquisition of Novelis in 2007 marked a turning point.

The company operates in:

1. Aluminium Business

- Mining: Bauxite mines in Jharkhand, Odisha, and Chhattisgarh

- Refining: Alumina production at Muri, Renukoot, Belgaum

- Smelting: Manufacturing units at Hirakud, Mahan, Aditya Aluminium

- Downstream: Flat-rolled products, extrusions, foils, automotive body sheets

Applications: aerospace, packaging, transport, construction, electricals.

2. Copper Business

Hindalco operates one of the world’s largest copper smelters at Dahej. Its key products include:

- Copper cathodes

- Continuous cast rods (CCR)

- Gold & silver (by-products)

- DAP fertilisers produced through refinery output

This integrated structure allows Hindalco to supply consistently, innovate faster, and support large-scale industries that depend on reliability and quality.

Hindalco Industries Limited – Important Company Details

- Hindalco share price: ₹822.50 per share (as of December 5, 2025)

- Hindalco owner: The company is owned by the Aditya Birla Group, led by Chairman Kumar Mangalam Birla.

- Hindalco Industries Ltd products: Aluminium ingots, rolled products, foils, extrusions, copper cathodes, and CCR rods.

- Parent company background: Hindalco Industries Limited is a core pillar of the Aditya Birla Group, one of India’s largest and most diversified conglomerates.

Hindalco Industries Ltd Products

| Category | Products |

| Aluminium | Ingots, Billets, Rolled Products, Foils, Extrusions |

| Copper | Copper Cathodes, CCR Rods |

| Downstream Products | Automotive body sheets, Packaging foils, Plates, Heat Exchangers |

| Fertilizers & By-Products | DAP fertilisers, Precious metals |

Hindalco Industries: Subsidiaries & Global Presence

Major Subsidiaries

- Novelis Inc. (USA)

- Utkal Alumina International Limited

- Mahan Aluminium

- Aditya Aluminium

- Renuka Aluminium

Global Footprint

Through Novelis, Hindalco has operations and customers across:

- North America

- South America

- Europe

- Asia

This global integration makes the company one of the most geographically diversified aluminium producers.

Hindalco Net Worth and Financial Strength

Hindalco Industries is among India’s most financially strong and valuable metals companies, supported by large-scale aluminium and copper operations, integrated manufacturing, and global leadership through Novelis, the world’s largest aluminium recycler. The company’s financial strength is reflected in its FY25 performance, where Hindalco reported consolidated revenue of ₹2.38 lakh crore.

Hindalco continues to invest in capacity expansion, green metal initiatives, and high-value downstream products that support future mobility, renewable energy, and sustainable manufacturing. These strategic priorities position the company for global competitiveness.

Conclusion

Hindalco Industries has grown from a pioneering Indian aluminium producer into a global materials powerhouse. The company blends legacy with continuous innovation, from bauxite mines and smelters in India to advanced rolling and recycling operations across the world.

As industries shift to lightweight, sustainable materials, Hindalco’s role becomes even more central. With strong leadership under the Aditya Birla Group, the company remains one of the pillars of India’s industrial and economic progress.

For investors, Hindalco’s shares, commodity trends, and Novelis’ performance remain key indicators of long-term growth prospects.

Hindalco Industries Limited – FAQs

Hindalco is a leading aluminium and copper manufacturing company under the Aditya Birla Group.

The Hindalco share price on NSE is around ₹822.50 per share. Investors often search for the Hindalco share price (NSE) for daily market updates.

Hindalco is owned by the Aditya Birla Group, led by Kumar Mangalam Birla.

The company manufactures aluminium rolled products, extrusions, foils, copper cathodes, and copper rods.

Yes. Through its subsidiary, Novelis, Hindalco operates across North America, Europe, Asia, and South America.

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.