Jindal Steel Limited – Legacy, Innovation, and Share Price Insights

Steel plays an important role in India’s industrial growth, and Jindal Steel Limited has consistently contributed to this journey. The company has grown alongside the country’s economic ambitions, right from building core infrastructure to supporting power and manufacturing needs. Today, movements in the Jindal share price often reflect not just company performance, but wider trends across India’s steel and energy sectors.

To understand where Jindal Steel stands today, it is important to look at how its history quietly shaped its position in India’s steel industry and among the top 10 Nifty Metal Index components.

Jindal Steel Limited: History and How It All Began

Early Beginnings: The Vision of O.P. Jindal

The birth of Jindal Steel Limited is guided by the vision of Shri O. P. Jindal. In 1969, he established a pipe manufacturing unit under the name Jindal India Limited in Hisar, Haryana. Jindal Steel Limited was formally incorporated in 1979 as part of the O.P. Jindal Group. In the 1980s and 1990s, the company started focusing on establishing its core steelmaking capabilities.

Entering Power: Strategic Diversification in the 1990s

In the mid-1990s, the company diversified into power generation. The late 1990s also saw corporate restructuring within the broader Jindal Group, leading to Jindal Steel Limited focusing on steel and power as its main growth drivers.

2000s Growth: Product Expansion

In the early 2000s, Jindal Steel Limited expanded its product offerings and manufacturing capabilities by producing various semi-finished steel products.

Strategic Recalibration

Following the passing of O.P. Jindal and the division of group businesses among his sons, Jindal Steel Limited directed efforts toward balance-sheet consolidation.

Present Day: A Technology-Led Steel Leader

As of date, Jindal Steel Limited stands among India’s leading private steelmakers. It is the country’s only private manufacturer of railway rails and has pioneered innovations such as the world’s first coal gasification-based DRI plant at Angul.

Jindal Steel Limited– Yearly Milestones

| Year | Key Milestone |

| 1969 | O.P. Jindal established Jindal India Limited in Hisar, Haryana, marking the foundation of the Jindal Group. |

| 1979 | Jindal Steel and Power Limited was incorporated on 28 September. |

| 1984 | 340 MW power plant commissioned at Chandrapur, Maharashtra. |

| 1991 | First integrated steel plant commissioned at Raigarh, Chhattisgarh; Jindal Power Limited formed for captive power. |

| 1999 | Company listed on the BSE; coal washery set up; alloy steel products introduced. |

| 2005 | O.P. Jindal passes away; group businesses are divided among the four sons, with Naveen Jindal leading JSPL. |

| 2007 | One million tonne plate mill commissioned at the Raigarh facility. |

| 2010 | Acquisition of Shadeed Iron and Steel in Oman, expanding international presence. |

| 2021 | Angul steel plant in Odisha begins operations. |

| 2021 | Acquisition of the Kasia iron ore mine in Odisha, recognised with a national CSR award. |

| 2024 | Reduced dependence on Australian coking coal by over fifty per cent through diversified sourcing. |

| 2025 | Company renamed Jindal Steel Ltd; announces expansion plans to reach 12 MTPA crude steel capacity by FY26. |

What Does Jindal Steel Limited Do?

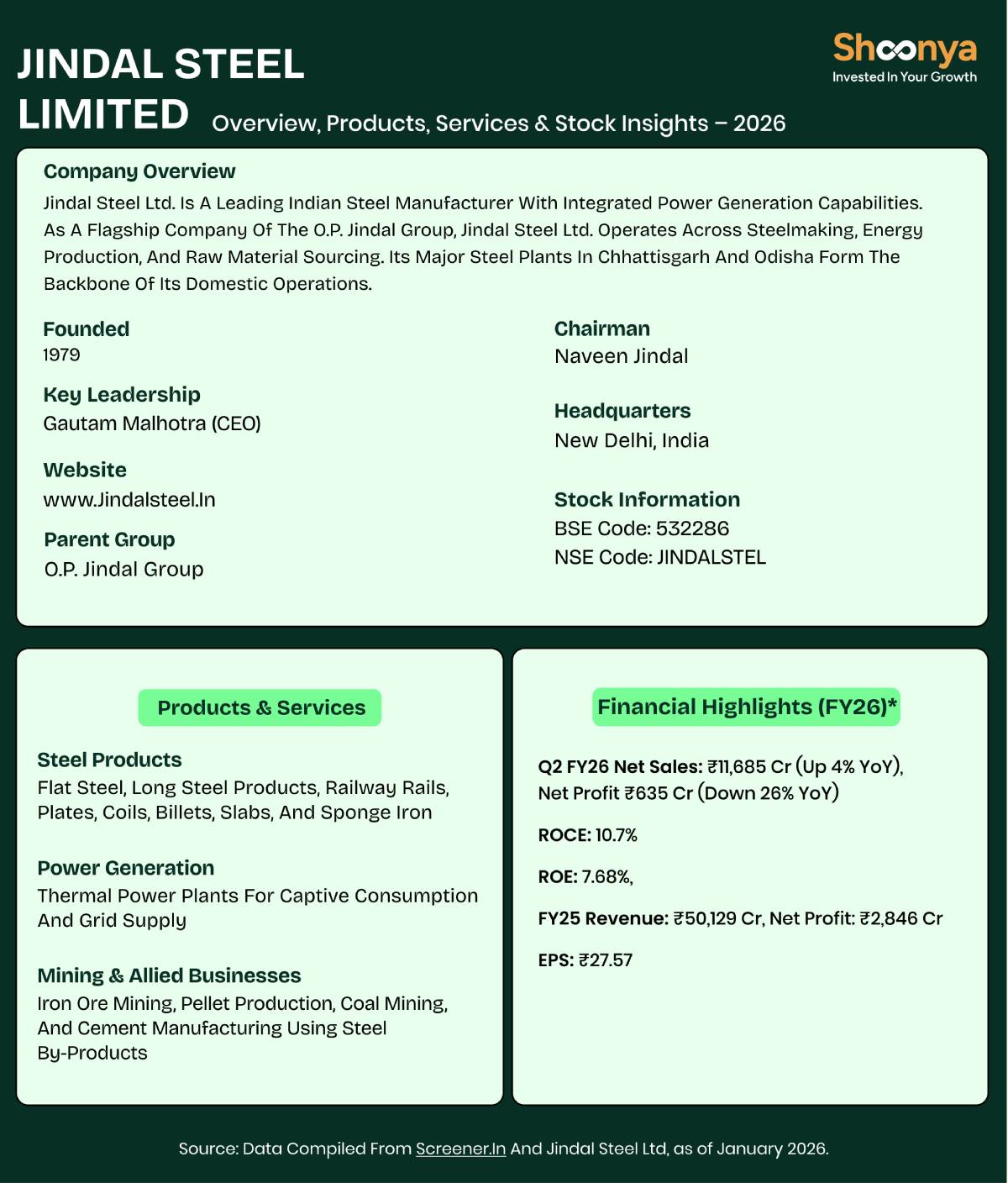

Jindal Steel Limited operates an integrated business model spanning mining, steel manufacturing, and power generation.

Steel Business

They produce steel products from their integrated plants at Raigarh and Angul. Jindal Steel Limited is the only private manufacturer of railway rails in India and supplies steel for infrastructure, construction, oil & gas pipelines, and manufacturing sectors.

Power Business

Jindal Steel Limited developed large captive power plants to ensure uninterrupted electricity for steelmaking.

Jindal Steel Limited – Important Company Details

- Jindal share price: ~ ₹1156.70 per share (January 29, 2026)

- Jindal Steel Limited’s owner: Naveen Jindal

- Products: Rails, structural steel, plates, coils, TMT rebars, sponge iron, pellets, power, cement

- Group background: A flagship company within one of India’s leading steel and energy conglomerates.

Jindal Steel Limited – Products by Category

| Category | Products |

| Steel | Rails, structural sections, TMT rebars, wire rods, plates, coils |

| Power | Thermal electricity generation |

| Allied | Iron ore pellets, cement, and industrial by-products |

Jindal Steel Limited: Subsidiaries & Global Presence

Jindal Steel Limited operates through multiple subsidiaries across steel, power, and green initiatives. They export steel products globally and hold mining assets abroad.

Jindal Steel Limited’s Financial Strength

As of FY24, Jindal Steel Limited reported consolidated revenue of ₹58,115 crore and a net profit of ₹5,943 crore.

Conclusion

Jindal Steel Limited’s journey has been defined by expansion, innovation, and timely consolidation, reflecting the trajectory of India’s industrial growth. For investors, the Jindal share price continues to serve as a lens into broader trends within the steel and power sectors.

Jindal Steel Limited – FAQs

Jindal Steel Limited is an Indian company engaged in steel manufacturing and power generation, and a flagship of the O.P. Jindal Group.

The Jindal Steel share price trades around ₹1,156.70 per share as of January 2026.

The company is owned by the O.P. Jindal Group and is led by Chairman Naveen Jindal.

Jindal Steel produces railway rails, structural steel, TMT rebars, plates, coils, sponge iron, and electricity.

While its core operations are in India, Jindal Steel exports steel products globally and owns mining assets overseas, giving it an international presence.

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.