Investor’s Guide To Taxation

Investing and trading can be a great way to grow your wealth, but it’s important to remember that with potential gains come potential tax liabilities. Whether you’re a seasoned investor or just starting out, understanding the tax implications of your investments is crucial to making informed decisions and avoiding any unpleasant surprises at tax time. This taxation guide is here to help you navigate the complex world of taxes for traders and investors. We’ll cover the basics of how taxes apply to different types of investment income, as well as strategies for minimizing your tax bill and maximizing your returns. So sit back, relax, and let’s dive into the world of taxes for investors and traders!

Investment Tax Basics for Beginners

When it comes to taxes, investments can be classified into two categories: taxed and tax-advantaged.

- Taxed investments: These are investments that are subject to taxes on the capital gains or income they generate. For example, stocks, bonds, and real estate are taxed investments. The tax rate on capital gains from these investments can vary based on factors such as the holding period and the investor’s tax bracket.

- Tax-advantaged investments: As an investor, it’s important to know the various tax-advantaged investment options available to you. For example, 401(k) and traditional IRA accounts allow for tax-deductible contributions and tax-free investment income growth within the account.

Income Tax Structure for Stock Market Investors & Traders.

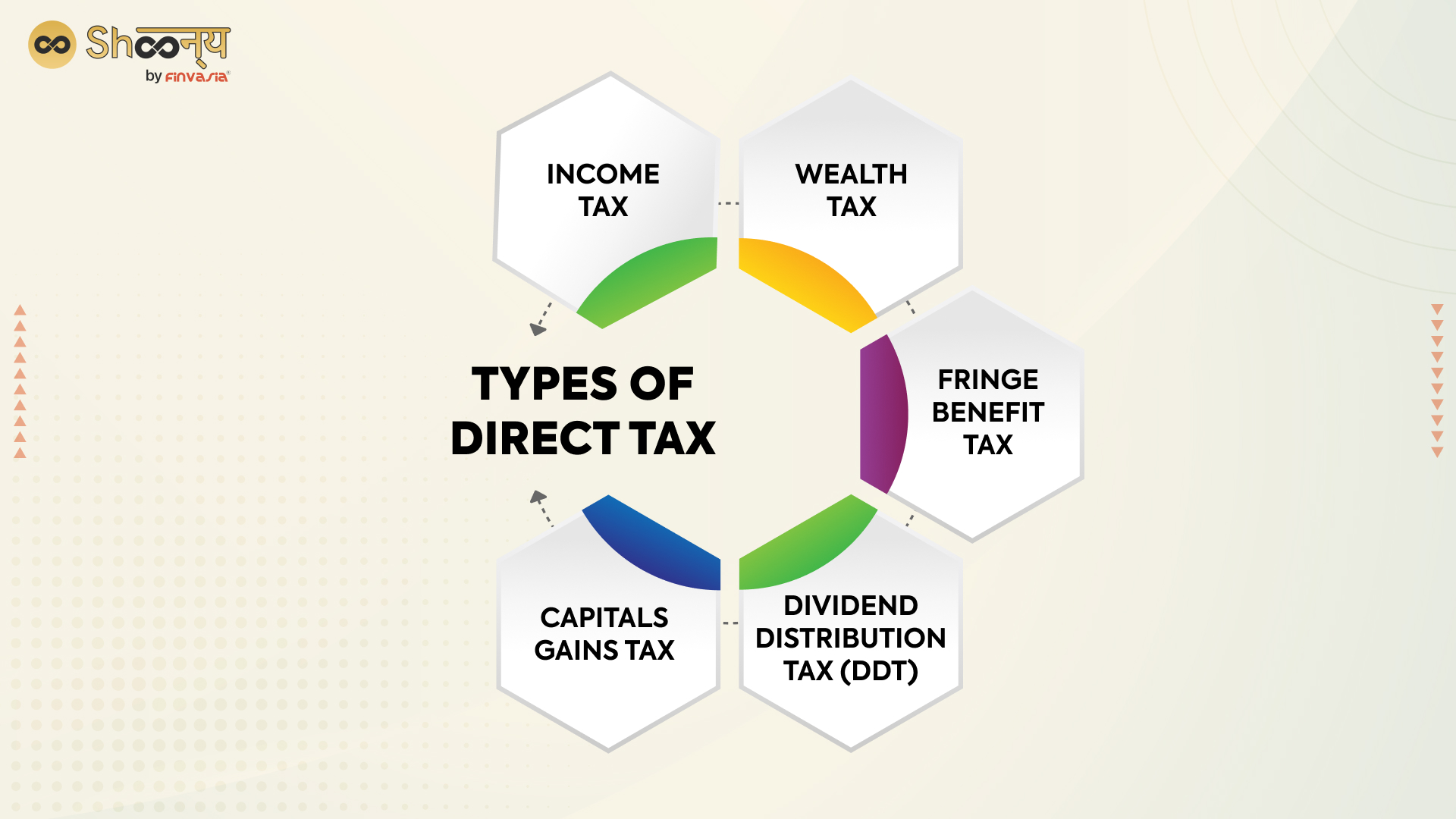

The income tax structure for stock market investors and traders in India varies based on the type of income and the duration of holding the shares or securities. Here’s an overview of the different types of taxes that stock market investors and traders may be subject to:

- Securities Transaction Tax (STT): This is a tax that is levied on the value of the securities traded. The STT rate varies based on the type of security and the nature of the transaction.

- Capital Gains Tax: Capital gains tax is levied on the profits made from selling shares or securities. The tax rate varies depending on how long the shares or securities were held. Short-term capital gains (STCG) on shares or securities held for less than a year are taxed at the normal income tax rate of the individual. Long-term capital gains (LTCG) on shares or securities held for more than a year are taxed at 10% without indexation and 20% with indexation.

- Dividend Distribution Tax (DDT): The current Dividend Distribution Tax (DDT) rate in India is 29.12%, which includes surcharge and cess.

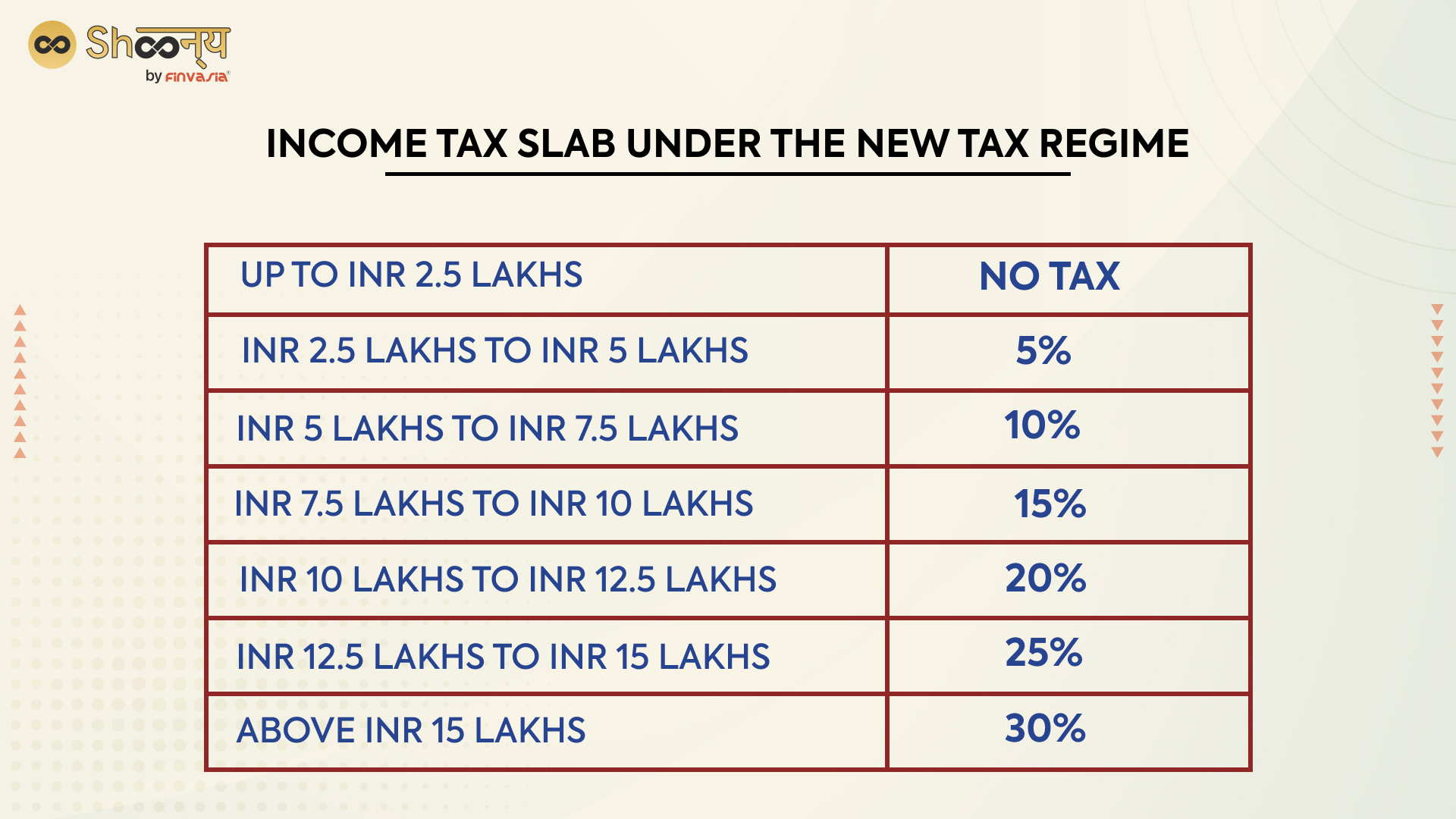

- Income Tax: Income from stock trading is considered business income and is taxed as per the slab rate of the individual.

It’s important to note that these slab rates are subject to change based on government policy and budget announcements.

- Other taxes: other taxes such as wealth tax and Fringe Benefits Tax (FBT) may also be applicable to the income generated from the stock market.

If you wish to know about them in detail, check this- How income tax is levied on your stock market transactions?

Types of Taxes on Mutual Funds.

- Dividend Distribution Tax (DDT):

If a mutual fund pays INR 1,000 as dividends to an investor, the Dividend Distribution Tax (DDT) of 29.12% would be INR 291.20.

So, the actual amount the investor would receive as dividends would be INR 708.80 (INR 1,000 – INR 291.20)

- Capital Gains Tax:

If an investor purchases a mutual fund unit for INR 10,000 and sells it after 6 months for INR 12,000, the investor would be subject to short-term capital gains tax.

Short-term capital gains (STCG) would be INR 2,000 (INR 12,000 – INR 10,000), which would be added to the investor’s income and taxed at their normal income tax rate.

On the other hand, if the investor holds on to the mutual fund unit for more than a year, and sells it after that, say for INR 15,000 the long-term capital gains (LTCG) would be INR 5,000.

LTCG is taxed at 10% without indexation or 20% with indexation.

- Exit Load:

For example, mutual fund A has an exit load of 1% and a NAV of INR 50. If an investor redeems 10,000 units of the fund, the exit load would be INR 1,000 (10,000 units x INR 50 x 1%). So, the investor would receive INR 9,000 from the redemption (INR 10,000 – INR 1,000).

Note- It’s important to note that the above examples are for illustrative purposes only, and actual taxes and exit loads may vary depending on the mutual fund and other factors.

Here is our detailed guide on How Are Income From Stocks And Mutual Funds Taxed?

Income Tax on Intraday Trading

In India, income from intraday trading is considered business income and is taxed according to the income tax slab rates for the financial year. In intraday trading, the investor buys and sells shares on the same day, and the profit or loss is determined by the difference between the buying and selling price.

Here’s an example of how taxes on intraday trading would be applied:

- If an investor buys 1,000 shares of XYZ Limited for INR 50 per share and sells them later the same day for INR 55 per share, the investor would make a profit of INR 5,000 (1,000 shares x INR 5).

- As per the slab rate mentioned above, this profit would be added to the investor’s income and taxed at the appropriate rate based on their total income.

In case of loss, an investor is allowed to offset the loss from intraday trading against any other business income or capital gains in the same financial year or the next 8 financial years.

It’s important to note that the Securities Transaction Tax (STT) is also applicable on Intraday trading at the rate of 0.025% of the sale value of securities.

If you need additional information, check this out- How Gains from Intraday Trading are Taxed?

Day Trading Taxes: What New Investors Should Consider

Navigating day trading taxes can be challenging for new investors. Understanding the tax implications of day trading is crucial to make informed decisions and avoiding unexpected tax liabilities. Stay ahead of tax time by educating yourself on the tax rules and regulations of day trading

Here are a few key things that new investors should consider when it comes to day trading taxes:

- Day trading income is considered business income: Day trading is considered a business activity, and the profits or losses from day trading are treated as business income or loss. As a result, day trading income is taxed at the individual’s income tax rate.

- Short-term vs. long-term capital gains: The tax treatment of day trading profits depends on the holding period of the securities. Short-term capital gains, which are profits from the sale of securities held for less than a year, are taxed as ordinary income at the individual’s income tax rate. Long-term capital gains, which are profits from the sale of securities held for more than a year, are taxed at a lower rate.

- Securities Transaction Tax (STT): In India, Securities Transaction Tax (STT) is also applicable on day trading. It is levied at the rate of 0.025% of the sale value of securities.

- Losses can be used to offset gains: Investors can use day trading losses to offset other business income or capital gains in the current year or in the next 8 financial years.

- Keep records: Investors should keep accurate records of their day trading activities, including the date of purchase and sale, the number of shares, and the purchase and sale price, to ensure they can accurately report their income and claim any eligible deductions or credits.

Tax-Saving Strategies- For Stock Traders and Investors

There are several tax-saving strategies that stock traders and investors can use to minimize their tax liabilities and maximize their returns. Some common strategies include:

- Taking advantage of long-term capital gains tax rates: Investors can hold on to their investments for more than a year to take advantage of the lower long-term capital gains tax rates.

- Using tax-loss harvesting: Investors can sell losing investments to offset any capital gains they have realized, thereby reducing their overall tax liability.

- Investing in tax-efficient vehicles: Some investment vehicles, such as exchange-traded funds (ETFs) and index funds, are more tax-efficient than others.

- Taking advantage of deductions and credits: Investors may be able to claim deductions or credits for certain expenses related to their investments, such as investment management fees, research expenses, and home office expenses.

- Using Section 80C: This section allows individuals to claim tax deductions on certain investments and expenses, such as Public Provident Fund (PPF), Equity Linked Savings Scheme (ELSS) etc.

- Using Section 80D: Investment in Health insurance policies also allows an individual to claim tax deductions

- Using tax-sheltered accounts: Some countries have tax-sheltered accounts such as retirement accounts, that allow the investment to grow tax-free.

Smart Tax-Saving Tips: For Stock Traders and Investors is needed to ensure you don’t miss out on losing any income or profits earned from the stock market.

ITR Filing for Investors in India.

ITR (Income Tax Return) filing is the process of submitting information about one’s income and taxes paid to the government. For investors, it’s important to accurately report all investment income, including dividends, capital gains, and interest income, when filing their ITR. It’s also essential to keep records of all investment transactions and expenses to claim any applicable deductions or credits. In India, ITR needs to be filed annually by individuals and companies, before the due date to avoid penalties or late fees.

Best Tax Saving Mutual Funds

Equity Linked Savings Scheme (ELSS) funds are considered the best tax-saving mutual funds. The benefits of investing in ELSS funds are many. They offer the dual benefit of tax saving under Section 80C and equity exposure. These funds have a lock-in period of 3 years and have been considered the most tax-efficient mutual fund schemes. They also offer higher returns as compared to fixed deposits.

Trading vs Investing Tax

Trading refers to buying and selling securities in the short term while investing refers to buying securities with the intention of holding them for the long term. The tax implications of trading and investing can be different. Short-term capital gains from trading are taxed at the normal income tax rate, while long-term capital gains from investing are taxed at a lower rate. Additionally, day trading also attracts Securities Transaction Tax (STT) in India, whereas investments in certain tax-saving instruments like ELSS or Public Provident Fund (PPF) attract tax deductions under section 80C.

In conclusion, taxes are an important consideration for traders and investors. Being informed about the tax implications of one’s trading and investing activities can help individuals make informed decisions and maximize their returns. There are several tax-saving strategies that traders and investors can use, such as taking advantage of long-term capital gains tax rates, using tax-loss harvesting, investing in tax-efficient vehicles, and using tax-sheltered accounts. Additionally, keeping accurate records and consulting a tax professional can help ensure that traders and investors are compliant with tax laws and regulations. It is essential to stay up to date with the changes in tax laws and regulations to ensure that traders and investors are taking full advantage of tax-saving opportunities and filing their ITRs correctly.

For more-

Investing and Taxes: What Beginners Need to Know

Taxation Of Investors, Traders, & Dealers In Securities

LLC for Trading Stocks & Tax Issues for Traders

How to file an income tax return for share trading

References

- Income Tax Slabs for FY 2022-23. (n.d.). Bankbazaar.com. Retrieved January 12, 2023, from https://www.bankbazaar.com/tax/income-tax-slabs.html

- Salaried individuals for AY 2022-23. (n.d.). Income Tax Department. Retrieved January 12, 2023, from https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1