Beneficiary Account vs Clearing Member Account: Understanding the Distinctions

When delving into the realm of investment and finance, terms like “beneficiary account” and “clearing member account” might seem complex at first. However, understanding these concepts is vital for Indian investors to navigate the financial landscape effectively. Let’s unravel the differences, significance, and implications of beneficiary accounts and clearing member accounts in a conversational manner.

Beneficiary Account: A Closer Look

In the world of banking and finance, a beneficiary account holds a crucial role. This type of account pertains to designating a person who will receive the funds within the account after the account holder’s demise. While many accounts, like checking accounts, aren’t required to have beneficiaries, designating one can offer significant advantages.

Why Choose a Beneficiary Account?

The primary motivation for naming a beneficiary is to facilitate a smoother transfer of assets post the account holder’s passing. Unlike other accounts, where the funds typically become part of the estate and subject to probate, a beneficiary account expedites the process. The funds are directly passed to the named beneficiary, circumventing delays and complications.

How to Name a Beneficiary

Naming a beneficiary involves a relatively straightforward process. It can be done online or through paper forms, depending on your financial institution. You have the flexibility to choose one or multiple beneficiaries, with the option to specify the distribution percentages. Additionally, you might need to provide essential details about the beneficiary, such as their full name, Social Security number, and relationship to you.

Clearing Member Account: Unveiling the Definition

On the other hand, a clearing member account relates to transactions within a stock exchange or clearinghouse. Clearing members play a pivotal role in ensuring seamless trade settlements and maintaining market integrity. They act as intermediaries between traders and the exchange, guaranteeing that trades are executed smoothly.

The Role of Clearing Members

Clearing members facilitate the settlement process by ensuring that both sides of a trade are fulfilled. They ensure that the buyer receives the shares and the seller receives the funds. Additionally, they contribute to risk management by monitoring transactions, collateral, and overall market stability.

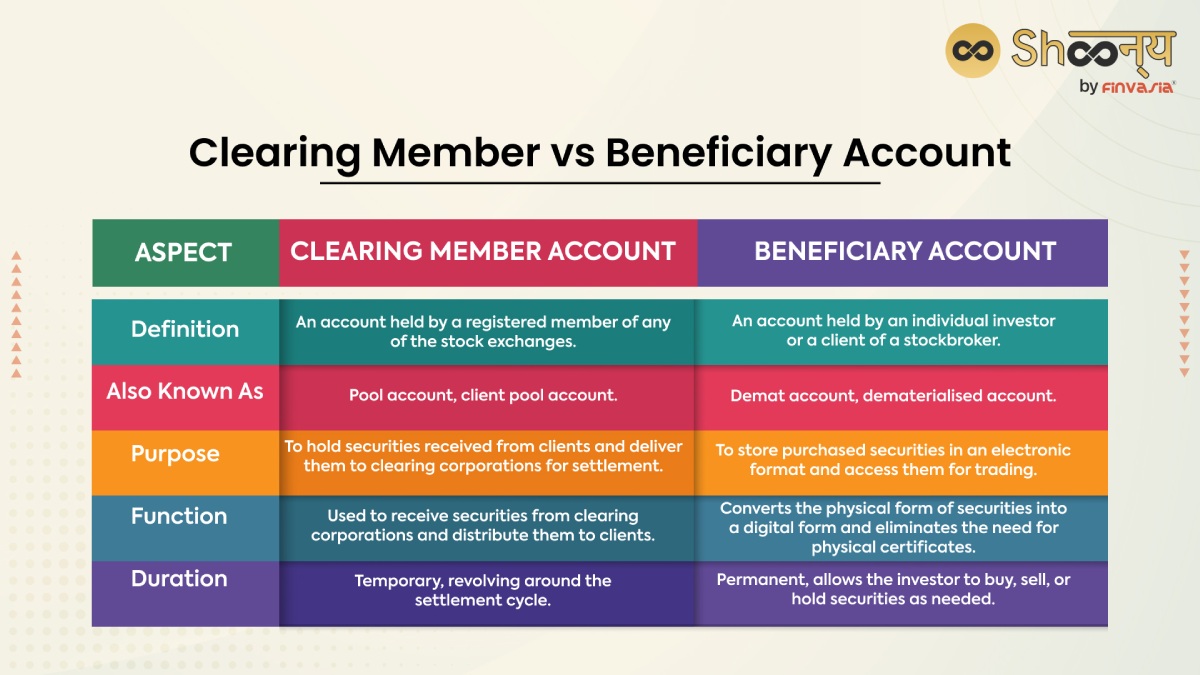

Clearing Member vs Beneficiary Account

Now, let’s differentiate between these two concepts:

- Nature and Purpose:

- Beneficiary Account: Primarily associated with inheritance and post-death fund transfer.

- Clearing Member Account: Involves trade settlement and risk management in financial markets.

- Focus Area:

- Beneficiary Account: Focuses on individual financial planning and asset distribution.

- Clearing Member Account: Concentrates on trade execution, settlement, and market stability.

- Process Complexity:

- Beneficiary Account: Generally simpler, with a paperwork-driven process.

- Clearing Member Account: Involves complex market dynamics, risk assessment, and regulatory compliance.

In Conclusion

Navigating the financial landscape requires grasping the nuances of terms like beneficiary accounts and clearing member accounts. While beneficiary accounts aid in asset transfer, clearing members are the linchpins of secure trade settlements. By understanding these concepts, Indian investors can make informed decisions and engage effectively in the dynamic world of investments.

FAQs| Beneficiary Account vs Clearing Member Account

A beneficiary account ensures a seamless transfer of funds to chosen recipients after the account holder’s demise.

Yes, you can modify beneficiaries or add new ones as your circumstances change.

Clearing members play a crucial role in risk management and trade settlement, ensuring a secure and smooth market environment.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.