Understanding Nifty 50 and Its Components

The Nifty 50 is a benchmark index of the National Stock Exchange of India, comprising 50 of the largest and most liquid Indian companies across various sectors. It is considered a metric for tracking the growing Indian economy by reflecting the performance of the country’s top publicly traded companies.

About Nifty 50

The Nifty 50 was launched on April 1996, with a starting value of 1000 and a base date of November 3, 1995. The index is calculated using free float market capitalization weighted methodology. The index level here reflects the total market value of all stocks in Nifty 50 relative to a specific base period. That means the stocks with higher market capitalizations are weighted more heavily in the index, and their movements significantly impact the overall index level.

The Nifty 50 is reviewed and re-balanced semi-annually, in June and December, to ensure that it remains representative of the Indian stock market.

Stocks are added to or removed from the index based on specific rules, including liquidity, market capitalization, and sector representation. This helps to ensure that the Nifty 50 remains relevant and representative of the Indian stock market.

What are the Components of Nifty 50?

The Nifty 50 is divided into 12 sectors, each representing a different aspect of the Indian economy. Here is a brief insight into it.

| Sector | Stocks |

| Finance | Bajaj Finance, Bajaj Finserv, SBI Life Insurance, and HDFC Life Insurance |

| Consumer Goods | Titan |

| Energy and Mining | BPCL, ONGC, IOC, Coal India, and Reliance Industries |

| FMCG | HUL and ITC |

| Banking | Axis Bank, HDFC Bank, ICICI Bank, IndusInd Bank, SBI, and Kotak Mahindra Bank |

| Software | HCL Technologies, Infosys, Wipro, Tech Mahindra, and TCS |

| Auto | Tata Motors, M&M, Maruti Suzuki, Eicher Motors, and Hero Motocorp |

| Pharma | Cipla, DIVIS Laboratories, Dr Reddy’s Laboratories, and Sun Pharma |

| Infrastructure | Ultratech Cement, HINDALCO, JSW Steel, and Tata Steel |

| Chemicals | UPL |

| Textiles | Grasim |

| Telecom | Bharti Airtel |

Understanding the key metrics impacting NIFTY components’ weightage

- Liquidity: It refers to the ease with which a stock can be bought or sold without affecting its price. In the share market, liquidity is calculated by dividing the number of shares traded over a specific period by the average daily trading volume during the same period. A higher liquidity ratio indicates a more liquid market, where stocks can be bought or sold quickly and with minimal impact on the stock price.

- Market capitalization: It measures a company’s total value in the stock market and is calculated by multiplying the company’s share price by its number of outstanding shares. It is used to determine a company’s size and its stock market position. A company with a high market capitalization is considered stable. A company’s market capitalization can change over time as the stock price and the number of outstanding shares change.

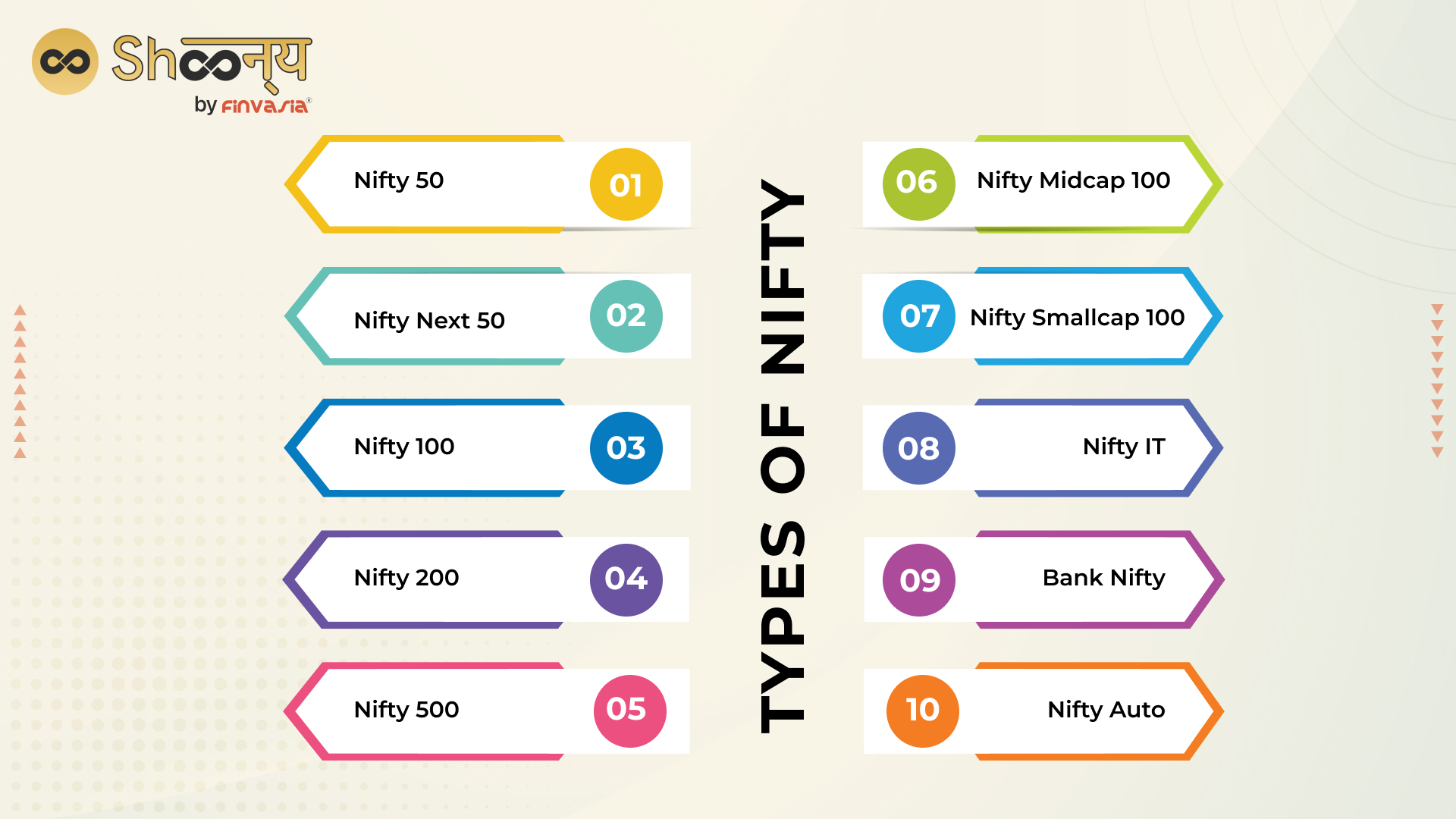

What are the other types of Nifty?

There are several Nifty indices in India, each offering a different perspective on the Indian stock market. The following are the most crucial ones.

- Nifty Next 50: It is a derivative of the Nifty 50 and comprises the 50 next largest companies listed on NSE after the Nifty 50. It represents the performance of mid-sized companies in the Indian stock market.

- Nifty Midcap 100: It represents the performance of the top 100 and most liquid mid-cap companies listed on the NSE. It provides a more focused measure of the mid-cap segment of the Indian stock market.

- Nifty Smallcap 100: It represents the performance of the top 100 most liquid smallcap companies listed on the NSE.

Nifty also has sector-specific indices such as Bank Nifty and Nifty Auto.

Final Words

The Nifty 50 is the NSE’s most widely used benchmark index. Understanding its components, the factors that influence its weightage and the addition and removal of stocks, and how it represents the Indian economy can help investors make more informed decisions.

FAQs

Nifty 50 components are selected by the NSE based on factors like market capitalization, liquidity, and sector representation. The list is periodically reviewed and updated.

Yes, you can invest in individual Nifty 50 components by buying shares of these companies through a stockbroker or online trading platform.

Yes, changes in the composition of Nifty 50 components can impact the index’s performance and, in turn, your investments. It’s essential to stay updated on any changes.

While most Nifty 50 components are Indian companies, there can be exceptions. Some foreign companies listed on Indian exchanges may also be included.

The main components of NIFTY 50 are the 50 largest Indian companies listed on the National Stock Exchange (NSE). These companies are selected based on factors like market capitalization, liquidity, and sector representation.

Yes, Nifty is calculated using 50 large-cap stocks actively traded on the NSE. These stocks come from various sectors and industries, and their free-float market capitalization determines their weightage in the Nifty index.

The 13 sectors in NIFTY 50 are Financial Services, Information Technology, Consumer Goods, Oil and Gas, Automobiles, Telecommunications, Construction, Pharmaceuticals, Metals, Power, Cement and Cement Products, Fertilizers and Pesticides, and Media and Entertainment.

Nifty composition refers to the list of 50 companies that make up the Nifty index and their respective weightage within the index. The NSE reviews and updates this composition periodically based on factors like market capitalization, liquidity, and sector representation.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.