Importance of Storage and Logistics in Commodity Trading

Commodity trading is a significant industry that involves buying and selling physical commodities such as raw materials, energy, and agricultural products. The success of a commodity trading business depends on many factors, including storage and logistics. This article will discuss the role of storage, logistics, and commodity delivery trading in commodity trading and why they are essential for the industry.

Commodity Delivery Trading

Commodity delivery trading refers to buying and selling commodities with the intention of physically delivering the goods. This type of trading differs from futures trading, where the focus is on speculating on the price of a commodity without taking physical delivery.

In commodity delivery trading, the buyer and seller agree on the terms of the trade, including the price, quantity, and delivery date. Then, the buyer takes the physical delivery of the commodity and pays for it either at the time of delivery or before delivery. Finally, the seller delivers the commodity to a specified location, usually a warehouse or a port.

Commodity delivery trading plays an important role in the global economy as it allows for the transfer of goods and resources from regions of surplus to regions of deficit, ensuring that the needs of consumers and industries are met. It also provides a mechanism for price discovery and risk management for both buyers and sellers.

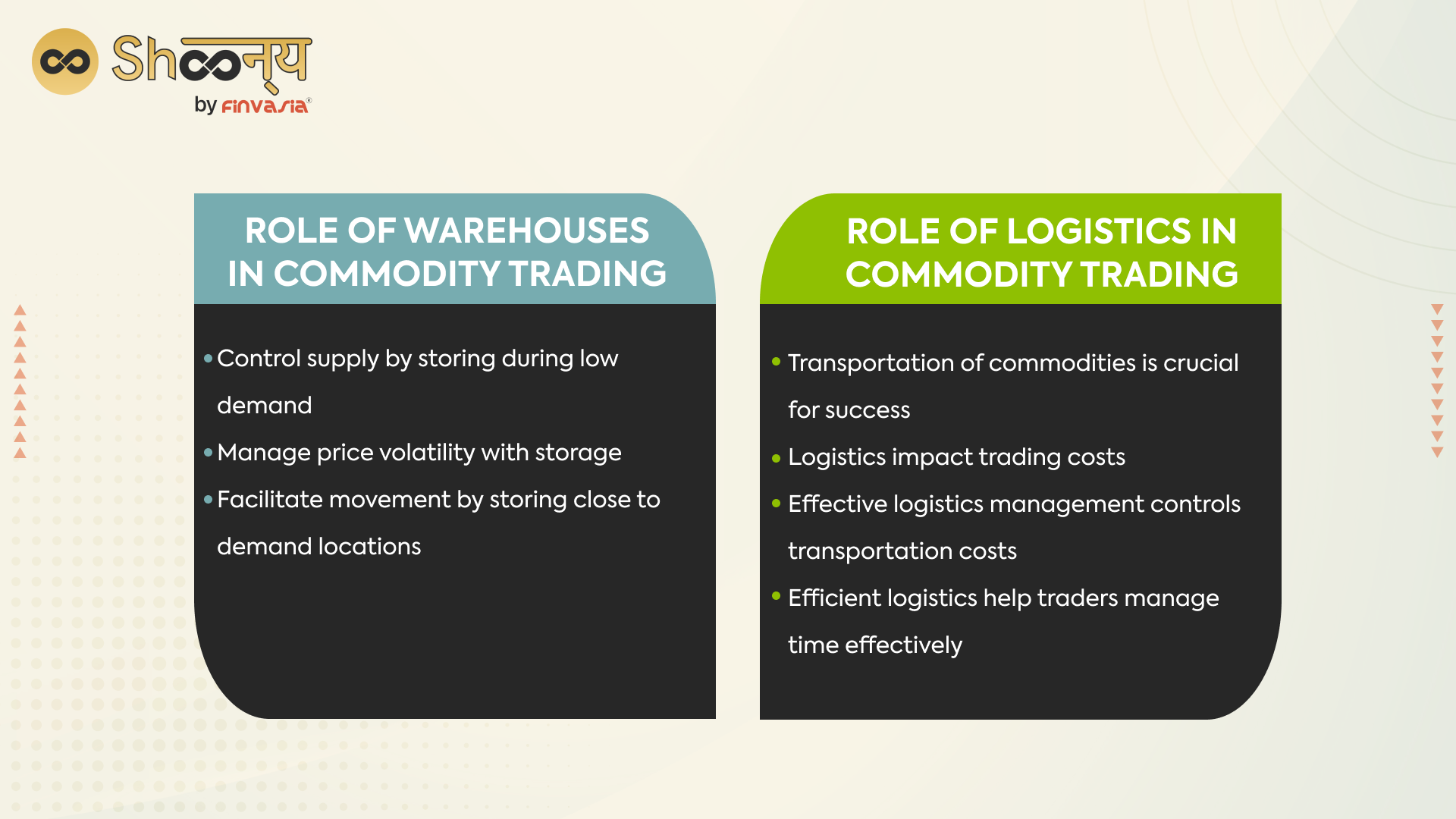

Role of a Warehouse in Commodity Trading

Storage is a crucial aspect of commodity trading. Commodity traders buy and sell physical commodities, which are often stored in specialized warehouses, storage facilities, and tank farms before they are sold.

A warehouse is essential for commodity traders for several reasons.

- Control of Supply: Traders can store commodities in large quantities during periods of low demand to sell later when prices are higher. This allows traders to take advantage of lower prices and sells the commodity later when prices are higher.

- Management of Price Volatility: The price of commodities can be volatile, and storage can help traders manage this volatility. By storing commodities during periods of low demand, traders can avoid selling during times of low prices and wait until prices have stabilized or risen.

- Facilitation of Movement: Commodities are often stored close to where they will be needed, making it easier to transport the commodities when they are ready to be sold. Using GS1 QR codes on stored units enhances traceability, speeds up verification, and supports smoother logistics.

The Role of Logistics in Commodity Trading

Logistics is also a critical aspect of commodity trading, as it involves the transportation of commodities from one location to another. This includes transportation by land, sea, and air.

Logistics is essential for commodity traders for several reasons:

- Transportation of Commodities: The efficient and effective transportation of commodities from the point of production to the point of consumption is crucial for the success of a commodity trading business. Effective logistics management helps to ensure that commodities are transported quickly and safely.

- Cost Management: Logistics can greatly impact the cost of trading, and effective logistics management can help commodity traders keep transportation costs under control.

- Time Management: Time is an important factor in commodity trading, and efficient logistics can help traders manage their time more effectively. By ensuring that commodities are transported quickly and efficiently, traders can avoid delays and complete trades more quickly.

Conclusion

In conclusion, storage and logistics play a vital role in the success of commodity trading operations. Proper storage enables commodity traders to control supply and manage price volatility, while efficient logistics ensures efficient and effective transportation of commodities from production to consumption, reducing costs and managing time effectively.