What are the Benefits of Linking a Demat Account with a Savings Account

Linking your demat and savings accounts streamlines the entire process of investing in the stock market. It not only saves your time but also provides a level of convenience and security that can encourage more people to invest confidently. If you’re new to the stock market it is important for you to know the benefits of linking demat account with savings account!

Let us begin!

Essential Accounts for Trading in the Securities Market

Do you know that, in India, to buy or sell any securities you must have these accounts?

Savings Account

You can open a savings account in any bank. It is useful for transferring and receiving funds related to buying and selling securities.

Trading Account

Your trading account is managed with a SEBI-registered Stock Broker (Trading Member/ TM).

You can use it to buy and sell securities in the market.

Demat Account

You can open it with a SEBI registered Depository Participant (DP).

It is a must to hold shares and securities in electronic (Demat) form.

Savings Account

Your savings account is where you keep your money safe. You can easily take it out whenever you need to buy something or pay for things.

Just like the introduction of apps like GPay/Google Pay has become a trend, linking a demat account with a savings account is becoming increasingly necessary.

Demat Account

An online demat account is like a digital locker where you can keep all your stocks and other investments instead of physical papers.

It’s a safe and electronic way to hold your shares and bonds when you invest in the stock market.

Open a free demat account with zero annual charges

Trading Account

A trading account is like a special pass that lets you to buy and sell stocks and bonds in the Indian stock market. Just as you need a ticket to enter a concert, a trading account is essential to begin trading in the stock market.

It marks the first step towards becoming an investor!

Linking Demat with Savings Account

When you link your demat account with your savings account, it makes it easier for you to move money between them. So, when you want to buy stocks, you can use the money from your savings account.

Similarly, when you sell stocks, the money goes into your savings account.

- You can’t transfer funds directly from your Demat account to your bank account. The trading account acts as an link for transfers.

- You can only withdraw the money earned from selling securities.

- Your fund limit isn’t the same as the amount you can transfer. It includes funds available for trading based on your securities.

This linkage also helps you keep track of all your money in one place. It’s a good step especially if you’re starting out in investing in India, as it makes things more organised.

Linking your demat account with a savings account is like connecting your phone to your bank app.

Let us see the benefits you can experience if you link demat account with savings account!

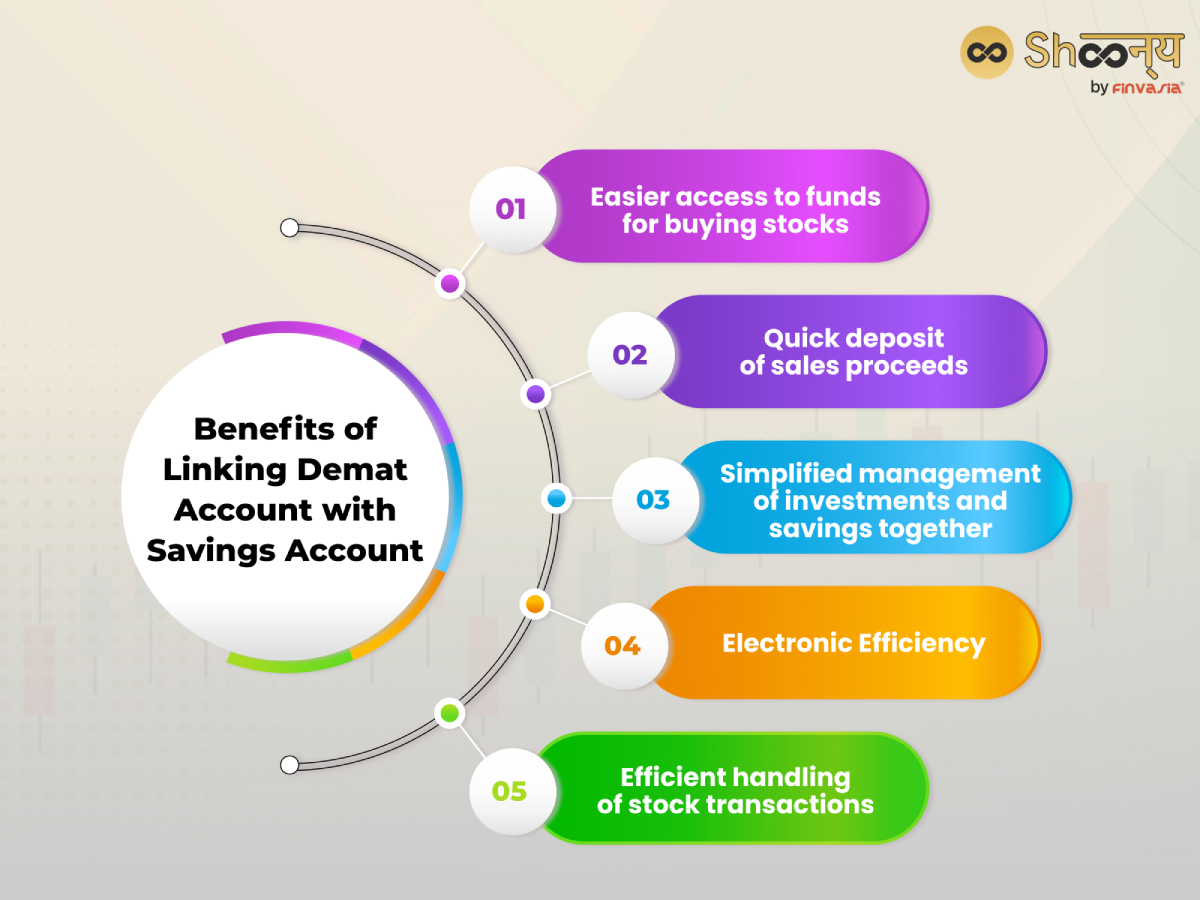

Benefits of Linking Demat Account with Savings Account

- Easier access to funds for buying stocks

- Quick deposit of sales proceeds

- Simplified management of investments and savings together

- Electronic Efficiency

- Efficient handling of stock transactions

Just like transferring money to a friend using your bank app, you can move money to buy stocks without hassle.

Here’s why it matters and how you can do it:

Convenience of Transactions

- When you link a demat account with a savings account, you can seamlessly transfer funds between them.

Anytime, Anywhere Access

- Access and manage your accounts and transactions from anywhere, anytime, which is essential given the volatile nature of stock markets.

Better Tracking

- Linking demat and savings accounts makes it simpler to track your investments.

Faster Settlement of Trades

- After you buy or sell stocks, there is a process called settlement, where the transaction is finalised.

- Linking demat account with savings account speeds up this process. You can immediately use funds from your savings account to settle purchases.

Also, the proceeds from stock sales can be deposited directly into your savings account without delay.

Ease of Investment

- With linked accounts, you can initiate investments directly from your savings account.

- It simplifies the investment process. You don’t need to manually transfer money each time you want to buy stocks. You can initiate transactions conveniently through your demat account linked with your savings account.

Single Platform Management

- Instead of managing multiple accounts separately, you can oversee your investments and funds from one platform.

- This helps you keep a check on your financial activities more efficiently. You can monitor your stocks and funds in one place.

Automatic Deposits and Withdrawals

- You can benefit from automatic transactions such as dividends, interest payments, and refunds directly into your bank account.

- It ensures you receive your earnings from investments without manual intervention.

This can save time and lessen the risk of missing payments or dividends.

Integrated Banking and Investment Experience:

- Your banking and investment activities become integrated and synchronized.

By linking demat account with savings account, you can enjoy the convenience of integrated financial services.

How to Link Demat Account with Savings Account

In the digital age, trading happens online, making transactions quick and secure.

To open a demat account, you’ll need to provide your address proof, PAN card details, and bank account details to the depository participant (DP). The DP will link demat account with savings account.

However, if you have missed linking your demat account with savings account, here’s how you can do it:

Linking Savings Account with Demat Account on Shoonya

In order to update your bank in your trading account, you must raise a ticket through PRISM.

- You can do it by clicking on ‘Request to Change Bank Account’. Additionally, you need to upload proof of your bank account

- Next, our team will verify the details you submitted with the bank proof. Once verified, you’ll receive an option for eSign.

- After eSigning, it will take 24-48 working hours to update your bank details in all our records.

Please note: This process updates the bank details only in the trading account, not in the demat account. To update the bank details in the demat account, you need to follow an offline process.

To Update Bank Details in Demat Account

Here’s an offline process to link demat account with savings account on Shoonya:

- You need to request a bank update form for the demat account via call/chat/ticket/email.

- Our Customer Service team will send the form to your registered email address.

- As you receive the form, you need to take a printout of the form, fill it out with your signature, and attach a self-attested bank proof. This could be a cheque or the front page of your passbook.

- Next, send the completed form via courier to our office at the below address:

Finvasia Tower, C-214, 4th Floor, Phase 8B, Sector 74, Industrial Focal Point, SAS Nagar (Mohali), Punjab – 160055

- Once we receive the form, it will take 2-3 days to update the bank account details in the demat account with CDSL as well as in our records.

You can now enjoy the comfort of adding funds through UPI.

Dividends and corporate cash benefits are credited directly to the bank account linked to your demat account.

However, each demat account can only be linked to one bank account.

Linking Your Demat Account With Your Bank Account through the Banking Portal

You can also link your demat Account with your savings account in India through mobile banking:

- Log in to your bank’s Internet banking portal.

- You must check your account management or profile settings section.

- Look for an option that says ‘Link Demat Account’ or something similar.

- Enter your Demat account details, such as the account number and the name of the depository participant (DP).

- You may also need to provide additional details like your IFSC code and bank account number.

- Submit the request for linking the accounts.

- The request will then undergo a verification process to ensure the accuracy of the details provided.

- Once verified, your Demat Account will be successfully linked to your Savings Account.

Here are some additional things you must know about demat and bank accounts in India.

Can I link Multiple Bank Accounts to My Demat Account?

You can link only one bank account to your demat account. However, you can utilise multiple bank accounts to transfer funds to your trading accounts.

When withdrawing funds, they are transferred to the linked bank account. Your dividends are also directly credited to the linked bank account. You can exchange to a different bank account after opening a demat account.

Why Should an Investor Give their Bank Account Details at the Time of BO Account Opening?

Investors must provide bank account details to safeguard their interests. When companies announce cash or non-cash depositories, share investor details and holdings with the issuer or its Registrar and Transfer Agent (RTA) based on record dates.

This ensures you receive all of the benefits, such as dividends, rights issues, bonuses, and entitlements, accurately.

Can an Investor Change their Bank Account Details?

Yes. Investors can update their bank account details by informing their DP about the change, including the MICR/IFSC code. In the depository system, you receive all your monetary benefits based on the bank account details registered during account opening.

Thus, it’s crucial for investors to notify your DP promptly of any change.

FAQs|Linking Bank Account with Demat Account

Yes, if you have multiple demat accounts with different DPs. However, you cannot link more than one bank account with the same DP.

Linking your bank account to your Demat account streamlines your trading, making it faster and more efficient.

Yes, you can link a Demat account to a savings account for seamless financial transactions in the stock market.

Linking accounts offers convenience, quicker settlements, and easier management of investments and funds.

Money from the sale of stocks in your Demat account can be transferred directly to your linked savings account.

Source- livemint.com, sebi.gov.in, investor.sebi.gov.in

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.