Benefits of the Education Loan Scheme By Government of India

Education is a fundamental right for every individual. However, India continues to face low literacy levels due to inadequate financial support, particularly affecting backward classes. In response, the Government of India has launched a targeted initiative to support youth from these communities. This education loan scheme by government offers financial assistance for higher education. Thus enabling easier access to professional and technical courses.

Now, what exactly is this government education loan scheme, and who can benefit from it?

Let us take a look!

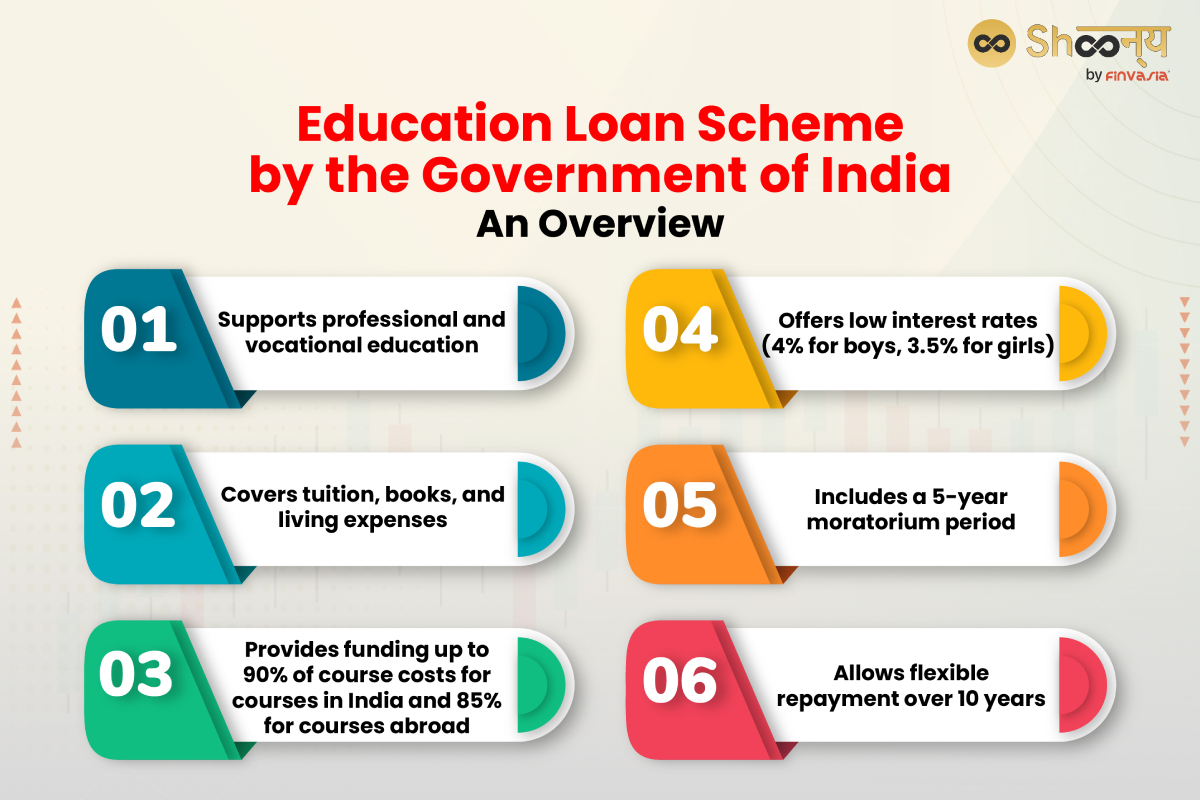

Education Loan Scheme by Government of India| An Overview

NBCFDC Education Loan Scheme

NBCFDC stands for the National Backward Classes Finance and Development Corporation. It is a Government of India undertaking under the Ministry of Social Justice & Empowerment.

Through this educational loan scheme, NBCFDC aims to promote developmental activities for backward classes.

Why is this education loan by government suitable for you?

It provides education loans to students from Backward Classes. This government education loan scheme covers various approved professional, technical, and vocational courses.

Interesting, isn’t it?

What Courses Does This Central Government Education Loan Scheme Cover?

This education loan scheme by government covers all types of courses at the graduate and higher levels approved by the appropriate authority.

How Long Is the Moratorium Period?

The moratorium period for loan repayments is fixed at five years, regardless of the type or duration of the course.

When Do I Need to Start Repaying the Loan?

This government education loan scheme offers a 5-year waiting period where you don’t have to make payments (called the moratorium period). After that, you have up to 10 years to fully repay the loan.

So, in total, you have 15 years from when you first received the loan to repay it all to NBCFDC through your Channel Partner.

Can the Borrower Repay the Loan Early?

Yes, the borrower can repay the loan at any time after the repayment period begins.

There are no charges for closing the loan early if you decide to repay it before the scheduled end of the repayment period.

Government Education Loan Scheme Benefits

The Education Loan scheme by Government covers various expenses essential for your education journey:

- Admission Fee & Tuition Fee

- Books, Stationery & other course-related instruments

- Examination Fee

- Boarding & Lodging Expenses

- Insurance Premium for the policy during the loan period

For Professional/Technical Courses in India

You can get a loan covering 90% of the course expenses, up to a maximum of ₹15,00,000. The remaining 10% of the expenses will either be your responsibility or that of State Channelising Agencies (SCAs).

Note- This is applicable if you study in India.

For Studying Abroad

You can get a loan covering 85% of the course expenses, up to a maximum of ₹20,00,000. You or State Channelising Agencies (SCAs) will need to cover the remaining 15% of the expenses.

Note- This is applicable only if you study a course in a foreign country.

For Vocational Courses

The government education loan scheme covers 90% of the necessary expenses for the course. It depends upon government stipulations, market conditions, and the course’s level of specialization.

The loan amount will be subject to the same limits as those for professional and technical courses.

What Is the Rate of Interest?

- For Boys: 4% per year

- For Girls: 3.5% per year

Eligibility Criteria for Government Education Loan Scheme

To be eligible for this scheme, you need to meet the following criteria:

- You must belong to the Backward Classes as identified by the Central Government/State Government.

- Is your family’s annual income ₹3,00,000 or less?

The State Channelising Agencies/Banks must allocate at least 50% of the funds to those with family incomes up to ₹1,50,000.

- Have you secured admission to a professional or technical course approved by bodies like AICTE, Medical Council of India, UGC, etc., at a recognised institute?

You need to have scored at least 50% marks in the qualifying exam required for the course.

- You must have gained admission to a professional/technical course in India or abroad through an entrance test or based on merit.

OR

- The trainee must have taken admission to a course.

- The training course duration should be at least six months

- The course must be supported by a Government Ministry/Department/Organization or a Company/Society/Organization backed by the National Skill Development Corporation or State Skill Missions/State Skill Corporations.

- Preferably, the course should lead to a Certificate/Diploma/Degree issued by a Government Organization or an organisation authorised by the Government.

This includes fields such as Nursing, Pharma, Tourism & Catering, teacher training, etc.

How Can You Apply?

You can apply for financial help through a government education loan scheme either offline or online.

If you’re interested and eligible, you must contact your District Collector or the District Manager/Officer/Branch Manager at your local Channel Partner (CP) office in your State or District.

They’ll guide you through the process.

If you want to apply online:

You can do it through the official website of NBCFDC.

It’s that simple!

What are the Documents Required For this Education Loan Scheme by Government

To apply to this government education loan scheme, you’ll need:

- Proof of Identity (Aadhaar Card)

- Passport-sized Photograph

- Proof of Educational Qualification (Passing Certificate / Marksheet)

- Caste Certificate (issued by relevant District Administration Authority)

- Annual Family Income Certificate, self-certified by beneficiaries and endorsed by a Gazetted Officer

- Bank Details of the Applicant

If applying through a bank (Channel Partner), the Branch Manager’s assessment and endorsement can serve as valid proof.

Interest Subsidy Scheme on Education Loan

The Ministry of Education launched the “Pradhan Mantri Uchchatar Shiksha Protsahan Yojana: Central Sector Interest Subsidy Scheme” in 2009. This scheme offers full interest subsidy on loans taken under the Model Education Loan Scheme by the Indian Banks’ Association (IBA).

This education loan subsidy scheme aims to increase the number of qualified technicians and professionals in India.

It benefits students from economically weaker sections whose parents’ annual income is up to ₹4.5 Lakhs.

You may also want to know the Pradhan Mantri Suraksha Bima Yojana

FAQs| Education Loan Scheme by Government

An education loan scheme is a financial support system offered by banks to students for pursuing higher education in India or abroad.

Yes, there are two exclusive loan schemes for women beneficiaries: the New Swarnima Scheme under Term Loan and the Mahila Samriddhi Yojana under Micro Finance.

The central government education loan scheme, like the ‘Pradhan Mantri Vidya Lakshmi Karyakram’, provides a single-window platform for students to apply for educational loans.

Source– myscheme.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.