Emergency Fund| The Smart Way to Prepare for Unplanned Expenses

Life can throw surprises at us when we least expect them. One day, you’re on a fun road trip with your family, and the next, your car suddenly breaks down. Now, you’re stuck with an unexpected repair bill. And let’s be honest, a car is a necessity. There is no way you could delay this repair. Now, as you look at your budget, you also remember there are groceries to buy and monthly bills coming up. This is just one example, and we all face similar situations at some point in our lives. It can be a medical emergency, unexpected company layoffs, or even a minor repair on your two-wheeler. Often, we don’t think about how to handle these financial surprises until we’re in the middle of one. That’s why having an emergency fund is so important.

What exactly is an emergency fund, and what is the importance of emergency fund?

Let’s explore it together!

What is an Emergency Fund?

An emergency fund is a sum of money you must set aside to cover unexpected expenses or financial crises. It acts as a financial emergency support that helps you manage unforeseen life situations. This fund is designed to keep you from dipping into your regular savings or taking on debt during difficult times.

This cash is meant for urgent needs. The biggest advantage of an emergency fund is that it allows you to handle life’s unexpected situations. And that too, without relying on credit cards, loans, or tapping into your home’s equity.

But remember, an emergency fund isn’t for indulgences like a new iPhone or your solo trip. Knowing when to use your emergency fund is just as important as having one.

Why is an Emergency Fund Important?

Having an emergency fund allows you to handle a financial emergency calmly.

For example, if you’re the only earner in the family, and your company announces layoffs, your emergency fund can cover your essential expenses.

When emergencies arise, many people rely on credit cards or personal loans to cover expenses. However, this can lead to high-interest debt, which might take years to pay off.

Let us see some of the emergency fund investment benefits.

Emergency Fund Benefits: How it Can Save you

Let us understand this with a few emergency fund examples:

Neha, a 25-year-old marketing professional, used to live in a rented apartment. After renewing her lease, she discovers that her landlord has raised the rent significantly. On top of her regular bills, this unexpected increase affects her overall budget. Neha wanted to save for a vacation but realised that she needed to tighten her budget.

Now, if she had an emergency fund, she would have handled this financial emergency easily.

Her friend, Priya, had a different story.

She had saved 6 months’ worth of expenses in an emergency fund. When her company laid off employees, Priya had enough savings. She was able to cover her rent and monthly groceries, while she searched for a new job.

This is exactly why an emergency fund is so crucial.

Let us take a look at the importance of emergency funds:

1. Financial Security

Having an emergency fund means you will always be ready for unexpected financial emergencies.

2. Avoiding Debt

With an emergency fund, you won’t need to rely on loan options that charge hefty interest rates.

3. Flexibility in Job Changes

If you lose your job or decide to switch careers, an emergency fund gives you time to find the right job.

Let us say you are in your 30s and want to start your own business. This would be such an easy step if you have savings in an emergency fund.

4. Encourages Saving Habits

Making emergency fund investments teaches you the habit of saving regularly. Once you start saving for emergencies, you may also begin to save for other goals.

5. Better Decision-Making

When unexpected costs arise, having an emergency fund allows you to make the best choices for you. For instance, if you need to choose between different repair services for your home, you can pick the best one without rushing due to financial pressure.

6. Coverage for Everyday Emergencies

Life is unpredictable. Things like a broken washing machine, a child’s compulsory school excursion or a last-minute family emergency can pop up. An emergency fund ensures you’re prepared for these.

How Much Should you Save in an Emergency Fund?

By now, you must have asked yourself at least one question: How much emergency fund should I have?

Ideally, your emergency fund should cover 3 to 6 months’ worth of living expenses. This includes things like rent, groceries, utility bills, transportation/fuel, etc.

If your monthly expenses are ₹25,000, you should aim to save at least ₹75,000 to ₹1,50,000 in your emergency fund.

However, this doesn’t mean you have to save it all at once. The key for emergency fund investment is to start small and build up gradually. To determine your target amount, you can use an emergency fund calculator to help you assess how much you need based on your expenses.

It’s about taking small steps consistently.

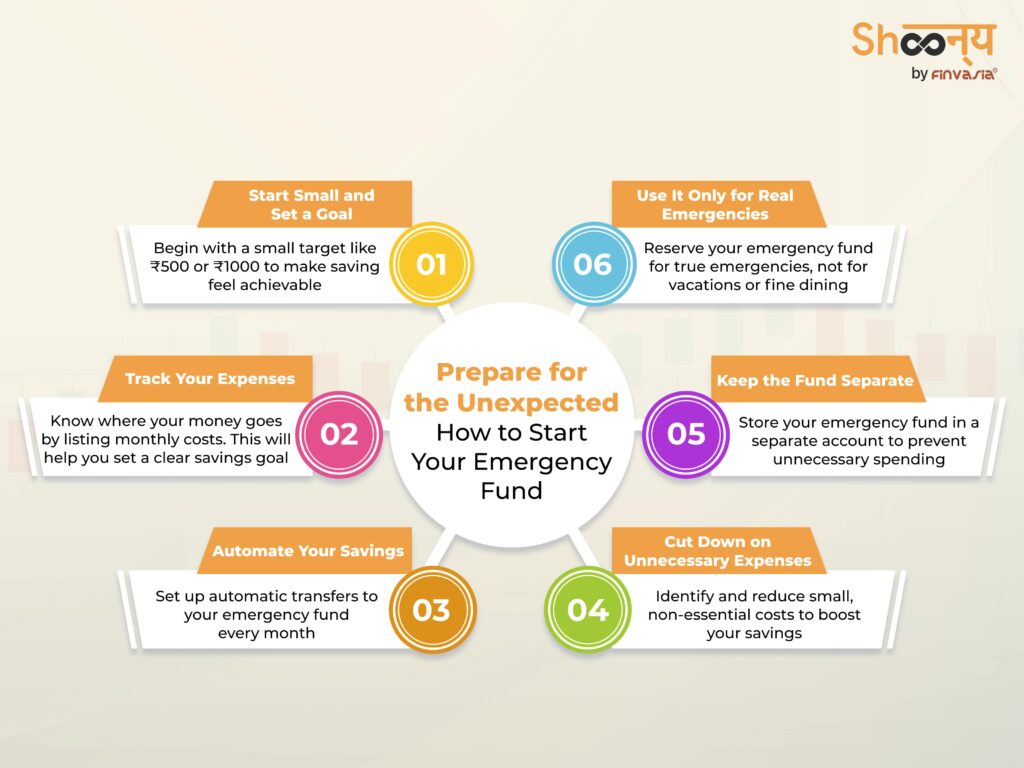

Steps to Building an Emergency Fund

Thinking about where to keep emergency fund?

Here are the steps to build your emergency investment fund in India:

Step 1: Start Small and Set Goals

Begin with a manageable goal. If the idea of saving six months’ worth of expenses feels overwhelming, start with just ₹5,000 or ₹10,000. This way, you can gradually build your fund without feeling too much pressure.

For instance, you could save ₹1,000 each month. In just five months, you’ll have ₹5,000 set aside. Keep increasing this amount as you get more comfortable with saving.

Step 2: Track Your Expenses

Before you start saving, you need to know where your money is going. Make a list of your monthly expenses like rent, care outings, bills, and transportation. This will help you understand how much money you need for your emergency fund.

For example, let’s say your total monthly expenses come up to ₹25,000. If you aim to save 3 months of expenses, your target should be ₹75,000.

Step 3: Automate Your Savings

One of the easiest ways to build an emergency fund is by automating your savings. You can set up a recurring transfer from your main account to a separate savings account each month.

This way, the money is moved before you even notice it, and you’re less tempted to spend it.

If you earn ₹50,000 per month, set up an automatic transfer of ₹5,000 into your emergency fund as soon as you get paid.

Over time, this will grow without any extra effort on your part.

Step 4: Cut Down on Unnecessary Expenses

We all spend money on things we don’t necessarily need, whether ordering food online or subscribing to multiple streaming services. The best way is to cut down on these small expenses. They can add up.

For example, if you’re spending ₹2,500 a month on dining out, try cutting it to ₹1,000 and save the difference. Over a year, that’s an extra ₹18,000 for your emergency fund!

Step 5: Keep the Fund Separate

Don’t mix your emergency fund with your regular savings. Keep it in a separate account to avoid using it for non-emergency purposes. You can look for high-interest savings accounts.

In India, many banks offer special savings accounts.

Explore the top private banks in India!

You can compare and choose the one that offers better interest rates.

Step 6: Use It Only for Real Emergencies

It’s important to recognise what qualifies as a real emergency.

For example, an emergency fund should be used if you lose your job or need to pay for urgent medical treatment. It shouldn’t be used for your vacations.

Let’s say your fridge breaks down in the middle of summer, and you don’t have the funds to replace it right away.

In this case, your emergency fund can help you avoid dipping into your regular savings.

Conclusion

Building an emergency fund is one of the best financial decisions you can make.

So, begin today.

You can set up that separate savings account and automate your savings.

An emergency fund is not just a nice-to-have; it’s essential. By starting to save today, you can build a more secure and confident future for yourself and your family.

Key Takeaways:

- An emergency fund gives you protection.

- You must aim to save 3 to 6 months’ worth of living expenses.

- Automate your savings to make building your fund easier.

- You should use the fund only for true emergencies.

Remember, it’s not about how much you earn but how well you manage what you have.

FAQs| Emergency Fund Investment

An emergency fund should have enough money to cover three to six months of your living expenses.

First, you must figure out your monthly expenses, then save that amount each month for six months.

A high-yield savings account or a liquid mutual fund is best because it offers easy access to your money.

It depends on your monthly expenses; it should ideally cover three to six months of costs.

This rule suggests you spend 50% of your income on needs, 30% on wants, and save 20%.

For many people, three months can be enough. However, it is always better to save it for at least six months.

To find out how much you need, you can multiply your monthly living expenses by the number of months you want to cover.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.