Exploring the Advantages and Disadvantages of Commodity Trading in India

In the realm of financial markets, commodities stand as distinct assets that offer both opportunities and complexities for investors. A commodity is a fundamental good, often a raw material, that is interchangeable with others of the same kind. In India, the commodity market is a vital platform facilitating the buying and selling of these goods, shaping industries and investments alike. Key players include metals like gold and silver, agricultural products like wheat and cotton, and energy resources like crude oil. As India surges forward, understanding its commodity landscape becomes crucial for informed Let’s delve into the benefits and drawbacks of venturing into the world of commodities.

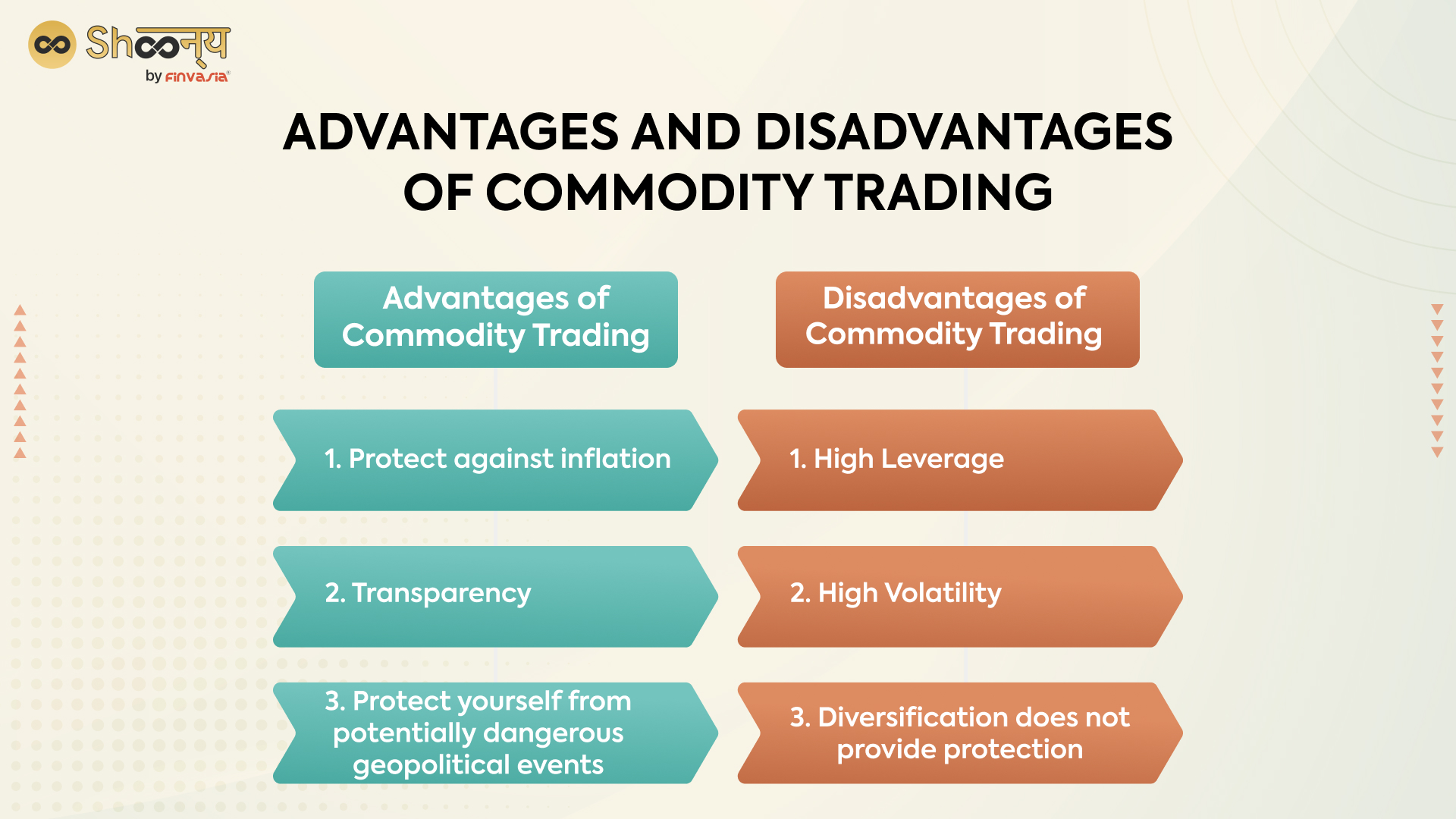

Advantages of Commodity Trading

- Diversification: Commodities introduce diversification to investment portfolios, reducing overall risk exposure. Their performance often differs from traditional assets like stocks and bonds, acting as a buffer during market volatility.

- Inflation Hedge: As commodities tend to rise in value during inflation, they serve as a safeguard against currency depreciation. Investors seek commodities to preserve purchasing power.

- Global Demand Influence: Commodities’ prices can surge due to geopolitical events, natural disasters, or supply disruptions, providing lucrative opportunities for investors.

- Profit Potential: Trading commodities allows investors to profit from both rising and falling markets, thanks to options like futures and options contracts.

Disadvantages of the Commodity Trading

- Price Volatility: Commodities can experience rapid price swings due to external factors, potentially leading to substantial gains or losses for traders.

- Lack of Income: Unlike dividend-paying stocks or interest-bearing bonds, commodities do not provide regular income, making them more suitable for capital appreciation.

- Limited Knowledge: Successful commodity trade demands specialized knowledge of specific markets, often requiring diligent research and analysis.

- Market Complexity: Derivative trading, such as futures and options, can be intricate and necessitates understanding contract terms and market dynamics.

Understanding the Indian Context: Commodity Market and Commodity Trading

Commodity trading in India has gained traction, especially with the Multi Commodity Exchange (MCX) offering a platform to trade in various commodities, from metals to agricultural products. While it holds the potential for handsome returns, it’s vital to acknowledge the risks and seek expert guidance.

In the dynamic landscape of commodity trading, understanding the benefits and drawbacks is crucial. Whether you’re drawn to its potential for profits or its role as a portfolio diversifier, careful consideration and a balanced approach are essential in harnessing the power of commodities in the Indian investment arena.

FAQs| Commodity Market

Commodity trading can be complex for beginners due to its unique dynamics and derivative instruments. Newcomers should seek educational resources and consider paper trading before committing to real funds.

To begin commodity trading in India, open a trading account with a recognised brokerage offering commodity trade services. Familiarise yourself with different commodities and market trends.

Yes, commodities like gold and oil historically act as an inflation hedge, tending to appreciate when inflation rises.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.