Atal Pension Yojana Details| Benefits, Eligibility and Application Process

Planning for retirement is a common concern that seems to frighten many of us, especially those in the unorganised sector. However, there’s good news. A new pension scheme provides a guaranteed pension, ensuring a regular income post-retirement. In this article, we understand the features and benefits of the Pradhan Mantri Atal Pension Yojana.

Start Saving Today with the PM Atal Pension Yojana for a Better Tomorrow!

Do you know?

With APY, you can start building your retirement fund now, with contributions starting as low as Rs. 42 per month.

What is Atal Pension Yojana Scheme (APY)?

Atal Pension Yojana (APY) is a government pension scheme for Indian citizens, especially those working in the unorganised sector. It offers a guaranteed minimum pension of Rs. 1,000, 2,000, 3,000, 4,000, or 5,000 per month at the age of 60. This pension amount depends upon the contributions made by subscribers.

The Atal Pension Yojana (APY) scheme is available to savings account holders aged 18-40 years who are not income tax payees.

Why is this scheme special?

APY primarily targets the poor, the underprivileged, and workers in the unorganised sector.

Atal Pension Yojana Scheme aims to provide them with a secure income post-retirement. It also encourages voluntary savings for their future.

Atal Pension Yojana Details| Charges, Fees, and Overdue Interest

The APY scheme involves charges and fees that are levied on the subscribers.

Pension Fund Regulatory and Development Authority (PFRDA) determine these in consultation with the Central Government.

Raising Grievances under APY

If you have any grievances regarding the Atal Pension Yojana, you can raise them anytime, free of cost, from anywhere.

Here’s how:

- Visit the Official Website: Go to www.npscra.nsdl.co.in.

- Next, from the Grievance Section:

- Select Home.

- Choose NPS-Lite or go through CGMS.

- Submit Your Grievance, and You will be allotted a token number for tracking.

- You can check the position of your grievance anytime by using the token number under the section “Check the status of Grievance / Enquiry already registered”.

What are the Benefits of Atal Pension Yojana (APY)?

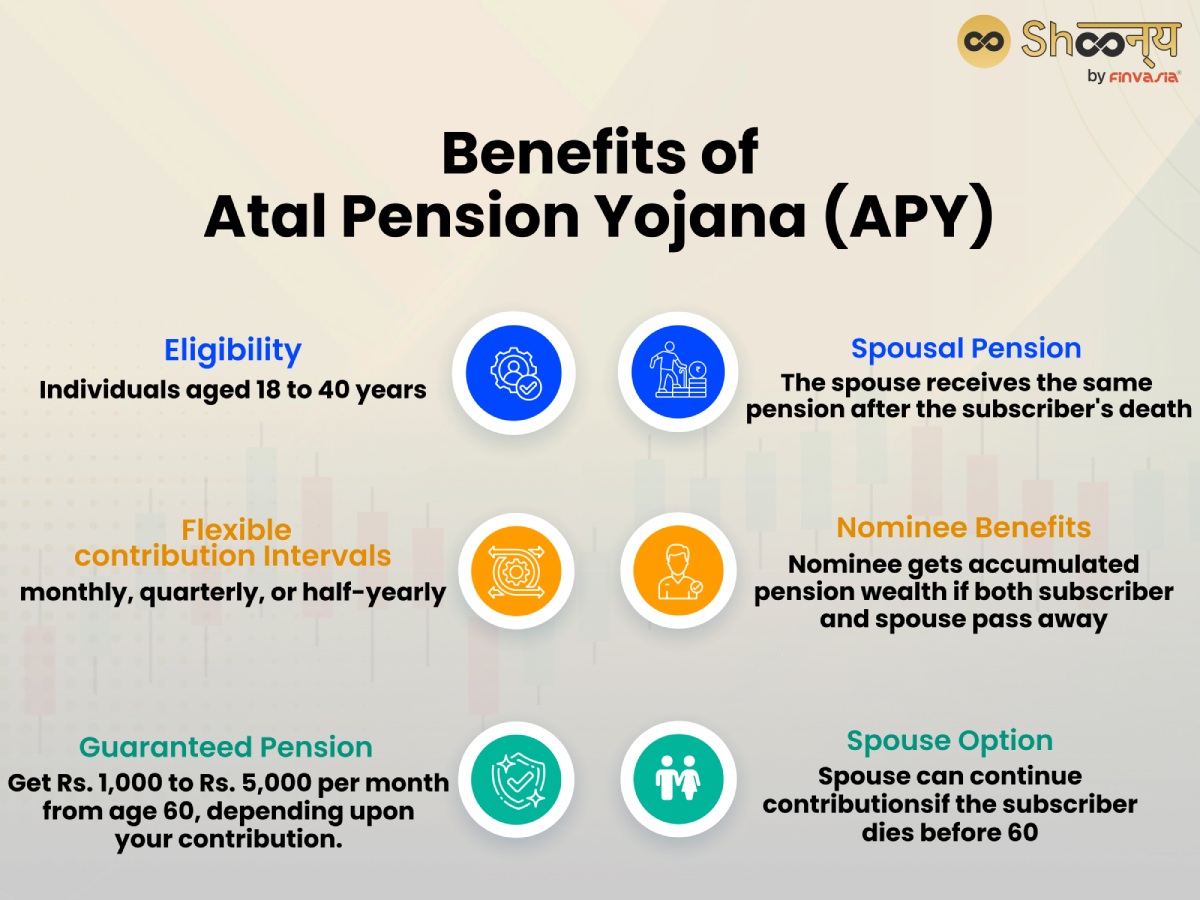

There are several reasons to join the Atal Pension Yojana scheme:

Guaranteed Minimum Pension: Receive a guaranteed pension ranging from Rs. 1000 to Rs. 5000 per month.

Spousal Pension: The spouse receives the same pension amount after the subscriber’s death.

Nominee Benefits: Nominee gets accumulated pension wealth upon both subscriber and spouse’s demise.

Option for Spouse: If the subscriber dies before 60, the spouse can continue contributing to the same pension.

Tax Benefits

- Your contributions to the scheme are eligible for tax benefits. This is similar to the National Pension System (NPS) under section 80CCD(1).

Now, how do you exit from the Atal Pension Yojana Scheme (APY)?

Withdrawal from Pradhan Mantri Atal Pension Yojana

You can exit the scheme in multiple ways:

A. Upon reaching the age of 60:

When you turn 60, you must request to your associated bank to withdraw the guaranteed monthly pension. If investment returns exceed the guaranteed returns, a higher pension can be requested. The same pension amount is payable to the spouse (default nominee) upon the subscriber’s death.

Check out the top government banks in India in 2024!

The nominee is entitled to receive the pension wealth accumulated until the subscriber’s age of 60 upon the deaths of both the subscriber and the spouse.

B. Subscriber’s death after age 60:

If the subscriber passes away after the age of 60, the pension becomes available to your spouse. However, what if you and your spouse both pass away?

In that case, the pension wealth accumulated until the subscriber’s age of 60 is returned to the nominee.

C. Exiting before the age of 60:

In case you want to exit before the age of 60, it is generally not allowed.

However, there are a few exceptional circumstances, such as the beneficiary’s death or terminal illness, as per NPS provisions.

If you have received Government co-contribution under APY and you choose to exit APY voluntarily later, you are eligible to revive only your contributions to APY, along with the actual accrued income (after deducting maintenance charges).

The Government co-contribution and its accrued income is not returned to such subscribers.

Eligibility for Atal Pension Yojana (APY)

Here is a simple eligibility criteria defined for the scheme:

- Age of Joining:

- Minimum age: 18 years

- Maximum age: 40 years

- Contribution Period:

- You need to make contributions from the age of joining APY until the age of 60 years.

- Start of Pension:

- Pension begins at the age of 60 years.

- Auto-Debit Facility:

- APY scheme provides auto-debit premium option from the subscriber’s savings bank account on a monthly, quarterly, or half-yearly basis.

How do you apply to this scheme?

Application Process for Atal Pension Yojana (APY)

You can become part of Atal Pension Yojana (APY) by applying online as well as offline.

Online Process

Process 1:

- Log in to your internet banking account.

- There is always an option for Atal Pension Yojana on the dashboard.

- Fill in basic and nominee details.

- Provide consent for auto-debit of premium.

- Submit the form.

Process 2:

- Visit the website https://enps.nsdl.com/eNPS/NationalPensionSystem.html.

- Select “Atal Pension Yojana” and then “APY Registration”.

- Next, you must fill in basic details in the form.

- Complete KYC through one of the following options:

- Offline KYC: Upload XML file of Aadhaar.

- Aadhaar: Verify KYC through OTP on the registered mobile number.

- Virtual ID: Create an Aadhaar virtual ID for KYC.

Know how to link your Adhaar card with your PAN card!

- After filling in basic details, an acknowledgement number is generated.

- Fill personal details and select the desired pension amount that you wish to receive after 60 years.

- Decide the frequency of contribution.

- Confirm personal details and fill in nominee details.

- Submit personal and nominee details.

- Proceed to the NSDL website for eSign.

- Once your Aadhaar is OTP verified, you’re successfully registered in APY.

Other Options:

- You can also join digitally through the e-APY portal or web portal of banks providing such a facility.

Offline Process

You can visit your nearest bank branch or post office where you have a savings account and fill out the APY registration form to open an APY account.

Documents Required for Atal Pension Yojana (APY)

All your KYC details are fetched from the active Bank/Post Office Savings account.

Which social security scheme beneficiaries aren’t eligible for Government co-contribution under APY?

Beneficiaries covered under certain statutory social security schemes aren’t eligible for Government co-contribution under APY.

For instance, members of social security schemes under acts like:

(i) Employees’ Provident Fund and Miscellaneous Provision Act, 1952.

(ii) The Coal Mines Provident Fund and Miscellaneous Provision Act, 1948.

(iii) Assam Tea Plantation Provident Fund and Miscellaneous Provision, 1955.

(iv) Seamens’ Provident Fund Act, 1966.

(v) Jammu Kashmir Employees’ Provident Fund and Miscellaneous Provision Act, 1961.

Conclusion

The Atal Pension Yojana is an affordable and secure way to ensure a retirement income, with comprehensive benefits for both subscribers and their families. Start saving today to guarantee financial stability for your future.

FAQs| Atal Pension Yojana Online Apply

You don’t have to give your Aadhaar number to start an APY account, but it’s a good idea for better subscriber identification.

Nope, you need a savings bank account or a post office savings bank account to get into APY.

Atal Pension Yojana ek sarkari pension scheme hai jo unorganized sector ke logon ko retirement ke baad ek nishchit pension pradaan karti hai. Yeh yojana 18 se 40 saal ke umra ke beech ke savings account holders ke liye hai jo income tax nahi bharte.

You can open only one APY account. Multiple accounts are not allowed.

Source- myscheme.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.