Nowadays, choosing the right bank is crucial for everyone. Why? Because the economy constantly evolves, so do the services offered by banks. We Indians still prioritise safety above all else and thus tend to favour top government banks in India. India’s banking sector is dominated by several Sarkari banks that offer reliable financial services. The top 10 government banks in India include the State Bank of India (SBI), Punjab National Bank (PNB), and Bank of Baroda, among others. If you’re looking for the best government bank in India, it is important to see who provides the best rates, products, and services. Best banks in India are not only ranked on the basis of their services but also on factors like the adoption of new technology.

In this blog, we have curated a list of the top 10 government banks in India with detailed analyses of their service, product offerings, and more!

Let us begin- Top 10 Public Sector Banks in India – 2025 Ranking

- Government Banks in India

- Latest List of Government Banks in India- 2025

- Top 10 Public Sector Banks in India – 2025

- Top 10 Public Sector Banks in India by Market Cap – 2025 Edition

- SBI- 1st Among the Top 10 Government Banks in India

- PNB- Ranked 2nd Among the Top 10 Government Banks in India

- BOB- 3rd Top Performer in the Best Government Bank in India List

- IOB- 4th Choice Among the Top 10 Government Banks in India

- Union Bank of India- 5th Best Government Bank in India

- Canara Bank- 6th in the Top 10 Public Sector Banks in India

- Indian Bank- Ranked 7th Among Top 10 PSU Banks

- UCO Bank: Ranked 8th Among the Top 10 Government Banks in India

- Bank of India- 9th Among the Top 10 Government Banks in India

- Central Bank of India- Best Sarkari Bank

- Types of Government Banks in India

- Pros of Government Banks

- Cons of Government Banks

- Top Public Banks in India- FAQs

Government Banks in India

A government bank in India is one where the government owns more than 50% of its shares. These banks, also called public sector banks or Sarkari banks, focus on public welfare by making banking accessible to everyone.

The roots of many of these banks trace back to the pre-independence era. Those were the times when these top government banks in India were established to meet the basic financial needs of the public.

India’s banking system has grown over time. Early banks like the Bank of Bengal (1806) laid the foundation. Later, the Imperial Bank became SBI in 1955 to strengthen banking. In 1969, 14 major banks were nationalised, followed by 6 more in 1980.

Key Developments in India’s Public Sector Banking Consolidation

The last significant consolidation occurred in April 2020, when Andhra Bank and Corporation Bank merged into Union Bank of India. In November 2024, the government proposed reducing the number of regional rural banks from 43 to 28 to enhance efficiency and capital strength.

After 2020, several government banks in India after merger became larger and more efficient financial institutions. In this process, six public sector banks merged into six larger independent public sector banks.

- Oriental Bank of Commerce and United Bank merged with Punjab National Bank.

- Andhra Bank and Corporation Bank merged with Union Bank of India.

- Syndicate Bank was merged with Canara Bank. Lastly, Allahabad Bank merged with Indian Bank.

- Earlier, in 2018, Vijaya Bank and Dena Bank were merged into Bank of Baroda.

Best Bank in India- 2025

State Bank of India (SBI) Leads with a Market Cap of ₹6,87,597 Cr. and Stock Price of ₹770 as of February 5th, 2025

SBI continues to lead the way with strong financial performance, trusted services, and a wide range of banking solutions.

Explore: Top Private Banks in India – 2025

Latest List of Government Banks in India- 2025

There are 12 government banks in India, as per the data released in 2025. These include:

- State Bank of India

- Canara Bank

- Indian Bank

- Union Bank of India

- Bank of India

- Punjab National Bank

- Bank of Baroda

- UCO Bank

- Central Bank of India

- Bank of Maharashtra

- Indian Overseas Bank

- Punjab and Sind Bank

These banks play a crucial role in the country’s banking and financial system.

But, out of these, which are the top 10 government banks in India?

Let us take a look!

Top 10 Public Sector Banks in India – 2025

Be it for savings, loans, or investments, the top 10 public sector banks in India offer it all.

Here is the list of the top 10 government banks in India – 2025!

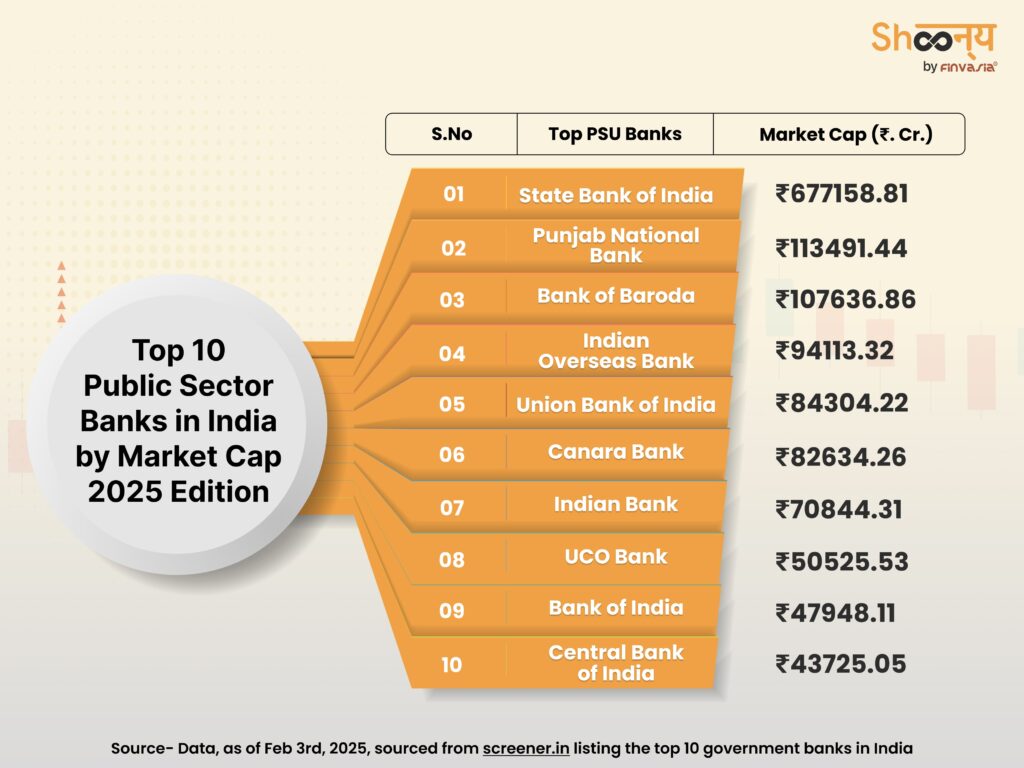

Top 10 Public Sector Banks in India by Market Cap – 2025 Edition

| No. | Top PSU Banks | Founded | Market Cap ₹ Cr |

| 1. | State Bank of India | 1995 | 677158.81 |

| 2. | Punjab National Bank | 1894 | 113491.44 |

| 3. | Bank of Baroda | 1908 | 107636.86 |

| 4. | Indian Overseas Bank | 1937 | 94113.32 |

| 5. | Union Bank of India | 1919 | 84304.22 |

| 6. | Canara Bank | 1911 | 82634.26 |

| 7. | Indian Bank | 1907 | 70844.31 |

| 8. | UCO Bank | 1943 | 50525.53 |

| 9. | Bank of India | 1906 | 47948.11 |

| 10. | Central Bank of India | 1911 | 43725.05 |

Source– Data, as of Feb 3rd, 2025, sourced from screener.in listing the top 10 government banks in India/ top 10 public sector banks in India 2025

Top 10 Government Banks in India 2025: An Overview

Here’s a brief overview of each of the best government banks in India, complete with their latest financial insights!

SBI- 1st Among the Top 10 Government Banks in India

Year of Establishment: 1806 (as Bank of Calcutta), renamed as State Bank of India in 1955

SBI is the leading public sector bank in India based on market cap, standing at ₹6,87,641.94 crore as of February 5, 2025.

SBI stands as one of the largest government banks in India. It holds the first position among the top 10 public sector banks in India.

As a Fortune 500 company, SBI has a rich heritage of over 200 years, earning the trust of generations of Indians.

- As of Feb 4th, 2025, SBI serves more than 500 million customers.

- It has a network of 22,500+ branches, 63,580 ATMs, and 82,900 BC outlets.

- As one of the top government banks in India, SBI has successfully diversified its business through subsidiaries.

SBI General Insurance, SBI Life Insurance, SBI Mutual Fund, and SBI Card.

With a global presence, operating across 241 offices in 29 countries, SBI stands as a leading name in the list of public sector banks in India.

PNB- Ranked 2nd Among the Top 10 Government Banks in India

Year of Establishment: 1894

Punjab National Bank holds a market cap of ₹1,15,389.17 crore as of February 5, 2025.

Punjab National Bank (PNB) is a government-owned bank in India, and its main office is in New Delhi.

It was founded on May 19, 1894, at the instance of Rai Mool Raj and Lala Lajpat Rai.

Lala Harkrishan Lal, inspired by his ideas on commerce and industry, helped shape the bank’s practical approach.

Want to invest in PNB shares? Start today with a FREE demat account!

Punjab National Bank (PNB): Top Sarkari Bank Key Insights 2025

- PNB’s stock is currently trading at ₹99.05 (as of Feb 4, 2025).

- The stock’s price ranges between ₹92.40 and ₹142.90, reflecting recent volatility.

- The bank’s 3-year CAGR revenue growth is 8.8%.

As of 2025, PNB has introduced various new initiatives, such as Digital Transformation, the issuance of the Rupay Credit Card through the BHIM PNB App, cash withdrawal using UPI, etc.

BOB- 3rd Top Performer in the Best Government Bank in India List

Year of Establishment: 1908

Bank of Baroda has a market cap of ₹1,13,821.70 crore as of February 5, 2025.

Bank of Baroda (BOB) is an Indian government-owned bank with its main office in Vadodara, Gujarat. It holds the 4th position among the top 10 government banks in India.

Established by Maharaja Sayajirao Gaekwad III on July 20, 1908, the bank today holds the 4th position among the top 10 government banks in India.

It was nationalised on July 19, 1969, along with 13 other commercial banks in India.

Key Offerings as of Feb 2025-

- Home Loan Interest Rate: 8.40% P.A.*

- Car Loan Interest Rate: 8.85% P.A.*

- Education Loan Interest Rate: 8.15% P.A.*

- Personal Loan Interest Rate: 10.80% P.A

- Bank of Baroda’s stock is trading at ₹197.50, with a 0.56% increase (as of Feb 4, 2025).

This leading public sector bank has implemented advanced tech solutions like CBS, mobile banking, and online services to improve customer experience.

IOB- 4th Choice Among the Top 10 Government Banks in India

Year of Establishment:– 1937

Indian Overseas Bank (IOB) reports a market cap of ₹97,234.04 crore as of February 5, 2025.

Indian Overseas Bank (IOB) was founded on February 10, 1937, by Shri M.Ct.M. Chidambaram Chettyar. He started the bank with the aim of focusing on foreign exchange services and expanding it globally.

IOB began operations in Karaikudi, Chennai, and Rangoon (Myanmar), later opening a branch in Penang, Malaysia. By the time of India’s independence, the bank had 38 branches in India and 7 overseas, with total deposits of ₹6.64 crore and advances of ₹3.23 crore.

In 1969, IOB was nationalised, becoming one of the 14 major banks taken over by the government. At that time, it had 195 branches in India, with deposits of ₹67.70 crore and advances of ₹44.90 crore.

Today, IOB has an international presence in Singapore, Hong Kong, Thailand, and Sri Lanka.

Union Bank of India- 5th Best Government Bank in India

Year of Establishment: 1919

Union Bank of India has a market cap of ₹90,992.56 crore as of February 5, 2025.

Union Bank of India, headquartered in Mumbai, is a leading public sector bank in India.

Established on November 11, 1919, as a limited company, it stands on 5th rank among the top 10 government banks in India.

It expanded significantly with the amalgamation of Andhra Bank and Corporation Bank on April 1, 2020.

Key Highlights as of March 2025

- Over 8,400 domestic branches, 8,900+ ATMs, 75,800+ employees, and 18,900+ BC Points.

- The Government of India holds 74.76% of the Bank’s paid-up capital, making it one of the best government banks in India.

- Union Bank of India was registered on November 11, 1919.

- As of December 31, 2024, the Bank’s total business stood at ₹21,65,726 crore, strengthening its position among the top 10 public sector banks in India.

- Union Bank of India employs 74,000+ staff and operates over 8,500 domestic branches, contributing to its status as one of the leading government banks in India.

- With a network of 9,000+ ATMs and operations across all States and Union Territories, Union Bank of India is a key player in the PSU banks sector.

- The Bank has expanded its global footprint with overseas branches in Dubai (UAE) and Sydney (Australia), positioning it as one of the top government banks in India with international reach.

- Overseas Presence: 2 branches (Dubai, UAE & Sydney, Australia), 1 banking subsidiary (London, UK), 1 banking joint venture (Malaysia).

- Domestic Subsidiaries: 4 para-banking subsidiaries, 2 joint ventures, 1 associate (Chaitanya Godavari Gramin Bank).

- First largest bank in India (public sector) to implement a 100% core banking solution.

Canara Bank- 6th in the Top 10 Public Sector Banks in India

Year of Establishment: 1906

Canara Bank records a market cap of ₹87,332.30 crore as of February 5, 2025.

Founded in July 1906 by the visionary Shri Ammembal Subba Rao Pai, Canara Bank is one of the top government banks in India, ranking second on the list.

Canara Bank is the second largest public sector bank in India.

Key Highlights (Dec 2024)

- Global Business Growth: Increased by 9.30% compared to last year, reaching ₹24,19,171 Crores.

- Global Deposits: Grew by 8.44% year-on-year, totaling ₹13,69,465 Crores.

- Global Advances (Loans): Increased by 10.45%, reaching ₹10,49,706 Crores.

- Gross NPA (Non-Performing Assets): Fell by 3.34%, improving by 105 basis points.

- Net Profit: Rose by 12.25%, totalling ₹4,104 Crores.

- Provision Coverage Ratio (PCR): Improved to 91.26%, up by 225 basis points.

- Operating Profit: Grew by 15.15%, reaching ₹7,837 Crores.

- Net NPA: Fell by 0.89%, improving by 43 basis points.

- International Branches: 4 (London, New York, Dubai, and GIFT City, Gujarat)

Indian Bank- Ranked 7th Among Top 10 PSU Banks

Year of Establishment: 1907

Indian Bank holds a market cap of ₹73,012.19 crore as of February 5, 2025.

It is one of the best government banks in India.

Indian Bank was incorporated with an authorised capital of ₹20 lakhs and commenced its business on August 15, 1907. Currently, it ranks as the 7th largest public sector bank in India by market cap.

2025 Performance Highlights:

- Indian Bank’s Q3 FY25 net profit is ₹2,910 crore.

- Total income grew 11% to ₹18,167 crore.

- Total deposits increased by 7% to ₹7.02 lakh crore.

- Capital Adequacy Ratio improved to 15.92%, with EPS up 26% to ₹84.70.

Indian Bank aims to provide innovative, customer-focused services and grow sustainably, with an emphasis on digital banking, MSME support, and CASA (Current & Savings Account) growth.

- Branch Network: As of December 2024, Indian Bank operates 5,877 domestic branches and 3 overseas branches.

- ATMs & BNAs: 4,937.

- Business Correspondents: 11,297.

UCO Bank: Ranked 8th Among the Top 10 Government Banks in India

Year of Establishment: 1943

UCO Bank has a market cap of ₹51,482.39 crore as of February 5, 2025.

UCO Bank is one of the oldest and most trusted government banks in India. It was founded in 1943 in Kolkata by eminent businessmen and visionaries.

UCO Bank offers its customers multiple financial and banking services, such as personal, corporate, rural, MSME, digital, and international banking.

- Services and Reach:

- Over 3,000 service units across India.

- Presence in international financial centres like Hong Kong and Singapore.

- Correspondents in over 50 centers globally.

- Headquartered in Kolkata with 43 zonal offices in India.

- Zonal offices report to head office departments.

- International Operations: Includes foreign exchange business at over 50 centers in India.

Bank of India- 9th Among the Top 10 Government Banks in India

Year of Establishment: 1906

Bank of India stands with a market cap of ₹49,282.68 crore as of February 5, 2025.

Bank of India was established on 7th September 1906 by a group of prominent businessmen from Mumbai.

The bank remained under private ownership and control until July 1969, when it, along with 13 other banks, was nationalised.

It has a network of over 5,100 branches across all states and union territories, including specialised branches.

Ranked fifth among the top government banks in India, this bank went public with its maiden issue in 1997. It also conducted a Qualified Institutions Placement in February 2008.

Key Highlights:

- BOI is the first nationalised bank to establish a fully computerised branch and ATM at Mahalaxmi Branch, Mumbai, in 1989.

The Bank started with one office in Mumbai, a paid-up capital of Rs. 50 lakh, and 50 employees. Over time, it became a significant institution with strong national and international operations.

- National Presence:

Over 5100+ branches in India across all states and union territories, including specialized branches.

Controlled through 69 Zonal Offices and 13 FGMO Offices.

- International Operations:

47 branches/offices abroad, including 22 owned branches.

It has presence in key locations: Tokyo, Singapore, Hong Kong, London, Paris, New York, Dubai, and Gandhinagar (IBU at GIFT City).

4 subsidiaries, 1 representative office, and 1 joint venture.

Central Bank of India- Best Sarkari Bank

Year of Establishment:– 1911

Central Bank of India has a market cap of ₹44,949.92 crore as of February 5, 2025.

Central Bank of India is the first Indian commercial bank wholly owned and managed by Indians.

It has a widespread network covering all 28 States and 7 out of 8 Union Territories in India.

This leading government bank is recognised as an “All India Bank” due to its widespread network across all 28 states and 7 out of 8 Union Territories.

The network includes 4541 branches, 1 extension counter, and 10 satellite offices (as of December 2024). Its corporate clients include ICICI, IDBI, UTI, LIC, HDFC, and numerous other significant corporate houses in India.

Branch Network: 4,493 Branches

Types of Government Banks in India

Government banks in India are divided into different categories based on their role in the financial system.

- Central Bank – Reserve Bank of India (RBI)

The Reserve Bank of India (RBI) was established in 1935 under the RBI Act, 1934. It is the country’s central bank that oversees all other banks.

- Commercial Banks

These are the most common government-owned banks, including the State Bank of India (SBI) and Punjab National Bank (PNB).

- Cooperative Banks

These sarkari banks work on a cooperative model and are mostly state-level institutions. They serve rural and agricultural communities by offering concessional loans and easy banking access.

- Regional Rural Banks (RRBs)

RRBs were established in 1975 to provide banking services to rural areas. They focus on lending to small farmers, artisans, and businesses in villages.

These banks are owned jointly by the central government (50%), state governments (15%), and sponsoring commercial banks (35%).

- Payments Banks

Payments banks, like India Post Payments Bank, offer basic banking services without providing loans or credit cards.

Pros of Government Banks

Here are some benefits of choosing public sector banks for your savings:

- Public sector banks are seen as safe because the government supports and manages them.

- They often have a lower minimum balance requirements compared to private banks.

- Their long-standing presence and established reputation contribute to public trust.

Cons of Government Banks

However, you may face certain challenges:

- Government banks in India are often considered slower in adopting the latest technology than private banks.

- They are known to offer fewer schemes, especially digital solutions.

- People often perceive government banks as less customer-friendly.

These top government banks in India are not just financially strong but also utilise advanced technology to improve customer service. We hope our list of the best government banks in India serves as a purposeful guide for you.

Top Public Banks in India- FAQs

RBI (Reserve Bank of India) handles the working of banks in India. The State Bank of India- SBI, Punjab National Bank, HDFC Bank, and ICICI Bank are widely recognised for their robustness and stringent safety protocols.

SBI is a public sector bank with a vast branch network, lower minimum balance requirements, and higher deposit interest rates. In contrast, HDFC Bank is a private sector bank known for excellent customer service, advanced technology, and lower interest rates on loans. You can choose based on whether you prefer a public or private bank.

A public sector bank is a financial institution owned and operated by the government. It focuses mainly on the weaker sections of society.

As of 2025, there are 12 government banks in India.

The State Bank of India (SBI) is the largest public sector bank in India, with a market cap of ₹677158.81 as of February 6, 2025.

State Bank of India (SBI) is the No 1 government bank in India, with a market capitalization of ₹677,158.81 crore (as of 2025).

Public sector banks in India include State Bank of India (SBI), Punjab National Bank (PNB), Bank of Baroda, Canara Bank, Union Bank of India, and others, totaling over 10 banks.

Bank of Baroda is the 3rd largest government bank in India, with a market capitalization of ₹107,636.86 crore (as of 2025).

The top 5 public sector banks in India by market capitalisation are State Bank of India (₹677,158.81 crore), Punjab National Bank (₹113,491.44 crore), Bank of Baroda (₹107,636.86 crore), Indian Overseas Bank (₹94,113.32 crore), and Union Bank of India (₹84,304.22 crore).

Sarkari banks refer to government-owned banks in India, which include the top 10 banks with a combined market cap of over ₹1.3 trillion (as of 2025).

Following recent mergers, prominent government banks like Bank of Baroda and Punjab National Bank have grown significantly. For instance, Bank of Baroda’s market cap stands at ₹107,636.86 crore, making it the 3rd largest government bank (as of 2025).

Source- FinancialServices

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.