Aasaan Steps Mein Demat Account Kaise Kholein

Kya aap stock market trading mein kadam rakhne ka iraada rakhte hain? Par kya aapko alag alag tarah ke demat accounts aur important documents mein hamesha confusion rehti hai? Aj hum batayegy ki demat account kya hai, demat account kyu jaroori hai, aur beginners ke liye India mein demat account kholne ke kuch aasaan steps.

Demat Account Kya Hai Aur Ye Kaise Kaam Karta Hai?

Demat account aapko alag-alag securities jaise ki stocks, bonds, mutual funds, etc. ko digital format mein store aur manage karne ki suvidha deta hai. Online demat account physical certificates aur paperwork ki zarurat ko khatam kar deta hai.

Online demat account trading aur investing process ko asaan, tez aur surakshit banata hai.

Bharat mein Demat accounts ka concept 1996 mein shuru hua. Demat account ka kaam physical securities ke saath judi problems ka samadhan karna hai, jaise ki nuksan, chori, aur nakli certificates ka khatra.

Aap ek Demat account mein kai securities hold kar sakte hain, jaise ki:

- Equity: Companies ke shares ya stocks.

- Bonds aur Debentures: Corporations aur government dvara jaari debt instruments.

- Exchange-Traded Funds (ETFs): Stock exchanges par trade hone wale funds, jo stocks, bonds, etc. ko hold karke diversification aur flexibility deten hain.

- Government Bonds: Sarkar dvara fund raise ke liye jaari kie debt securities.

- Mutual Funds: Mutual funds ek tarah ke investment hain jisme kai investors ka paisa ek saath jama hota hai aur ye paisa stocks, bonds ya doosre assets mein invest kiya jata hai.

Abi Demat Account Kaise Kholte Hai, isko samajhne se pehle, ek baar dekhte he demat account ky fayde kya hain.

Demat Account Kyun Jaroori Hai?

Indian share market mein trade ya invest karne ky liye demat account hona jaroori hai.

Demat account kholne ky bohot fayde hote hain, jaise ki:

- Ek online demat account aapko apne securities ko kahin bhi aur kabhi bhi ek user ID aur password ke saath access karne ki ijajat deta hai.

- Demat account physical certificates ke chori, damage, ya dhokhebaazi ke khatre ko kam karta hai.

- Ye aapke linked bank account mein dividends, interest, refunds, etc. ko apny aap transfer karne mein madad karta hai.

- Ek Demat account ke saath, aap aasani se apne investment portfolio ko track kar sakte hain aur aapke holdings ki value mein kisi bhi change ko monitor kar sakte hain.

Demat Account Open Karny Ky Liye: Fees and Charges ko Samajhen

India Mein demat accounts se judy alag-alag brokerage charges hote hain:

- Demat Account Kholne ke Charges: Jab aap Demat account kholte hain, aapko kuch charges dena hota hai.

Yeh aam taur par ₹200 se ₹3001 tak hota hai.

Shoonya free demat account pradan karta hai.

- Trading Account Kholne ke Charges: Demat account ke alawa, aapko trading karne ke liye bhi ek trading account ki zaroorat hoti hai.

Kuch brokers online trading account kholne ke liye kush fees charge karty hain.

- Annual Maintainance Charges (AMC): AMC ek annual charge hai jo aapko apna Demat account maintain karne ke liye dena padta hai.

- Brokerage Fees: Aapka broker aapke liye investment karne ke liye brokerage charge leta hai.

Yeh, ek fixed amount ho sakta hai har trade ke liye ya phir transaction ke value ka percentage.

Shoonya ke saath, aapko niche diye gaye labh milte hain:

- Free demat account aur zero AMC

- Mutual funds, IPOs, bonds wagera par Zero brokerage

- Free demat aur trading account

Shoonya Par Demat Account Kaise Kholein

Shoonya par demat account kholne ky liye sabse pehle aap Shoony app ko Play Store ya Apple Store se download karein. Aap seedhe PRISM par jakar bhi apna demat account open kar sakte hein.

Aaiye dekhte hain Zero brokerage online trading platform par demat account kholne ke kuch aasaan steps:

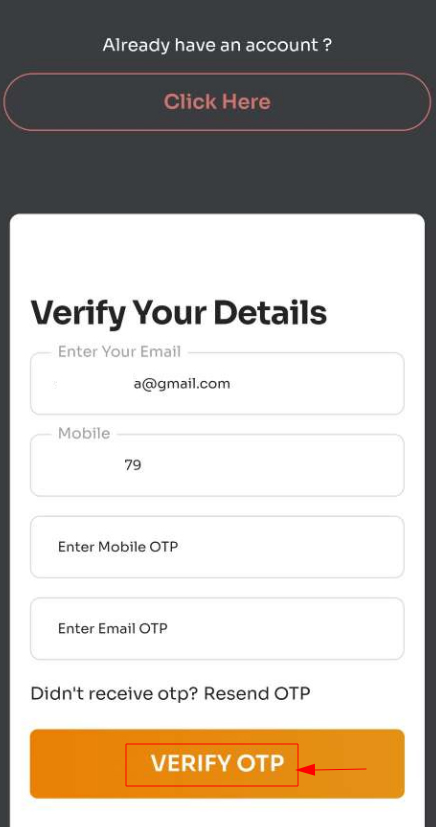

- Details fill karein aur OTP verify karein: ‘Register Now’ par click karein aur apna email aur mobile number provide karein. Uske baad aapko dono jagah verification codes send kiye jayegy, unhe respective fields par dal karke account verify karein.

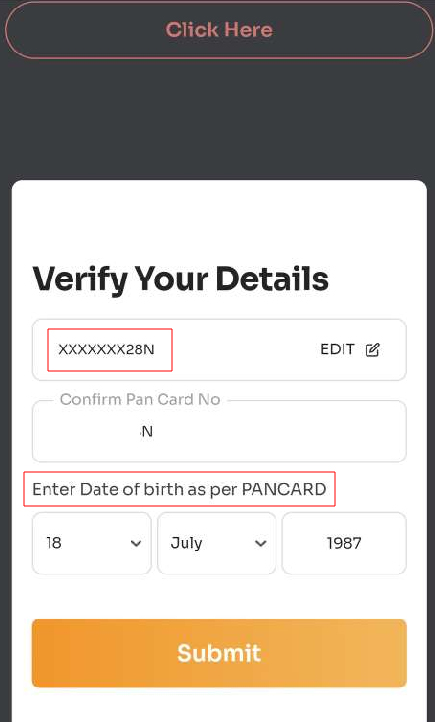

2. PAN aur Date of Birth fill karein: Apna pan card aur birth date jo ke apke pan card par likhi hui hai yha fill karein.

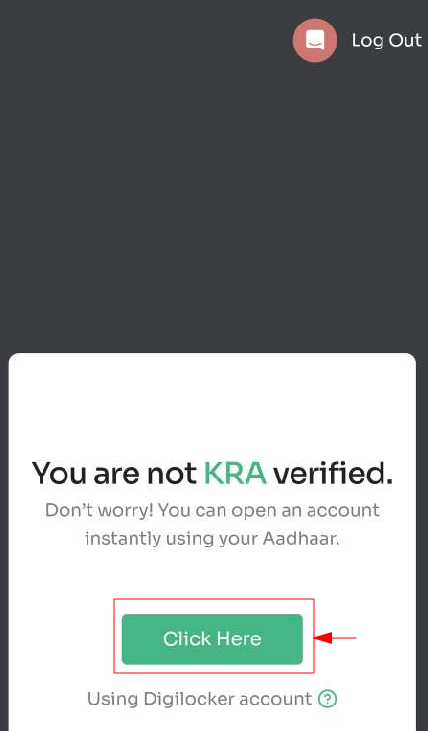

Kuch extra steps sirf non-KRA users ke liye-Agar aapne apna KRA KYC validation nahi kiya hai, toh yahaan click karein↓

Aapko notification milega ki ‘You are not KRA verified.’

KRA, yaani KYC Registration Agency, securities market mein investor KYC details ko store aur verify karti hai. Apna KRA verification status check karne ke liye, apna PAN number kisi bhi KRA website jaise CVL, DotEx, Karvy, NDML, ya CAMS par enter karein. Agar verified hai, toh status ‘Verified’ dikhayi dega, varna ‘Not Available’ ya ‘Pending’ hoga.

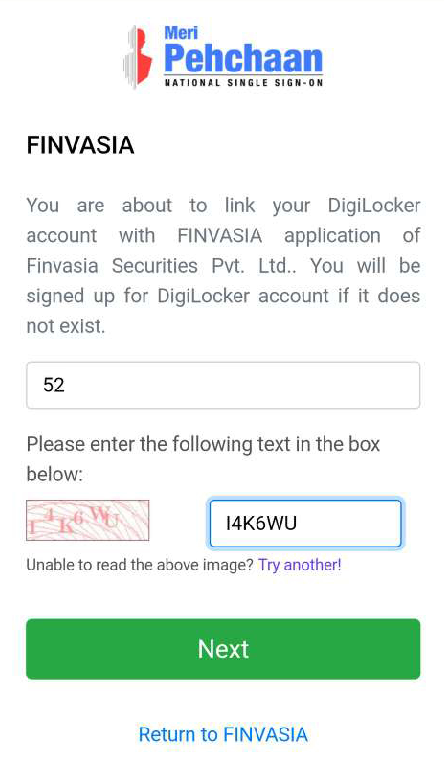

Next, aapko apna Aadhar number aur CAPTCHA enter karna hai.

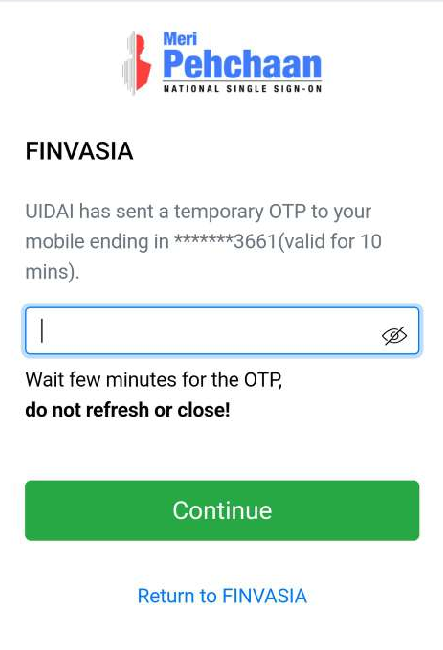

- Fir aap OTP receive karenge.

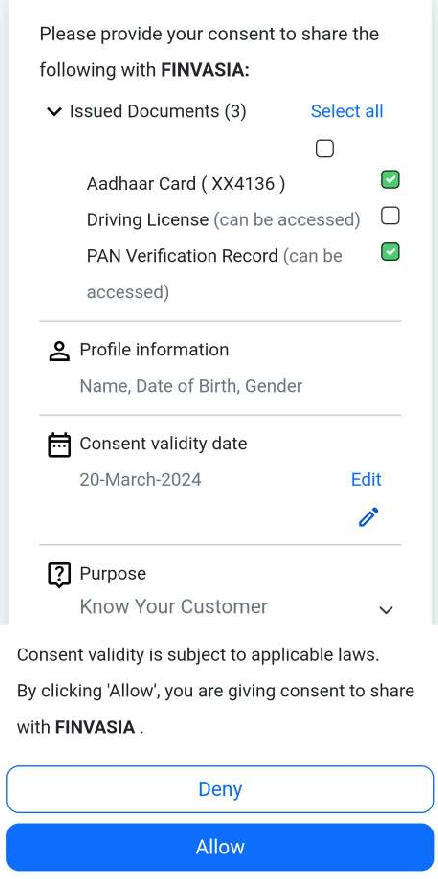

- Uske baad, ‘Allow’ par click karke apne digilocker details ko consent dena hoga jo automatically aapke account se fetch ki jaati hain.

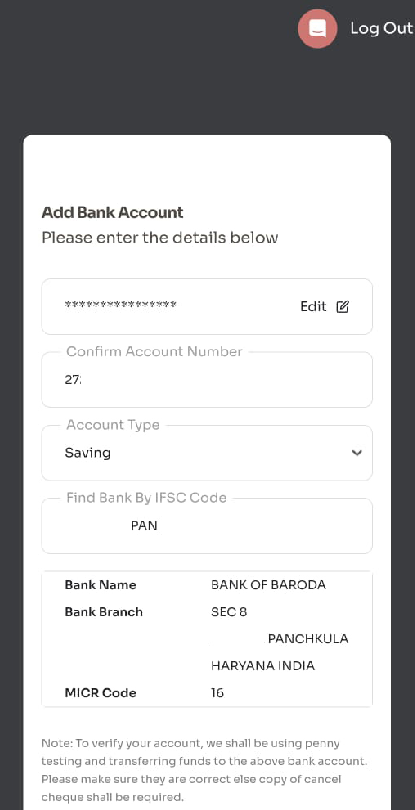

- Bank account details fill karein: Apna account number, IFSC code fill karein.

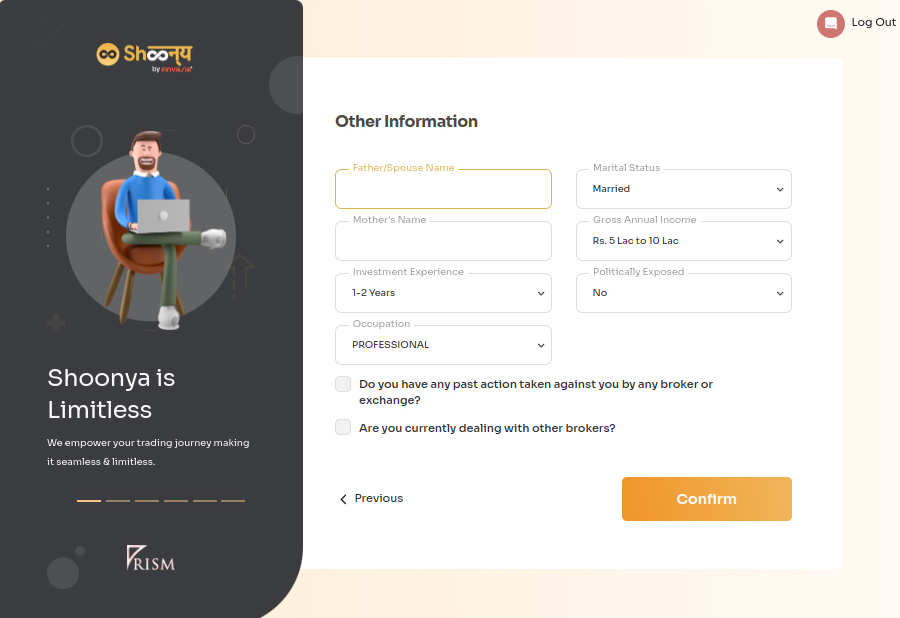

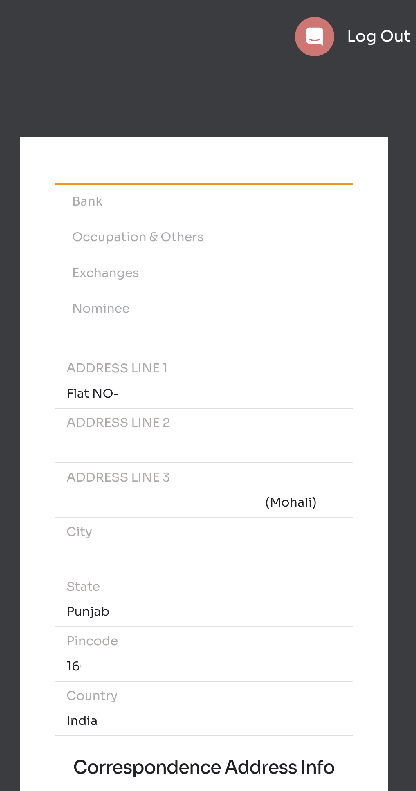

4. Personal details fill karein: Apni saari zaroori details niche de gyi image ke anusar fill karein.

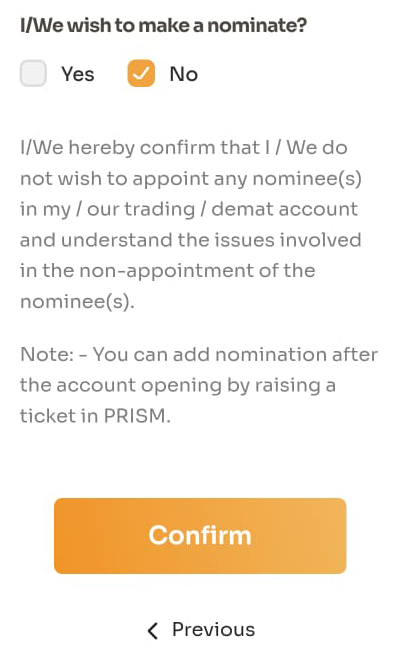

- Nominee Add Karain

Nominee ko add karne ka option, by default ‘No’ set hoga.

Aap baad mein PRISM portal par ticket raise karke bhi apne nominee ko add kar sakte hain.

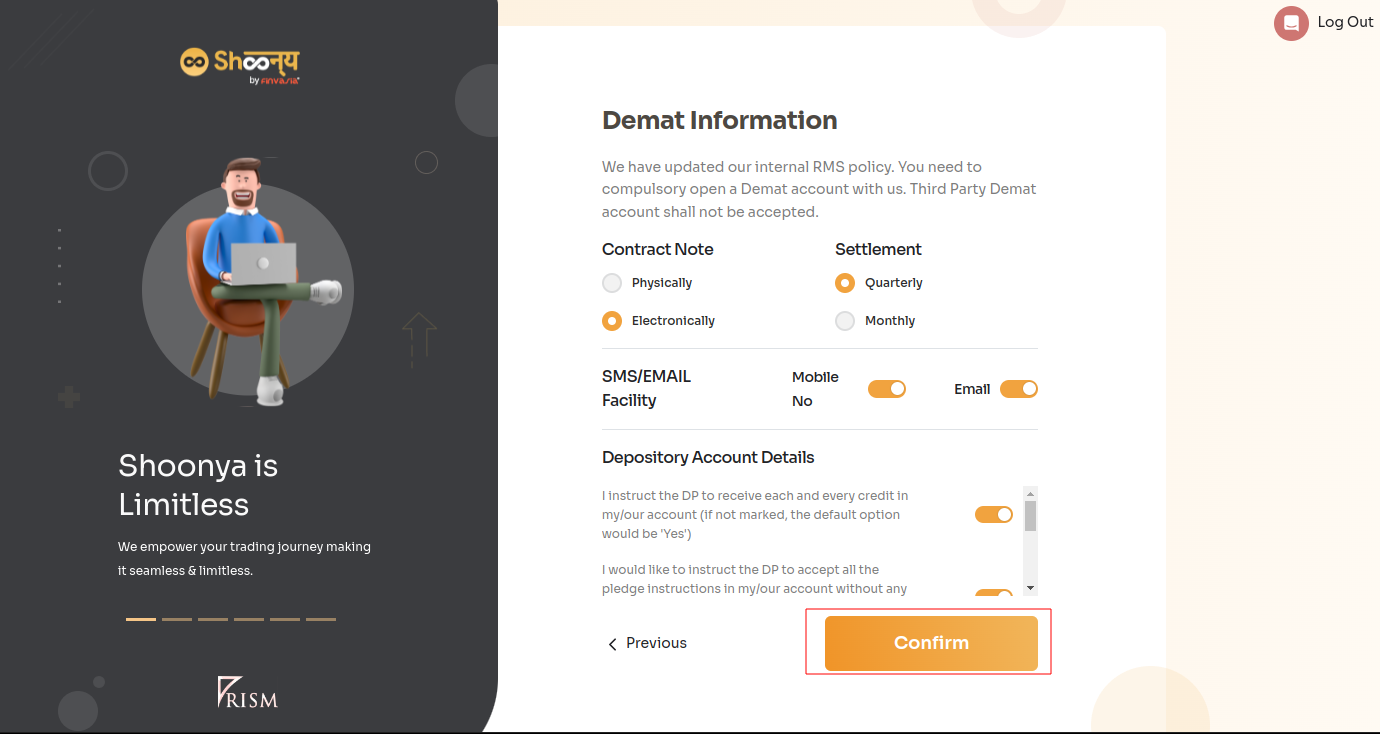

- Niche de gyi image ke anusar Demat account ki information ko cross-check karein aur ‘confirm’ par click karein.

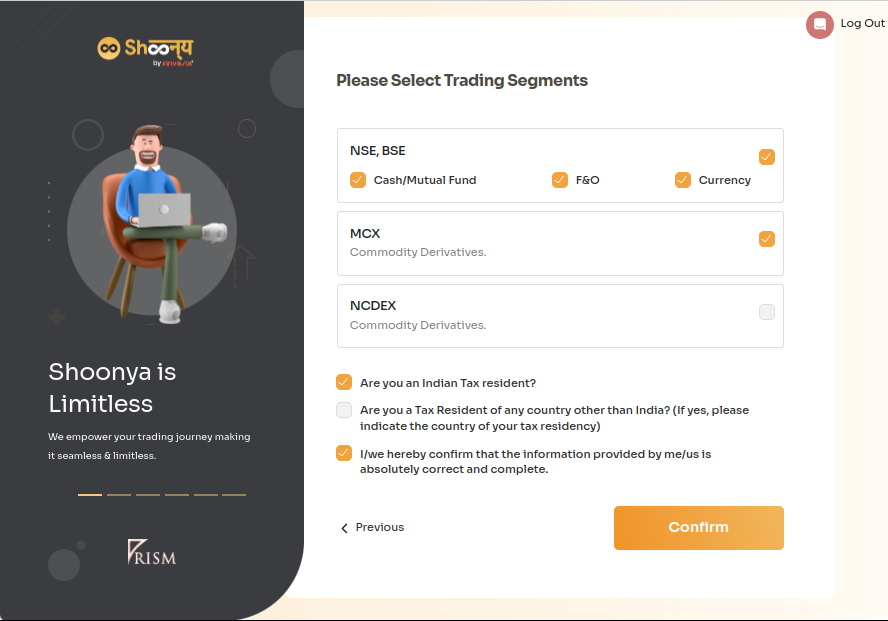

- Details ko confirm karein aur apne trading segments select karien: Details confirm karein aur apne trading segments jaise NSE, BSE, MCX ko select karein.

Note: FATCA instructions ke liye, agar aap NRI hain toh hi doosra option choose karein.

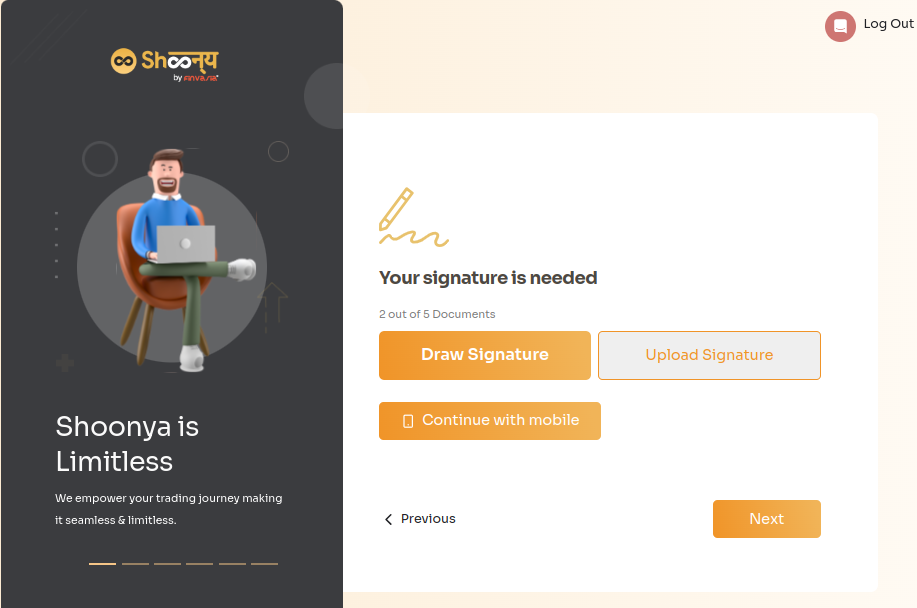

- Latest Signature Upload: Aap screen par apna signature draw kar sakte hain, ya fir ek paper par apne signature karke uski photo upload kar sakte hain.

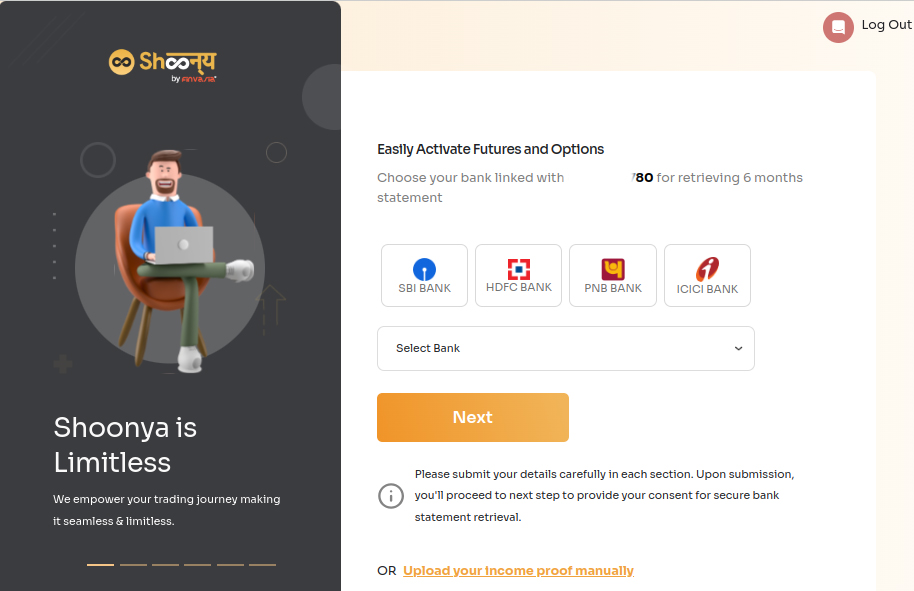

7. Additional Steps Pura Karein: Aapko apne chune gaye segment ke hisaab se income ka parman dena hoga.

Dhyaan dein ki FnO segment ke liye aapki income ka proof dena jaroori hai.

Note- Ab hum ek account aggregator ka istemal kar rahe hain jahan aapko apna bank select karna hoga aur OTP daalna hoga. Sirf ek OTP se aapka latest 6 months ka bank statement automatically hi fetch ho jayega.

or, agar aap chahein, aap documents ke liye manual upload option ko select sakte hain.

Aap inme se kisi ek documet ko as a income proof upload kar sakte hain:

- Latest 6 Months Bank Statement

- Latest ITR

- Latest Form 16

- Latest 3 Months Salary Slips

- Latest Networth Certificate

- Latest Demat Holding Statement

Demat Account opening process ko jaldi pura karne ke liye, bas ‘I will provide later‘ par click karke next step par ja sakte hain.

Is process se aapka demat account cash segment mein khulega.

Account open hone ky baad aap ticket raise kar ky FnO ko activate kar sakte hain.

Non-KRA Users Ke Liye Additional Steps – Agar aapne apna KRA KYC Validation nahi kiya hai, toh yahan click karein↓

Address Proof: Digilocker ki madad se, aapka pata apne aap hi fetch ho jayega.

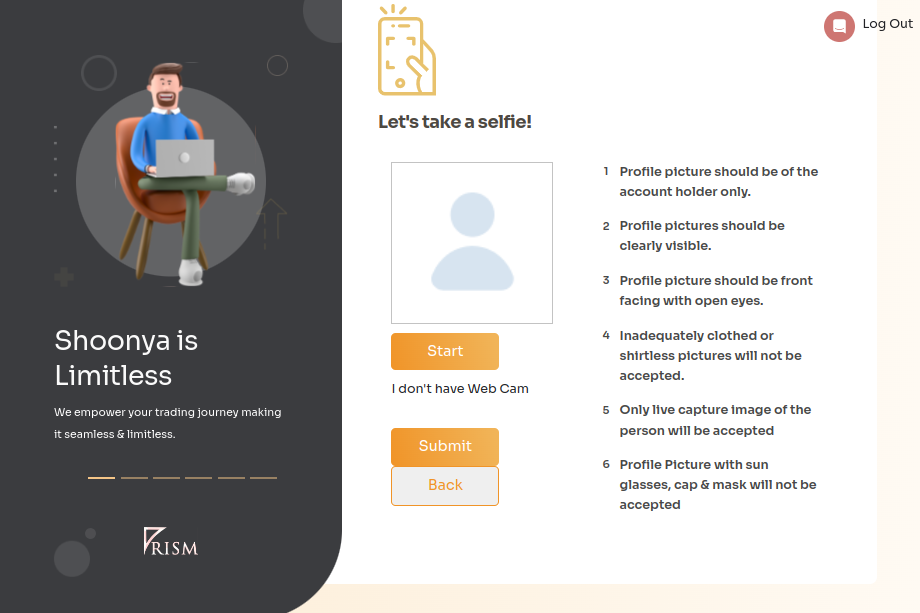

8. Photo verification: Online demat account khole jane ke liye apni pehchan ko confirm karne ke liye aapko ek selfie leni hogi aur ‘submit‘ par click karna hoga.

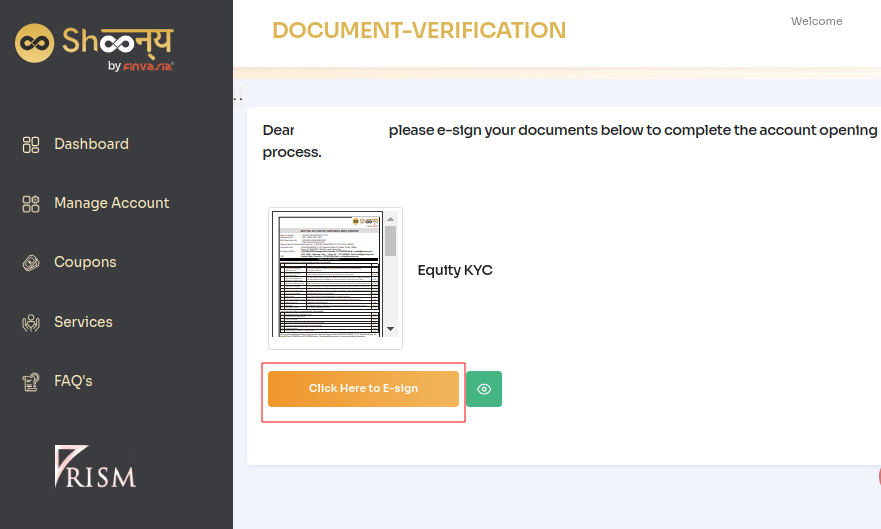

9. Apna KYC Document E-Sign Karein: Yeh account opening ka last step hai jismey KYC document e-sign karke apki account registration ki process puri ho jayegi.

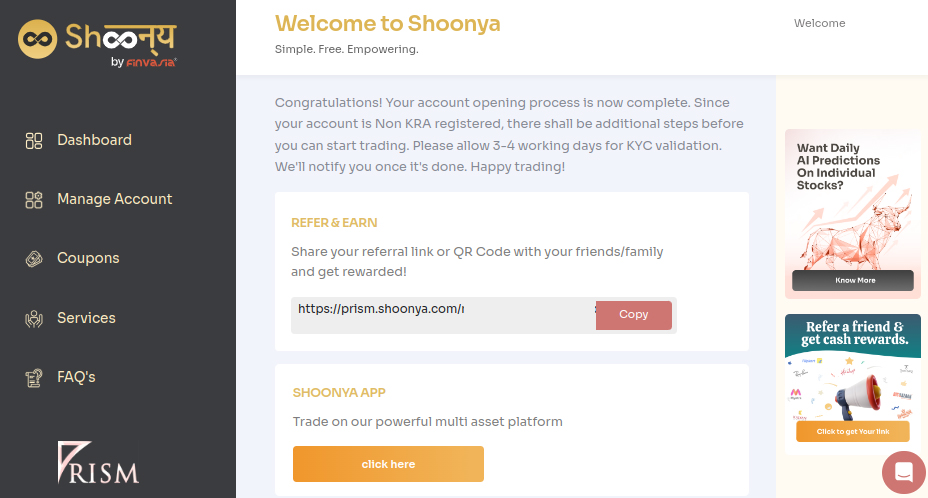

10. Confirmation: Ek baar sab kuch process ho jaye, apko ek message milega jo batayega ki aapka demat account khul gaya hai.

Apne trading login jaankari ke liye apni email check karein.

Aapka Shoonya trading aur demat account ab bilkul ready hai!

“Demat account” ke khole jane ke is process mein, aapko apna email address aur mobile number dena hoga.

Aur sath hi, kuch documents tayar rakhein:

- PAN Card: Yeh dhyaan rakhein ki aapke paas apna PAN card number aur janam tithi honi chahiye. En details ko apne PAN card par likhe tarike se enter karein.

- Mobile Number se linked Aadhar Card: Aapka Aadhar card verification ke liye istemal hoga. Yeh zaroori hai ki yeh aapke mobile number se juda ho.

- Bank Account Ki Jaankari: Apne bank account ki jaankari tayar rakhein, jisme aapka account number, IFSC code, aur branch ki jaankari shamil ho.

Agar aap FNO ya derivatives segment mein trading karne mein dilchaspi rakhte hain, to aapko yeh additional documents bhi chahiye:

- (Income Proof) Aay Ka Parman: Yeh ek latest 6 months ka bank statement ya aapki Income Tax Return (ITR) ho sakta hai.

- Signature: Aap screen par apna signature draw kar sakte hain, ya fir ek paper par apne signature karke uski photo upload kar sakte hain.

Various Types of Demat Accounts Offline Kaise Kholein: Steps and Instructions

Offline demat account kholne ke steps es prakar hai:

- Tay karein ki aap kis prakar ka account kholna chahte hain (non-individual, minor, NRI, or joint account)

- Aap hamare website se KYC form download kar sakte hain (https://shoonya.com/download), ya phir ek email request contactus@shoonya.com par bhej sakte hain.

- Aapki request milny par, Apko Shoonya se demat account ke liye KYC form aur zaroori documents ki list milegi.

- Agla kadam hai ki kripaya form print karein, unhein bharein aur un par apna signature karein.

- Iske baad, aapko form ko Finvasia Center k niche dei gaey paty par bhejna hai:

Finvasia Tower, C-214, 4th Floor, Phase 8B, Sector 74, Industrial Focal Point, SAS Nagar (Mohali), Punjab – 160055.

Note: Offline account kholne ki suvidha sirf HUF, minor, corporate, LLP, partnership, and joint accounts par available hai.

India Mein Demat Account Kaise Kholein | Jaroori Documents

Demat account kholne ke liye, aapko niche deye gaey documents dene honge:

• Pehchan Ka Parman (Proof of Indentity): Aapko ek pramanit tasveer wala pehchan document jaise PAN card ya Aadhaar card pradan karna hoga.

• Paty Ka Parman (Proof of Address): Aapko ek pramanit paty ka parman, jaise Aadhaar card, pradan karna hoga.

• Aay Ka Parman (Proof of Income): Agar aap nivesh karne ki iraada rakhte hain jaise ki futures aur options mein, to aapko aay ka parman dena hoga.

Aap inme se koi ek pradan kar sakte hain: latest 6 months ka bank statement, latest Income Tax Return (ITR), latest Form 16, latest 3 months salary slips, latest net-worth certificate, ya latest Demat holding statement.

• PAN Card: Aapko apna PAN card ki ek copy pradan karein. Yeh online Demat account kholne ke liye jaroori hai.

India Mein Demat Account Kholne ky Liye Zaroori Baatein Yaad Rakhein

Online demat account kholte samay kuch yaad rakhne layak baatein hain:

- Demat Account ka Prakaar: Aapko apne trading ki zarooraton aur pasand ke anusaar demat account ka prakar chunna hoga.

Alag alag prakaar ke demat accounts hote hain, jaise:

- Online: Resident Individual

- Offline: NRI demat account, HUF demat account, minor demat account, corporate account, LLP account, Partnership demat account, Joint account.

- Brokerage Fees: Har trade ke liye fees aur charges ko dekhein.

Shoonya ke saath, aap Bharat mein ek free demat account khol sakte hain aur sabhi segments mein, jaise ki stocks, futures, options, currencies, commodities, mutual funds, ETFs, bonds, aur IPOs mein zero AMC par trading kar sakte hein. Shoonya sabhi stock exchanges jaise ki, BSE, NSE, MCX par trading allow karta hai.

- Customisation aur Features: Shoonya par AI-powered stock market predictions aur signals ka anand uthayein. Hamare online trading platform par advanced tools ka upyog karein.

- Trading Platform: Yeh dekhein ki broker aapko aise trading platform pradan karta hai jisme aapko zaroori features milte hain.

- Customer Seva: Aise broker ko dhoondein jo apko shai samay par customer service pradan kry.

- Reputation: Aapko broker ki pehchaan aur reputation ke baare mein research karna chahiye, jisme customers ky reviews bhi shamil hain.

- Security: Yeh ensure krien ki broker ke paas ek surakshit trading platform hai jo aapke funds aur personal jaankari ko surakshit rakhta hai.

Sahi Depository Participant Chunein | Iska Importance Kya Hai?

Investments ke liye sahi depository participant (DP) chunna important hai. Yeh aapke trades aur investments ke parinaam par bada asar dalta hai.

Yeh kuch vajah hai jinke baare mein sochna chahiye jab aap DP chunte hain:

- Kuch DP kam charges ya fixed charges offer karte hain, jo aksar tarde karte hain.

- DP ko chunna jo kum AMC charge ya zero AMC ley rhy ho aapke overall investment charges ko kam kar sakta hai.

- DP ki sevaayein, jaise ki online trading platforms aur customer service, aapke investment ko behtar bana sakti hain. Dhyaan dein ki DP wahi sevaayein pradan karta hai jo aapke investment ke liye zaroori hote hain.

- Leverage aapko apne account mein se zyada vyapar karne ki anumati deta hai. Jabki yeh aapke potential labh ko bada sakta hai, yeh saath hi adhik riske ko bhi laata hai.

- Aise DP ko chunein jo aapki risk ability ke anusaar leverage pradan karta hai.

Yaad rakhein, sahi DP aapke nivesh yatra mein ek madadgar saathi ho sakta hai.

Apne Demat Account ko Digital Age Mein Surakshit Rakhein

Aaj ke digital nivesh duniya mein apne Demat account ko surakshit rakna behad important hai. Ek online trading platform ko chunein jo majboot suraksha ka istemaal karta hai jaise ki two-factor authentication.

Apne login details ko surakshit rakhein, passwords ko niyamit roop se badlein, aur apne account ke statements ko monitor karte rahein.

FAQs | Demat Account Kaise Kholein | Shoonya

Ek shuruaati Demat account kholne ke liye, aapko Shoonya app download karna ya PRISM par jaana hoga. Apne details daalein, OTP verify karein, aur apna PAN, Aadhar, bank account, aur personal details pradan karein. Kuch hi steps mein, aap sabhi market segments mein trading shuru kar sakte hein.

Aapko online Demat account kholne ke liye kuch bhi nahi dena padega. Shoonya free Demat account aur kain segments par zero brokerage deta hai.

Shoonya free Demat account aur zero AMC deta hai or sath hi, kain segments jaise IPOs, bonds, mutual funds, etc. par commission-free trading bhi.

NRIs Shoonya ke saath ek Demat account khol sakte hain, jaroori documents jaise PAN, Aadhar, aur videshi paty ka parman (Driving License, Electricity Bill, Water Bill, Tenant Agreement).

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.