Difference Between FDI and FII: Everything You Must Know About Foreign Investments

Foreign investment is an essential source of capital, technology, and growth for India. The most important types of foreign investment are Foreign Direct Investment and Foreign Institutional Investment. But what is the difference between FDI and FII?

Let us find out!

Types of Foreign Investments

There are three types of foreign investments that you must be aware of:

• Foreign Direct Investment

This is when a company or an individual from one country invests in a business or a company of another country. But to have a long-term interest and control.

For example, when a Japanese car manufacturer sets up a plant in India, it is FDI.

• Foreign Portfolio Investment

This is when large financial institutions from one country invest in the securities and assets of another country. This could be stocks, bonds, mutual funds, and derivatives.

For example, when a US hedge fund buys shares of an Indian company, it is FPI.

• Foreign Institutional Investment

This is when large foreign institutions (such as mutual funds, hedge funds, or pension funds) in the financial markets of another country. They do it for short to medium-term gains.

Read the difference between FPI and FII.

For example, when an Indian retail investor buys a US exchange-traded fund (ETF), it is a foreign indirect investment.

Before we jump in to understand the difference between FDI and FII, let us understand them in detail.

What is FDI?

FDI full form- Foreign Direct Investment.

FDI is a type of international investment that involves the transfer of capital, technology, management, and know-how from one country to another.

Foreign Direct Investment (FDI) is when a company or individual from another country invests directly in businesses or assets in India.

For instance, if a company from the United States builds a factory in India, that’s FDI. It shows a long-term interest in Indian businesses and often comes with control or significant influence over the company.

FDI aims to establish a long-term interest and influence in the foreign entity and often results in the creation of a new business, a merger, an acquisition, or a joint venture.

FDI can be classified into two types: horizontal and vertical.

- Horizontal FDI occurs when the investor company invests in the same industry as its domestic operations.

For e.g. when a car manufacturer from one country sets up a plant in another country.

- Vertical FDI occurs when the investor company invests in a different stage of the production process of its domestic operations.

For e.g. when a car manufacturer from one country sources raw materials or components from another country.

What is FII?

FII full form- Foreign Institutional Investment.

FII is a type of portfolio investment that involves the purchase and sale of securities and assets, such as stocks, mutual funds, and derivatives, in a foreign country.

Foreign Institutional Investment (FII) is when investors from other countries put their money into assets like stocks and bonds in India’s financial markets.

FII does not aim to establish a lasting interest or control in the foreign entity and is usually short-term and speculative in nature.

FII can be classified into two types: debt and equity.

- Debt FII occurs when foreign institutional investors invest in the debt securities of the host country, such as government bonds, corporate bonds, and commercial papers.

- Equity FII occurs when foreign institutional investors invest in the equity securities of the host country, such as shares, stocks, and mutual funds.

Now, what is the basic difference between FDI and FII?

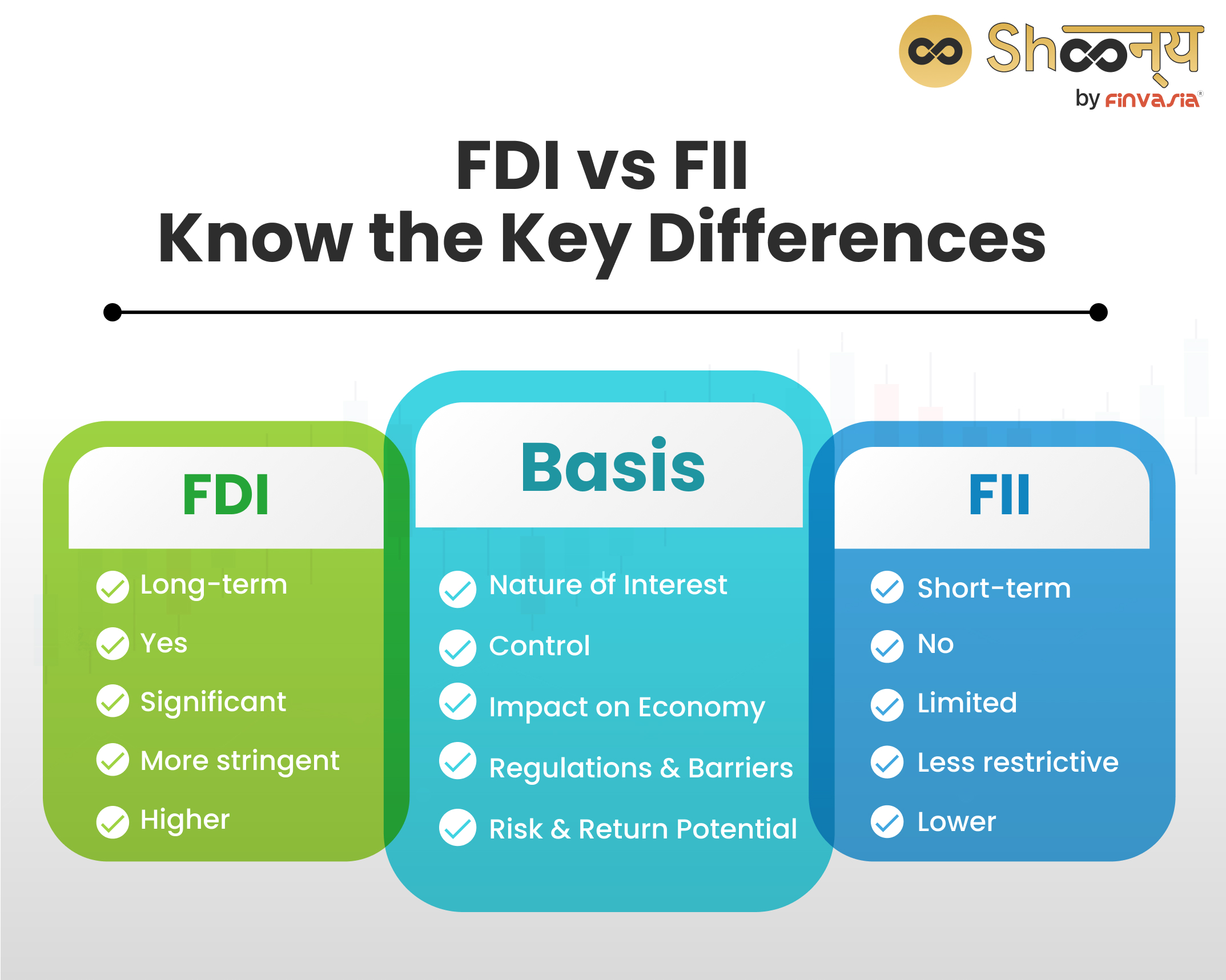

FDI vs FII: Exploring the Difference Between FDI and FII

Foreign Direct Investment (FDI) and Foreign Institutional Investment (FII) are two types of foreign investment that differ in multiple ways.

| Basis | FDI | FII |

| Nature of Interest | Long-term | Short-term |

| Control | Yes | No |

| Impact on Economy | Significant | Limited |

| Regulations & Barriers | More stringent | Less restrictive |

| Risk & Return Potential | Higher | Lower |

Difference Between FDI and FII

The main difference between FDI and FII includes multiple aspects:

• FDI implicates a direct investment in a company with the purpose of acquiring management control or influence.

On the flip side, FII involves investment in securities/ assets of a foreign company.

• FDI results in a long-term interest in the investee company.

FII investment is short-term and focused on the secondary market.

• FDI brings capital, technology, management, and know-how to the host country.

FII brings in only capital.

• FDI contributes to the economic growth and development of the host country.

FII has a limited impact on the real economy.

• FDI faces more entry and exit barriers and regulations, while FII faces fewer restrictions and is more flexible.

• FDI has a higher risk and returns potential.

FII has a lower risk and return potential.

FDI vs FII: Benefits of Foreign Investments in India

FDI and FII are both important sources of foreign investment for India.

Some of the benefits of FDI and FII for India are:

• FDI helps create long-term and stable linkages between Indian and foreign firms. This leads to the transfer of technology, skills, and management practices. FDI also boosts the productivity and competitiveness of the domestic industry.

• FII enhances the liquidity and efficiency of the Indian capital market. It provides more funds and diversification opportunities for investors. FII also reflects the confidence and attractiveness of the Indian economy in the global scenario.

• Both FDI and FII contribute to India’s economic growth and development. They increase the GDP, employment, exports, and tax revenues. They also help in financing the current account deficit and building the foreign exchange reserves.

• Both FDI and FII foster innovation and entrepreneurship in India. They support the creation and expansion of new ventures, especially in emerging sectors. Some of the common ones are IT, biotechnology, renewable energy, etc.

• Both FDI and FII promote India’s integration and cooperation with the global economy. They facilitate the exchange of ideas, knowledge, and best practices.

FDI vs FII| Regulatory Framework

Regulatory Framework for FDI and FII

- Automatic Route: No need for prior Central Government approval for investments by non-residents.

- Government Route: Requires prior Government approval for investments by non-residents. Investments under this route must adhere to Government-set conditions.

• FII: Foreign Institutional Investors (FIIs) must register with SEBI and adhere to investment limits, typically 24% of an Indian company’s paid-up capital, extendable with approval.

FDI vs FII| Entry and Exit

The difference between FDI and FII lies in the ease of entry and exit for investors:

Entry into FDI involves making significant commitments. This could be for establishing operations or acquiring a substantial stake in a foreign company.

On the other side, exiting an FDI can be complex.

This is due to factors like finding a buyer for assets and regulatory hurdles.

The exit process often requires strategic planning.

On the other hand, FII investments are more fluid.

Investors can quickly enter and exit financial markets as they primarily invest in liquid assets like stocks and bonds.

The process has fewer regulatory barriers. This allow for rapid adjustments to investment portfolios in response to market conditions.

When analysing FDI vs FII, the fluid nature of FII investments makes them more susceptible to market volatility. However, it does provide flexibility.

FDI vs FII| Risks

The difference between FDI and FII also lies in the number of risks these involve:

• FDI: Affected by political instability, economic fluctuations, and regulatory changes.

• FII: Subject to market risks and volatility, impacting rapid capital outflows.

FDI vs FII| Taxation

This is the difference between FDI and FII tax calculations:

• FDI: Taxed on profits and property in India, based on prevailing laws and DTAAs.

• FII: Subject to capital gains tax and withholding taxes, with recent exemptions and relaxations.

Income Tax on Foreign Investments

Here are certain specifications related to the income tax on FDIs and FIIs in the Indian Market:

- Foreign Institutional Investors (FIIs) face a 5% TDS rate under Section 194LD for certain investments.

- The Income Tax Act of 1961, specifically Section 115AD, deals with taxing FIIs’ income from securities.

- Tax rates on FIIs in India differ depending on income types and amounts.

- Dividends, interest on specific bonds, and securities income have distinct tax rates.

- Capital gains, both short-term and long-term, are taxed differently, along with business income, considering DTAA and PE presence.

- Surcharge and education cess are added to tax rates. FIIs can offset TDS through DTAA or local laws.

- Non-residents can consult the Advance Rulings Authority for Indian tax matters.

Statistical highlights regarding Income Tax for Foreign Investors in India as of AY 2024-25:

- Dividends:

The tax rate ranges from 20.800% to 23.920% based on income brackets.

- Interest on certain bonds & Government securities:

Tax rates range from 5.200% to 7.124% for various income levels.

- Income from securities/units of a Mutual fund:

The tax rate varies from 20.800% to 28.496% based on income brackets.

- Capital Gains – Securities Transaction Tax (STT) applicable:

Short Term: Varies from 15.600% to 17.940%.

Long Term Capital Gain: Ranges from 10.400% to 11.960%.

- Capital Gains – Securities Transaction Tax not chargeable:

Short Term: Varies from 31.200% to 35.880%.

Long Term: Ranges from 10.400% to 11.960%.

- Business Income:

Tax rates for business income range from 39.000% to 42.744%.

- Tax Rate Considerations:

Taxes include surcharges at applicable rates and education cess at 4% of the tax amount.

Conclusion

FDI and FII are two different types of foreign investment that have different implications for India. FDI is more long-term and strategic, while FII is more short-term and speculative. FDI brings more benefits to the real economy, while FII benefits the financial markets. Both FDI and FII are essential for India’s economic growth and development. They are a source of capital, technology, innovation, and integration.

FAQs | Difference Between FDI and FII

Foreign Portfolio Investment (FPI) involves trading securities and assets of a foreign country, like stocks or bonds. Foreign Institutional Investment (FII) is specifically conducted by large financial institutions such as mutual funds or pension funds.

FDI means investing in a business/ company of a foreign country with the intention of having a long-term interest. FPI means investing in securities or assets of a foreign country with a short-term perspective.

FDI can bring in technology, management, and know-how and contribute to the economic growth and development of India. FII can provide liquidity, market efficiency, and valuation to the Indian financial market.

Investment is a general term that means putting money or resources into something with the expectation of a return. FDI is a specific type of investment that means investing in a business or a company of a foreign country for a long-term interest.

Source- nseindia.com

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.