Shares vs Stocks: Understanding the Key Differences and Various Types.

Are you an Indian investor looking to navigate the complex world of financial markets? Do terms like “shares” and “stocks” leave you puzzled? Don’t worry; we’ve got you covered. In this article, we’ll demystify the differences between shares and stocks, delve into various types, and equip you with insights to make informed investment decisions.

Share and Stock Explained: Unraveling the Basics

Let’s start by clearing up a common misconception about shares vs stocks. While often used interchangeably, “shares” and “stocks” do have subtle distinctions. When you hear about stocks, think of them as certificates of ownership in a company. These certificates are held digitally in your demat account. Stocks provide you not only a stake in the company but also potential dividends and voting rights.

Shares, on the other hand, are like building blocks of stocks. A single share represents a fraction of the company’s ownership.

What is a Stock?

Imagine you’re joining a group of friends to create a big, delicious pot of biryani. Everyone contributes some ingredients to make the biryani special. Now, think of a company as that pot of biryani, and a stock is like a portion of that biryani that you own.

When you buy a stock, you become a part-owner of the company. Just like you get a share of the biryani when you help cook it, owning a stock means you own a small piece of the company. These pieces, or stocks, are traded on the stock market. For example, if a company has a total of 100,000 stocks and you own 1,000 of them, you own 1% of the company.

Here’s where it gets interesting. If the company does well and becomes more valuable, the value of your stocks can also go up. It’s like your share of the biryani becoming more valuable as more people want to taste it. You can sell your stocks later at a higher price than what you paid, and that’s how you can make a profit!

What is a Share?

Think of a box of your favorite sweets. When you open the box, you see different pieces of sweets, right? Each piece is like a share. In the world of companies, a share is a small piece of ownership in the company, just like each sweet is a piece of the whole box.

For instance, picture a company that makes popular mobile phones. They decide to let people have a piece of their success by dividing the company into smaller shares. If you own one share, you’re like a co-owner of that mobile phone company. If the company makes good profits by selling many phones, you get a part of those profits as a reward.

Shares become valuable because their prices can go up. If the mobile phone company becomes really popular and more people want its shares, the price of each share can increase. So, if you bought a share for ₹100 and its price goes up to ₹200, you could sell it and make a ₹100 profit!

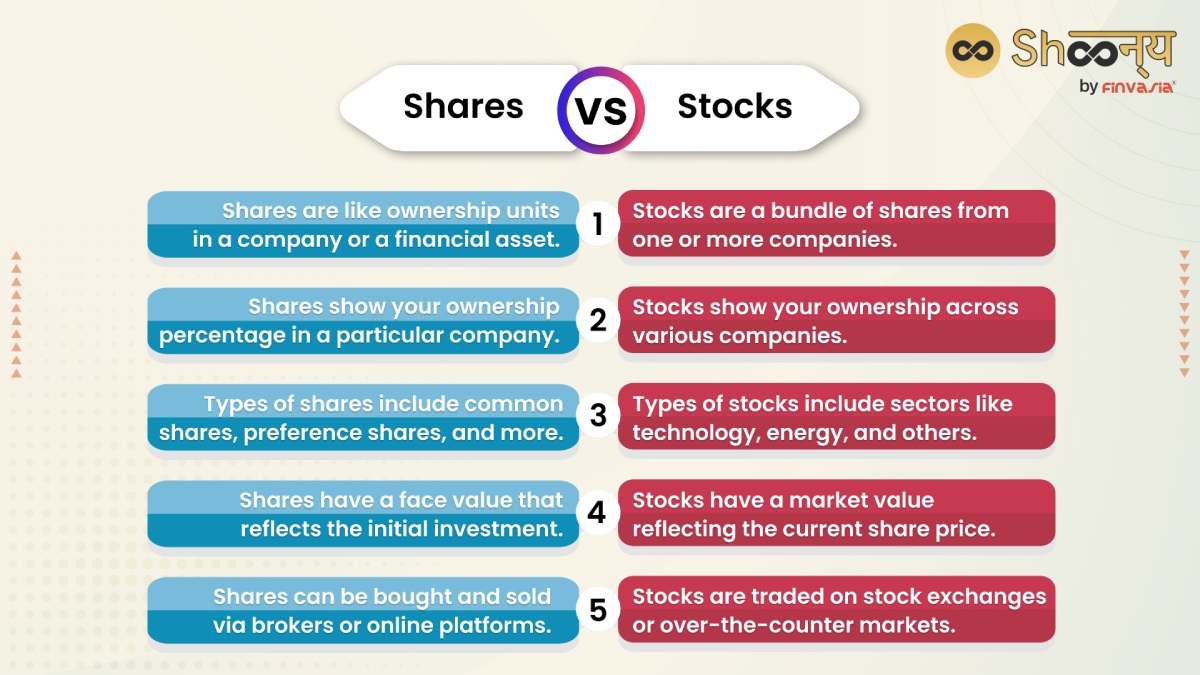

Shares vs. Stocks

Types Matter: Stocks and Shares in Diverse Forms

Now, let’s explore the diverse categories that both stocks and shares can assume in the Indian market.

Types of Stocks

- Common Stocks: These come with voting rights and potential dividends, giving you a say in crucial company decisions.

- Preferred Stocks: Offering guaranteed dividends, these hold priority during liquidation, ensuring repayment.

- Large-cap Stocks: Established giants with a market cap above 20,000 crores. Known for stability.

- Mid-cap Stocks: Companies with a market cap between 5,000 and 20,000 crores. Higher growth potential and volatility.

- Small-cap Stocks: More volatile, with a market cap below 5,000 crores.

- Growth Stocks: High-growth companies reinvest profits, yielding potential rewards.

Blue-chip Stocks: Elite, historically reputable companies with substantial dividends and ROI.

Types of Shares

- Equity or Common Shares: Typical ownership shares with voting rights.

- Preference Shares: Enjoy priority during liquidation but lack voting rights.

Benefits and Risks: Navigating the Stock Market

Investing in stocks offers diversification opportunities. But remember, volatility is inherent. To succeed, rely on expert advice and shun random stock tips. Also, comprehend delivery trading, intraday trading, and derivative trading to harness potential gains.

Investing Smartly: Your Path to Wealth Growth

Making money in stocks involves buying and selling, holding for value appreciation, and engaging in intraday and derivative trading. Explore mutual funds, index funds, bonds, and debentures for diversified investment.

Mastering the Art: Investing Guidelines for Indian Investors

For Indian investors, success lies in:

- Choosing the Right Broker: Opt for a secure platform with diverse investment options.

- Thorough Research: Due diligence is key to mitigate risks.

- Utilizing Modern Tools: Leverage expert advice for smarter investments.

- Strategic Selection: Opt for high-liquidity stocks at opportune times.

- Prudent Planning: Define profit and loss targets aligned with your risk tolerance.

In conclusion, understanding the nuances between shares and stocks empowers Indian investors to tread confidently in the financial market. With the right knowledge and strategic approach, you can make the most of your investments and build a prosperous financial future.

FAQs| Shares vs Stocks

Yes, shares form the building blocks of stocks. Stocks encompass ownership across various companies, while shares represent fractional ownership within a single company.

Volatility is a significant risk. Without careful handling, stock market investments can lead to losses. Rely on expert advice and avoid random tips.

You can profit from stocks through buying and selling, holding for value appreciation, intraday trading, and derivative trading. Explore diverse investment avenues like mutual funds and index funds.

Prioritize research, choose a reliable broker, utilize modern tools, select stocks wisely, and plan your investment targets diligently. Remember, there’s no guaranteed success; invest based on your risk appetite.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.