Types of SIP: Start Investing Smart with the Right SIP Plan

Not sure which SIP to pick? Let’s explore the best types of SIP for every investor!

Did you know that as of September 30, 2024, there were 9.87 crore Mutual Fund SIP accounts? In September alone, ₹24,509 crore was invested through SIPs!

What’s driving this growth?

It’s the simplicity and power of SIP investments. The beauty of SIP is that it allows you to invest small amounts of money regularly instead of making large lump-sum investments. There are multiple SIP plans in India.

What are the types of SIP that you can choose from?

Let’s explore which SIP type can help you, not just saving but giving you timely returns!

After all, wealth is built with time, patience, and smart choices.

What is SIP?

Before diving into the different types of SIP, let’s first understand what SIP means. In simple terms, an SIP is a method of investing in mutual funds where you contribute a fixed amount every month. It helps you invest in the markets without having to time your entry or exit.

You can start a SIP investment with only ₹500 per month. This makes it easy to manage even on a tight budget. This money is then invested in various mutual funds that further invest in stocks, bonds, or other assets. Over time, the power of compounding helps your money grow.

Let’s look at the SIP options in India that are available to help you choose the best fit for your needs. Now, not all SIP types are the same.

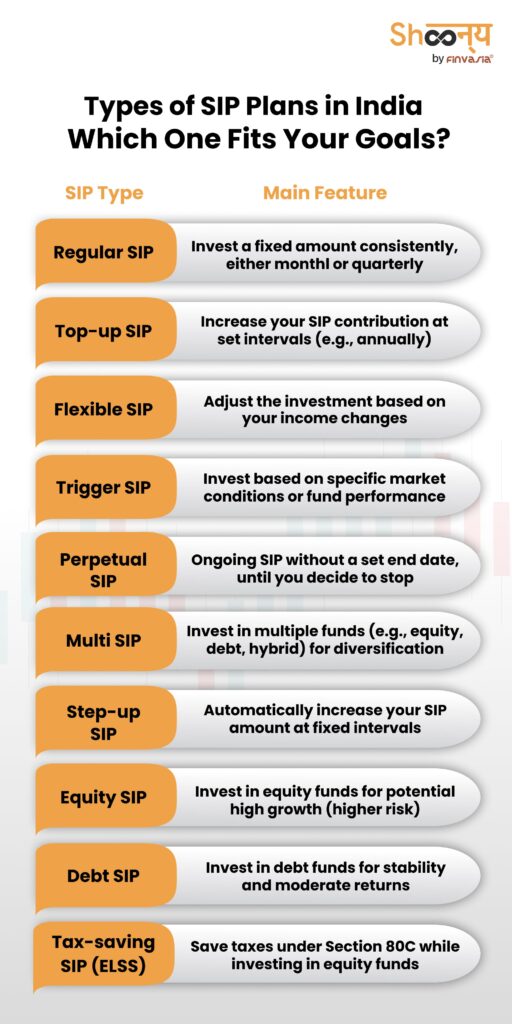

Types of SIP Plans

Let’s explore the different types of SIPs together!

1. Regular SIP – The Steady Path to Wealth

The Regular SIP is the most common and traditional sip plan in India. With Fixed SIP, you can invest a fixed amount of money at regular intervals. You can do this monthly or quarterly. The amount remains constant throughout the duration of your SIP investment. It is one of the most favoured SIP plans and helps you build a disciplined investment habit.

SIP Example: Let’s say you decide to invest ₹2,000 every month in a regular SIP. No matter what happens in the market, your ₹2,000 will automatically be invested into your chosen mutual fund each month.

It’s a great way to save and invest!

You might be wondering how much your investment will grow over time.

Use a SIP calculator today to see how your small, regular investments can grow into big returns!

2. Top-up SIP – Increase Your Investment Over Time

The Top-up SIP is perfect for those who want to grow their investments as their income grows. This type of SIP allows you to increase your contribution regularly, like every year.

SIP Example: Let us say that you start with ₹1,000 a month, and after a year, you decide to increase it by ₹500. Now, your monthly contribution is ₹1,500. This continues each year.

This type of SIP is ideal for anyone who expects their income to increase in the near future. With Top-up SIP, you can slowly but steadily increase your SIP investment.

It helps you keep up with inflation

3. Flexible SIP – Adjust to Your Changing Needs

The Flexible SIP is all about adaptability. If you’re a freelancer, a small business owner, or someone self-employed whose income varies each month, this SIP type allows you to adjust your investment amount whenever needed.

SIP Example

One month, you might have extra income and choose to invest ₹5,000 instead of ₹2,000. The next month, if things are tight, you can reduce it to ₹1,000.

This SIP plan in India is quite popular. It’s perfect for people with unpredictable incomes, as it gives them the freedom to pause, stop, or change their contribution.

4. Trigger SIP – Invest Based on Market Conditions

A Trigger SIP gives you a little more control over when and how your SIP investments happen. This SIP type allows you to set specific triggers based on market conditions or mutual fund performance.

SIP Example: You might set a trigger to increase your SIP amount if the stock market drops by 10%. Or, you might stop your SIP if the fund’s performance doesn’t meet your expectations.

This SIP type is perfect if you want to invest based on safe and suitable market conditions.

5. Perpetual SIP – Invest Without a Set End Date

A Perpetual SIP continues indefinitely. There’s no end date unless you choose to stop it. You keep investing in your mutual fund without worrying about setting an expiry date.

Invest in mutual funds with a lump sum or SIP—get started with a free demat and trading account!

SIP Example

Let us say that you start with ₹5,000 every month and choose to continue without setting an end date. Your SIP will keep running until you decide to stop.

If you’re planning for long-term goals like sending your kid to Canada for studies or for your retirement, this SIP type is perfect. This is because it ensures a consistent investment journey without needing renewal.

6. Multi SIP – Spread Your Risk Across Funds

Do you like to diversify your stock market investments? But do you not want to do self-research and make individual investments?

A multi-SIP allows you to invest in multiple funds simultaneously, diversifying your investments and reducing your overall risk. You can mix equity, debt, and hybrid funds in a single SIP.

If you decide to invest ₹2,000 per month in this SIP plan, you will be very smartly investing across three different funds—equity, debt, and hybrid.

7. Step-up SIP – Increase Your SIP Automatically

A Step-up SIP automatically increases your SIP contribution at set intervals. For example, you can choose to increase your SIP by 10% every year.

You start with ₹1,000 a month, and after one year, it automatically increases to ₹1,100, and so on each year.

8. Equity SIP – For Growth-Focused Investors

In an Equity SIP, you invest in equity mutual funds, mainly stocks. This type of SIP can offer higher returns, but it also comes with more risk due to market volatility.

If you’re young and looking for capital appreciation (and can tolerate some market ups and downs), Equity SIP is a great choice!

9. Debt SIP – Stability and Security

A Debt SIP involves investing in debt funds, which invest in fixed-income securities like bonds and government securities. These are safer and tend to offer more stable returns compared to equity funds.

It’s ideal for risk-averse investors who want to preserve their capital and earn steady, though moderate, returns over time.

10. Tax-saving SIP (ELSS SIP) – Save Taxes While Growing Wealth

An ELSS SIP (Equity Linked Savings Scheme) allows you to invest in equity mutual funds while also saving taxes under Section 80C of the Income Tax Act. It has a lock-in period of 3 years.

You invest ₹5,000 a month in an ELSS SIP, reducing your taxable income while aiming for long-term wealth growth.

If you want to save on taxes while investing in high-growth equity funds, an ELSS SIP is a great way to get the best of both worlds.

How Can You Invest in SIP?

You can invest in SIP mutual funds through Shoonya. Besides a free demat account and zero brokerage, it offers access to 3000+ direct mutual funds, advanced trading tools, and a multi-platform experience across mobile, web, and desktop.

Steps to Invest in SIPs on Shoonya

Here’s a simple guide to investing in different types of SIPs:

Step 1: Begin Your SIP Setup

- Go to Orders > XSIP > Search for the Mutual Fund (MF) you want to start a SIP with.

- If it’s your first SIP with Shoonya, you must create a Mandate ID.

Step 2: Create Mandate ID

- Click on Create Mandate ID.

- Enter the Mandate amount (the daily limit for your SIP).

- Set the validity date for how long you want to continue SIP investments, then click Submit.

- You’ll receive an authentication link via email. Approve this within 24 hours to complete the mandate setup with your bank.

Once your Mandate ID is approved, you can place the SIP order on Shoonya!

Step 3: Place Your SIP Order

- Return to Orders > XSIP > Search for your chosen MF.

- Click on XSIP > Enter the SIP amount and choose Fresh as the transaction type.

- Select the debit date for your SIP from your registered bank and Demat account.

- Once approved, your Mandate ID will appear automatically.

- Set Frequency to Monthly and specify the number of instalments (e.g., 24 instalments for a 2-year SIP).

You’re all set!

Your SIP will now run automatically based on the schedule you’ve chosen.

Conclusion

Now that you know about the various types of SIP, it’s time to decide which one fits your goals. Whether you’re looking for stability, flexibility, or tax savings, there’s a SIP plan for you.

So, which SIP will you choose to start your investment journey today? The power of SIP investment lies in taking that first step!

FAQs: Types of SIP Plans in India

The 5 main types of SIPs are Regular SIP, Flexible SIP, Top-up SIP, Trigger SIP, and Perpetual SIP. Each type offers unique benefits.

The best SIP category depends on your investment goals. For stable returns, Regular SIP works well. However, if you do not want the amount to be fixed, you can choose the Flexible SIP.

The seven common types of investments are stocks, bonds, mutual funds, currencies, commodities, index funds, and ETFs.

The SIP category refers to the type of systematic investment plan you choose. You can choose from Regular SIP, Top-up SIP, or Trigger SIP based on your financial goals.

SIP stands for Systematic Investment Plan. It is a method where you can invest fixed amounts at regular intervals. This is suitable for people who want to invest in mutual funds but in small amounts.

A SIP helps investors invest small, regular amounts in mutual funds to build wealth over time.

SIP is a disciplined investment strategy where you invest fixed amounts at regular intervals. Its advantages include rupee cost averaging, compounding, etc.

Source: AMFI

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.