FD vs Life Insurance: Which Investment Suits Your Needs Better?

When deciding between safe and reliable investment options, FDs and LIC plans often come to mind. Both have been trusted choices for years, providing financial security. But the real question is: FD vs Life Insurance, which is better?

If your financial strategy is steady and gradual—then Fixed Deposits (FDs) are a perfect fit. The various types of FDs allow your money to grow steadily. In contrast, LIC acts more like a shield. It provides crucial life protection against unforeseen events. So, when you’re wondering where to invest money to get good returns, this blog will help you determine which option aligns better!

Let us begin!

Fixed Deposit (FD)

Fixed Deposits are a popular and safe investment option. Here, you can deposit a lump sum amount with a bank or financial institution for a fixed period. In return, you will earn a guaranteed interest rate. The FD interest rate is usually higher than a regular savings account. It’s a great option if you want a risk-free investment with guaranteed returns. You can use an FD calculator to check the amount you will receive when your FD expires.

FDs have a fixed tenure. If you need to withdraw before the end of the term, you may face penalties and lower interest rates.

Types of FDs

Here are a few common types of fixed deposits (FDs) available in India:

- Standard Fixed Deposits: These are the most common FDs, where you invest money for a set period and earn a fixed interest rate.

- Tax-Saving Fixed Deposits: With these FDs, you can save on taxes under Section 80C. However, your money is locked in for five years.

- Senior Citizen Fixed Deposits: These FDs offer higher interest rates. However, these are meant only for particular age groups.

- Cumulative Fixed Deposits: Here, the interest is compounded, and you get it all at once with your principal at the end of the tenure. It’s a good option if you don’t need regular payouts.

- Non-Cumulative Fixed Deposits: Unlike cumulative FDs, these pay out the interest at regular intervals—monthly, quarterly, or yearly.

- Flexi Fixed Deposits: You can link an FD to your savings account. These FDs let you enjoy FD interest rates while still giving you the flexibility to withdraw when needed.

Life Insurance Investment

Life Insurance policy is not just an investment; it’s also a way to ensure financial protection for your family in case of your untimely demise. With life insurance, you pay regular premiums. However, in return, your beneficiaries receive a lump sum if something happens to you.

Some life insurance plans also offer various investment components, where a portion of your premiums is invested to grow over time.

Check out the top 10 insurance companies in India!

Life Insurance Types

Here are a few common types of life insurance investment plans available in India:

Term Life Insurance: It offers a coverage for a specific term. If you pass away during this period, your beneficiaries receive a payout.

Whole Life Insurance: This covers you for your entire life. You can also build cash value over time.

Endowment Plans: The life insurance plans combine insurance with savings. They pay a lump sum at the end of a specified term or on death.

Unit Linked Insurance Plans (ULIPs): Herein, you can invest a part of your premium in the stock market.

Retirement Plans: These offer guaranteed income options for retirement, with flexibility in choosing when to start receiving benefits.

Child Insurance: Such plans provide financial support for children’s future needs, combining savings and protection with periodic payouts and lump sum benefits.

Learn more about ULIPs.

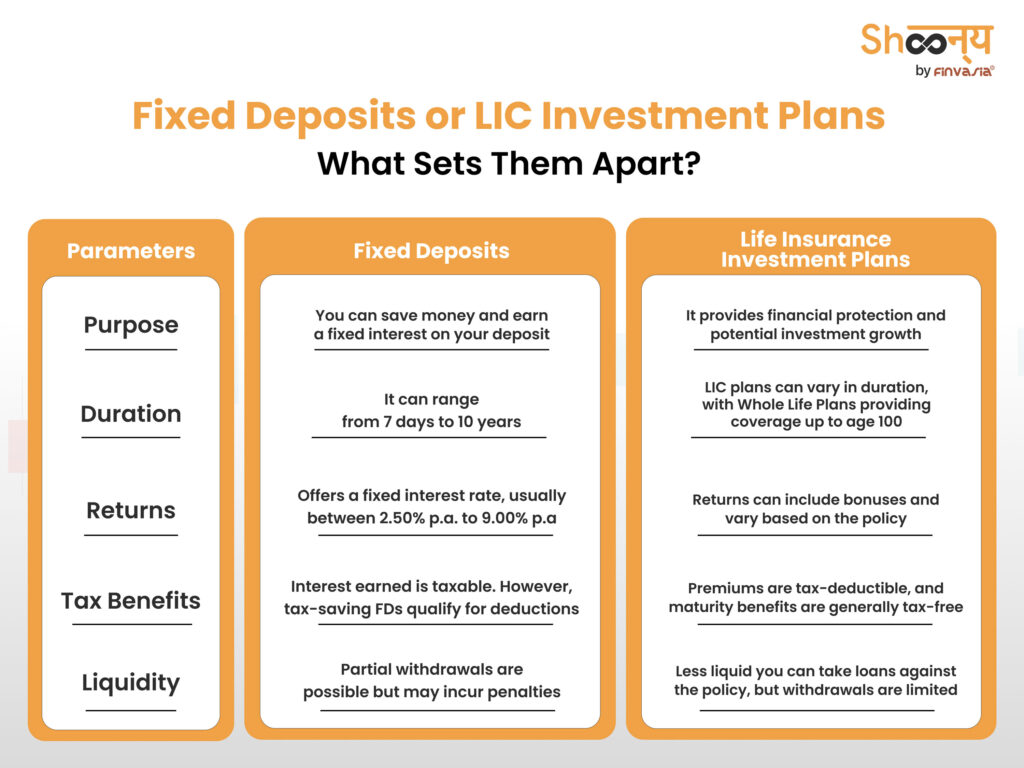

FD vs Life Insurance: How Do They Differ

Here’s a simple comparison table highlighting the key differences between Fixed Deposits (FDs) and Life Insurance Investment plans.

| Parameters | Fixed Deposit (FD) | LIC Plans |

| Purpose | Savings and investment | Insurance and investment |

| Risk Level | Low risk (capital is safe) | Low risk (insured amount is safe) |

| Returns | Fixed interest rate, predetermined returns | Varies (depends on the plan; can be fixed or linked to market performance) |

| Investment Duration | Short to long-term (e.g., 6 months to 5 years) | Long-term (e.g., 5 to 30 years) |

| Liquidity | High liquidity (can be withdrawn before maturity with penalties) | Low liquidity (surrender charges apply if withdrawn early) |

| Tax Benefits | Taxable interest income (but some tax-saving FD options are available) | Tax benefits on premiums under Section 80C and maturity proceeds under Section 10(10D) |

| Insurance Coverage | No insurance coverage | Provides life insurance cover |

| Interest Rate | Generally higher than savings accounts | Varies; typically lower than FD interest rates |

| Investment Amount | Flexible amounts, usually with minimum limits | Generally higher minimum premiums |

| Plan Options | Standard FDs, tax-saving FDs, senior citizen fixed deposits, flexi fixed deposits, etc. | Multiple plans (endowment, ULIPs, term insurance, etc.) |

| Payout | Lump sum at maturity | Lump sum or periodic payouts, depending on the plan. |

FDs vs. Life Insurance: Which Is Better?

Many investors debate the features of LIC vs Fixed Deposit for long-term financial security. To make the right choice, it’s essential to compare Life Insurance vs Fixed Deposit suitability to see which best aligns with your financial goals.

Who Should Invest in Fixed Deposits (FDs)?

- If you have a short-term goal, like buying a car or planning your child’s marriage in the next couple of years, FDs are a solid choice.

- Do you prefer zero risk? If you like knowing exactly how much you’ll get back without worrying about market ups and downs, FDs are your go-to.

- If having quick access to your funds is important, FDs offer some flexibility with withdrawals.

Who Should Invest in Life Insurance Plans?

- If you want to ensure your loved ones are financially secure, life insurance is the way to go.

- For those looking to invest for the long term with added tax benefits, life insurance plans offer both savings and protection.

- If you’re comfortable with making regular premium payments over many years, life insurance provides valuable coverage and savings.

Remember, it’s not always about choosing one over the other. Many people use both FDs and life insurance as part of their financial strategy. FDs can help with short-term goals and emergency funds, while life insurance offers long-term security and sometimes additional savings benefits.

Fixed Deposits (FDs) are ideal for those who want a reliable way to grow their money safely.

Life Insurance policy provides financial protection for your family and may include a savings component along with tax benefits. They are a good choice if you’re looking for both security for your loved ones and potential long-term savings.

Best Investment Options: Where to Invest Your Money for Good Returns

Looking for some great investment options in India besides fixed deposits and life insurance?

Here are a few worth considering:

- Mutual Funds offer the potential for higher returns through diversified investments in stocks, bonds, or a mix of both.

- Public Provident Fund (PPF) is a government-backed savings scheme that offers tax benefits and guaranteed returns.

- Whether it’s physical gold, gold ETFs, or sovereign gold bonds, investing in gold can help protect your wealth against inflation.

- Real Estate Investment Trusts (REITs) allow you to invest in real estate properties without directly owning them.

- Systematic Investment Plans (SIPs) are a disciplined way to invest in mutual funds regularly. You can start with just ₹500 per month.

These options give you a good mix of higher returns, tax savings, and diversification.

Conclusion

Both FD vs Life Insurance options have their own advantages. If you’re looking for a safe, predictable return, FDs might be better. However, if you want a combination of insurance and potential investment growth, Life Insurance could be the way to go.

You can now invest in the stock market at zero brokerage!

FAQs| LIC vs FDs

Fixed deposits are great for guaranteed returns, while insurance is more about protecting your family’s future. It really depends on your financial goals.

LIC gives you life coverage along with potential returns, whereas FDs stick to fixed, guaranteed returns. Each has its own perks; the choice depends on your future goals.

If you’re looking for higher returns, mutual funds, PPFs, and ULIPs might be more rewarding than FDs. But they also come with different levels of risk.

Mutual funds can help you grow your wealth, while life insurance is better suited for financial protection. It’s all about what’s more important to you.

LIC is generally seen as safe because it’s backed by the government, but remember, no investment is complete without risk.

FDs offer steady income, which is great, but they might not keep pace with inflation or cover all your financial goals in the long run.

While FDs are secure, the returns are lower compared to other investments.

Source: LicIndia, Moneycontrol, Mint

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.