Top 10 Government Banks in India 2026: PSU Banks List and Rankings

We Indians still prioritise safety above all else and thus tend to favour top government banks in India. Several Sarkari banks offer reliable financial services. If you’re looking for the best government bank in India, it is important to see who provides the best rates, products, and services.

In this blog, we have curated a list of the top 10 government banks in India with detailed analyses of their service, product offerings, and more!

Government Banks in India

A government bank in India is one where the government owns more than 50% of its shares. These banks, also called public sector banks or Sarkari banks, focus on public welfare by making banking accessible to everyone.

The roots of many of these banks trace back to the pre-independence era. Those were the times when these top government banks in India were established to meet the basic financial needs of the public.

List of Government Banks in India – 2026

There are 12 government banks in India.

Here is the latest PSU bank list of 2026 based on the latest market capitalisation data-

• Bank of Baroda – ₹1,49,710.99 crore

• Bank of India – ₹75,210.10 crore

• Bank of Maharashtra – ₹50,402.82 crore

• Canara Bank – ₹1,31,343.04 crore

• Central Bank of India – ₹33,318.24 crore

• Indian Bank – ₹1,18,768.57 crore

• Indian Overseas Bank – ₹67,937.25 crore

• Punjab & Sind Bank – ₹18,994.90 crore

• Punjab National Bank – ₹1,38,834.79 crore

• State Bank of India – ₹11,00,243.37 crore

• Union Bank of India – ₹1,38,015.57 crore

Note: This list of public sector banks in India reflects branch counts as of Feb 2026.

But, out of these, which are the top 10 government banks in India?

Let us take a look!

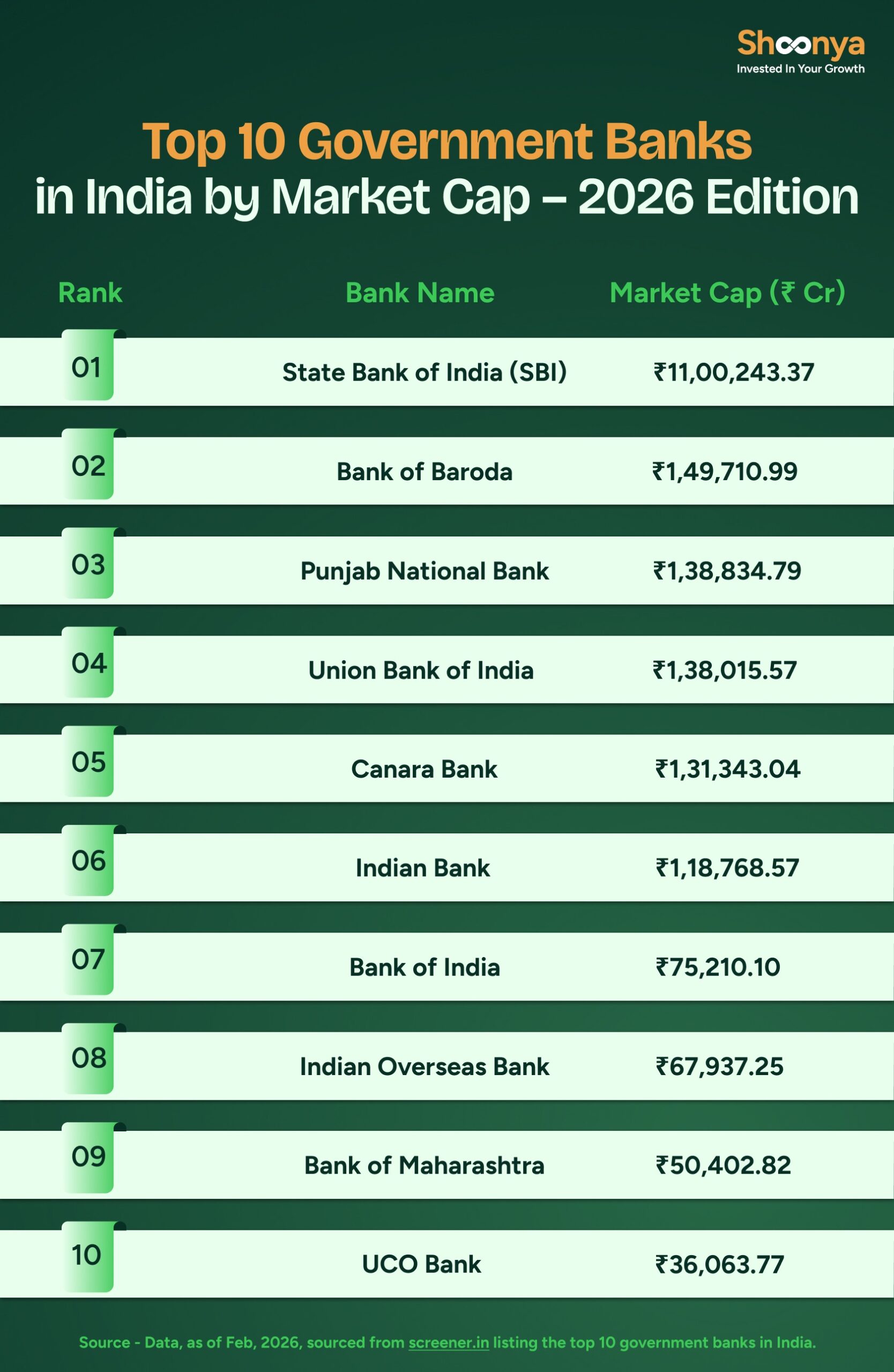

Top 10 Public Sector Banks in India – 2026

Be it for savings, loans, or investments, the top 10 government banks in India offer it all.

Here is the government bank list that shows the list of the top 10 public sector banks in India based on market cap in 2026!

Top 10 Sarkari Banks in India – 2026

| Rank | Bank Name | Year of Foundation | Market Cap (₹ Cr.) | Branches (2026) | ATMs (2026) |

| 1 | State Bank of India (SBI) | 1955 | 11,00,243.37 | 22,500 | 62,475 |

| 2 | Bank of Baroda | 1908 | 1,49,710.99 | ~9,500 | 11,130 |

| 3 | Punjab National Bank | 1894 | 1,38,834.79 | ~12,000 | 11,240 |

| 4 | Union Bank of India | 1919 | 1,38,015.57 | ~9,000 | 8,895 |

| 5 | Canara Bank | 1906 | 1,31,343.04 | ~9,800 | 10,846 |

| 6 | Indian Bank | 1907 | 1,18,768.57 | ~6,500 | 5,466 |

| 7 | Bank of India | 1906 | 75,210.10 | ~5,200 | 7,986 |

| 8 | Indian Overseas Bank | 1937 | 67,937.25 | ~3,500 | 3,460 |

| 9 | Bank of Maharashtra | 1935 | 50,402.82 | ~2,000 | 2,464 |

| 10 | UCO Bank | 1943 | 36,063.77 | ~3,000 | 2,556 |

This government bank list has the names of the top 10 sarkari banks in India, their founding years, and their market cap, branches, and number of ATMs.

Source– Data, as of Feb, 2026, sourced from screener.in listing the top 10 government banks in India/ top 10 public sector banks in India 2026.

Top 10 Government Banks in India 2026: Market Cap, Branches and Key Metrics

Here’s a brief overview of each of the best government banks in India, complete with their latest financial insights!

SBI- 1st Among the Top 10 Government Banks in India

Year of Establishment: 1806 (as Bank of Calcutta), renamed as State Bank of India in 1955

Chairman: Shri Challa Sreenivasulu Setty

SBI is the leading public sector bank in India based on market cap, standing at 11,00,243.37 crore as of Feb, 2026. It stands as one of the largest government banks in India and holds the first position among the top 10 public sector banks in India.

Is SBI 100% government bank?

No, State Bank of India is not 100 percent government owned. It is a public sector bank in which the Government of India holds a majority stake, approximately between 55 percent and 58 percent as of 2026. The remaining shares are publicly traded and held by institutional and retail investors.

- As of Feb, 2026, SBI serves more than 500 million customers.

- It has a network of 22,500+ branches, 63,580 ATMs, and 82,900 BC outlets.

- As one of the top government banks in India, SBI has successfully diversified its business through subsidiaries.

- It operates in 29 countries with 241 international offices

BOB – 2nd Top Performer in the Best Government Bank in India List

Year of Establishment: 1908

MD and CEO– Dr Debadatta Chand

Bank of Baroda has a market cap of ₹1,49,710.99 crore as of Feb, 2026.

Bank of Baroda (BOB) is an Indian government-owned bank with its main office in Vadodara, Gujarat. It holds the 2nd position among the top 10 government banks in India.

It was nationalised on July 19, 1969, along with 13 other commercial banks in India.

PNB- Ranked 3rd Among the Top 10 Government Banks in India

Year of Establishment: 1894

MD & CEO- Ashok Chandra

Punjab National Bank holds a market cap of ₹1,38,834.79 crore as of Feb, 2026.

PNB is a government-owned bank in India, and its main office is in New Delhi. It was founded on May 19, 1894, at the instance of Rai Mool Raj and Lala Lajpat Rai.

Lala Harkrishan Lal, inspired by his ideas on commerce and industry, helped shape the bank’s practical approach.

Want to invest in PNB shares? Start today with a FREE demat account

As of 2026, PNB has introduced various new initiatives, such as Digital Transformation, the issuance of the Rupay Credit Card through the BHIM PNB App, cash withdrawal using UPI, etc.

Union Bank of India- 4th Best Government Bank in India

Year of Establishment: 1919

CEO– Shri Asheesh Pandey.

Union Bank of India has a market cap of 1,38,015.57 crore as of Feb, 2026.

Established on November 11, 1919, as a limited company, it stands in the 4th rank among the top 10 government banks in India. It is headquartered in Mumbai.

It expanded significantly with the amalgamation of Andhra Bank and Corporation Bank on April 1, 2020.

Key Highlights as of Nov 2025

- Over 9000 domestic branches, 8,900+ ATMs, 75,800+ employees, and 18,900+ BC Points.

- The Government of India holds 74.76% of the Bank’s paid-up capital, making it one of the best government banks in India.

- Union Bank of India was registered on November 11, 1919.

- During the second quarter of FY26, the bank reported a net profit of ₹4,249 crore.

- The overall business grew by 3.24% year-on-year

- The Retail, Agriculture, and MSME (RAM) segment recorded an 8.14% year-on-year growth, driven by a strong 23.98% rise in the retail portfolio.

- Overseas Presence: 2 branches (Dubai, UAE & Sydney, Australia), 1 banking

Canara Bank- 5th in the Top 10 Public Sector Banks in India

Year of Establishment: 1906

MD & CEO- Shri K Satyanarayana Raju

Canara Bank records a market cap of ₹1,31,343.04 as of Feb, 2026. Founded in July 1906 by the visionary Shri Ammembal Subba Rao Pai, Canara Bank is one of the top government banks in India, ranking fifth on the list.

Key Highlights (Nov 2025)

- Total business grew 13.55 per cent year on year to ₹26,78,963 crore, signalling strong balance-sheet expansion.

- Net profit increased 18.93 per cent year on year to ₹4,774 crore, and earnings per share stood at ₹21.01.

- Gross non-performing assets improved to 2.35 per cent, and the provision coverage ratio strengthened to 93.59 per cent.

- International Branches: 4 (London, New York, Dubai, and GIFT City, Gujarat)

Indian Bank- 6th Among Top 10 PSU Banks

Year of Establishment: 1907

MD & CEO– Shri Binod Kumar

Indian Bank holds a market cap of ₹1,18,768.57 as of February 2026.

It is one of the best government banks in India. Indian Bank was incorporated with an authorised capital of ₹20 lakhs and commenced its business on August 15, 1907. Currently, it ranks as the 7th largest public sector bank in India by market cap.

2025 Performance Highlights:

- Indian Bank’s Q3 FY25 net profit is ₹2,910 crore.

- Total income grew 11% to ₹18,167 crore.

- Total deposits increased by 7% to ₹7.02 lakh crore.

- Capital Adequacy Ratio improved to 15.92%, with EPS up 26% to ₹84.70.

Bank of India- 7th Among the Top 10 Government Banks in India

Year of Establishment: 1906

CEO- Rajneesh Karnatak

Bank of India stands with a market cap of ₹75,210.10 crore as of Feb, 2026.

It was established on 7th September 1906 by a group of prominent businessmen from Mumbai. The bank remained under private ownership and control until July 1969, when it, along with 13 other banks, was nationalised.

Ranked seventh among the top government banks in India, this bank went public with its maiden issue in 1997.

Key Highlights as of Nov 2025:

- Net profit rose to ₹2,555 crore in Q2 FY26, marking an 8% year-on-year increase.

- Operating profit for the quarter stood at ₹3,821 crore.

- Total income reached ₹20,739.87 crore

- Net Interest Income (NII) was ₹5,912 crore

- Asset quality improved.

IOB- 8th Choice Among the Top 10 Government Banks in India

Year of Establishment: 1937

CEO– Ajay Kumar Srivastava

Indian Overseas Bank (IOB) reports a market cap of ₹67,937.25 crore as of February, 2026.

It was founded on February 10, 1937, by Shri M.Ct.M. Chidambaram Chettyar. He started the bank with the aim of focusing on foreign exchange services and expanding it globally.

- IOB began operations in Karaikudi, later opening a branch in Penang, Malaysia.

- By the time of India’s independence, the bank had 38 branches in India and 7 overseas, with total deposits of ₹6.64 crore and advances of ₹3.23 crore.

- In 1969, IOB was nationalised, becoming one of the 14 major banks taken over by the government. At that time, it had 195 branches in India, with deposits of ₹67.70 crore and advances of ₹44.90 crore.

- Today, IOB has an international presence in Singapore, Hong Kong, Thailand, and Sri Lanka.

Bank of Maharashtra- Ranks 9th Among Top Sarkari Banks in India

Bank of Maharashtra has a market cap of 50,402.82, as of Feb 2026. It is a public sector bank based in Pune, India. It is recognised for its focus on retail banking, low non-performing asset levels, and strong digital banking services.

Key Highlights (as of Nov 2025):

- Net Profit: ₹5,520 crore for the financial year ending March 2025, showing a 36% year-on-year increase.

- Total Business reached ₹5,63,987 crore.

- It maintained the asset quality of Gross NPA at 1.74%

- Total deposits rose by 12.13% year-on-year to ₹3,09,800 crore, while gross advances increased by 16.87% to ₹2,54,187 crore.

UCO Bank: One of the Best Public Sector Banks in India (2026)

Year of Establishment: 1943

MD & CEO– Ashwani Kumar

UCO Bank has a market cap of ₹36,063.77 crore as of Feb, 2026.

It is one of the oldest and most trusted government banks in India. It was founded in 1943 in Kolkata by eminent businessmen and visionaries.

UCO Bank offers its customers multiple financial and banking services, such as personal, corporate, rural, MSME, digital, and international banking.

Services and Reach:

- Over 3,000 service units across India.

- Presence in international financial centres like Hong Kong and Singapore.

- Correspondents in over 50 centres globally.

- Headquartered in Kolkata with 43 zonal offices in India.

- Zonal offices report to the head office departments.

- International Operations: Includes foreign exchange business at over 50 centres in India.

Key Developments in Government Banks in India and PSU Bank Consolidation (1969–2026)

| Year / Period | Development | Details / Outcome |

| 2018 | Merger of Vijaya Bank and Dena Bank with Bank of Baroda | This was the first major consolidation move in recent years. |

| April 2020 | Merger of Six Public Sector Banks into Larger Entities | The government merged several PSBs to improve efficiency and capital strength. The number of public sector banks was reduced from 27 to 12. |

| 2020 – Specific Mergers | Oriental Bank of Commerce and United Bank of India merged with Punjab National Bank | Created a larger, unified Punjab National Bank, making it one of India’s top three public sector banks. |

| Andhra Bank and Corporation Bank merged with Union Bank of India | Strengthened Union Bank’s national footprint and branch network across regions. | |

| Syndicate Bank merged with Canara Bank | Enhanced Canara Bank’s retail base and digital reach. | |

| Allahabad Bank merged with Indian Bank | Expanded Indian Bank’s operations and customer base nationwide. | |

| November 2024 | Proposal for Regional Rural Bank (RRB) Merger | The government announced plans to consolidate 43 RRBs into 28 to boost operational efficiency and improve capital adequacy. |

Types of Banks in India

Banks in India are divided into different categories based on their role in the financial system.

| Type of Banks | Working and Role |

| Central Bank | The Reserve Bank of India (RBI) acts as the country’s central bank and monetary authority. It regulates and supervises all other banks in India. |

| Commercial Banks | These are the most common government-owned banks that handle deposits, loans, and other retail services for individuals and businesses. |

| Cooperative Banks | These operate on a cooperative model, primarily at the state and district level. They cater to rural and agricultural sectors by offering affordable credit and easy banking access. |

| Regional Rural Banks (RRBs) | Established in 1975 to extend banking services to rural areas. These banks focus on lending to small farmers, artisans, and village-based enterprises. |

| Payments Banks | Designed to promote financial inclusion by offering basic banking services such as savings accounts and fund transfers, but without loan or credit facilities. |

How to Choose the Right Government Bank in 2026

With every public sector bank now offering digital services, low-cost accounts, and online loans, the decision depends on what you value more. Is it accessibility, service, or technology?

What are the Pros of Government Banks

Here are some benefits of choosing public sector banks for your savings:

- Public sector banks are seen as safe because the government supports and manages them.

- They often have lower minimum balance requirements compared to private banks.

- Their long-standing presence and established reputation contribute to public trust.

What are the Cons of Government Banks

However, you may face certain challenges:

- Government banks in India are often considered slower in adopting the latest technology than private banks.

- They are known to offer fewer schemes, especially digital solutions.

- People often perceive government banks as less customer-friendly.

These top government banks in India are not just financially strong but also utilise advanced technology to improve customer service. We hope our list of the best government banks in India serves as a purposeful guide for you.

Also check – top 10 private banks in India 2026!

Top Public Banks in India- FAQs

There is no single “safest” bank in India. All scheduled commercial banks operate under the strict supervision of the Reserve Bank of India and must follow regulatory capital, liquidity, and risk management norms.

SBI is a public sector bank with a vast branch network, lower minimum balance requirements, and higher deposit interest rates. In contrast, HDFC Bank is a private sector bank known for excellent customer service, advanced technology, and lower interest rates on loans. You can choose based on whether you prefer a public or private bank.

A public sector bank is a financial institution owned and operated by the government. It focuses mainly on the weaker sections of society.

As of 2026, there are 12 government banks in India.

As of 9 February 2026, based on the latest market capitalisation ranking, the largest public sector bank in India is the State Bank of India (SBI). It holds the 1st rank with a market capitalisation of ₹11,00,243.37 crore.

As of 9 February 2026, the No. 1 government bank by market capitalisation is the State Bank of India (SBI). It holds the 1st rank with a market capitalisation of ₹11,00,243.37 crore.

Public sector banks in India include the State Bank of India (SBI), Punjab National Bank (PNB), Bank of Baroda, Canara Bank, Union Bank of India, and others.

According to the latest market capitalisation ranking dated 9 February 2026, Punjab National Bank is the 3rd-largest government bank in India. It holds a market capitalisation of ₹1,38,834.79 crore.

As of 9 February 2026, based on market capitalisation, the top five government banks in India are State Bank of India, Bank of Baroda, Punjab National Bank, Union Bank of India, and Canara Bank.

A Sarkari bank in India refers to a government-owned bank where the Government of India holds more than 50 percent ownership. These banks are also known as public sector banks.

As of February 2026, India has 12 government-owned Public Sector Banks. Earlier, there were 27, but due to mergers between 2017 and 2020, the number was consolidated to create stronger and more efficient banking institutions.

As of 9 February 2026, the number one government bank in India is the State Bank of India based on market capitalisation. It ranks first with a market value of ₹11,00,243.37 crore. The bank operates 22,500 branches and 62,475 ATMs, making it the largest public sector bank in India by scale, reach, and overall valuation.

As of 2026, the 12 Public Sector Banks where the Government of India holds majority ownership are:

Punjab National Bank, Bank of Baroda, Canara Bank, Union Bank of India, Indian Bank, Bank of India, Indian Overseas Bank, UCO Bank, Bank of Maharashtra, Central Bank of India, Punjab & Sind Bank, and State Bank of India.

No, The Government of India holds approximately 57.44 percent stake in State Bank of India as of late 2025. The remaining shares are publicly traded on stock exchanges.

The Reserve Bank of India is not a commercial government bank. It is India’s central bank, wholly owned by the Government of India, and is responsible for regulating banks, issuing currency, and managing monetary policy.

Fourteen major commercial banks were nationalised on 19 July 1969 under the Banking Companies Act during the tenure of Prime Minister Indira Gandhi. This move aimed to expand banking access across rural and priority sectors.

No. The Reserve Bank of India is not a Public Sector Bank. Public Sector Banks are commercial banks where the government holds more than 50 percent ownership, whereas RBI is the statutory central bank established under the RBI Act, 1934, and acts as the regulator of the banking system.

Source- https://financialservices.gov.in

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.