Top 10 Green Energy Stocks in India You Should Explore in 2025

Everyone’s talking about inflation, oil price shocks, and power shortages. Your electricity bill’s probably gone up too. And behind all this chaos, India’s green energy is becoming a real investment theme. The government is pumping in crores. Simultaneously, top private banks in India are lending substantial amounts to construct solar parks, wind farms, green hydrogen plants, etc. And stock prices? Some of them have already doubled. So here’s the question: while you’re chasing momentum in F&O or looking for stability in large caps, are you ignoring the one sector that could give you both? If you’re looking to invest in a way that’s both future-proof and planet-friendly, this list of top green energy stocks in India is a must-watch!

Let’s uncover it all!

What Are Green Energy Stocks?

Green energy stocks are shares of companies that operate in the clean energy sector. This includes solar, wind, hydro, and even bioenergy. These companies either generate power from renewable sources or make the tools, technology, and infrastructure that support green electricity.

So, investing in green energy stock means you get an indirect opportunity to invest in the following-

- Solar farms, wind turbines, or hydropower plants that produce electricity

- Companies that make solar panels, batteries, wind turbine parts, and other clean tech

- EPC (Engineering, Procurement and Construction) firms that build renewable projects

- Government-backed power utilities that are shifting to greener energy sources

In India, the green energy space is expanding.

Let’s explore the best green stocks in India!

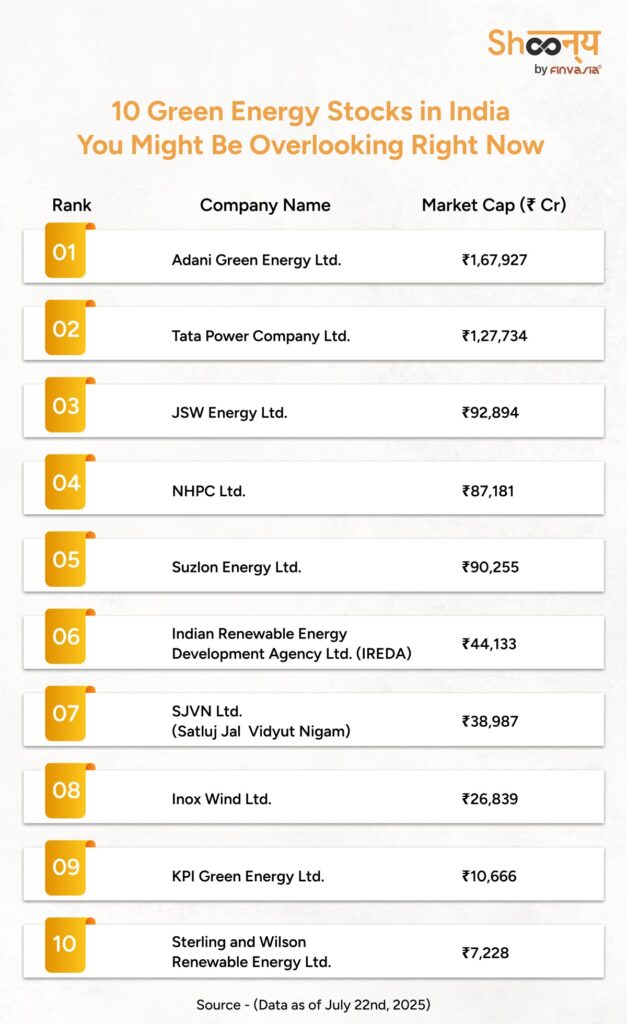

Top 10 Green Energy Stocks by Market Cap- 2025

Best Green Energy Stocks in India- An Overview

Here is the detailed analysis of the top 10 green stocks in India.

Adani Green Energy Ltd.

Adani Green Energy is one of the top green energy stocks in India, leading the way in solar and wind power. It is among the largest renewable energy companies in India, with a massive 14 GW operational capacity and plans to expand to 50 GW by 2030.

The company builds large-scale solar, hybrid, and wind farms. From Gujarat’s energy parks to pan-India projects, Adani Green continues to grow fast.

You will be glad to know that it has also partnered with global names like TotalEnergies. With operations across 12 Indian states, Adani Green reflects strong future-readiness. If you are researching top 10 green energy stocks in India, this company is always on the list.

Tata Power Company Ltd.

Tata Power is one of the oldest and best energy stocks in India. It began as a traditional utility provider. However, it has now become a key player in the green energy stocks segment.

It operates over 5,500 MW of clean energy capacity and aims to make 70% of its future power green. With projects in rooftop solar and EV charging, Tata Power is modernising fast.

Tata Power offers both legacy and innovation. It is also a safe bet for those who want steady growth from top renewable energy stocks in India. With a strong brand, it is often part of long-term ESG portfolios.

Invest in these green energy stocks with a free demat account!

JSW Energy Ltd.

JSW Energy has placed itself among the top green energy stocks in India through its solar, hydro, and wind projects. As a major part of the JSW Group, the company is expanding fast in clean energy.

It has plans to scale up to 30 GW of power and 40 GWh of storage by 2030. Its clean energy division focuses on both sustainability and profitability. This makes it a strong name among the best renewable energy stocks in India.

From solar farms to battery storage, JSW is building a modern power business. It ranks in several lists of top 10 green energy stocks in India for its aggressive plans. With a focus on green hydrogen and grid-scale power, JSW Energy is moving beyond traditional generation. If you’re exploring best green energy stocks, this is a stock worth watching.

NHPC Ltd.

NHPC is India’s largest hydropower-focused company and an important name in the list of renewable energy companies in India. As a government-backed Navratna PSU, it is often considered a low-risk option among green energy stocks.

NHPC currently operates over 7,000 MW of clean energy capacity and is actively expanding into solar and wind projects. It is regularly featured among the top renewable energy stocks in India. With a focus on large-scale hydropower dams and sustainable development, NHPC plays a big role in India’s energy transition story. This stock also appeals to investors looking for government-supported green energy stocks India.

Suzlon Energy Ltd.

Suzlon has long been part of the green energy stocks India conversation. Known for manufacturing wind turbines and managing full-scale projects, Suzlon has installations across 17 countries. It is often counted among the best renewable energy stocks in India, especially for wind-focused investors.

With a renewed focus on reducing debt and growing profits, Suzlon is regaining momentum. It plays a big part in India’s wind energy landscape, contributing to national renewable goals. As one of the oldest names in clean energy, it is frequently listed under top green energy stocks in India. It has the legacy, technical expertise, and large-scale execution experience. If you are exploring green energy stocks, Suzlon is still relevant in 2025.

Indian Renewable Energy Development Agency Ltd. (IREDA)

IREDA is known to be a financial backbone for India’s entire renewable sector. It provides loans and funding to various renewable energy companies in India. These include, solar, wind, and biomass developers. As a government-owned NBFC, it plays a hugerole in the growth of green energy stocks in India.

With decades of experience, IREDA is accelerating the clean energy shift at scale. For those who want to support India’s green mission indirectly, IREDA is a smart pick. It offers exposure to the full clean-tech ecosystem. That’s why it appears in many lists of top 10 green energy stocks in India today.

SJVN Ltd.

SJVN is another public-sector company that has grown from being a hydro-focused firm to a full-fledged renewable energy company in India. It is now involved in solar, wind, and hybrid energy projects too.

As of 2025, SJVN has over 3,000 MW in green energy capacity. It is becoming a regular feature among top green energy stocks in India. Its focus on high-altitude hydro and large-scale solar parks makes it stand out.

SJVN is also among the few green energy stocks offering strong dividend potential.

Inox Wind Ltd.

Inox Wind is a full-service wind energy company offering turnkey solutions for project developers. It is part of the INOXGFL Group, a known name in chemicals and renewable power.

Inox Wind’s business includes turbine manufacturing, EPC services, and post-installation O&M. Among the many green energy stocks India has to offer, this one appeals to infrastructure-focused investors. It often appears in lists of top 10 green energy stocks in India for its strong performance.

Its plans for capacity addition and new orders make it one of the top renewable energy stocks in India to monitor in 2025.

KPI Green Energy Ltd.

KPI Green Energy is a rising name in the list of best green energy stocks in India, focused on solar power development. The company works in both Independent Power Producer (IPP) and Captive Power Producer (CPP) segments. It builds, operates, and maintains solar power plants for business and industrial clients.

For investors exploring small and mid-cap green energy stocks in India, KPI Green could be a promising option. Its growth in Gujarat and expanding customer base show its potential.

Sterling and Wilson Renewable Energy Ltd.

Sterling and Wilson is a global solar EPC company that originates from the Shapoorji Pallonji Group. It builds large-scale solar farms in India, Africa, and the Middle East.

Though it does not generate power directly, it enables many renewable energy companies in India to operate. Its role makes it a unique pick among green energy stocks for infrastructure-focused portfolios.

Sterling and Wilson also takes up large rooftop and floating solar assignments. Its international presence gives investors global exposure through an Indian firm.

Top 10 Green Energy Stocks in India by LTP- Last Traded Price

| Rank | Company Name | LTP (₹) | Market Cap (₹ Cr) |

| 1 | Adani Green Energy Ltd. | ₹1,026.70 | ₹1,67,927 |

| 2 | BF Utilities Ltd. | ₹809.80 | ₹3,050 |

| 3 | KPI Green Energy Ltd. | ₹540.50 | ₹10,666 |

| 4 | JSW Energy Ltd. | ₹531.50 | ₹92,894 |

| 5 | Zodiac Energy Ltd. | ₹467.10 | ₹706 |

| 6 | Tata Power Company Ltd. | ₹399.75 | ₹1,27,734 |

| 7 | Sterling and Wilson Renewable Energy Ltd. | ₹309.55 | ₹7,228 |

| 8 | Inox Green Energy Services Ltd. | ₹166.30 | ₹6,103 |

| 9 | Inox Wind Ltd. | ₹165.25 | ₹26,839 |

| 10 | Indian Renewable Energy Development Agency Ltd. (IREDA) | ₹157.10 | ₹44,133 |

Note- A high LTP does not always mean a better investment. You must always look at fundamentals like PE, ROE, debt levels, and future potential. Several of these companies are involved in solar, wind, hydro, or green infra projects.

Why Green Energy Is a Long-Term Theme in India

India’s clean energy transition is being driven by strong, long-term forces.

Here’s why green energy stocks are expected to grow steadily:

1. Government support

From the Production Linked Incentive (PLI) scheme for solar to faster green clearances, the government is pushing this sector hard. Rules like green open access and SECI-backed auctions are also giving private companies more room to grow.

2. Global funding and ESG

India’s renewable sector is attracting big global investors who want to back sustainable businesses. India’s clean energy firms, with low costs and high potential, are now on the global radar.

3. Corporate demand

Large businesses, from tech companies to manufacturers, are signing long-term green energy deals to reduce their carbon footprint. This demand is pushing energy providers to scale up renewables fast.

4. Lower costs

Producing clean power is no longer expensive. Solar and wind have become cheaper than coal in many cases, which makes renewable companies more competitive and profitable over time.

5. Better infrastructure

India is investing in grid upgrades and battery storage. This makes renewable energy more stable and reliable.

Now, Why Green Energy Stocks Are Gaining Attention

India’s push towards a sustainable future is real. With the government aiming for 500 GW of non-fossil fuel capacity by 2030, the renewable energy sector is getting a lot of support. This growth is reflecting on the markets too.

Green energy stocks in India are all about future-forward technology, strong government backing, and global relevance. Many investors see these stocks as a way to participate in India’s energy shift while also diversifying their portfolio.

For example, renewable energy companies in India like Adani Green, Tata Power Renewable, and ReNew Power have seen strong interest from both domestic and global investors.

Is Now the Right Time to Start?

The shift towards renewables is already gaining popularity. And India is in the early stages of this change. That means the best green energy stocks in India are still building, expanding, and winning new projects. This offers long-term opportunities, but also calls for patience.

Right now, many top green energy stocks in India are attractively priced due to broader market corrections. It could be a smart time to begin building exposure slowly.

Risks Involved with Green Energy Stocks

While green energy stocks in India are actively gaining attention, investing in them is not without risk.

Many investors hop in because the sector feels “future-proof”. However, that’s only one side of the story.

Here are a few real risks you need to keep in mind:

a. Policy Dependence

The biggest strength of renewable energy stocks in India is also their biggest vulnerability – government policy. Green energy growth depends heavily on subsidies, incentives, and supportive regulations. A sudden policy change can affect the stock performance.

b. Capital-Intensive Business

Unlike tech companies that can scale with low fixed costs, renewable energy companies in India need heavy upfront investment. From setting up solar farms to wind turbines and grid infrastructure, the capital requirement is massive.

c. Execution Delays

India’s infrastructure challenges mean power transmission bottlenecks are real. Even the best renewable energy stocks in India can face losses if their plants are ready but can’t connect to the grid or receive payments on time. These execution risks make timelines hard to predict, which creates uncertainty for investors.

d. Global Factors

Prices of raw materials like polysilicon (used in solar panels) or rare earth metals (used in wind turbines) fluctuate globally. Even though you’re buying green energy stocks India, the companies often depend on international suppliers. So, global inflation or geopolitical tensions can increase costs and shrink margins.

Mistakes to Avoid While Investing in Green Stocks

1. Investing without research

Just because a stock is labelled green or sustainable does not mean it’s a good investment.

You must always read the financials, growth history, future roadmap, and real contribution to sustainability before investing.

2. Falling for greenwashing

Some companies claim to be eco-friendly, but their actual practices tell a different story. This is called greenwashing.

You must verify if the company follows sustainable practices, has independent certifications, and meets regulatory standards.

3. Ignoring policy risks

The renewable energy space is heavily impacted by government policies and global regulations. A subsidy cut or delay in approvals can impact project timelines and profits. Before investing, you need to understand the company’s dependence on these factors.

4. Looking only at short-term returns

Green stocks often require patience. These companies are building future-ready models that may not give immediate profits. If you expect quick returns, you may get disappointed.

5. Ignoring global developments

The green sector is affected by international events, including climate conferences, oil prices, and global ESG norms. Keeping track of these can help you make the right entry and exit decisions.

7. Overpaying due to hype

Many green stocks are trading at high valuations. If you buy them when they are overpriced, your chances of getting good returns go down. Don’t buy just because everyone else is doing it. You should always wait for the right entry point.

Budget 2025: Clean and Green Energy Focus

In the Union Budget 2025, the Indian government has made a strong push toward green growth and energy transition. A total of ₹35,000 crore has been allocated to boost the country’s net-zero efforts. This includes funding for renewable energy projects, green hydrogen, solar panel manufacturing, and bio-energy initiatives.

A key focus is on expanding India’s rooftop solar coverage under the PM Surya Ghar Yojana, with a target of 1 crore households receiving free electricity up to 300 units per month. ₹10,000 crore has been set aside for green energy corridors and transmission lines. Support has also been announced for e-vehicle infrastructure, waste-to-energy projects, and compressed biogas plants.

Additionally, financial support and viability gap funding will be extended to offshore wind energy projects.

Green Energy Stocks in India- 2025| FAQs

As of July 23rd, 2025, Adani Green is the largest by market cap (₹1.67 lakh crore) with 14 GW operational and a 50 GW target, but Tata Power offers balanced growth with strong brand trust and 70% clean energy transition goals.

Adani Green Energy Ltd. leads with the highest market capitalisation (₹1.67 lakh crore, as of July 22, 2025) and the largest operational capacity among renewable energy stocks.

You must research all the factors before investing. It has strong long-term potential. However, high valuations and debt levels mean it’s suited for risk-tolerant, long-term investors.

Renewables are a long-term theme with government backing, but sector risks like policy shifts, execution delays, and high capex mean you should diversify and always invest with caution.

Stocks like Suzlon, IREDA, and KPI Green have shown sharp momentum post-policy announcements and budget moves. They could be ideal for traders tracking short-term upside.

Tata Power offers stable, diversified growth with a legacy base and strong ESG focus. On the other hand, Adani Green has more aggressive expansion and scale but carries higher valuation risk.

In terms of scale and industry, Adani Green leads the sector. For hydropower, NHPC holds the top spot, while Tata Power leads in balanced green-modern utility models.

Source: Screener.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.