How to Increase CIBIL Score When You Need a Loan Urgently

Banks do not approve loans based on intent or need. They approve loans based on risk signals. Your CIBIL score is one of the strongest of those signals, and it influences not only whether you get a loan, but also how much it costs you in interest over time. If your goal is to increase CIBIL score quickly, you need to understand which actions of yours can improve lender confidence and which ones quietly work against you.

This article breaks down the practical steps to improve CIBIL score quickly and easily.

What is a CIBIL Score?

A CIBIL score is a three-digit number ranging from 300 to 900 that reflects an individual’s credit history in India. It is maintained by TransUnion CIBIL and is used by banks and financial institutions to assess creditworthiness.

The CIBIL full form is Credit Information Bureau (India) Limited.

A higher score, usually 750 or above, indicates lower risk for lenders and improves the chances of loan or credit card approval, quicker processing, and access to better interest rates.

Knowing your CIBIL score is helpful, but it often raises more questions than it answers. Especially when real decisions around loans and credit are involved.

Are credit score and CIBIL score the same?

Technically, no. The two terms are often used interchangeably in India because CIBIL was the first credit bureau and remains the most widely checked by banks and NBFCs.

All credit scores issued by licensed bureaus are valid. However, most lenders still prefer to review the CIBIL score first when processing loan applications. It is also normal for scores to differ slightly across bureaus because each uses its own calculation model and reporting cycle.

What is the difference between a credit score and a CIBIL score?

A credit score is a general term for a three-digit number that reflects your creditworthiness. This score can be generated by any of India’s licensed credit bureaus, including CIBIL, Experian, Equifax, and CRIF High Mark.

A CIBIL score is a specific type of credit score issued only by TransUnion CIBIL Limited.

In simple terms, every CIBIL score is a credit score, but not every credit score is a CIBIL score.

How much CIBIL score is good?

In 2026, lenders generally evaluate CIBIL scores across the following ranges:

750 to 900- Considered excellent. Loan approvals are more likely, interest rates are lower, and processing tends to be faster.

700 to 749- Considered good. Most loans and credit cards are approved at standard terms without additional conditions.

650 to 699- Considered fair. Loan approval is possible, but often comes with higher interest rates or stricter eligibility requirements.

How to Check CIBIL Score Free Online by PAN Number

You can check your CIBIL score for free online using your PAN number through authorised platforms. TransUnion CIBIL allows one free credit report every year via its official website after basic identity verification using PAN and OTP.

If you need to check your score more frequently, authorised third-party platforms and bank portals also offer free access using PAN details. Checking your own CIBIL score is treated as a soft enquiry and does not reduce your score.

Read About : How to Link PAN With Aadhaar Online

How Much CIBIL Score Is Required for a Personal Loan?

While different lenders follow their own risk policies, most banks and financial institutions in India generally require a minimum CIBIL score of around 700 to approve a personal loan application.

Some lenders may still consider applicants with a CIBIL score as low as 650, but approvals in this range often come with higher interest rates, lower loan amounts, or stricter repayment terms. A lower score signals higher risk, which lenders usually compensate for through tighter conditions.

For smoother approvals and better interest rates, maintaining a CIBIL score above 750 is typically viewed as ideal.

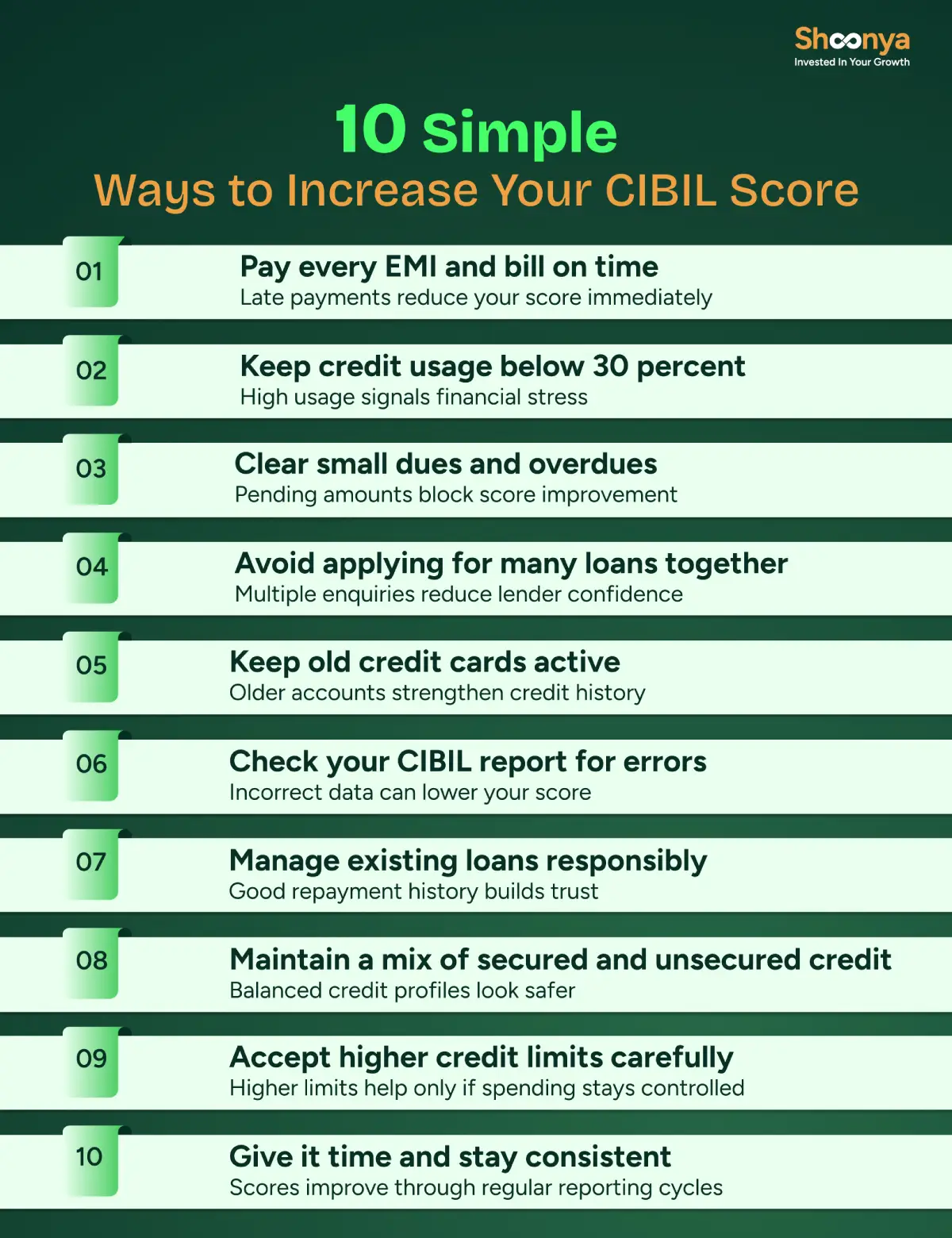

How to Increase CIBIL Score Faster: 10 Practical Strategies That Actually Work

Pay Every EMI and Credit Card Bill on Time

This is non-negotiable. Even one missed payment can wipe out months of effort. Set auto debit, use reminders, and treat repayments like rent or electricity bills. Also, remember this. If you are a co-applicant or guarantor, that repayment behaviour impacts your CIBIL score exactly like your own loan.

Reduce Credit Card Usage Before Closing Balances

Do not rush to clear everything at once. First, bring usage below 30 percent of the total limit and keep it there. Lower usage shows control, and that reflects faster than a zero balance.

Clear Small and Forgotten Dues First

Tiny overdues cause big damage. Old penalties, missed charges, or closed cards with pending amounts quietly block improvement. Clearing them is one of the fastest, simplest fixes.

Do Not Apply Everywhere After One Rejection

Multiple applications look desperate and pull the score down further. Pause, fix the basics, then apply only when your profile actually supports approval.

Keep Old Credit Cards Active

Closing old cards shortens your credit history and pushes usage up. Keep them open and use them occasionally for small spends. Credit age matters more than most people think.

Check Your CIBIL Report Regularly

Errors happen more often than expected. Wrong late payments, closed loans still active, duplicate entries. Disputing these can improve your score without changing spending habits.

Do Not Take New Loans Just to Improve the Score

Borrowing more does not repair a weak profile. What helps is clean repayment on existing credit. If history is very thin, a small secured product can help, slowly.

Maintain a Healthy Mix of Credit Over Time

Only unsecured loans can look risky. A well-managed secured loan, over time, improves lender confidence. This is gradual, not instant.

Accept Credit Limit Increases, But Spend the Same

Higher limits help only if spending does not rise. This is an easy way to improve usage ratios without extra cost or new loans.

Be Patient and Stay Consistent

CIBIL responds to patterns, not one-time actions. Real improvement usually takes three to six months. A low score is not a character flaw. It is just a rough financial chapter, and steady behaviour fixes it.

How Is a Credit Score Calculated?

In India, credit bureaus such as CIBIL collect data from banks and lenders and apply scoring models to evaluate repayment behaviour, credit usage, and overall borrowing patterns. The result is a three-digit score ranging from 300 to 900, where a higher score indicates lower risk to lenders.

Know Your GPay limit per day to Avoid Payment Failures!

Key Factors That Decide Your Credit Score

Payment history (around 35 percent)

This is the most important factor and reflects whether you pay your EMIs and credit card bills on time. Delays or missed payments can reduce your score significantly.

Credit utilisation or amounts owed (around 30 percent)

This measures how much of your available credit limit you are using. Consistently using a high portion of your limit signals financial pressure, while keeping utilisation below 30 percent is considered healthy.

Length of credit history (around 15 percent)

This considers how long you have been using credit, including the age of your oldest account and the average age of all accounts. A longer, well-managed history supports a stronger score.

Credit mix (around 10 percent)

Managing different types of credit, such as credit cards and instalment loans, shows lenders that you can handle varied financial commitments responsibly.

New credit and enquiries (around 10 percent)

Applying for multiple loans or credit cards within a short period leads to several hard inquiries, which may indicate higher risk and affect your score.

What Does Not Affect Your Credit Score

Savings accounts, fixed deposits, and investments are not considered when calculating your credit score. Checking your own score or viewing pre approved offers also does not impact it.

What Happens When Your Credit Score Goes Down

Your credit score can fluctuate due to factors like your payment history, credit utilisation, credit diversity, recent credit applications, and the accuracy of your credit report.

In case your credit score is good, it can lead to more favourable loan terms, while a lower score can limit your access to credit and result in higher borrowing costs.

When your credit score declines in India, it usually indicates unfavourable changes in your credit profile.

Common reasons include:

- Missing or making late payments on loans or credit cards can greatly impact your credit score. Remember that the payment history is a crucial factor in credit scoring in India.

- High credit utilisation, indicating excessive debt relative to your credit limits. Keeping a low credit utilisation ratio is essential for a healthy credit score in India.

- Multiple credit inquiries or new credit applications in a short period of time can signal financial instability to lenders.

- Errors or fraudulent information on your credit report should be promptly updated to prevent negative effects on your credit score, as per Indian credit reporting agencies like CIBIL.

Your CIBIL score cannot improve overnight. When payments are timely, credit usage is controlled, and reports are checked regularly, the score starts correcting itself across reporting cycles.

How to Increase CIBIL Score Quickly – FAQs

A good CIBIL score is generally 700 or above, as most lenders consider this range favourable when assessing loan and credit card applications.

You should check your credit report at least once a year to identify errors, monitor changes, and take corrective action before issues affect your score.

Improving a credit score takes time, but following responsible credit habits can lead to steady and gradual improvement.

Multiple loan applications within a short period can reduce your credit score, as they indicate higher credit dependency and financial stress to lenders.

If your CIBIL score is low, prioritise timely payments, work on reducing outstanding balances, and avoid applying for new credit until your score improves.

You can increase your CIBIL score faster by paying all dues on time, keeping credit utilisation low, limiting new credit applications, and checking your credit report for errors.

Significant improvement in 30 days is unlikely, but clearing overdue payments, lowering balances, and correcting report errors can help create a small positive impact.

Achieving an 800 CIBIL score requires consistent on time repayments, controlled credit utilisation, a healthy mix of secured and unsecured loans, and regular credit monitoring.

A perfect 900 CIBIL score demands an impeccable credit history maintained over time, with complete discipline in repayments, credit usage, and borrowing behaviour.

Credit scores are not calculated daily, as lenders report credit information at monthly or periodic intervals, which is when score updates usually occur.

Source: https://web.umang.gov.in/

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.