Importance of Personal Finance: Know The Principles For a Safe Path to Your Future

In a world where financial stability reigns supreme, understanding the importance of personal finances becomes paramount. Journey with us as we unravel the significance of financial prowess, delve into the art of personal financial planning, uncover fundamental principles of personal finance, and harness the power of intelligent finance strategies. This comprehensive guide is tailored to the Indian audience, equipping you with the knowledge to elevate your financial journey and secure a prosperous future.

Why Are Finances Important?

- Understanding the importance of personal finance unveils its pivotal role in our lives. Taking the reins of your financial matters starts with delving into the core questions:

- What constitutes your monthly budget?

- How do you allocate funds between indulgences and necessities?

- What future financial needs await?

- By addressing these queries, you illuminate the path to comprehending your earnings, spending patterns, and savings. This foundational understanding aids in crafting insightful financial plans. Moreover, recognising the significance of personal finance empowers you to:

- Strategically Plan Investments: When you’re attuned to your financial landscape, devising investment strategies emerges as a natural progression. Reflecting the wisdom exemplified by Subash, meticulous financial planning streamlines investment decisions, fostering clear objectives for both short and long terms.

- Mitigate Debt Risks: Mastering personal finance is a shield against insurmountable debt. By curbing impulsive expenditures and embracing a meticulously structured financial plan, you sidestep the pitfalls of overwhelming debt burdens.

- Nurture Wealth Expansion: Personal finance transcends routine saving practices. It endows you with the ability to amplify your resources through prudent investment choices. This framework for financial growth not only ensures stability but also paves the way for a retirement that aligns with your dreams.

The Essence of Personal Financial Planning

Imagine embarking on a journey without a map. Personal financial planning provides that map for your financial voyage. It involves:

- Setting Clear Goals: Define your personal financial aspirations—be it owning a home, funding your child’s education, or retiring comfortably. Goals guide your financial decisions, infusing purpose into your actions.

- Budgeting with Precision: A budget isn’t a constraint; it’s a tool of empowerment. Allocate funds to essentials, discretionary expenses, and savings. This disciplined approach fosters financial stability.

- Investing Wisely: Echoing the wisdom of Subash, intelligent investments are your stepping stones to wealth. Develop tailored investment plans aligned with short-term and long-term objectives.

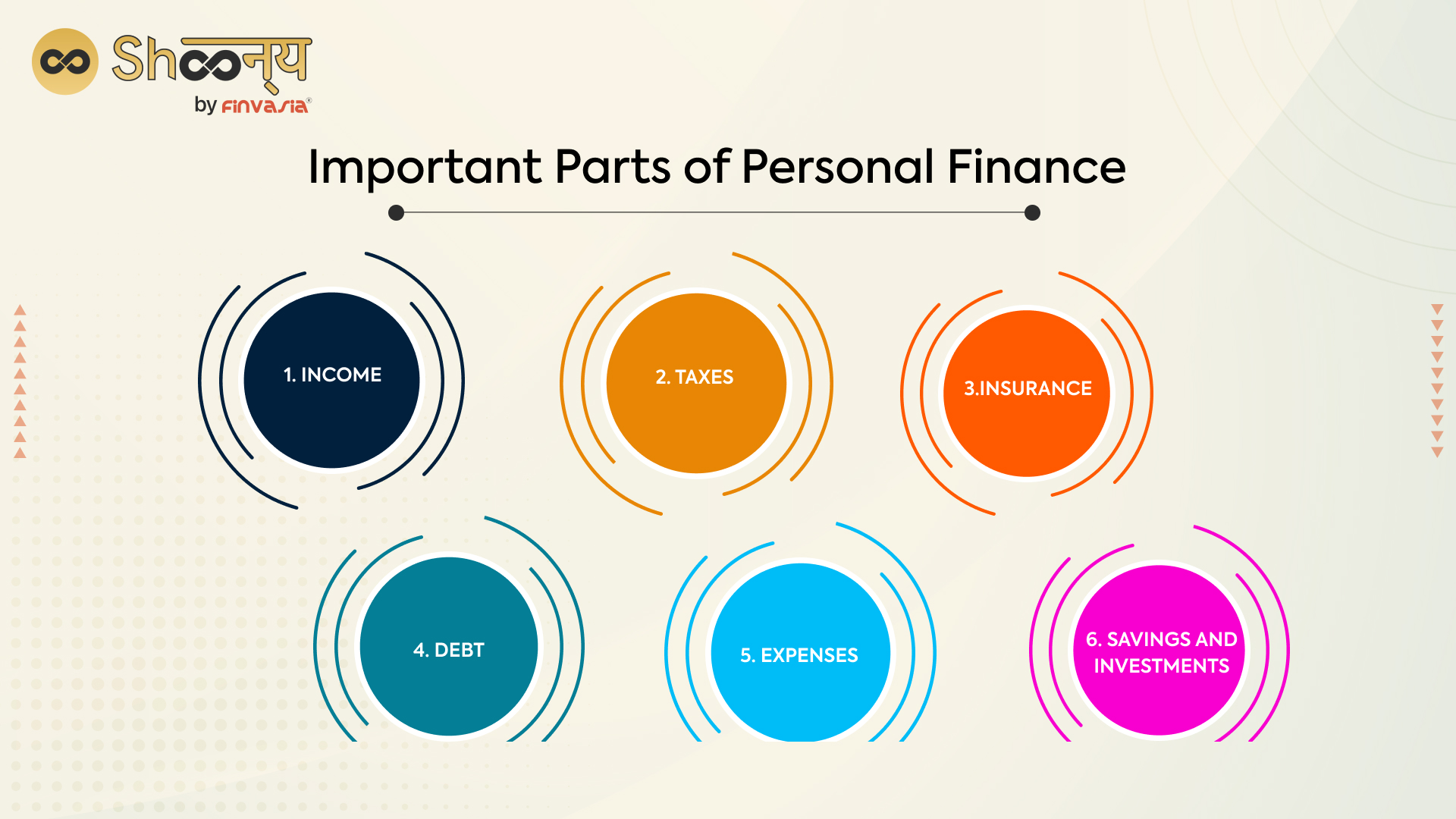

Principles Guiding Personal Finance

Every masterpiece has a foundation. Principles of personal finance provide that sturdy groundwork. Embrace these guiding principles:

- Prioritisation: Channel your resources to income streams that matter most. Nurture and sustain them for enduring financial success.

- Assessment: Regularly evaluate your earnings and spending patterns. Optimize income sources while minimising unnecessary expenses.

- Restraint: In a world of abundance, exercising restraint is your superpower. Avoid overindulgence and prioritize needs over wants. Embrace the philosophy of responsible spending.

Strategies for Intelligent Finance

Empower yourself with intelligent finance strategies tailored for the Indian context:

- Leverage Tax Benefits: Seamlessly navigate the labyrinth of taxes. Identify deductions and credits that optimise your financial gains, allowing you to keep more of your hard-earned money.

- Protect with Insurance: Shield yourself and your loved ones from life’s uncertainties. Invest in health, life, and disability insurance to safeguard your financial fortress.

- Invest for Prosperity: The journey to prosperity begins with intelligent investments. Explore diverse options such as mutual funds, stocks, and bonds. Seize the power of compounding by initiating investments early.

Conclusion: Your Financial Odyssey Begins

Your quest for financial mastery commences now. Armed with insights into why finances are important, the essence of personal financial planning, key principles of personal finance, and intelligent financial strategies, you’re poised for an empowered financial journey. Navigate the intricate waters of personal finance with confidence, secure in the knowledge that your journey is informed, purposeful, and tailor-made for a brighter future.

FAQs| Importance of Personal Finance

The five key importance of personal finance includes understanding one’s financial situation, planning for the future, managing debt, enabling wealth growth, and achieving financial security.

Financial importance in life stems from its role in facilitating everyday needs, realizing dreams and goals, mitigating risks, and securing a stable future.

Finance encompasses the management of funds and resources to achieve financial goals. Its importance lies in enabling individuals to make sound monetary decisions, secure their future, and foster economic growth.

The five critical aspects of personal finance importance are understanding financial status, planning for goals, debt management, wealth creation, and ensuring financial stability.

Finance offers benefits such as aiding in everyday transactions, funding major life goals, providing a safety net during emergencies, and facilitating economic growth through investments and entrepreneurship.

The five principles of finance encompass risk and return, time value of money, diversification, cost-benefit analysis, and the principle of conservatism.

There are various principles in personal finance that guide sound financial management, including budgeting, savings, investment, debt management, and risk mitigation.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.