Income Tax for Domestic Company: Tax Slabs, Forms & Deductions – 2025

Income tax filing is mandatory for all domestic companies operating in India. The Income Tax Department has laid out specific forms, tax rates, and procedures for companies to ensure compliance with tax laws. In this article, you will learn about income tax for domestic company in India, company tax slabs and everything related to ITR form for domestic company in India.

Importance of Filing ITR for Domestic Company

Filing taxes is a legal obligation for domestic companies in India. It helps maintain financial transparency and builds credibility with investors, lenders, and regulatory authorities.

Companies that regularly file taxes can carry forward losses to offset future profits, reducing their tax liability. It strengthens corporate governance and improves a company’s reputation in the market.

So, what are the domestic company tax slabs?

Let’s see!

Domestic Company Tax Slabs in India (AY 2026-27)

Here are the details of the domestic company tax slab in India!

| Condition | Income Tax Rate (excluding surcharge and cess) |

| Turnover or Gross Receipts in FY 2020-21 up to ₹400 crore | 25% |

| Opted for Section 115BA | 25% |

| Opted for Section 115BAA | 22% |

| Opted for Section 115BAB | 15% |

| Any other Domestic Company | 30% |

Surcharge and Other Charges- Company Income Tax

- Surcharge:

- 7% if taxable income exceeds ₹1 crore but is up to ₹10 crore

- 12% if taxable income exceeds ₹10 crore

- 10% for companies opting for Section 115BAA or Section 115BAB

- Marginal Relief: Provided where surcharge exceeds additional income over ₹1 crore/₹10 crore.

- Health & Education Cess: 4% on total tax and surcharge.

- Minimum Alternate Tax (MAT):

- 15% of book profit (plus surcharge and cess) if normal tax liability is less.

- 9% for companies in an International Financial Services Centre (IFSC) earning in foreign exchange.

Exemptions: Companies under Sections 115BAA & 115BAB are not required to pay MAT.

Income Tax Deductions for Domestic Company in India

A domestic company in India can claim tax deductions under various sections like 80JJAA (new employment generation), 80G (donations), and 35 (R&D expenses).

Not only this, the benefit of filing taxes for domestic company includes the provisions of Section 115 BAA. Thus allowing a lower corporate tax rate of 22% if no other exemptions are claimed.

- Donations (Section 80G & 80GGA) – Companies can claim deductions on donations to charitable institutions, scientific research, or rural development (up to 100%, subject to limits). Cash donations above ₹2,000 are not eligible.

- Political Contributions (Section 80GGB) – Any contribution to political parties or electoral trusts is fully deductible if paid through non-cash modes.

- Infrastructure & SEZ (Sections 80IA, 80IAB, 80IC, 80IE) – Businesses in infrastructure, SEZs, and North-Eastern states can claim 100% profit deductions for a specific period.

- Startups & Employment Benefits (Sections 80IAC, 80JJAA) – Eligible startups get 100% tax exemption for 3 out of 10 years, while companies hiring new employees can deduct 30% of their additional employee cost for 3 years.

- Inter-Corporate Dividends (Section 80M) – A domestic company can claim deductions on dividends received from other companies if they are redistributed to shareholders before the ITR filing due date.

Tax-saving options for domestic company are numerous.

Have a look at these!

| Section | Deduction Details |

| 80G | Donations to charitable funds (50%-100% deduction) |

| 80GGA | Donations for scientific research & rural development |

| 80GGB | Contributions to political parties (non-cash only) |

| 80IA | 100% deduction for 10 years (Infrastructure & Power) |

| 80IAB | 100% deduction for 10 years (Special Economic Zones) |

| 80IAC | 100% deduction for 3 years (Start-ups) |

| 80IB | 100% deduction for 5-10 years (Manufacturing & Food Processing) |

| 80IBA | 100% deduction (Affordable Housing Projects) |

| 80IC | 100% deduction for 5 years, then 25% (30% for companies) (Himachal, Sikkim, North-East) |

| 80IE | 100% deduction for 10 years (Industries in North-East) |

| 80JJA | 100% deduction for 5 years (Biodegradable Waste Processing) |

| 80JJAA | 30% deduction on additional employee costs for 3 years |

| 80LA | 100% deduction for 5 years, then 50% for next 5 years (IFSC & Offshore Banking) |

| 80M | Deduction for inter-corporate dividends distributed |

| 80PA | 100% deduction for Producer Companies (AY 2019-20 to 2025-26, turnover < ₹100 Cr) |

Applicable ITR Form for Domestic Companies

Applicable ITR Form for Domestic Company includes the following:

| ITR Form | Applicable To | When to Use |

| ITR-6 | All domestic companies except those claiming exemption under section 11 (income from property held for charitable/religious purposes) | Companies with taxable income from business or profession |

| ITR-7 | Companies registered under section 8 (charitable/religious trusts) or claiming exemption under section 11 | If the company earns income from charitable or religious properties |

Important Points for domestic company ITR filing:

- ITR-6 is the most commonly used form for corporate tax filing.

- Companies must file ITR electronically using a Digital Signature Certificate (DSC).

- The due date for filing ITR for domestic companies is usually October 31 of the assessment year (AY).

1. ITR-6

This form applies to all companies except those claiming exemption under Section 11 (income from property held for charitable or religious purposes).

Companies eligible to file ITR-6:

- Indian companies

- Foreign body corporates operating in India

- Any association, institution, or body (Indian or non-Indian) declared as a company by the Board

2. ITR-7

This form applies to companies required to file returns under Sections 139(4A), 139(4B), 139(4C), or 139(4D), such as:

- Section 139(4A) – Companies receiving income from property held for charitable or religious purposes

- Section 139(4B) – Political parties

- Section 139(4C) – Entities like research associations, news agencies, etc.

- Section 139(4D) – Universities, colleges, or institutions referred under Section 35

Tax Compliance ITR Form for Domestic Company

Domestic company tax filing may require the following ITR forms!

| Form | Purpose |

| Form 26AS | Shows tax deducted/collected at source and other financial details. |

| AIS (Annual Information Statement) | Provides detailed income and tax information. |

| Form 3CA-3CD | Mandatory tax audit report under Section 44AB. |

| Form 3CEB | For companies involved in international transactions (Section 92E). |

| Form 16A | TDS certificate for income other than salary. |

| Form 29B | Certifies book profit calculation under Section 115JB. |

| Form 67 | Declares income from foreign countries and claims tax credits. |

| Form 10-IC | Opting for 22% tax rate under Section 115BAA. |

| Form 10-ID | Opting for 15% tax rate under Section 115BAB (new manufacturing companies). |

| Form 10-CCB | Claiming deductions under Sections 80-IA, 80-IB, etc. |

| Form 10-CCBBA | Claiming deductions under Section 80-ID(3)(iv). |

| Form 10-CCBC | Claiming deductions under Section 80-IB(11B). |

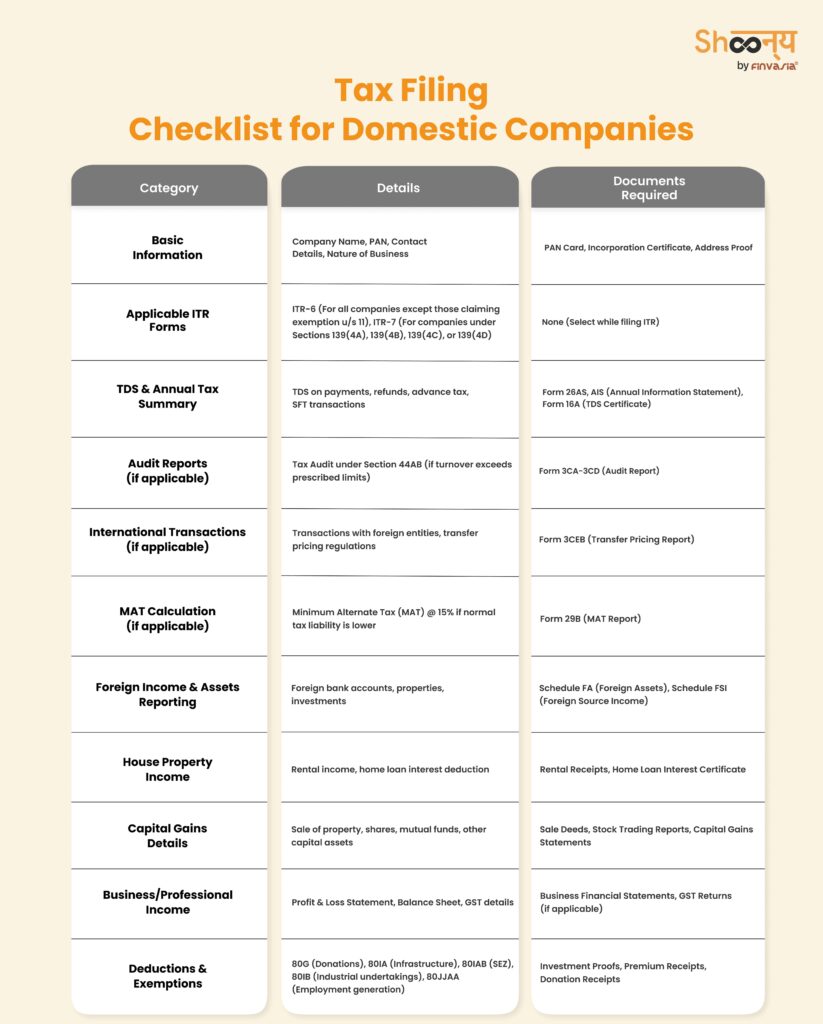

ITR Filing Checklist for Domestic Companies

Before filing your Income Tax Return (ITR), as a domestic company in India, you must ensure that you have all the necessary documents and details ready. Here’s a quick checklist to help your company stay compliant and avoid errors:

Ready to Explore the Indian Market? Get Your Free Demat Account!

How to File ITR for Domestic Company

Here’s How You can File Income Tax Return (ITR) for a Domestic Company (ITR-6 & ITR-7)

Filing an Income Tax Return (ITR) for a domestic company is different from individual filings.

Below is a step-by-step guide for filing ITR-6 & ITR-7 online through the Income Tax e-Filing portal.

Step 1: Register on the e-Filing Portal

- Visit the Income Tax e-Filing Portal: https://www.incometax.gov.in

- Click on “Register” and choose Company as the user type.

- Enter PAN, email ID, and mobile number to complete the registration.

Step 2: Log In

- Use your Company PAN as the User ID.

- Enter your password and captcha code to log in.

Step 3: Choose the Correct ITR Form

- ITR-6 → For companies not claiming exemption under Section 11 (income from property held for charitable/religious purposes).

- ITR-7 → For companies required to file returns under Sections 139(4A), 139(4B), 139(4C), or 139(4D) (such as charitable trusts, political parties, or research associations).

Step 4: Pre-Fill Company Data

- The portal auto-fills data from Form 26AS, TDS details, and previous ITRs.

- Verify and update details such as revenue, expenses, depreciation, and tax payments.

Step 5: Enter Financial & Tax Details

- Fill in income details from Profit & Loss Account and Balance Sheet.

- Enter deductions and exemptions under applicable sections.

- Include Tax Deducted at Source (TDS) details.

Step 6: Review and Validate Information

- Ensure that total income, deductions, and tax liabilities are correctly entered.

- Use the “Validate” button to check for errors.

Step 7: Calculate & Pay Tax (if applicable)

- The system will automatically calculate the company tax liability.

- Pay any outstanding tax via net banking, debit card, or challan before submission.

Step 8: Submit the ITR & E-Verify

- Click “Submit” and choose an e-Verification method:

- Digital Signature Certificate (DSC) – Mandatory for companies

- Electronic Verification Code (EVC) via net banking (if applicable)

Step 9: Get ITR Acknowledgment

- Once filed, the portal generates an ITR-V Acknowledgment.

- Save it for future reference.

✔ ITR-6 must be filed online with DSC.

✔ ITR-7 applies to specific institutions and requires proper documentation.

✔ Failure to file within the due date results in penalties.

Benefits of Filing ITR for Domestic Company

Domestic companies that file taxes on time can take advantage of various benefits. These include lower tax rates under special provisions like Section 115 BAA (22%) and Section 115 BAB (15%).

Proper tax filing enables businesses to qualify for government schemes, subsidies, and incentives designed to promote industry growth. It ensures eligibility for claiming tax refunds if excess tax has been paid during the year.

Companies engaged in research, infrastructure, or manufacturing can claim additional deductions under sections 80IA, 80IB, and 80IC, leading to significant tax savings.

Common Mistakes to Avoid While Filing ITR for Domestic Companies

Filing income tax for a domestic company requires careful attention to detail to avoid errors that can lead to penalties. Here are common mistakes to watch out for:

1. Selecting the Wrong ITR Form

- The correct ITR form for a domestic company is ITR-6, unless the company claims exemption under Section 11.

- Using an incorrect form can delay processing or trigger tax notices.

2. Not Understanding the Corporate Tax Rate

- The corporate tax rate in India varies based on the company type and chosen tax regime:

- 25% for companies with turnover up to ₹400 crore.

- 22% for companies opting for Section 115BAA (No deductions allowed).

- 15% for new manufacturing companies under Section 115BAB.

- 30% for other companies.

- Check the applicable domestic company tax slab to avoid incorrect tax payments.

3. Ignoring Income Tax Deductions for Domestic Companies

- Tax-saving options for domestic companies include deductions under Section 80G (donations), 80JJAA (employment generation), and 80M (inter-corporate dividend deductions).

- Companies opting for the lower tax rates (115BAA or 115BAB) cannot claim these deductions.

4. Errors in Company Income Tax Calculation

- Using an income tax calculator ensures accurate tax liability calculations.

- Mismatches between financial statements and ITR filings can lead to audits or demand notices.

5. Missing Advance Tax Payments

- Company tax in India requires advance tax payments in quarterly installments.

- Failing to pay advance tax leads to interest penalties under Sections 234B & 234C.

6. Not Filing Form 10-IC or 10-ID for Lower Tax Rates

- Companies opting for Section 115BAA (22% tax) or 115BAB (15% tax) must file Form 10-IC or 10-ID before the due date.

- Missing this form means the company gets taxed at a higher corporate tax rate.

7. Ignoring Minimum Alternate Tax (MAT) Compliance

- Companies not opting for Sections 115BAA/115BAB must pay Minimum Alternate Tax (MAT) at 15% of book profits under Section 115JB.

8. Not Reconciling Tax Credits with Form 26AS & AIS

- The Annual Information Statement (AIS) and Form 26AS provide tax deducted, advance tax paid, and other transactions.

- Ensure data matches with domestic company tax filing records to avoid discrepancies.

Things to Keep in Mind While Filing Income Tax for a Domestic Company

Filing income tax for a domestic company involves multiple steps, and careful planning can help avoid unnecessary penalties. Here are some important things to keep in mind:

1. Understand Your Tax Slab & Applicable Tax Rate

- The corporate tax rate in India depends on the company’s turnover and chosen tax regime:

- 25% for companies with turnover up to ₹400 crore.

- 22% under Section 115BAA (no exemptions allowed).

- 15% under Section 115BAB (for new manufacturing companies).

- 30% for other companies.

- Choosing the right company tax slab ensures correct tax computation.

2. Ensure Timely Tax Payments & Compliance

- Advance tax must be paid in four installments if the tax liability exceeds ₹10,000.

- A Minimum Alternate Tax (MAT) at 15% of book profits applies unless the company opts for Sections 115BAA or 115BAB.

3. Maintain Accurate Financial & Tax Records

- Keep records of:

- Balance sheets and profit & loss statements.

- Tax Deducted at Source (TDS) certificates.

- Form 26AS and AIS (Annual Information Statement).

- GST details and advance tax receipts.

- Using an income tax calculator can help estimate tax liability in advance.

4. Utilize Available Tax Deductions & Benefits

- Income tax deductions for domestic companies include:

- Section 80G (Donations to charitable institutions).

- Section 80JJAA (Hiring new employees).

- Section 80M (Inter-corporate dividends).

- Companies under 115BAA and 115BAB cannot claim most deductions.

5. File Mandatory Forms for Special Tax Rates

- To opt for lower corporate tax rates, companies must file:

- Form 10-IC (for 22% tax under Section 115BAA).

- Form 10-ID (for 15% tax under Section 115BAB).

- Missing these forms results in a higher tax liability.

Filing taxes for a domestic company requires selecting the correct ITR form based on the business type and income structure. You must always use an online income tax calculator to ensure you know how much you might be paying!

Income Tax for Domestic Companies (AY 2026-27): FAQs

Corporate tax in India is the tax levied on the net income or profits of a company. Domestic companies and foreign companies operating in India are required to pay corporate tax based on their earnings and applicable tax slabs.

The corporate tax in India is calculated based on a company’s taxable income after deductions, exemptions, and applicable tax rates.

An income tax calculator helps businesses estimate their tax liability by considering taxable income, deductions, and applicable corporate tax rates in India.

A company is required to file ITR-6, except for companies that claim exemption under Section 11 for income from property held for charitable or religious purposes.

The income tax rate for a domestic company varies between 15% and 30%, depending on the turnover and the tax regime opted by the company.

ITR-7 is applicable to entities such as trusts, political parties, research associations, universities, and other institutions that are required to file returns under Sections 139(4A), 139(4B), 139(4C), and 139(4D) of the Income Tax Act.

The type of Income Tax Return (ITR) form for business income depends on the nature and size of the business. ITR-3 is applicable for individuals and Hindu Undivided Families (HUFs) having business or professional income. ITR-4 is for small businesses opting for the presumptive taxation scheme. ITR-6 is for companies, except those exempt under Section 11.

As per Section 2(22A) of the Income Tax Act, a domestic company refers to an Indian company or any other company that pays dividends in India from its taxable income and has made the necessary arrangements for such payments.

The tax slab for a company is structured based on its turnover and the tax scheme it chooses. Companies with a turnover of up to ₹400 crore in the previous financial year are subject to a 25% tax rate, while companies with a higher turnover pay 30% tax.

ITR-4 is applicable to individuals, Hindu Undivided Families (HUFs), and partnership firms (excluding LLPs) that have business or professional income and opt for the presumptive taxation scheme under Sections 44AD, 44ADA, or 44AE.

Source- Incometax.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.