Mphasis Ltd History, Stock Info & Financial Highlights 2025

Investors and traders often analyse a company’s past performance to predict its future growth. If you follow India’s IT sector, one company that stands out is Mphasis Ltd. With over 25 years in IT services, Mphasis has evolved with cutting-edge trends like AI and cloud computing.

Understanding Mphasis history, innovations, and financial strength can help you assess its potential as an investment.

So, let’s dive into the world of Mphasis Technologies Limited’s History and explore what makes it a key player in the industry!

Mphasis History & Milestones: Major Acquisitions, Innovations & Growth

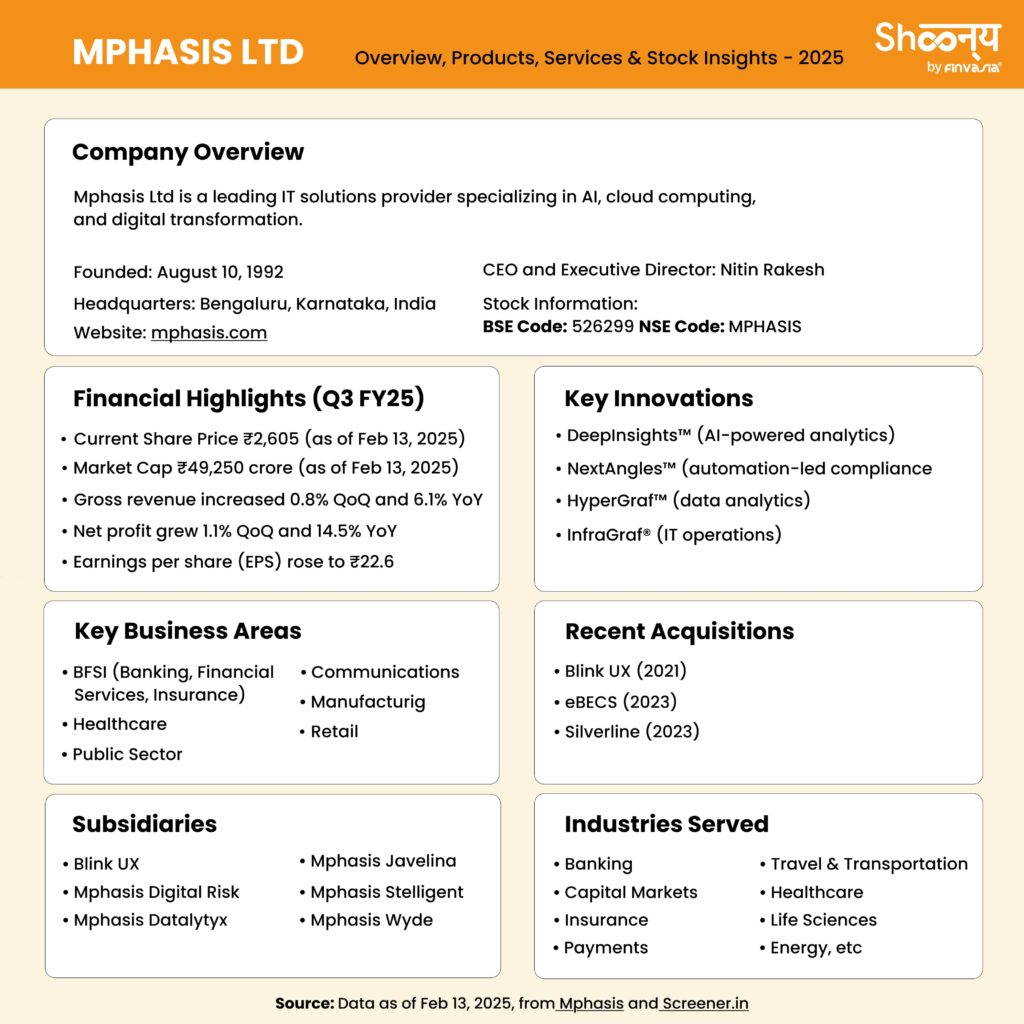

Mphasis company began its journey on August 10, 1992, when it was incorporated as BFL Software Limited. The company started as a high-end technology architecting firm. The ultimate goal of Mphasis Ltd was to deliver advanced software solutions.

As the company grew, it underwent a major rebranding, changing its name to Mphasis BFL Limited on July 25, 2000.

Later, on November 24, 2006, the company simplified its name to Mphasis Limited, which remains its identity today.

As of Feb 13th, 2025, it stands as one of the top 10 constituents of the Nifty IT index on the basis of market cap.

Open a free Demat account to start investing in Nifty IT today!

When we talk about the Mphasis history, the early 2000s saw rapid growth.

In 2004, the company acquired Kshema Technologies and Onida Info Tech, expanding its capabilities in IT services.

This was a great milestone year as Mphasis revenue crossed $100 million. By 2006, Mphasis had strengthened its global presence by acquiring Princeton Consulting and Eldorado Computing.

That same year, EDS (Electronic Data Systems) acquired a 62% stake in Mphasis, giving the company access to a larger global network.

A major turning point in Mphasis history came in 2008 when HP acquired EDS. This move brought Mphasis into the HP Enterprise ecosystem. This acquisition allowed Mphasis to leverage HP’s global reach and technological expertise.

Mphasis company continued its expansion in 2009, acquiring AIG Software Solutions.

Around the same time, EDS was officially rebranded under HP Enterprise.

By 2010, there came another victory. Mphasis revenue crossed $1 billion.

This year also marked the company’s global expansion into Sri Lanka, Australia, and Poland.

Mphasis continued to build its capabilities by acquiring Fortify IS, enhancing its cybersecurity solutions.

Over the next few years, the company continued its acquisition strategy, purchasing WYDE in 2011, which specialised in insurance solutions, and Digital Risk LLC in 2013, a company focused on financial risk assessment.

In 2015, it launched NextAngles™, an automation-led compliance product, along with HyperGraf™ and InfraGraf®. These solutions aimed at data analytics and automation.

In 2016, the company introduced DeepInsights™, a machine-learning platform.

A major shift in ownership also took place this year, as Blackstone acquired a 61% stake in Mphasis from HPE, making it part of one of the world’s largest private equity firms.

In 2017, Mphasis launched its Front2Back™ (F2B) Transformation Strategy: C=X2C²TM=1.

This was also the year the company announced a buyback of 17.37 million shares at ₹635 per share, amounting to a total of ₹11.03 billion. The buyback process, which began in May 2017, was completed by June 2, 2017.

In 2018, it acquired Stelligent Systems LLC.

The following year, in 2019, it launched NEXT Labs solutions Autocode.AI and Optimize.AI, focusing on automation and optimisation.

The Mphasis company’s focus on data analytics was further reinforced in 2020 when it acquired Datalytyx, enhancing its data engineering and analytics expertise.

In 2021, Mphasis expanded into the user experience domain by acquiring Blink UX, a well-known research, strategy, and design firm. Continuing its expansion in the UK and Ireland, the company acquired eBECS in 2023, one of the largest Microsoft Dynamics partners in the region. That same year, Mphasis also acquired Silverline, a Salesforce Service Partner, strengthening its presence in the CRM solutions market.

From a small software firm in 1992 to a global IT leader, Mphasis has continuously evolved by adopting new technologies, making strategic acquisitions, and focusing on customer-centric solutions.

About Mphasis: A Trusted Tech Partner Since 1992

Mphasis company works with six of the top global banks, eleven of the top fifteen mortgage lenders, and three of the world’s leading insurance firms. With a workforce of 37,500 employees across 21 countries, Mphasis is one of the top 10 Nifty IT companies in India.

In a major deal, Blackstone Private Equity (NYSE: BX), the world’s largest private equity firm, acquired a 60.5% stake in Mphasis from Hewlett Packard Enterprise (NYSE: HPE). This was not only Blackstone’s biggest investment in India but also its largest tech acquisition.

Mphasis stands out due to its strong expertise in Banking, Financial Services, and Insurance (BFSI).

As the Mphasis company shared its latest financial results for Q3 FY25 (October–December 2024), the numbers reflected steady growth and exciting new opportunities.

Mphasis continued to grow, even in a changing market:

Revenue climbed 0.8% from last quarter and 6.1% from last year.

Profits surged 1.1% from last quarter and 14.5% from last year, reaching ₹4,278 million.

Earnings per share (EPS) also grew, now at ₹22.6.

New deals worth USD 351 million were signed this quarter.

With its deep expertise in AI, cloud, and digital innovation, Mphasis is shaping the future—one breakthrough at a time. ????

- Mphasis Share Price: As of February 13, 2025, the share price is ₹2,614.40.

Mphasis Revenue: Reported revenue of $1.6 billion for the fiscal year ending March 31, 2024. - Mphasis Products: Offers services, including application development, blockchain platforms, and digital solutions.

- Mphasis Market Cap: As of February 13, 2025, the market capitalisation is ₹49,250 crore.

- Mphasis Net Worth: Total assets valued at $1.6 billion as of March 31, 2024.

- Mphasis Headquarters: Located in Bengaluru, Karnataka, India.

Mphasis Products and Services –

| Application Services, Blockchain, Business Process Services, Cognitive, Cyber Security, DevOps, DevOps Automation Services, AI, Digital, Enterprise Automation, Experience Design, Governance, Risk & Compliance, Infrastructure Services, Microsoft COE, Modernization, Next-Gen Data, Agile IT Operations, Product-Engineering-Services, Platforms & Protocols – XAAP, Salesforce Consulting and Services COE, Cloud, AWS Services, Azure Services, GCP Services, VMware Tanzu Services. |

Mphasis Subsidiaries

| Blink UX, an Mphasis Company, Mphasis Datalytyx, Mphasis Digital Risk, Mphasis Javelina, Mphasis Silverline, Mphasis Stelligent, Mphasis Wyde. |

Mphasis Industries

- Banking – Capital Markets

- Asset Management

- Corporate Banking

- Investment Banking

- Retail Banking

- Wealth Management & Brokerage

- Mortgage Solutions

- Insurance

- Insurance Services

- Life-Annuity and Benefits

- Property & Casualty

- Specialty Insurance

- Brokerage

| Payments, ALTA – Financial Supply Chain Innovation, Hospitality Services, Travel and Transportation, Healthcare, Life Sciences, Oil and Gas, Public Sector, Hi-Tech, Communications, Energy and Utilities, Logistics, Manufacturing |

Mphasis India’s F1 Foundation: Driving Change with Technology

Mphasis, through its F1 Foundation, works to improve education, livelihoods, inclusion, and environmental sustainability. Their CSR programs use technology to create positive change, focusing on:

1. Education & Livelihoods

Mphasis company is helping 5,000 young girls and women gain skills for jobs, including STEM careers.

2. Inclusion

Mphasis Technologies supported 5,000 people with disabilities by providing accessible technology and policy support.

3. Environmental Sustainability

- Water conservation efforts like the “One Billion Drops” campaign.

- Reducing carbon emissions and improving air quality.

- Researching new ways to protect the environment.

4. Technology for Good

Mphasis has partnered with organisations like Ashoka University, IIT Madras, and SOS Children’s Village to bring real impact. They also support afforestation, rainwater harvesting, and skilling programs to create lasting change.

Mphasis Ltd: FAQs

Mphasis provides IT services, including cloud solutions, AI, cybersecurity, and digital transformation for businesses.

Mphasis Limited offers AI-driven automation, cloud computing, cybersecurity, and blockchain-based financial solutions.

Mphasis has been operating for over 26 years since its establishment in 1992.

As of February 13, 2025, Mphasis Ltd ranks 10th among the top 10 Nifty IT companies based on market capitalisation.

Mphasis provides a range of IT solutions, including AI-powered analytics (DeepInsights™), compliance automation (NextAngles™), data analytics (HyperGraf™), cybersecurity, cloud computing, and digital transformation services.

Mphasis serves multiple industries, including Banking, Financial Services & Insurance (BFSI), Healthcare, Public Sector, Retail, and Communications.

Mphasis has acquired several companies to strengthen its offerings, including Blink UX (2021), eBECS (2023), and Silverline (2023), expanding its expertise in user experience, Microsoft Dynamics, and CRM solutions.

Source- screener.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.