How the Nifty Auto Index Helps Track India’s Leading Automobile Stocks

Passionate about automobiles? Here’s how to invest in the best with the Nifty Auto Index!

India’s automobile sector is accelerating at a remarkable pace, with auto sector stocks seeing strong demand. In 2024, Nifty Auto Index stocks saw an uptrend that was driven by record passenger vehicle sales of 42.7 lakh units. Are you an automobile enthusiast looking to invest in stocks of companies like Maruti Suzuki, Tata Motors, and Mahindra & Mahindra? You can do so through the Nifty Auto Index. From Maruti’s reliable hatchbacks to Tata’s futuristic EVs, the Nifty Auto Index lets you invest in the brands you admire. If you’re passionate about automobiles, why not turn that passion into profit?

Now, what exactly is the Nifty Auto Index, and which companies are part of the Nifty Auto Index stock list?

Let’s explore!

What is the Nifty Auto Index?

The Nifty Auto Index is a stock market index that measures the performance of India’s automobile sector. It includes 15 top auto-related companies listed on the stock exchange.

These automobile companies in Nifty 50 come from different segments:

1. Four-wheeler manufacturers (like Maruti Suzuki, Tata Motors)

2. Two and three-wheeler makers (like Bajaj Auto, TVS Motors)

3. Auto component makers (like Bharat Forge, Samvardhana Motherson)

4. Tyre manufacturers

The Nifty automobile index uses the free-float market capitalisation method. This means the weight of each stock is based on the company’s market value that is available for public trading.

The Nifty Auto Index, also known as the Auto Index NSE, measures the performance of India’s leading automobile companies, acting as a benchmark for investors.

Features of the Nifty Auto Index

Nifty Auto Index can be used for a variety of purposes such as benchmarking fund portfolios, launching of index funds, ETFs and structured products.

Here’s why the Nifty Auto Index is important:

Portfolio Characteristics of the Nifty Auto Index

- Methodology: Periodic Capped Free Float

- Launch Date: July 12, 2011

- Base Date: January 01, 2004

- Base Value: 1000

- Market Cap- ₹ 19,08,950 Cr. (As of March 7th, 2025)

- Nifty Auto Index Price- ₹21050 (As of March 7th, 2025)

- Number of Constituents: 15 companies

- Calculation Frequency: Real-Time updates

- Index Rebalancing: Semi-Annually (January and July)

- Performance Indicator – Used as a benchmark for investment portfolios and fund comparisons.

- Investment Options – Can be used for ETFs, index funds, and structured investment products.

- Real-Time Tracking – The index value updates continuously based on stock movements.

- Auto Index NSE Returns & Valuation – As of February 2025:

- Dividend Yield: 1.08%

- P/E Ratio: 19.7

- P/B Ratio: 4.2

- 5-Year CAGR: 16.82%

Want to check the Nifty Auto share price or analyse the Nifty Auto chart? Before jumping into auto index investing, let’s explore the top companies in the Nifty automobile index!

Nifty Auto Index Stock List- Nifty Auto Chart 2025

The Nifty Auto Index features top auto companies like Maruti Suzuki, Tata Motors, and M&M—driving the future of mobility!

Here, have a look at their details:

| Company Name | Symbol | ISIN Code |

| Apollo Tyres Ltd. | APOLLOTYRE | INE438A01022 |

| Ashok Leyland Ltd. | ASHOKLEY | INE208A01029 |

| Bajaj Auto Ltd. | BAJAJ-AUTO | INE917I01010 |

| Balkrishna Industries Ltd. | BALKRISIND | INE787D01026 |

| Bharat Forge Ltd. | BHARATFORG | INE465A01025 |

| Bosch Ltd. | BOSCHLTD | INE323A01026 |

| Eicher Motors Ltd. | EICHERMOT | INE066A01021 |

| Exide Industries Ltd. | EXIDEIND | INE302A01020 |

| Hero MotoCorp Ltd. | HEROMOTOCO | INE158A01026 |

| MRF Ltd. | MRF | INE883A01011 |

| Mahindra & Mahindra Ltd. | M&M | INE101A01026 |

| Maruti Suzuki India Ltd. | MARUTI | INE585B01010 |

| Samvardhana Motherson International Ltd. | MOTHERSON | INE775A01035 |

| TVS Motor Company Ltd. | TVSMOTOR | INE494B01023 |

| Tata Motors Ltd. | TATAMOTORS | INE155A01022 |

Top 10 Companies in the Nifty Auto Index by Weightage- 2025

Here is the latest list of the top 10 companies in the Nifty Automobile Index:

| Company | Weight (%) |

| Mahindra & Mahindra Ltd. | 23.97 |

| Maruti Suzuki India Ltd. | 16.46 |

| Tata Motors Ltd. | 13.62 |

| Bajaj Auto Ltd. | 9.18 |

| Eicher Motors Ltd. | 6.88 |

| TVS Motor Company Ltd. | 5.47 |

| Hero MotoCorp Ltd. | 5.00 |

| Samvardhana Motherson Ltd. | 3.66 |

| Ashok Leyland Ltd. | 3.19 |

| Bharat Forge Ltd. | 2.78 |

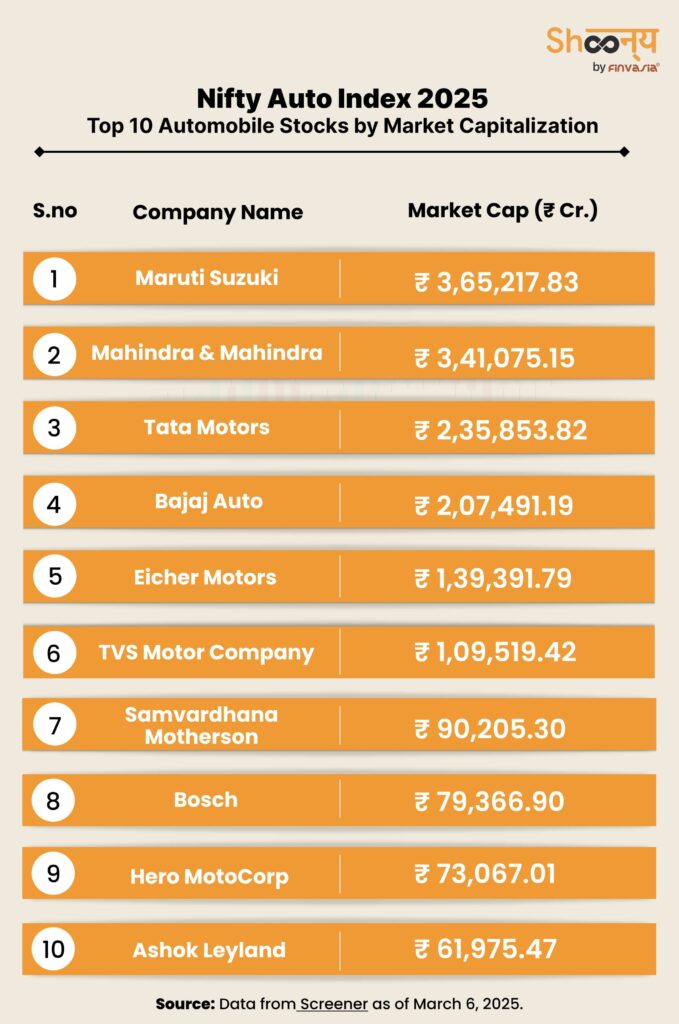

Top 10 Companies in the Nifty Auto Index by Market Capitalization- 2025

This list highlights the top automobile companies in the Nifty Auto Index based on market capitalisation.

Top 10 Nifty Auto Companies by Market Capitalization: An Overview

1. Maruti Suzuki (₹3,65,217.83 Cr Market Cap)

Maruti Suzuki is India’s largest passenger car manufacturer and a dominant participant in the Nifty Auto Index. Known for models like the Swift, Baleno, and WagonR, it holds the highest market share in India’s car industry. The company benefits from strong brand loyalty, an extensive dealer network, and growing exports.

2. Mahindra & Mahindra (₹3,41,075.15 Cr Market Cap)

Mahindra & Mahindra (M&M) is a leader in SUVs, commercial vehicles, and tractors. Its Scorpio, XUV700, and Thar are among India’s best-selling SUVs. M&M also has a strong presence in the electric vehicle (EV) segment, with investments in next-gen mobility solutions. As one of the top Nifty Auto companies, it plays a crucial role in India’s growing auto industry.

3. Tata Motors (₹2,35,853.82 Cr Market Cap)

Tata Motors is a major player in the passenger, commercial, and electric vehicle segments. Its popular models like the Nexon EV and Punch have helped boost its market position. The company also owns Jaguar Land Rover (JLR), which adds to its global reach. With a focus on EVs and sustainable mobility, Tata Motors is a key driver in the Nifty Automobile Index.

4. Bajaj Auto (₹2,07,491.19 Cr Market Cap)

Bajaj Auto is a leading two and three-wheeler manufacturer in India, with strong exports to global markets. Known for models like Pulsar, Dominar, and Chetak (EV), Bajaj dominates the sports bike segment. It has a growing presence in the EV space.

5. Eicher Motors (₹1,39,391.79 Cr Market Cap)

Eicher Motors owns Royal Enfield, one of India’s most iconic motorcycle brands. With popular models like the Classic 350, Meteor, and Interceptor 650, it caters to the premium biking segment. The company also manufactures commercial vehicles through its joint venture with Volvo.

6. TVS Motor Company (₹1,09,519.42 Cr Market Cap)

TVS is India’s third-largest two-wheeler manufacturer, known for models like Apache, Jupiter, and iQube (EV). It has been expanding aggressively in the electric scooter segment. With strong sales growth and a focus on exports, TVS remains a top performer in the Nifty Auto stocks list.

7. Samvardhana Motherson (₹90,205.30 Cr Market Cap)

Samvardhana Motherson is a leading auto components manufacturer. The company specializes in wiring harnesses, mirrors, and plastic parts. Its strong global presence and acquisition-driven growth strategy make it a key player in India’s auto index NSE.

8. Bosch (₹79,366.90 Cr Market Cap)

Bosch is one of the largest auto technology and engineering companies in India. It provides automotive components, software, and safety solutions to leading automobile brands.

9. Hero MotoCorp (₹73,067.01 Cr Market Cap)

Hero MotoCorp is the world’s largest two-wheeler manufacturer, with models like Splendor, Passion, and Xtreme. It has a massive rural and urban customer base. Hero is also focusing on electric mobility, aiming to expand its EV lineup in the coming years.

10. Ashok Leyland (₹61,975.47 Cr Market Cap)

Ashok Leyland is a market leader in commercial vehicles, manufacturing trucks, buses, and defense vehicles. It has a strong presence in heavy-duty and medium-duty truck segments. With investments in alternative fuels and electric buses, Ashok Leyland is adapting to India’s evolving auto industry.

These companies form the backbone of the Nifty Auto Index, offering a diverse mix of passenger vehicles, commercial vehicles, two-wheelers, and auto components, making the Nifty Auto Index Fund a key investment choice for those tracking India’s automobile sector.

How to Buy Nifty Auto Index?

Investors looking to invest in Auto Nifty can choose from:

- Nifty Auto Index Fund – A mutual fund that holds all Nifty Auto stocks

- ETFs (Exchange-Traded Funds) – Trade the Nifty Automobile Index like a stock for diversification

- Direct Stocks – Buy shares from the Nifty Auto Index stocks list based on your preference

By investing in the Nifty Auto Index, traders and investors can track India’s evolving automobile sector while managing risk through diversification.

Things You Must Know Before Investing in the Nifty Auto Index

If you’re planning to invest in the Nifty Auto Index, here are a few things to know before getting started.

1. Market Capitalization Determines Index Movement

The Nifty Auto Index is calculated using the free-float market capitalization method. This means that auto sector stocks with a higher market value have a greater impact on the index’s movement. Mahindra & Mahindra, Maruti Suzuki, and Tata Motors, which are among the automobile companies in Nifty 50, hold the highest weight and are the key drivers of the Nifty Auto Index share price.

2. 15 Leading Auto Companies Make Up the Nifty Automobile Index

The Nifty Auto Index stocks list includes 15 major automobile companies across different segments:

- Passenger vehicle manufacturers (Maruti Suzuki, Tata Motors, Mahindra & Mahindra)

- Two and three-wheeler makers (Bajaj Auto, TVS Motor, Hero MotoCorp)

- Auto components and tyre manufacturers (Bharat Forge, Samvardhana Motherson)

3. Diversification Reduces Risk

No single stock in the Nifty Automobile Index can have more than 33% weightage, and the top three stocks together cannot exceed 62%. This ensures balanced representation and prevents excessive reliance on a single company’s performance.

4. A Long-Term Growth Opportunity in India’s Auto Sector

With rising demand for passenger vehicles, electric mobility, and two-wheelers, India’s automobile sector is expanding rapidly. The Auto Index NSE provides a diversified investment option.

Nifty Automobile Index: FAQs

The Nifty Auto Index consists of 15 leading automobile and auto component companies listed on the NSE.

As of February 2025, the 5-year CAGR of the Nifty Auto Index is 16.82%, reflecting strong growth in India’s auto sector.

Yes, investors can invest in the Nifty Auto Index through ETFs that track its performance, offering diversification in auto stocks.

The best auto stock depends on your investment goals, but Maruti Suzuki, M&M, and Tata Motors hold the highest weightage in the Nifty Auto Index.

No, Bajaj Auto is not currently part of Nifty 50, but it is a major constituent of the Nifty Auto Index.

The Nifty Auto Index includes 15 automobile stocks, covering passenger vehicles, two-wheelers, and auto components.

The Nifty Auto Index tracks the performance of India’s top automobile and auto-component companies, acting as a benchmark for investors.

The Nifty 50 is primarily driven by heavyweight stocks like Reliance Industries, HDFC Bank, Infosys, TCS, and ICICI Bank.

Source: Screener.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.