How the Nifty IT Index Helps Track India’s Leading IT Stocks

India’s technology industry is growing fast and is expected to double its revenue to US$ 500 billion by 2030. This rapid growth is attracting many people to invest in the tech sector. We’re all familiar with names like Wipro, Infosys, and HCL Technologies, which have helped make India’s IT sector a global leader. But how do we know how these companies are performing in the stock market? That’s the job the Nifty IT Index performs.

The Nifty IT Index fund, or the IT Index NSE, captures the performance of India’s top IT companies. It acts as a useful standard measure for investors and market intermediaries and shows how India’s IT sector is performing. Thus giving traders and investors a track record of the health of the IT sector. How to buy the Nifty IT Index?

You can invest through options like ETFs, index funds, or even direct Nifty IT stocks of companies in the index.

Want to know the Nifty IT share price of your favourite IT company or explore the Nifty IT stocks list?

But before jumping into Nifty IT investing, let’s start with the basics:

- What is Nifty IT?

- Which are the top companies in Nifty IT?

- And how do you decide if an investment in the Nifty IT Index fund is right for you?

Let’s make things simple for you!

What is Nifty IT?

The Information Technology (IT) industry has been a cornerstone of India’s economic growth. To provide a clear benchmark for the performance of this sector, the National Stock Exchange (NSE) introduced the Nifty IT index. This index offers an overview of how the top IT companies in India are performing. It is indeed a useful tool for all the stock market participants.

Key Features of Nifty IT

The Nifty IT index serves multiple purposes. It’s not only a benchmark for fund portfolios but also forms the basis for index funds, Exchange Traded Funds (ETFs), and other structured products.

Now, invest in stocks, bonds, mutual funds, ETFs, etc, all with a free demat and trading account!

Let us take a quick look at the features of the Nifty IT index:

- Methodology: Periodic Capped Free Float

- Base Date: January 01, 1996

- Base Value: 100

- Calculation Frequency: Real-Time

- Number of Constituents: 10

- Index Rebalancing: Semi-Annually

- Nifty IT Share Price: ₹ 45,457 (As of Dec 13th, 2024)

- Nifty IT Market Cap: ₹ 39,38,046 Cr. (As of Dec 13th, 2024)

These features ensure that the Nifty IT index remains up-to-date and accurately reflects the performance of the IT sector.

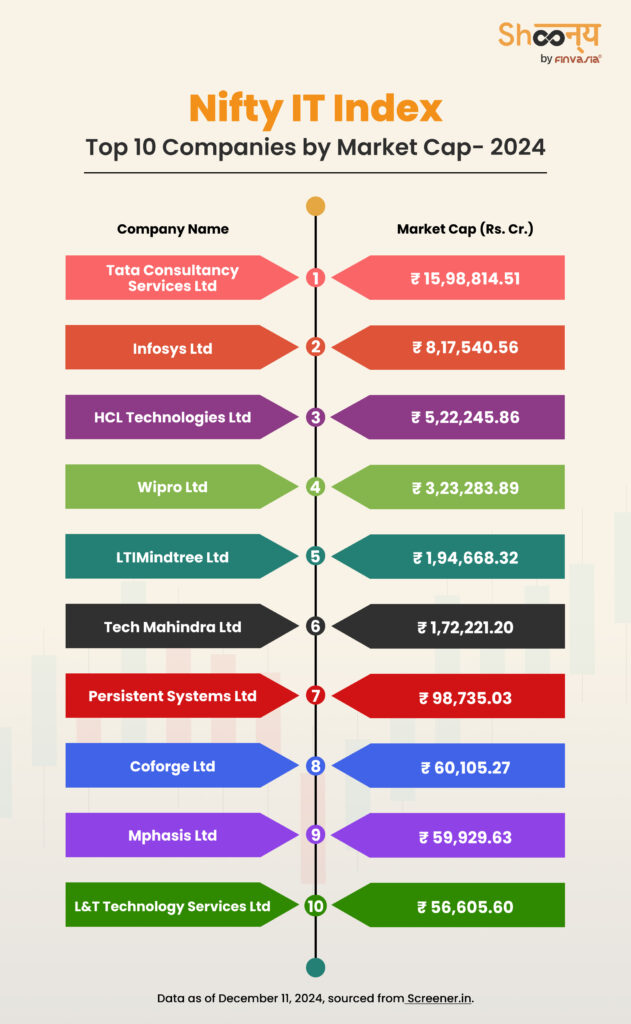

Top 10 Companies in Nifty IT by Market Cap

Curious about which companies make it to this IT index?

Let’s take a look at the top 10 IT giants that form the Nifty IT stocks list:

A Detailed Overview of the Top 10 Companies in Nifty IT Index

Let us walk you through a brief overview of the top NIFTY IT companies in India.

1. TCS

CEO- K. Krithivasan

Tata Consultancy Services (TCS) is a global leader in IT services, consulting, and business solutions. As the top company on the Nifty IT stock list and IT index, TCS has been in existence for over 50 years. It operates in various sectors like BFSI, consumer business, life sciences, etc.

With over 600,000 employees across 55 countries, TCS is a leader in services. As of December 2024, TCS holds a market capitalisation of ₹15.99 lakh crore, making it one of the top stocks for Nifty IT investing.

2. Infosys

CEO- Salil Parekha

Infosys is a global leader in digital services and consulting. Ranked 2nd in the Nifty IT stocks list as of December 2024, Infosys has a market capitalisation of ₹8.17 lakh crore. Known for its advanced digital transformation capabilities, Infosys aims is to implement AI-driven solutions, cloud computing, and cybersecurity.

With a workforce of over 345,000 employees across 56 countries, Infosys offers cutting-edge technologies.

3. HCL

Founder- Shiv Nadar, CEO- Vijayakumar

HCL Technologies (HCLTech) is currently the third-positioned NIFTY IT company, as of December 2024, with a market capitalisation of ₹5.22 lakh crore. Known for its comprehensive digital, engineering, and cloud solutions, HCLTech serves businesses globally.

With a workforce of over 218,000 professionals spread across 60 countries, HCLTech specialises in delivering solutions in areas such as AI, Cloud, Engineering, and Digital Services. It supports industries like automotive, banking, telecom, and life sciences.

4. WIPRO

CEO- Srini Pallia

Wipro is another of the leading Nifty IT companies, ranked 4th as of December 2024, with a market capitalisation of ₹3.23 lakh crore. Known for its innovative services in cloud, cybersecurity, data & analytics, and digital experiences, Wipro helps businesses across industries.

With a global reach and a customer-first approach, Wipro continues to lead in the IT industry.

5. LTIMindtree

CEO- Debashis Chatterjee

This NIfty IT company currently ranked 5th in the Nifty IT index with a market capitalisation of ₹1.94 lakh crore as of December 2024. It is a global leader in technology consulting and digital solutions and is also part of the prestigious Larsen & Toubro group.

With a talented workforce of over 84,000 employees spanning more than 30 countries, LTIMindtree focuses on delivering future-ready solutions to its 700+ clients.

6. Tech Mahindra

CEO- Mohit Joshi

Tech Mahindra is currently ranked 6th in the Nifty IT index with a market capitalisation of ₹1.72 lakh crore as of December 2024. Operating in over 90 countries, Tech Mahindra offers solutions that help enterprises scale at speed.

Part of the Mahindra Group, Tech Mahindra leverages innovative technologies to enable organisations to achieve rapid growth.

7. Persistent Systems

CEO- Sandeep Kalra

Persistent Systems has a market capitalisation of ₹98,735.03 Cr as of December 11, 2024. By combining deep technical expertise with industry experience, they offer innovative solutions.

As one of the key players in the Nifty IT stocks list, Persistent Systems offers services in cloud infrastructure, AI-driven insights, and much more. Their main focus is on intelligent automation and data analytics.

8. Coforge

CEO- Sudhir Singh

Ranked 8th in the Nifty IT index with a market capitalisation of ₹60,105 crore as of December 2024, it is a leader in digital services and solutions. Coforge specialises in leveraging emerging technologies to drive digital transformation across sectors such as insurance, healthcare, and banking.

With a global presence in over 23 countries and 30+ delivery centres, the company is a key part of the IT index NSE. Coforge’s focus on technological excellence makes it a significant contributor to the Nifty IT index.

For those interested in Nifty IT investing, Coforge is an option worth considering. The company’s expertise in digital transformation has helped it rise to the top ranks in the Nifty IT sector.

9. Mphasis

CEO- Nitin Rakesh

Ranked 9th in the Nifty IT index with a market capitalisation of ₹59,930 crore as of December 2024, it is a global leader in next-generation IT and digital transformation solutions. Known for its Front2Back™ Transformation approach, Mphasis helps enterprises with multiple solutions. These include cloud, cognitive computing, and automation to create personalised digital experiences and modernise legacy systems.

Part of the Nifty IT stocks list, Mphasis is known for its great track record of delivering scalable, sustainable software solutions. If you’re considering Nifty IT index fund investments, Mphasis’ consistent innovation and focus on customer-centric digital transformation make it a significant contributor to IT index NSE.

10. L&T Technology Services (LTTS)

CEO- Mr. Amit Chadha

Ranked 10th in the Nifty IT index with a market capitalisation of ₹56,605 crore as of December 2024, it offers engineering and technology services. LTTS specialises in digital engineering and product development, and it helps clients across diverse industries. These include automotive, energy, and telecommunications to innovate and scale their operations.

With operations in over 25 countries and a focus on sustainable engineering, LTTS is committed to delivering future-ready solutions that support business transformation.

For those exploring Nifty IT investing, LTTS stands out for its ability to innovate.

Nifty IT Investing

The Nifty IT Index is calculated using free float market capitalisation. This means the index reflects the market value of these companies based on shares that are actively traded, giving a real-time overview of the IT sector’s market performance.

How to Invest in Nifty IT?

There are several ways you can invest in the Nifty IT Index:

- Index Funds: These funds pool money from investors to buy stocks that reflect the performance of the Nifty IT Index.

- ETFs (Exchange-Traded Funds): These are similar to index funds but trade like stocks on the exchange. You, as a trader, have the flexibility to buy and sell throughout the day.

- Direct Stocks: You can also invest directly in the companies that make up the Nifty IT Index, like Infosys, Wipro, and TCS.

Whether you choose index funds, ETFs, or direct stocks, it’s an easy way to gain exposure to India’s top IT companies.

5 Key Things Indian Traders and Investors Must Know Before Investing in the Nifty IT Index

If you’re looking to invest in the Nifty IT index, it’s important to first understand a few things!

- The Power of Market Capitalization

The Nifty IT index is calculated using the free float market capitalisation method. In simple terms, this means the performance of the Nifty IT stocks is heavily influenced by the market value of the companies in it. Infosys and TCS, with their large market caps, hold the biggest weight in the IT index.

- Top 10 Companies in the Index

Nifty IT is made up of 10 leading IT companies, which include Infosys (26.19% weight), TCS (23.44% weight), and others like Wipro, HCL Technologies, and Tech Mahindra. These companies are the backbone of the index, and their performance directly impacts the Nifty IT index share price.

- It’s Not Just About One Stock

The Nifty IT index is a good way to invest in the IT sector, but it’s important to note that no single stock makes up more than 33% of the index. This diversification helps reduce risk.

- Rebalancing Every Six Months

The Nifty IT index is rebalanced semi-annually. This means that every six months, the companies in the index might change based on performance, and their weightage may shift.

- A Long-Term Investment with Strong Growth

India’s IT sector has consistently outperformed, and the Nifty IT Index has shown impressive returns over the long term. For Indian investors looking to benefit from the global demand for tech services, this index is a golden opportunity. It provides a diversified way to invest in India’s booming IT sector.

Conclusion

The Nifty IT index isn’t just for financial experts. It is a benchmark tool for all traders, investors and market participants. By tracking this IT index NSE, you can keep a real-time track of the Nifty IT stocks and check the market performance of IT sector in India.

FAQs: Nifty IT Index Fund

Yes, there is a NIFTY IT index that tracks the performance of the Indian IT sector.

NIFTY stands for National Stock Exchange Fifty, which represents the top 50 companies listed on the NSE.

Yes, there are options available for the NIFTY IT index. You can invest in the ten companies that it tracks.

The NIFTY IT index includes 10 companies like Infosys, TCS, HCL, Wipro, etc.

You can buy NIFTY IT through index funds, ETFs, or by purchasing shares of the companies in the index.

Yes, the NIFTY IT index exists and tracks the performance of the Indian IT sector.

Source: Screener

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.