Exploring the Role and Functions of SEBI: Empowering Indian Investors

In the dynamic realm of Indian securities, the Securities and Exchange Board of India (SEBI) stands as a sentinel, tirelessly working to ensure transparency, safeguard investor interests, and nurture a thriving investment environment. Established on April 12, 1992, through the SEBI Act 1992, SEBI emerged as a regulatory authority with a mission to reshape the securities market landscape. In this blog, we will take a detailed look at the role and functions of SEBI in the Indian market.

Evolution of SEBI: From Disarray to Discipline

Before SEBI’s advent, India’s securities market was a fragmented landscape, governed by disjointed institutions. The transformative power of SEBI was amplified in 2014, as it was bestowed with enhanced regulatory powers. These empowered SEBI to conduct search and seizure operations, ensuring stricter punishment for market manipulation and insider trading.

Functions of SEBI: Guardian, Regulator, Developer

The functions of SEBI are multifaceted and are intrinsic to its role as a guardian of market ethics. Its functions encompass investor protection, seamless market functioning, and effective business oversight. SEBI extends its umbrella to embrace portfolio managers, investment advisers, and more, ensuring fair play.

On the flip side, the power of SEBI is equally potent. From adjudicating fraud to scrutinizing accounts for violations, SEBI ensures transparency and equity. It intervenes to prevent fraudulent practices, and its regulations touch on insider trading, disclosure norms, and market malpractices.

SEBI fulfills three vital functions:

- Protective Function: SEBI safeguards investors by preventing insider trading, curbing price manipulation, promoting fair practices, and educating them about market intricacies.

- Regulatory Function: It establishes rules and guidelines for market participants, regulates takeovers, audits stock exchanges, and oversees brokers’ activities.

- Developmental Function: SEBI strives to educate intermediaries, introduce electronic trading, and create an enabling environment for seamless market growth.

Role of SEBI in Investor Protection

SEBI, a statutory body under the Indian Government, was conceived to cultivate trust and confidence among investors. With its headquarters nestled in Mumbai and regional offices scattered across the country, from New Delhi to Chennai, SEBI boasts an extensive reach in its pursuit of market integrity.

Aims and Objectives of SEBI: A Shield for Investors

Objectives of SEB revolve around safeguarding the interests of Indian investors. As a vigilant regulator, SEBI diligently monitors and governs the securities market to instill investor confidence. Through meticulous rule-making and guideline formulation, SEBI creates a secure investment environment, curtailing malpractices.

- Investor Protection: Foremost among its missions is safeguarding investors’ interests, ensuring they operate in a fair and protected environment.

- Tackling Malpractices: SEBI is resolute in its stand against fraudulent practices, striving to keep the market free from any unethical behavior.

- Guiding Financial Intermediaries: SEBI lays down a code of conduct for various financial intermediaries, ensuring they operate ethically and transparently.

Balancing Regulation: Striking the right balance between statutory regulations and self-regulation is central to SEBI’s mission.

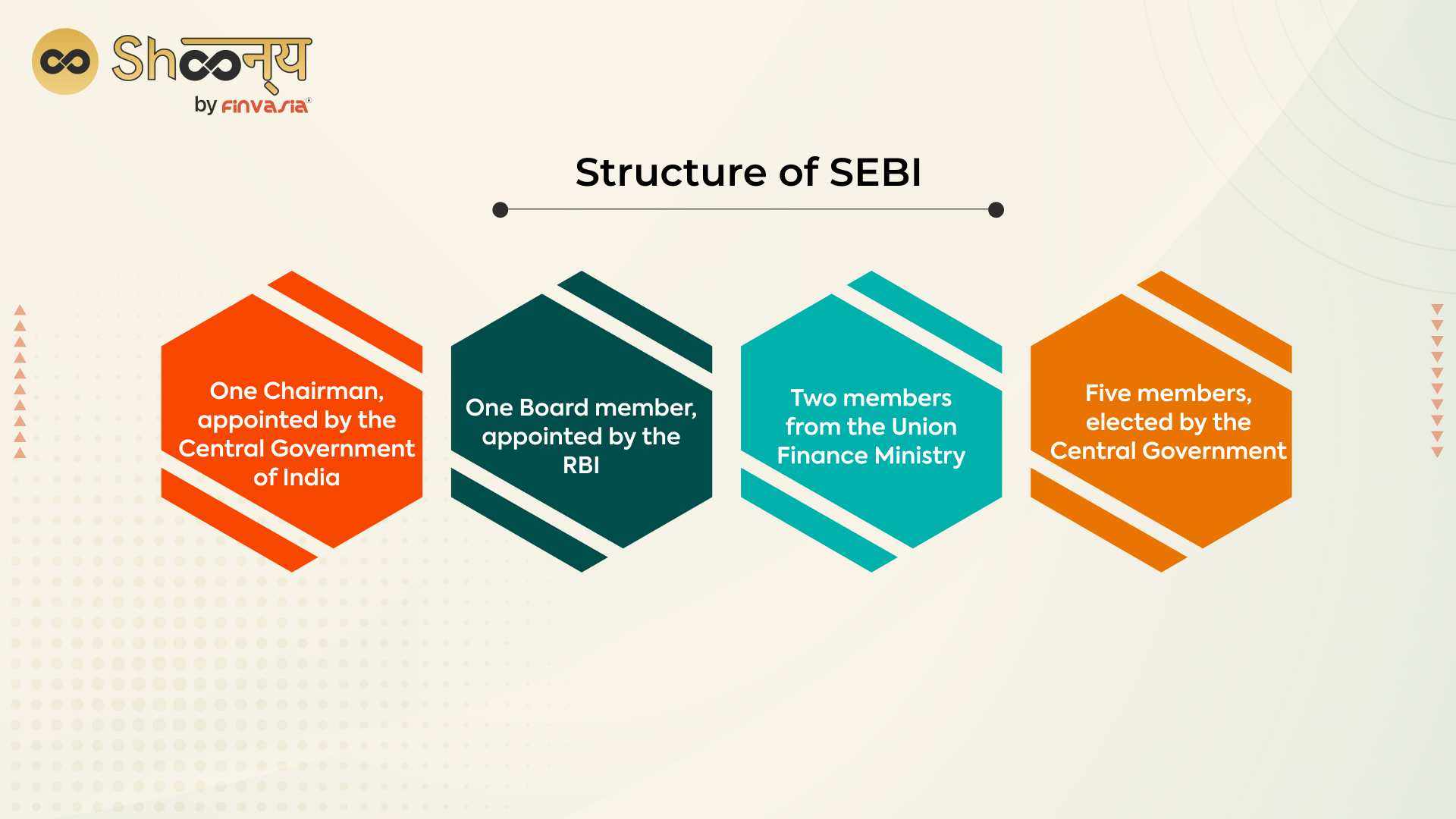

Structure of SEBI

SEBI has nine members on its board. These are

- One Chairman, appointed by the Central Government of India

- One Board member appointed by the RBI

- Two members from the Union Finance Ministry

- Five members, elected by the Central Government

Purpose of SEBI: A Facilitator of Capital Mobilization

SEBI’s establishment was driven by the need to facilitate the efficient mobilization and allocation of resources. Its purpose serves:

- Issuers: SEBI offers a platform for raising funds, promoting growth for companies seeking investment.

- Investors: SEBI ensures a safe and well-informed investment space, building trust through accurate and timely information.

- Intermediaries: By providing a competitive market and robust infrastructure, SEBI supports intermediaries in their crucial roles.

SEBI’s Organizational Structure: A Framework for Regulation

SEBI’s hierarchical structure, comprising over 20 departments, is orchestrated to maintain order and efficacy. Guided by designated officers, including the Chairman and representatives from the Union Finance Ministry and RBI, SEBI’s departments orchestrate a symphony of regulation, encompassing everything from technology to market participants’ conduct.

Structure: Governance for Fair Practices

SEBI’s board is comprised of nine members, including a Chairman appointed by the Central Government, representatives from the Union Ministry of Finance and RBI, and members elected by the Central Government. This diverse composition ensures holistic governance.

Role of SEBI in Mutual Funds

SEBI’s realm extends to mutual funds, where it lays down meticulous guidelines for their operation. These regulations encompass shareholding limits, index weightages, trading frequencies, and asset allocation. By keeping a watchful eye on mutual funds, SEBI shields investors’ interests.

Conclusion: Empowering India’s Financial Future

SEBI’s role as a guardian, regulator, and developer weaves together the fabric of India’s securities market. By striving for transparency, ethical conduct, and investor protection, SEBI lays the foundation for a robust and trustworthy investment landscape. It continues to evolve, adapt, and innovate to secure India’s financial future.

FAQs | Role and functions of SEBI

SEBI’s role is to prohibit insider trading, which involves the buying or selling of securities by individuals with access to non-public information. SEBI’s guidelines ensure a level playing field and protect investors from unfair advantages.

SEBI conducts educational programs, both online and offline, to educate investors about the securities market and its nuances. By enhancing financial literacy, SEBI empowers investors to make informed decisions.

SEBI promotes fair practices by establishing a code of conduct for financial intermediaries, prohibiting fraudulent activities, and ensuring that market participants adhere to ethical standards.

SEBI regulates mutual funds through comprehensive guidelines that cover aspects like shareholding limits, index weights, trading frequencies, and asset allocation. These regulations protect investors’ interests and promote transparency.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.