Key Saving Schemes for Women in India You Should Know About

When considering your next investment opportunity, what’s the first thing that comes to mind? Is it the interest you will earn or the financial resources needed to make it happen? As women investors, we often encounter challenges in balancing our investment goals with personal aspirations. We also frequently express frustration over our inability to save enough. Now, what’s the best way to achieve all of the above? Savings! The key to realising these ambitions lies in effective financial planning and strategic saving methods. Did you know that there are several saving schemes for women in India?

In today’s world, where financial autonomy is paramount for women’s empowerment, specialised savings schemes tailored for women in India can make a significant difference. These saving schemes for women not only promote a culture of saving but also come with additional tax advantages.

Today, we will share the details of multiple such government schemes for housewives and working women.

It’s time to empower yourself and let dreams come true.

Let us take a look at some amazing saving schemes for women in India!

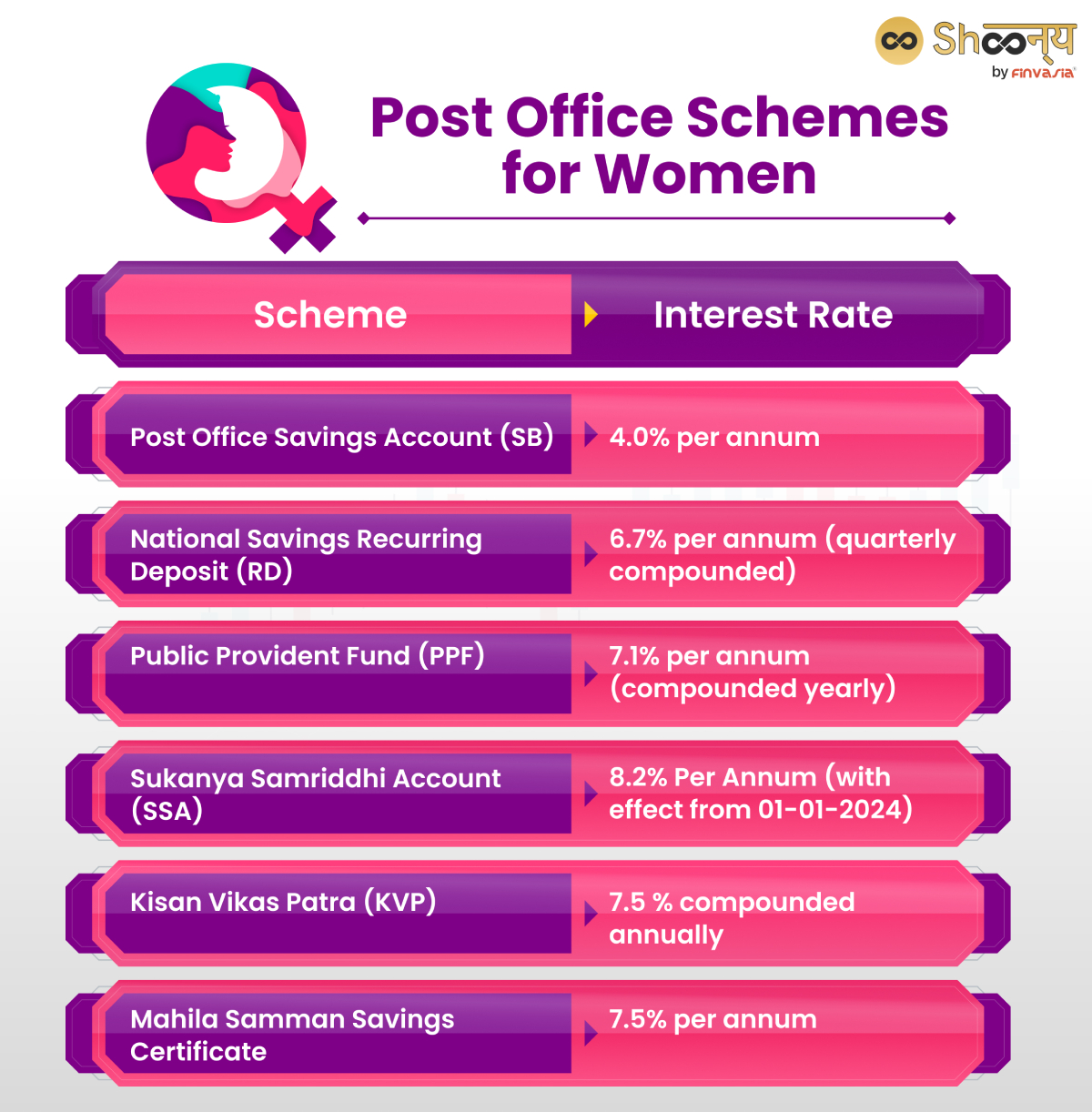

Post Office Schemes for Women

| Scheme | Interest Rate | Key Features |

| Post Office Savings Account (SB) | 4.0% per annum | – Minimum deposit: INR 500 – Withdraw as little as INR 50 |

| National Savings Recurring Deposit (RD) | 6.7 % per annum (quarterly compounded) | – Minimal deposit: INR 100 – Loan up to 50% of account balance after 12 instalments and 1 year |

| Public Provident Fund (PPF) | 7.1 % per annum (compounded yearly). | – Minimum deposit: INR 500 – Maximum deposit: INR 1.50 lakh/year – Tax-free interest |

| Sukanya Samriddhi Account (SSA) | Rate of interest 8.2% Per Annum(with effect from 01-01-2024 | – For girls under 10 years – Minimum deposit: INR 250 – Tax-free interest |

| Kisan Vikas Patra | 7.5 % compounded annually | Minimum deposit: Rs. 1000/- (in multiples of Rs. 100/-); No maximum limit. |

| Mahila Samman Savings Certificate | 7.5% per annum | – Minimum deposit: INR 1,000 – Maximum deposit: INR 2,00,000 – Partial withdrawals allowed |

The government of India has introduced multiple post office schemes for women. These schemes are accessible to women in rural and urban areas.

Post Office Savings Account(SB)

Women can open a Post Office Savings Account individually or jointly with another adult.

This post office scheme is quite similar to the savings bank account.

You can start with a minimum deposit of INR 500 and can withdraw as little as INR 50.

Interest Benefits

You can enjoy an annual interest rate of 4.0% on savings.

National Savings Recurring Deposit Account(RD)

This 5-Year Post Office Recurring Deposit Account (RD) is another beneficial savings scheme for women.

You can become part of this post-office-based RD scheme with a minimal deposit of INR 100.

What is interesting about this?

After 12 instalments and maintaining the account for a year, women can access a loan of up to 50% of their account balance. That too with flexible repayment options.

The RD matures after 5 years (60 monthly deposits). However, you can extend it for an additional 5 years.

Additionally, premature closure is possible after 3 years.

PPF

The Public Provident Fund (PPF) Account is a valuable savings option for everyone, especially women.

You can deposit a minimum of INR 500 and a maximum of INR 1.50 lakh per financial year,.

However, this can be in multiple installements or even as lumpsum.

What’s the best part of this saving scheme for women?

This post office savings scheme is tax-free. It qualifies for deduction under Section 80C of the Income Tax Act.

You enjoy a whopping interest rate of 7.1% per annum, compounded yearly. Interest is also tax-free and credited annually to the account.

At the end of the second year, you can also take a loan for up to 25% of the balance. You can make one withdrawal each financial year after completing five years from the year of opening the account.

The withdrawal amount can be up to 50% of the balance in the account either at the end of the fourth year preceding the withdrawal year or at the end of the preceding year, whichever is lower.

On maturity after 15 years, women have the flexibility to withdraw the entire amount,

There is an option for premature closure under specific conditions, such as life-threatening illness, higher education needs, etc, with a nominal interest deduction.

SSY

Sukanya Samriddhi Account (SSA) is a government-backed savings scheme for women in India. It helps secure the financial future of girl children in India.

- Opened by a guardian for girls under 10 years old, limited to one account per girl child.

- Flexible deposits from a minimum of Rs. 250 to a maximum of Rs. 1,50,000 per financial year.

- Earns a competitive interest rate of 8.2% per annum, compounded yearly, with tax-free returns.

NPS

The National Pension System (NPS) is a popular retirement savings scheme for women with tax benefits and investment flexibility.

- Contributions made to NPS are eligible for deductions under Section 80C (up to a certain limit). It also offers an additional deduction under Section 80CCD(1B). The returns from NPS are also tax-free up to a certain limit upon maturity.

- NPS invests in diversified portfolio comprising Equity, Government Bonds, Liquid Funds, Corporate Bonds, and Fixed Income Instruments.

Check out the latest NPS interest rate!

Kisan Vikas Patra (KVP) for Women

Kisan Vikas Patra (KVP) is a savings scheme offering a fixed interest rate with a doubling period of 115 months (9 years & 7 months). As per this government scheme for a housewife, the invested amount doubles at an annual compound interest rate of 7.5%.

Minimum deposit of Rs. 1000/- in multiples of Rs. 100/- with no maximum limit.

Mahila Samman Savings Certificate

Now, have you heard about this new saving scheme for women introduced by the Department of Economic Affairs?

It is a one-time savings scheme!

This government scheme for housewives and girls has been up and running since April 1, 2023, and will be available until March 31, 2025.

Key Features

- Provides attractive and secure investment options.

- You can open an account until March 31, 2025, for a two-year tenure.

- Deposits earn interest at 7.5% per annum, compounded quarterly.

- Minimum deposit is ₹1,000/-, with multiples of ₹100/– up to a maximum of ₹2,00,000/-.

- The maturity period is two years from the account opening date.

- Allows partial withdrawals, up to 40% of the eligible balance.

This saving scheme doesn’t offer tax benefits!

Other Savings Scheme for Women

Mutual Funds and SIP

Besides the post office saving schemes for women, there’s another smart way for women to grow their money!

Invest in mutual funds at zero brokerage.

You can do it through mutual funds and Systematic Investment Plans (SIPs). You can begin from minimal of₹100.

And yes, they are not tax-free investments!

However, do remember that mutual fund investments are subject to market risk!

LIC (Life Insurance Corporation) Policies

For a secure future and financial protection, LIC policies are a popular choice. LIC policies provide not only life coverage but also investment opportunities.

Top insurance companies in India!

Special Initiatives for Women’s Welfare in India

The government of India’s Ministry of Women and Child Development is actively implementing these schemes for women in India.

- One Stop Centre and Universalization of Women Helplines

- Swadhar Greh Scheme

- Lakhpati Didi Scheme

- Working Women Hostel

- Beti Bachao Beti Padhao (BBBP) Scheme

- Pradhan Mantri Matru Vandana Yojana (PMMVY)

- Mahila E-Haat Scheme

- Nari Shakti Puraskars

The government of India’s Ministry of Women and Child Development is actively implementing schemes for women.

- One Stop Centre and Universalization of Women Helplines

Capitalized by the Nirbhaya Fund, these One Sakhi Centres offer various services under one roof. Their aim is to help women facing violence, including domestic violence.

These Women Helpline Scheme provides emergency and non-emergency assistance to women in public and private spaces.

- Swadhar Greh Scheme

This scheme provides institutional support and rehabilitation for women facing difficult circumstances, enabling them to lead dignified lives.

- The Lakhpati Didi Scheme

Introduced in December 2023 and highlighted in the Budget 2024-25, is a skill development program for empowering rural women.

Approximately 1 crore women have already benefited from this scheme.

- Skill training in agriculture, handicrafts, tailoring, and more.

- Interest-free loans of up to ₹5 lakh for business ventures.

- Facilitation of market linkages to connect women with buyers.

- Focus on benefiting women in rural areas and Self-Help Groups (SHGs).

- Rajasthan leading with efforts to benefit 11.24 lakh women through the scheme.

- Working Women Hostel

This scheme for women provides safe accommodation for working women. It includes daycare facilities for their children.

- Beti Bachao Beti Padhao (BBBP) Scheme

It was launched to address the falling Child Sex Ratio and empower girls and women across their life cycles. The goal is the survival, protection, education, and participation.

- Pradhan Mantri Matru Vandana Yojana (PMMVY)

A Conditional Cash Transfer Scheme provides maternity benefits to pregnant and lactating mothers. However, this scheme excludes women already receiving similar benefits from the government.

- Mahila E-Haat Scheme

Have you heard about the Mahila E-Haat Scheme?

It’s an initiative launched in 2015 by the Ministry of Women and Child Development (MWCD) under the Digital India and Stand Up India campaigns. This scheme offers an online marketing platform exclusively for women entrepreneurs across India.

Key Objectives:

- Empower women by providing them with a platform to showcase and directly sell their products and services to consumers.

- Promote entrepreneurship among women, fostering financial independence and sustainable livelihoods.

- Assist women in supporting their families through business ventures.

- Nari Shakti Puraskars

Recognizes and honours women and institutions for exceptional work towards women empowerment.

Schemes For Women in India By Banks

- The Mahila Udyam Nidhi Yojana is a fantastic support system for women entrepreneurs in India. It’s a partnership between Punjab National Bank and the Ministry of Finance. Eligible women can secure soft loans amounting to 25% of their project cost, with a cap of Rs.2.5 lakhs per project.

- Another great option is the Dena Shakti Scheme from DENA Bank. This scheme combines term loans and working capital for women entrepreneurs. It offers a 25% concessional rate on loans that can be repaid within one to three years.

- Cent Kalyani Scheme is another scheme for women offered by the Central Bank of India. It supports women entrepreneurs in starting new projects or upgrading existing ones.

It specifically targets micro and small enterprises in sectors like handloom weaving, handicrafts, and various professions, including doctors and engineers.

Conclusion

We women love to save our money in lockers, and many of us still prefer to hide it in utensils. However, it’s time to earn interest on your savings!

From government-backed post office schemes like PPF and Sukanya Samriddhi to initiatives supporting women entrepreneurs and empowerment, these schemes for women in India play a vital role in securing women’s economic independence and future aspirations.

Start today! Choose the saving scheme that suits your budget and lifelong goals.

FAQs| Saving Schemes For Women in India

The “Mahila Samman Savings Certificate” offers a deposit facility of up to ₹2 lakh for women, with a tenure of two years and an interest rate of 7.5%.

The Mahila Samman Savings Certificate is available through post offices and eligible scheduled banks like Bank of Baroda, Canara Bank, and Bank of India.

Various schemes like Beti Bachao Beti Padhao, One-Stop Centre Scheme, and UJJAWALA are focused on women’s empowerment, covering education, protection, and rehabilitation.

Welfare programs for women include Beti Bachao Beti Padhao, Working Women Hostel, One-Stop Centre Scheme, and Mahila Police Volunteers Scheme, supporting women’s safety, accommodation, and empowerment.

Source– pib.gov.in, startupindia.gov.in, indiapost.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.