Sukanya Samriddhi Yojana (SSY) Scheme: Features, Benefits and Eligibility

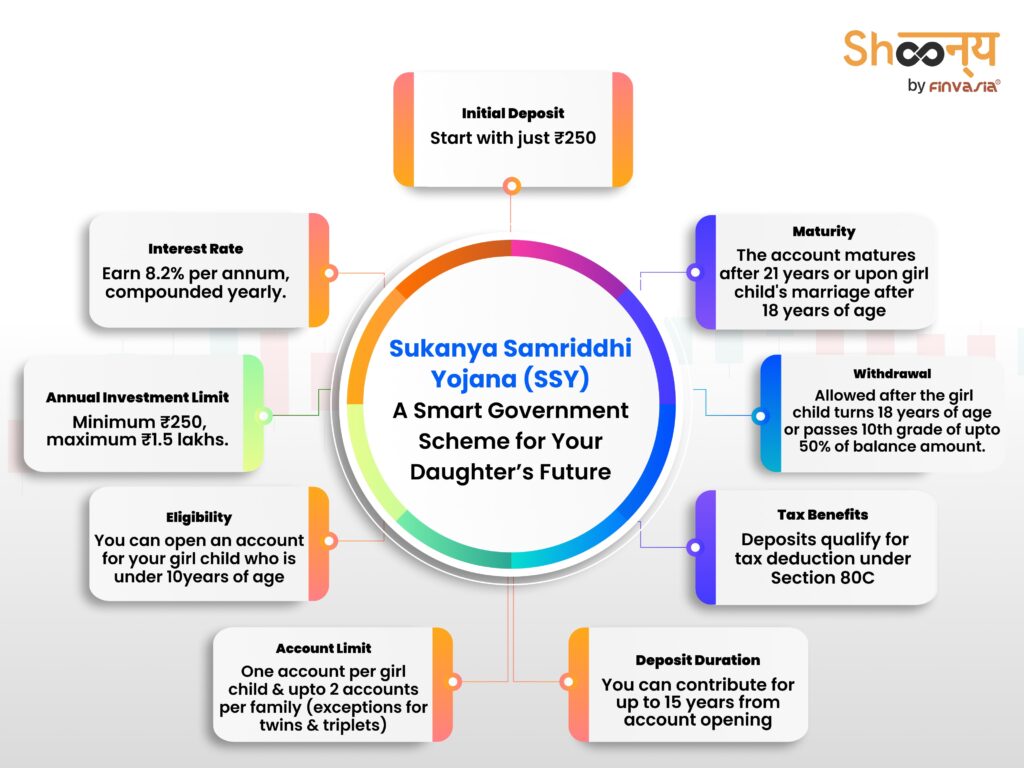

Imagine being able to start saving for your daughter’s future with just ₹250. The Sukanya Samriddhi Yojana is a special savings plan designed just for this purpose. By starting early, you can build a strong financial foundation for her future. Popularly known as the SSY scheme, this initiative by the Government of India encourages early saving to ensure a secure future for your daughter.

Wondering Sukanya Samriddhi Yojana started in which year?

The Sukanya Samriddhi Yojana (SSY) was introduced by PM Mr Narendra Modi on January 22, 2015, as part of the revolutionary campaign- Beti Bachao, Beti Padhao.

The best part?

The SSY scheme offers tax benefits, helping you save even more over time.

Let’s explore the benefits of Sukanya Samriddhi Yojana for you and your daughter!

Sukanya Samriddhi Yojana Scheme (SSY)

The declining sex ratio in our country has long been a concern. To tackle this, the government introduced the “Beti Bachao Beti Padhao” (BBBP) campaign in 2015. It supports a powerful message: “Save the girl child, educate the girl child.”

As part of this initiative, several schemes were launched to support the welfare of girls, including:

- Sukanya Samriddhi Yojana

- Balika Samriddhi Yojana

- Ladli Laxmi Yojana

- Kanyashree Prakalpa

- Dhanalakshmi Scheme

Among these, the Sukanya Samriddhi Yojana (SSY) helps parents save systematically for their daughter’s future.

Thus, ensuring that she has the financial backing needed for higher education and marriage.

With the Sukanya Samriddhi Account, you can make a meaningful difference in your daughter’s future.

Let us take a look at the SSY Scheme and SSA- Sukanya Samriddhi Account details.

Benefits of Sukanya Samriddhi Yojana Scheme

SSY scheme offers attractive benefits.

Let’s have a look at those!

- Deposits: You can start an account with just ₹250 and deposit up to ₹1.5 lakh each year.

- Eligibility: You can open an account in the name of a girl child who is under 10 years old.

- Where to Open: You can open SSA in Post Offices or authorised banks.

- Withdrawals: You can withdraw money to cover the cost of higher education for the account holder.

- Premature Closure: The account can be closed early if the girl gets married after she turns 18.

- Account Transfer: You can transfer the account anywhere in India, from one Post Office or bank to another.

- Maturity: The account matures 21 years after it’s opened.

- Tax Benefits: Deposits qualify for tax deductions under Section 80-C of the Income Tax Act.

- Tax-Free Interest: The interest you earn is tax-free under Section 10 of the Income Tax Act.

Sukanya Samriddhi Yojana Eligibility

Who Can Open an Sukanya Samriddhi Account?

- A guardian can open an account in the name of a girl child who is below 10 years old.

- SSY scheme allows only one account per girl child.

- You can open accounts for up to two girls in a family, but if you have twins or triplets, you can open more than two.

How to Open a Sukanya Samriddhi Yojana Account through Banks

Opening a Sukanya Samriddhi Yojana (SSY) account is easy. If you already have a savings account with one of the participating banks, it’s usually more convenient to open your SSY account there.

However, you can also open it at the postoffice or the designated banks.

Here’s a simple step-by-step guide to opening an SSY account through a bank:

- Check Participating Banks: You must ensure that your bank is a participating institution.

Here are a few banks where you can open an SSY account:

- State Bank of India

- Allahabad Bank

- Andhra Bank

- Punjab and Sind Bank

- Bank of Baroda

- Canara Bank

- Bank of India

- Bank of Maharashtra

- Corporation Bank

- Central Bank of India

- Indian Overseas Bank

- Dena Bank

- Indian Bank

- UCO Bank

- Syndicate Bank

- United Bank of India

- Punjab National Bank

- Union Bank of India

- Oriental Bank of Commerce

- IDBI Bank

- Vijaya Bank

- Axis Bank

- ICICI Bank

- Application Form

You can visit the bank’s website where you want to open the account and download the SSY Account Opening Application Form. You can also do it directly through your bank’s mobile application.

- Fill Out the Form: Complete the form with the required details.

- Submit the Form: Next, you must submit the filled-out form along with the necessary documents to the bank branch. Here is the list of the documents needed for the SSY scheme:

- Passport

- Driving license

- Voter’s ID card

- Job card issued by NREGA signed by the State Government officer

- Letter issued by the National Population Register containing details of name and address

- Account Opening: The account becomes operational once all the documents are verified.

If you prefer a post office, you can visit your nearest branch for the same process.

Here are some additional details related to the SSY scheme!

How Many Deposits Can You Make?

You can make multiple deposits in a Sukanya Samriddhi Yojana (SSY) account in a financial year as long as the total amount does not exceed ₹1.5 lakh.

- Initial Deposit: You can start an account with just Rs. 250.

Each year, you need to deposit at least Rs. 250.

- Deposit Period: You can keep depositing until 15 years from the date you opened the account.

- Inactive Account: If you don’t deposit the minimum amount in a year, the account becomes inactive.

However, you can reactivate it by paying Rs. 250 plus Rs. 50 penalty for each year you missed.

- Tax Benefits: The deposits qualify for tax deductions under Section 80C of the Income Tax Act.

Sukanya Samriddhi Yojana Interest Rate

The current interest rate for the Sukanya Samriddhi Yojana (SSY) is 8.2% per annum. This rate is compounded annually and is subject to quarterly revisions by the government.

How Can You Withdraw Amount from Sukanya Samriddhi Yojana Scheme?

You can withdraw money after your daughter turns 18 or completes the 10th standard. The withdrawal amount can be up to 50% of the balance for education or other expenses.

The withdrawal method allowed is either a lump sum or in instalments, up to once a year for a maximum of five years.

Premature Closure Rules for SSY Scheme

You can close the Sukanya Samriddhi Yojana account before the 21-year term under specific conditions:

- In the Case of Death

If the account holder passes away, the account can be closed from the date of death. Until then, the interest rate will be the same as that for Post Office Savings Accounts.

- Compassionate Grounds

You can also close the account early on compassionate grounds, such as:

Life-Threatening Illness: If the account holder is suffering from a severe illness.

Guardian’s Death: If the guardian who managed the account passes away.

Process: For premature closure, you’ll need to complete and submit a prescribed application form and the passbook at the concerned Post Office.

Closure on Maturity

The account matures 21 years after it’s opened.

It can also be closed at the time of the girl’s marriage after she turns 18. However, the account cannot be closed more than 1 month before or 3 months after the marriage date.

SSY Calculator- Sukanya Samriddhi Yojana Calculator

SSY Calculator- The Sukanya Samriddhi Yojana (SSY) calculator calculates the maturity amount for your SSY savings, considering your yearly investment and an 8.2% interest rate.

The SSY calculator is a great tool for parents who wish to invest in the SSY- Sukanya Samriddhi Yojana Scheme.

Check out the process of using the SSY calculator and its benefits.

You may also want to know the Pradhan Mantri Fasal Bima Yojana (PMFBY)

FAQs| Sukanya Samriddhi Yojana Scheme

You need to contribute for 15 years while the SSY account matures after 21 years.

The maturity amount depends on your annual investment. For example, if you invest ₹1.5 lakhs per year, you will earn an amount based on an 8.2% annual interest rate.

SSY scheme aims to secure the financial future of girl children by funding their education and marriage expenses.

Yes, you can withdraw up to 50% of the balance for education or marriage after the girl turns 18.

The maturity period is 21 years from the date of account opening.

Yes, it can be closed prematurely under specific conditions like the account holder’s death or extreme compassionate grounds.

Source: indiapost.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.