Vedanta’s Dividend History, Financial Highlights, and Growth Journey

There are companies whose financial results draw attention, and then there are companies whose decisions alter the direction of entire industries. Vedanta Limited belongs to the second category. It was the first private company in India to build a copper smelter at a time when the sector was dominated by public enterprises, a move that completely reshaped the competitive landscape. It transformed Hindustan Zinc into one of the world’s most efficient zinc producers after acquiring a majority stake in a once under-utilised public sector enterprise. It also became one of the very few Indian conglomerates to integrate metals, mining, oil and gas, power, and steel under one umbrella, creating a scale of vertical integration that gave India global stature in the natural resources sector.

Let’s read more about Vedanta Limited’s history!

Vedanta’s History and Evolution

The story of Vedanta begins in the modest home of Dwarka Prasad Agarwal in Patna, Bihar. Born into a middle-class Marwari family, Anil Agarwal grew up watching his father run a small aluminium conductor business.

After attending school in Patna, Anil decided to pursue business opportunities. He began trading in scrap metal and selling it in Mumbai’s markets.

In 1976, Agarwal took his first major entrepreneurial leap, acquiring Shamsher Sterling Corporation with a bank loan of just ₹20,000.

For the next decade, he juggled both scrap metal trading and manufacturing operations, gradually building capital and expertise. Interestingly, Agarwal tried his hand at nine different business ventures during this period, all of which failed. But he refused to give up.

By 1986, recognising the volatility of raw material prices, he established Sterlite Industries to manufacture jelly-filled cables, marking his transition from trader to manufacturer. This period laid the foundation for Vedanta’s core philosophy.

Vedanta’s Acquisitions and Global Expansion

The late 1980s and 1990s marked a transformative period for Agarwal’s business empire.

India’s First Private Copper Smelter

In 1993, Sterlite Industries achieved a historic milestone by becoming India’s first private sector company to establish a copper smelter and refinery. This was revolutionary at a time when the mining and metals sector was dominated by state-owned enterprises like Hindustan Copper Limited and National Aluminium Company (NALCO).

The Tuticorin copper smelter in Tamil Nadu, commissioned with an initial capacity of 38,000 tonnes per annum, became a cornerstone asset. By the late 1990s, capacity had expanded to 400,000 tonnes annually, making Sterlite India’s largest copper producer.

Backwards Integration Strategy

In 1995, he acquired Madras Aluminium Company Limited (later renamed Malco Energy), a dormant company that he successfully turned around. This pattern of acquiring underperforming or undervalued assets and transforming them through improved management and capital infusion would become a hallmark of Vedanta’s growth strategy.

The IPO Era

The company went public on Indian stock exchanges during this period. The initial Vedanta share price performance attracted investors. Investors often track Vedanta’s share rate alongside its stock price trends to gauge market sentiment and dividend potential.

Going Global

As the new millennium dawned, Agarwal recognised the need to access international capital markets. In 2003, Agarwal incorporated Vedanta Resources, a parent company, with Agarwal controlling it through Volcan Investments (a Cyprus-based holding company). Various operating companies, including Vedanta Limited, became a part of this.

Vedanta’s Demerger and Restructuring Plans

The period from 2002 to 2011 represents the most transformative phase in Vedanta’s history, characterised by a series of landmark acquisitions. For investors tracking Vedanta shares during this period, each acquisition announcement created both excitement and anxiety as the company took on significant debt to fund its expansion.

Hindustan Zinc Acquisition (2002)

As India advanced its strategic disinvestment programme, the government chose to bring Hindustan Zinc Limited (HZL) into private hands. Through a competitive bidding process, Vedanta secured a 64.92% controlling stake in the company. At the time, HZL was an under-optimised public sector enterprise and Vedanta’s entry marked a turning point, becoming one of India’s most successful privatisation cases.

Bharat Aluminium Company – BALCO (2001)

Vedanta had made another significant acquisition. In 2001, the company acquired a 51% controlling stake in Bharat Aluminium Company Limited (BALCO) from the Government of India. BALCO is one of India’s leading aluminium producers and a major contributor to Vedanta’s aluminium segment.

Sesa Goa (2007)

In 2007, Vedanta Resources acquired Sesa Goa Limited, India’s largest private sector iron ore producer and exporter. The company was later merged with Sterlite Industries in 2013 to create Sesa Sterlite Limited, which was eventually renamed Vedanta Limited. This corporate restructuring made it easy for investors to track Vedanta Ltd’s share price.

Konkola Copper Mines, Zambia (2004)

Vedanta acquired Konkola Copper Mines (KCM) in Zambia in 2004 for approximately $25 million plus commitments to invest $750 million in expansion.

Cairn India (2011)

In August 2011, Vedanta acquired a 58.5% controlling stake in Cairn India Limited from UK-based Cairn Energy PLC for approximately $8.67 billion, making Vedanta a major player in India’s oil and gas sector.

During this period, investors tracking the Vedanta stock price experienced significant volatility. The company traded at lower valuations compared to historical levels.

Electrosteel Steels (2018): Entry into Steel

Vedanta entered the steel sector by acquiring Electrosteel Steels Limited (ESL) for approximately ₹5,320 crore. ESL operates an integrated steel plant in Bokaro, Jharkhand. The steel plant acquisition complemented Vedanta’s existing iron ore operations.

By 2011, Vedanta had created an unprecedented diversified natural resources portfolio. The company had significant operations across:

- Zinc, Lead, Silver (Hindustan Zinc)

- Aluminium (BALCO, Jharsuguda operations)

- Copper (Tuticorin smelter, Zambian mines)

- Iron Ore (Goa, Karnataka operations)

- Oil & Gas (Cairn India’s Rajasthan fields)

- Power Generation (Captive and merchant power plants)

- Steel (Electrosteel operations)

Vedanta Limited — Yearly Milestones

| Category | Year / Period | Key Highlights |

| Company formation | 25–26 June 1965 | Incorporated as Sesa Goa Private Limited and later renamed as Vedanta Limited. |

| Early growth & consolidation | 1990s–2000s | Began building scale in aluminium, copper, zinc and power. |

| Hindustan Zinc acquisition | 2000–2003 | Vedanta acquired control of Hindustan Zinc, a transformational acquisition in the zinc and silver sectors. |

| Major oil & gas move (Cairn) | 2010s | Acquisition and subsequent merger of Cairn India into Vedant, adding material oil & gas production to the group. |

| Listing & international expansion | 2000s–2010s | Vedanta and its group companies increased international listings/visibility and expanded operations into Africa, Australia and the Middle East. |

| Vedanta demerger/restructuring | 2024–2025 (ongoing) | Group reorganisation/demerger plans announced to create focused commodity verticals; process progressed through filings and hearings in 2025 (subject to regulatory review and some reported government/NCLT/SEBI scrutiny). |

| ESG, sustainability & renewables push | Ongoing, FY24–FY25 highlights | Renewables PPAs and RE sourcing scaled, water recycling and sustainability reporting enhanced; Vedanta reported higher RE utilisation and specific ESG recognitions in FY25. |

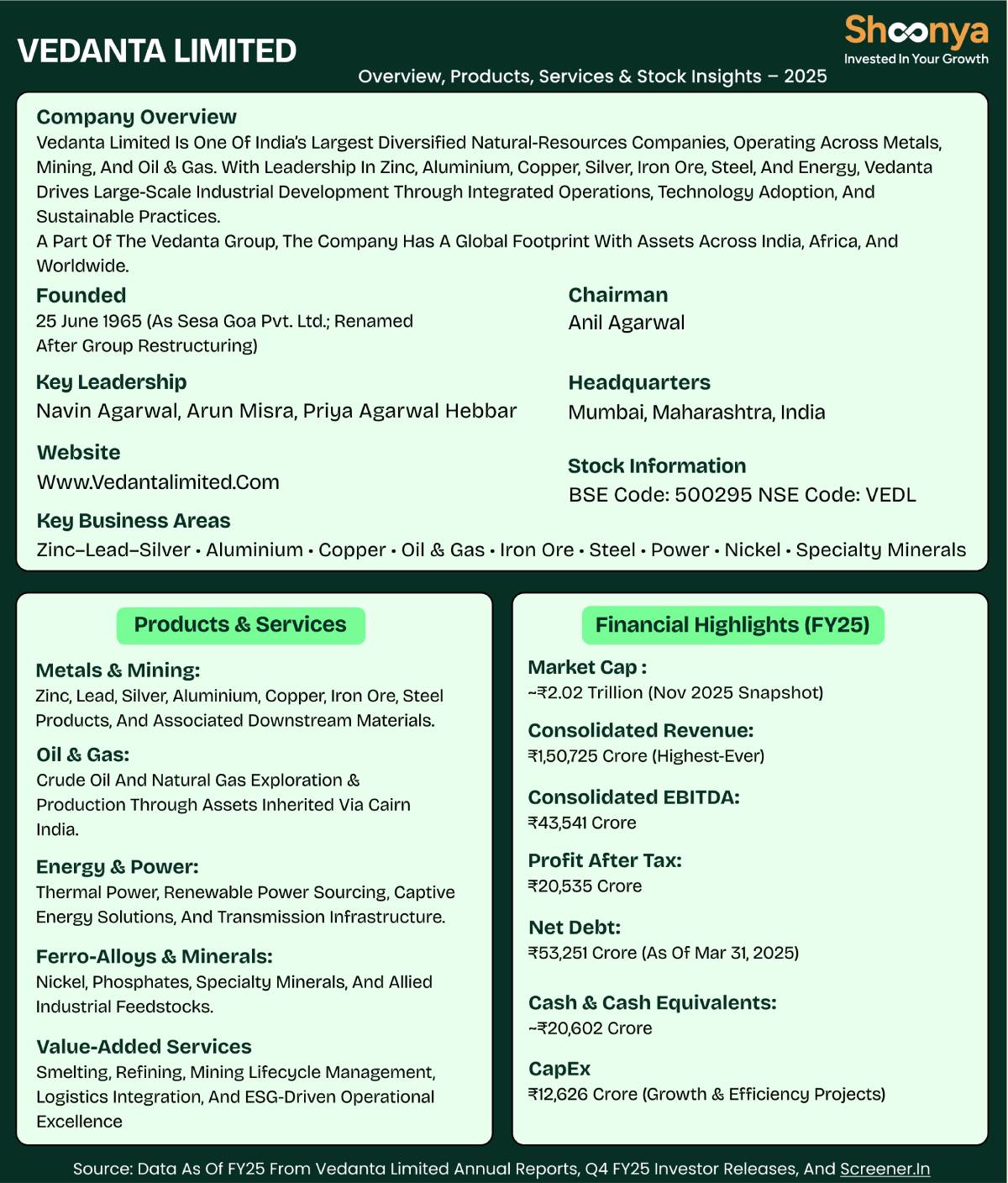

What does Vedanta do?

Vedanta Limited is a diversified natural resources company engaged in mining, oil and gas, metals, power, and technology. It operates across key segments, including zinc, lead, silver, aluminium, iron ore, copper, steel, and oil and gas, with a significant presence in India and globally. The company is known for its integrated operations spanning exploration, extraction, processing, and power generation, supporting its various mineral and energy businesses.

Vedanta’s Dividend History: A Strong Legacy of Shareholder Value

Vedanta Limited has established itself as one of India’s most reliable dividend-paying companies. The company’s dividend policy aims to balance rewarding investors with maintaining sufficient capital for growth and expansion. In August 2025, Vedanta declared a second interim dividend of ₹16 per share, showing its willingness to return value even amid ongoing investment, deleveraging, and a planned corporate restructuring.

Conclusion

As Vedanta Limited enters its seventh decade, the company has grown into a diversified powerhouse spanning metals, mining, oil and gas, and power. Its strategic acquisitions, combined with a consistent dividend track record, have reinforced investor confidence.

In addition to its diversified operations, Vedanta has been actively pursuing group restructuring and demerger plans to create focused commodity verticals.

For investors and industry watchers alike, Vedanta exemplifies how vision, strategic execution, and shareholder commitment can drive enduring value.

Vedanta Limited – FAQs

Vedanta Limited is a leading diversified natural-resources conglomerate operating across metals, mining, oil & gas, and power. The company produces aluminium, copper, zinc, lead, silver, iron ore, and steel, while also managing oil and gas operations and renewable energy initiatives.

Vedanta Limited was incorporated on June 25–26, 1965, initially as Sesa Goa Private Limited. Through mergers and restructuring, it evolved into Vedanta Limited in April 2015.

Anil Agarwal, the Chairman, founded Vedanta through early ventures in trading and metals. The company expanded through acquisitions, backward integration, and strategic diversification, establishing itself as a global player in natural resources.

Key acquisitions include Hindustan Zinc (2002), Bharat Aluminium Company (BALCO, 2001), Sesa Goa (2007), Konkola Copper Mines, Zambia (2004), Cairn India (2011), and Electrosteel Steels (2018). These moves diversified the company’s portfolio across metals, oil, and steel.

Vedanta has a long-standing record of paying dividends, with consistent interim and final payouts. Despite operating in cyclical commodity sectors, the company prioritizes disciplined capital allocation and shareholder value.

In FY25, Vedanta reported its highest-ever consolidated revenue (~US$17.8–18.2 billion), strong EBITDA and PAT growth, a consolidated net debt of ₹53,251 crore, and cash & cash equivalents of ~₹20,602 crore. Market capitalization is approximately ₹2.02 trillion (Nov 2025).

Vedanta employs over 97,000 people across India and international operations in Africa, Australia, and the Middle East. Its operations include mines, smelters, refineries, oilfields, power plants, and steel manufacturing facilities.

Vedanta invests in education, health, women’s empowerment, skill development, and environmental conservation. Programs like Sakhi empower women at the grassroots level, while community initiatives address local livelihoods and social development.

Vedanta’s vision is to be a global leader in natural resources, delivering sustainable value to stakeholders. Its mission focuses on innovation, operational excellence, safety, sustainability, and consistent shareholder returns.

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.