What’s in Budget 2023 for the Middle Class?

In Budget 2023-24, the Finance Minister prioritised improving taxpayer services by making compliance easy and smooth for the Middle-class section of society.

To achieve this, the Department has recommended the implementation of a new Common IT Return Form and wants to improve the grievance redressal process. A person’s income up to Rs. 7 lakh is exempt from taxation because the personal income tax refund ceiling has also been raised from the earlier Rs. 5 lakh to Rs. 7 lakh.

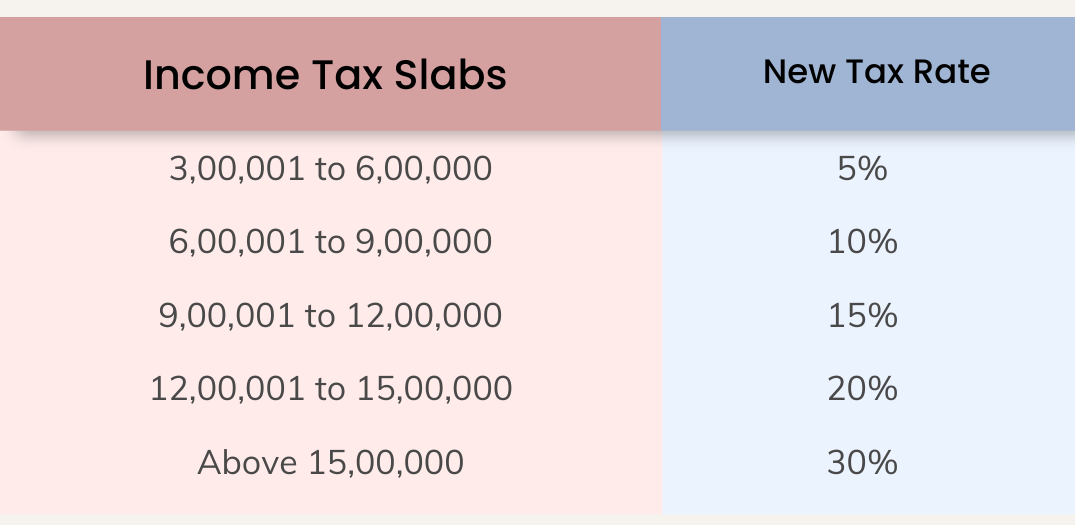

The new personal income tax regime’s tax structure has also been updated, with the number of slabs dropping from six to five and the tax exemption threshold rising to Rs. 3 lakh.

A standard deduction of Rs. 50,000 for salaried people and a deduction from family pensions of up to Rs. 15,000 have also been proposed by the Department. The top surcharge rate has been lowered from 37% to 25%, bringing the top personal income tax rate down to 39%. The cap for non-government salaried employees’ leave encashment upon retirement has been raised to Rs. 25 lakh.

As a default, the new tax system will be in place, but citizens will still have the option to choose the old one. Micro enterprises and certain professionals will also have enhanced limits for availing the benefit of presumptive taxation. The Department has also proposed that deduction for expenditure incurred on payments made to MSMEs should be allowed only when the payment is made.

- New co-operatives that commence manufacturing activities by 31.03.2024 will be eligible for a lower tax rate of 15%, as is currently available to new manufacturing companies.

- In addition, sugar co-operatives will have the opportunity to claim payments made to sugarcane farmers for the period before the assessment year 2016-17 as expenditure, providing them with a relief of almost Rs. 10,000 crores.

The carry forward of losses on a change in shareholding increased from seven years of incorporation to ten years will be advantageous to startups. The incorporation deadline for start-ups to receive income tax incentives has been extended to 31.03.24. The maximum amount that can be deducted from capital gains on an investment in a residential home under sections 54 and 54F is Rs. 10 crores.

In addition, the government is proposing a change to the income tax exemption for insurance policies with high values.

Income from policies: Only the revenue from insurance with an aggregate premium of up to Rs. 5 lakh will be tax-exempt as of April 1, 2023.

Taxability of online gaming: The minimum threshold for TDS will be removed, and the taxability of online gaming winnings will be clarified. TDS will be required on net winnings at the withdrawal time or the financial year’s end. TDS rate EPF: The TDS rate for the taxable portion of EPF withdrawals in non-PAN cases will be reduced from 30% to 20%.

Sources: moneycontrol.com

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks, read all the related documents carefully before investing.