Which Future Contract is Best for me?

Futures contracts are a well-known trading technique allowing you to take a position in any asset tradable on an exchange by paying a fraction of its value. Such contracts have no intrinsic worth and derive value from the underlying assets.

You can buy futures contracts in stocks, currencies, commodities, and bonds. Each has its own set of benefits and risks. The question now is in which future derivative you should invest.

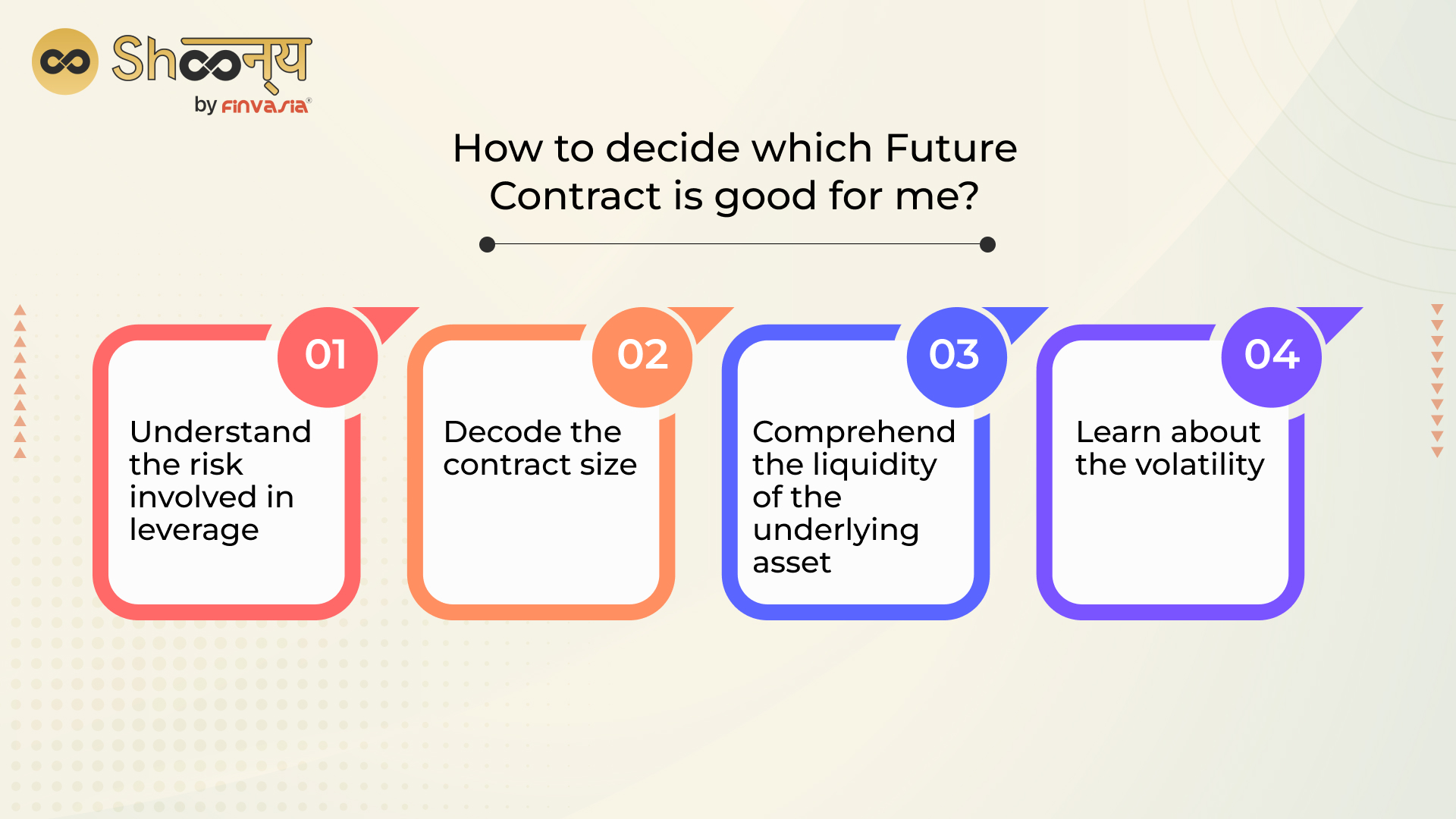

How to decide which Future Contract is good for me?

You must consider the following parameters before deciding on the ideal future derivatives.

1. Leverage

Futures derivatives are highly leveraged instruments. You can speculate on the price and profit when the price swing is favourable. It allows you to take a position by paying margin money on the contract’s notional value. However, the margin you pay can work in either direction, profit or loss. For example, you may be forced to execute a sale at a lower market price or purchase at a higher rate.

If you want to trade in futures with minimal leverage risk, stock futures are not ideal for you.

2. Contract size

Contract size refers to the number of underlying assets within a single future and is also known as the lot size. The larger contract size has a higher return potential but also higher risks. For example, if you want to trade TCS stock futures, a single contract contains 150 shares, and at the current share price of Rs 3,463, the total contract value will be around Rs 5,54,080. If the price of a stock rises and you have a long position, your profit will increase proportionally to the contract size. However, if prices fall, the loss will be proportionate.

If you are a small trader, you can opt for mini futures. They have a smaller contract size, lower margin requirements, and provide international exposure.

3. Liquidity

Liquidity is another vital consideration, and it depends upon the bid-ask spread and other factors. Bid-ask spread is the difference between what you are willing to pay and what the seller is ready to accept in the contract. It may be tough entering or exiting the futures contract if the bid-ask spread is significant.

Suppose you purchased the future contract with the intent to buy and expected the price to fall to 50 from its current price of 60. However, on the expiry date, the price dropped to Rs 10. Liquidity issues may arise in this situation due to significant price movement.

Commodities futures are ideal when it comes to liquidity.

4. Volatility

Some underlying assets are highly volatile. They can give exponential returns without increasing the transactional costs. However, the risk of the trade is also high. Therefore, the decision on how volatile a trade to enter should be based solely on your risk tolerance.

You can calculate market volatility by taking the mean range and standard deviation.

Final Words

Choosing the best futures contract necessitates extensive research. First, you must consider the above parameters to determine which contract best meets your needs.

Your F&O trading platform is also crucial in this case. The platform should allow for a quick trade, and the fee structure should be reasonable with low commission.