You must have known indices like Nifty 50, BSE 100 or Nifty Bank, Nifty IT, etc. They represent different parts of the Indian stock market. These indices reflect the overall market performance of specific sectors and investment approaches. But how is the performance of the Public Sector Undertaking (PSU) banks in India tracked? The answer is the Nifty PSU Bank Index.

What is it, and how does the Nifty PSU bank index work?

Let us understand!

What is Nifty PSU Bank

The Nifty PSU Bank Index actively tracks the performance of PSUs in India.

PSUs (public sector banks) are government-owned banks in India. They are responsible for a significant portion of banking services in the country.

The Nifty PSU bank index includes major banks such as:

- State Bank of India (SBI)

- Punjab National Bank (PNB)

- Bank of Baroda (BoB)

- Canara Bank

- Bank of India

- Union Bank of India, and others.

These banks play a crucial role in the Indian economy by providing credit facilities to various sectors. This includes agriculture, small-scale industries, and priority sectors identified by the government.

How is this helpful?

Nifty PSU bank helps you keep a check on the performance of public banks in India. If you are one of those investors who is actively seeking to invest in PSU, this is for you.

Nifty PSU Bank List

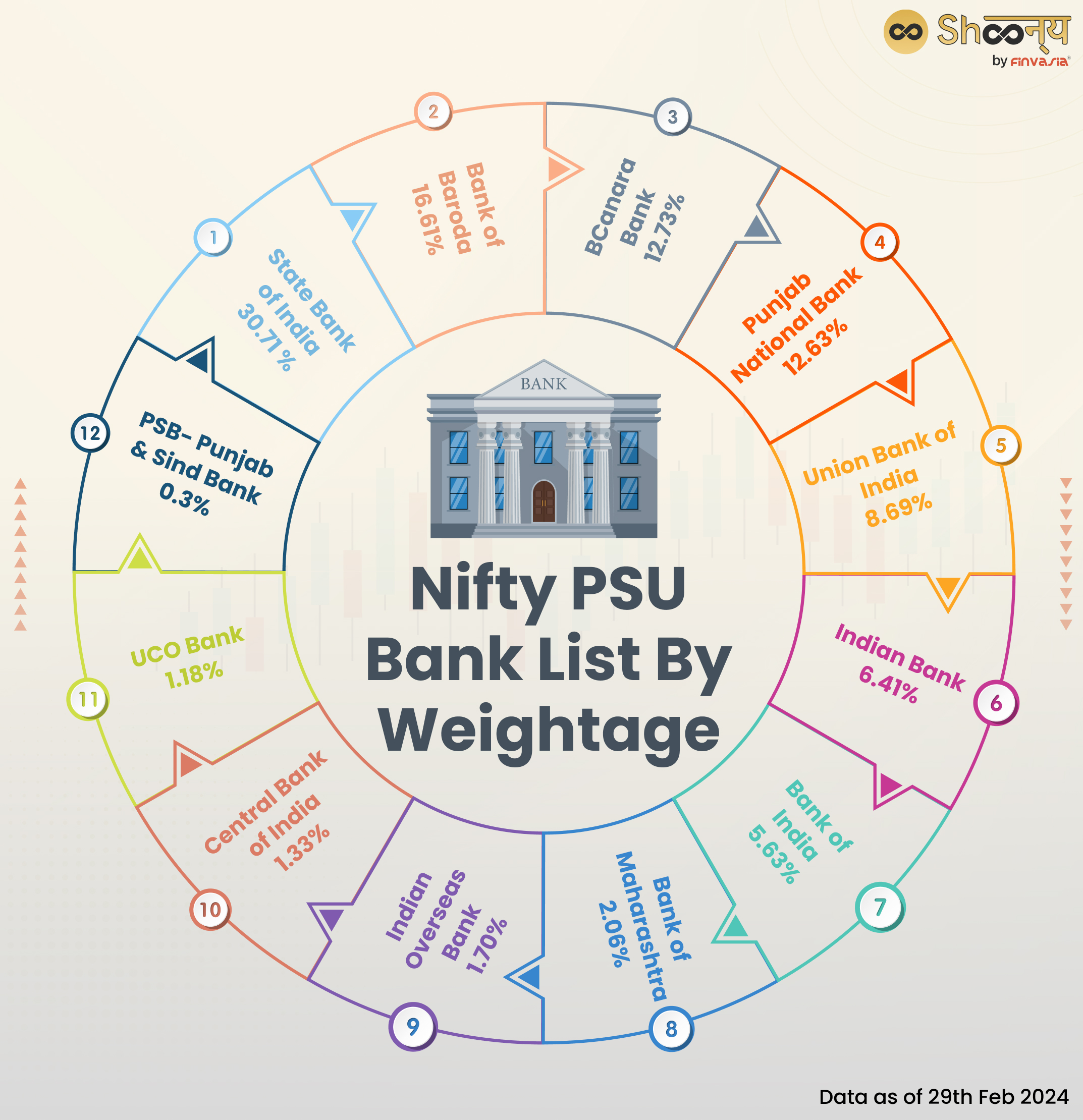

The Nifty PSU Bank index comprises a specific list of PSU banks.

The weightage composition of the index may vary over time due to changes in market dynamics. The PSU bank index includes major PSU banks that are actively traded on the NSE.

Nifty PSU Bank List

The table for the top constituents by weightage in the Nifty 50 Index is as follows:

| Bank | Weightage (%) |

| State Bank of India | 30.71 % |

| Bank of Baroda | 16.61% |

| Canara Bank | 12.73% |

| Punjab National Bank | 12.63% |

| Union Bank of India | 8.69% |

| Indian Bank | 6.41% |

| Bank of India | 5.63% |

| Bank of Maharashtra | 2.06% |

| Indian Overseas Bank | 1.70% |

| Central Bank of India | 1.33% |

| UCO Bank | 1.18% |

| PSB- Punjab & Sind Bank | 0.3% |

Nifty PSU Bank Index Re-Balancing

The index is rebalanced every six months, around January 31 and July 31 each year. NSE considers average data for the six months leading up to the cutoff date for this index review. Market participants receive a four-week notice prior to the change date.

Nifty PSU Bank Index Governance

A professional team manages all NSE indices.

They work under a three-level structure: First, there’s the Board of Directors of NSE Indices Limited. Then, there’s the Index Advisory Committee (Equity). And finally, there’s the Index Maintenance Sub-Committee. This setup ensures that decisions about the index are made carefully and with the input of experts.

PSU Bank Weightage

It refers to the importance or influence each public sector bank has on the index’s overall performance. The PSU Bank Weightage shows how much each public sector bank contributes to the overall performance of the Nifty PSU Bank index.

In the Nifty PSU Bank index, each stock holds a specific weight.

The higher the weight of a stock, the more it influences the Nifty PSU bank’s index value. These weights aren’t always fixed; NSE can change them to ensure the index accurately reflects the sector’s performance.

Therefore, it’s important to check the current value of the Nifty PSU Bank index before making any decisions.

PSU banks with higher market capitalisation have a greater weight in the index because they have a larger impact on their movements.

Changes in the market capitalisation of individual PSU banks or shifts in their relative performance can lead to changes in their PSU bank weightage.

How is the Nifty PSU Bank Index Calculated?

The index is usually calculated based on the market capitalisation of these banks.

Market capitalisation is the total value of a company’s outstanding shares in the stock market.

So, to calculate the Nifty PSU Bank index, the NSE takes the market capitalisation of each public sector bank in the index.

The index value changes throughout the trading day as the stock prices of these banks go up and down.

It helps benchmark fund portfolios and launch index funds, ETFs, and structured products.

It helps investors understand how PSUs are faring in the stock market.

Nifty PSU bank index is a simple way to gauge the health any Public bank.

Nifty PSU Bank Index Methodology

Here are the rules for selecting stocks for the Nifty PSU Index:

- Public sector banks need to be among the top 800 based on their daily trading volume and market value over the past six months.

- Companies must have at least 51% of their shares owned by the Central or State Government, directly or indirectly.

- The company’s trading frequency must be at least 90% over the last six months.

This means that at least 90% of the time in the last six months, people have been buying and selling their shares regularly. - The company should have been listed for at least 1 month as of the cutoff date.

- The final selection of companies will be based on their free-float market capitalisation.

- The free-float market value shall determine the weight of each stock in the index. This ensures that no single bank’s weight exceeds 33% of the total.

Additionally, the combined weight of the top three banks doesn’t go over 62% during rebalancing.

Which Bank Should You Pick: Public or Private?

Experts say public banks are better off now than private ones. This is because of the increasing trend of private bank mergers. However, it’s important for investors and stakeholders to keep an eye on market trends and top public banks in India before investing.

Conclusion

Overall, the Nifty PSU Bank index and its constituent stocks play a crucial role in the Indian stock market. They provide investors with insights into the performance of PSU banks and their contribution to the broader economy.

FAQs | Nifty PSU Bank

It is a stock market index established by the National Stock Exchange of India (NSE) to track the performance of the public sector banks listed on the exchange.

The 12 PSU banks in India consist OF SBI, BoB, Canara Bank, PNB, Union Bank, Indian Bank, BoI, BoM, IOB, Central Bank, UCO Bank, and PSB.

12 PSU banks, including State Bank of India, Punjab National Bank, and Bank of Baroda, are listed on stock exchanges and are part of the Nifty PSU Bank Index.

Source– niftyindices.com, nseindia.com

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.