Are you at a crossroads between investing directly in stocks or going through the route of equity mutual funds? Deciding between direct equity and equity funds is a crucial step for any investor. This guide will help you navigate the terrain and choose the investment path that aligns with your goals and risk appetite, specifically tailored for the Indian audience.

Direct Equity Explained

Direct equity involves purchasing shares of a company directly from the stock market. Each share represents a unit of ownership, entitling you to voting rights and a stake in the company. Investing in direct equities has become more accessible, thanks to demat and trading accounts. However, it demands a good understanding of markets and consistent monitoring, making professional guidance valuable.

Understanding Equity Mutual Funds

Equity mutual funds pool money from various investors to invest in a diversified portfolio of company stocks. These funds offer the advantage of professional management and risk diversification. You don’t need to be a stock market expert to invest in equity mutual funds. The fund manager handles decisions like buying, selling, and portfolio allocation, making it a convenient option for both new and experienced investors.

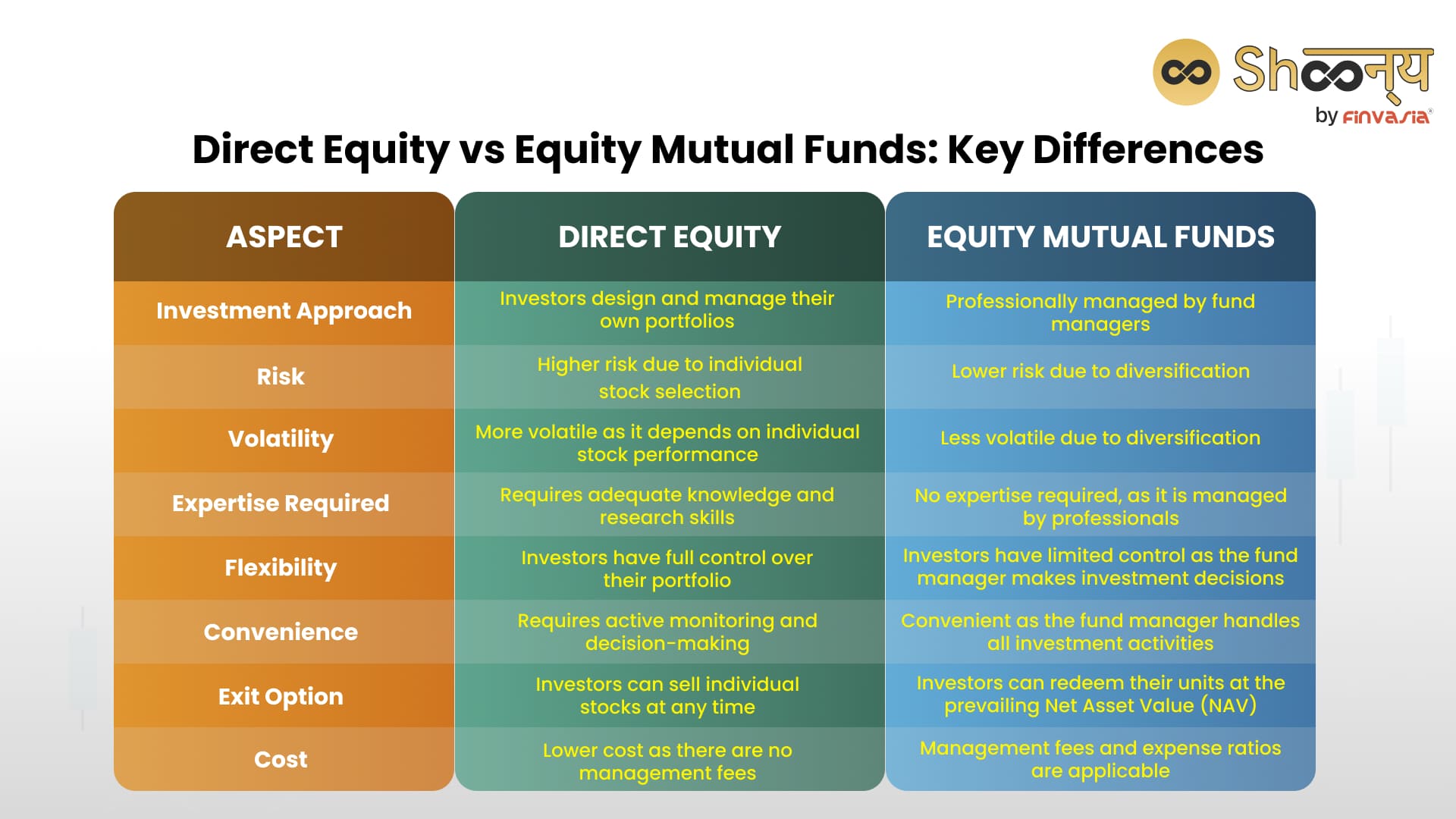

Key Differences: Direct Equity vs Equity Mutual Funds

- Risk and Management: Direct equity poses a higher risk and requires market expertise. Equity funds are managed by professionals, spreading risk across a variety of stocks.

- Cost and Accessibility: Direct equity involves account setup costs, while equity funds have entry points as low as Rs 500.

- Volatility and Convenience: Individual stocks are more volatile, while equity funds offer stability through diversification and professional management.

- Liquidity and Taxation: Equity funds offer easy exit with NAV-based prices, while selling individual stocks can be uncertain. Taxation is similar for both, with tax-saving options in equity funds.

Choosing the Right Path while choosing between Direct Equity vs Equity Mutual Fund

Direct equity suits those with in-depth market knowledge and the time to manage their investments. Equity mutual funds are suitable for investors seeking professional management and diversification without the need for constant monitoring. Both paths have their merits, so your choice should align with your financial goals and risk tolerance.

Factors to Consider:

- Understanding Equities: Evaluate your comprehension of the stock market and your ability to analyse businesses.

- Time and Monitoring: Consider if you have the time and expertise to monitor stocks regularly.

- Behavioral Biases: If you lack discipline or active decision-making, mutual funds could be more suitable.

- Long-Term Vision: Both paths yield results over the long term, so align your choice with your investment horizon.

Conclusion: Direct Equity vs. Equity Mutual Fund Which one should you choose?

In conclusion, direct equity and equity mutual funds each have their pros and cons. Direct equity offers control and potentially high returns, while equity mutual funds provide professional management and diversification. Your choice should hinge on your risk appetite, market knowledge, time availability, and investment goals. Remember, informed decisions pave the way to a successful investment journey.

FAQs| Direct Equity vs Equity Mutual Fund

Direct equity involves buying individual company stocks, demanding market expertise and active monitoring. Equity mutual funds pool money from investors to create a diversified stock portfolio, professionally managed by experts.

Direct equity carries higher risk due to individual stock volatility and requires market knowledge. Equity mutual funds offer risk diversification, reducing the impact of a single stock’s performance.

Yes, beginners can invest in direct equity, but it’s advisable to start with a good understanding of the market or seek expert guidance to mitigate risks.

Direct equity involves account setup costs and trading fees. Equity funds have fund management fees, with entry points as low as Rs 500.

Both direct equity and equity funds are taxed similarly. Short-term capital gains (less than one year) are taxed at 15%, while long-term capital gains (more than one year) have tax implications depending on the type of investment.

Equity mutual funds are more convenient as professional fund managers handle portfolio decisions. Direct equity requires constant monitoring and active management.

Consider your market knowledge, time availability for monitoring, risk appetite, and investment horizon. If you lack market expertise and prefer professional management, equity mutual funds might be a better fit.

Yes, you can start with small investments in both direct equity and equity mutual funds. Equity funds often have lower entry requirements, making them accessible for small investors.

Yes, investing in an Equity Linked Savings Scheme (ELSS), a type of equity mutual fund, offers a tax deduction under Section 80C of the Income Tax Act, up to Rs 1.5 lakh.

Both direct equity and equity mutual funds yield better results over the long term (at least 3-5 years). Short-term fluctuations may impact returns, so a longer investment horizon is recommended.

Yes, you can switch between the two options based on your changing financial goals and market conditions. However, understand the implications and consult experts before making changes.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.