Income Tax for AOP/BOI/Trust/AJP: Tax Slabs, Forms & Deductions – 2025

Did you know that non-company entities like AOP, BOI, Trusts, and Artificial Juridical Persons (AJP) are also liable to pay taxes? The income tax for AOP/BOI/Trust/AJP follows different rules than those for domestic and foreign companies. Thus, understanding income tax for non-company entities is important.

Let’s explore the non-company tax slabs, deduction for non-company, and filing process for non-company taxation in India!

What Are AOP, BOI, Trust, and AJP?

When it comes to non-company taxation, different entities are taxed based on their structure:

AOP Full Form in Tax

AOP stands for Association of Persons. It refers to a group of individuals or entities that come together to earn income. The taxation of AOP depends on whether the members’ shares are determined or indeterminate.

BOI Full Form in Tax

BOI stands for Body of Individuals. It is similar to an AOP but consists only of individuals. The tax liability of a BOI depends on how the income is distributed among its members.

AJP Full Form in Income Tax

AJP stands for Artificial Juridical Person. It includes entities like universities, temples, or other non-human legal persons that are treated separately for taxation. The AJP full form is often used to define such entities under the Income Tax Act of 1961.

Importance of Filing Income Tax for AOP/BOI/Trust/AJP

Filing income tax for AOP/BOI/Trust/AJP is essential to comply with tax laws and avoid penalties. These entities fall under non-company taxation, meaning they have different tax rules compared to companies.

The taxation of AOP depends on whether the share of members is determined. If members have a defined share, their income is taxed at individual rates; otherwise, the non-company tax slab applies at the maximum marginal rate. The taxation of trusts varies, with trust income tax exemptions available for charitable and religious trusts under Section 11. The tax rate for a trust depends on its registration and purpose.

Filing returns ensures access to tax-saving options for non-company entities, such as deductions under Section 80G for donations. The correct ITR form for non-company is crucial, such as ITR-5 for AOP/BOI and ITR-7 for trusts.

Latest Updates for the AY 2026-27: Income Tax for Non Company Entities

As per Budget 2025, individuals earning up to ₹12,00,000 will have zero tax liability under the new tax regime due to an increased rebate.

Here’s the revised tax slab structure:

| Annual Income | Tax Rate |

| Up to ₹4,00,000 | NIL |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

No tax on income up to ₹12,00,000, thanks to a rebate of ₹60,000.

Salaried individuals earning up to ₹12,75,000 will also pay zero tax after considering the ₹75,000 standard deduction.

Income Tax for AOP/BOI/Trust/AJP

The taxation of Association of Persons (AOP), Body of Individuals (BOI), Trusts, and Artificial Juridical Persons (AJP) is governed by two regimes:

- Old Tax Regime (with exemptions & deductions)

- New Tax Regime (Default) – Section 115BAC

Let’s explore the income tax for non-company details!

1. Income Tax for AOP/BOI/Trust/AJP- Old Tax Regime (With Deductions & Exemptions)

Tax Slabs & Rates for AOP, BOI, AJP (Not Being Co-operative Societies)

| Income Range (₹) | Tax Rate | Surcharge |

| Up to ₹2,50,000 | Nil | Nil |

| ₹2,50,001 – ₹5,00,000 | 5% on income above ₹2.5 lakh | Nil |

| ₹5,00,001 – ₹10,00,000 | ₹12,500 + 20% on income above ₹5 lakh | Nil |

| ₹10,00,001 – ₹50,00,000 | ₹1,12,500 + 30% on income above ₹10 lakh | Nil |

| ₹50,00,001 – ₹1 crore | ₹1,12,500 + 30% on income above ₹10 lakh | 10% |

| ₹1 crore – ₹2 crore | ₹1,12,500 + 30% on income above ₹10 lakh | 15% |

| ₹2 crore – ₹5 crore | ₹1,12,500 + 30% on income above ₹10 lakh | 25% |

| Above ₹5 crore | ₹1,12,500 + 30% on income above ₹10 lakh | 37% |

Additional Taxes in Old Regime

- Health & Education Cess: 4% on the total tax + surcharge.

- Maximum Marginal Rate (MMR): 30% + surcharge + cess for AOP/BOI with indeterminate shares.

2. Income Tax for AOP/BOI/Trust/AJP- New Tax Regime (Default) – Section 115BAC

The Finance Act 2023 made the new tax regime the default choice, but taxpayers can opt for the old regime if they file Form 10-IEA before the due date.

Tax Slabs & Rates for AOP, BOI, AJP under the New Regime

| Income Range (₹) | Tax Rate | Surcharge |

| Up to ₹3,00,000 | Nil | Nil |

| ₹3,00,001 – ₹7,00,000 | 5% on income above ₹3 lakh | Nil |

| ₹7,00,001 – ₹10,00,000 | ₹20,000 + 10% on income above ₹7 lakh | Nil |

| ₹10,00,001 – ₹12,00,000 | ₹50,000 + 15% on income above ₹10 lakh | Nil |

| ₹12,00,001 – ₹15,00,000 | ₹80,000 + 20% on income above ₹12 lakh | Nil |

| ₹15,00,001 – ₹50,00,000 | ₹1,40,000 + 30% on income above ₹15 lakh | Nil |

| ₹50,00,001 – ₹1 crore | ₹1,40,000 + 30% on income above ₹15 lakh | 10% |

| ₹1 crore – ₹2 crore | ₹1,40,000 + 30% on income above ₹15 lakh | 15% |

| Above ₹2 crore | ₹1,40,000 + 30% on income above ₹15 lakh | 25% |

Key Differences in the New Regime

- No deductions under Chapter VI-A (80C, 80D, etc.).

- No standard deduction or house rent allowance.

- Basic exemption limit is ₹3,00,000 instead of ₹2,50,000.

Alternate Minimum Tax (AMT) for AOP/BOI

- If the adjusted total income of an AOP/BOI exceeds ₹20 lakh, they must pay AMT at 18.5% (plus surcharge & cess), if their normal tax liability is lower.

Special Cases

- AOP/BOI with Determinate & Indeterminate Shares

- If all members have taxable income below ₹2.5 lakh, AOP/BOI is taxed like an individual.

- If any member’s income exceeds ₹2.5 lakh, tax is at Maximum Marginal Rate (MMR).

- If a member’s tax rate is higher than MMR, the AOP’s income is taxed at that higher rate.

- Co-operative Societies (Under Section 115BAE)

- 15% concessional tax rate for new manufacturing co-operative societies.

- Must start manufacturing before 31st March 2024 to qualify.

- Once opted, cannot switch back to regular tax slabs.

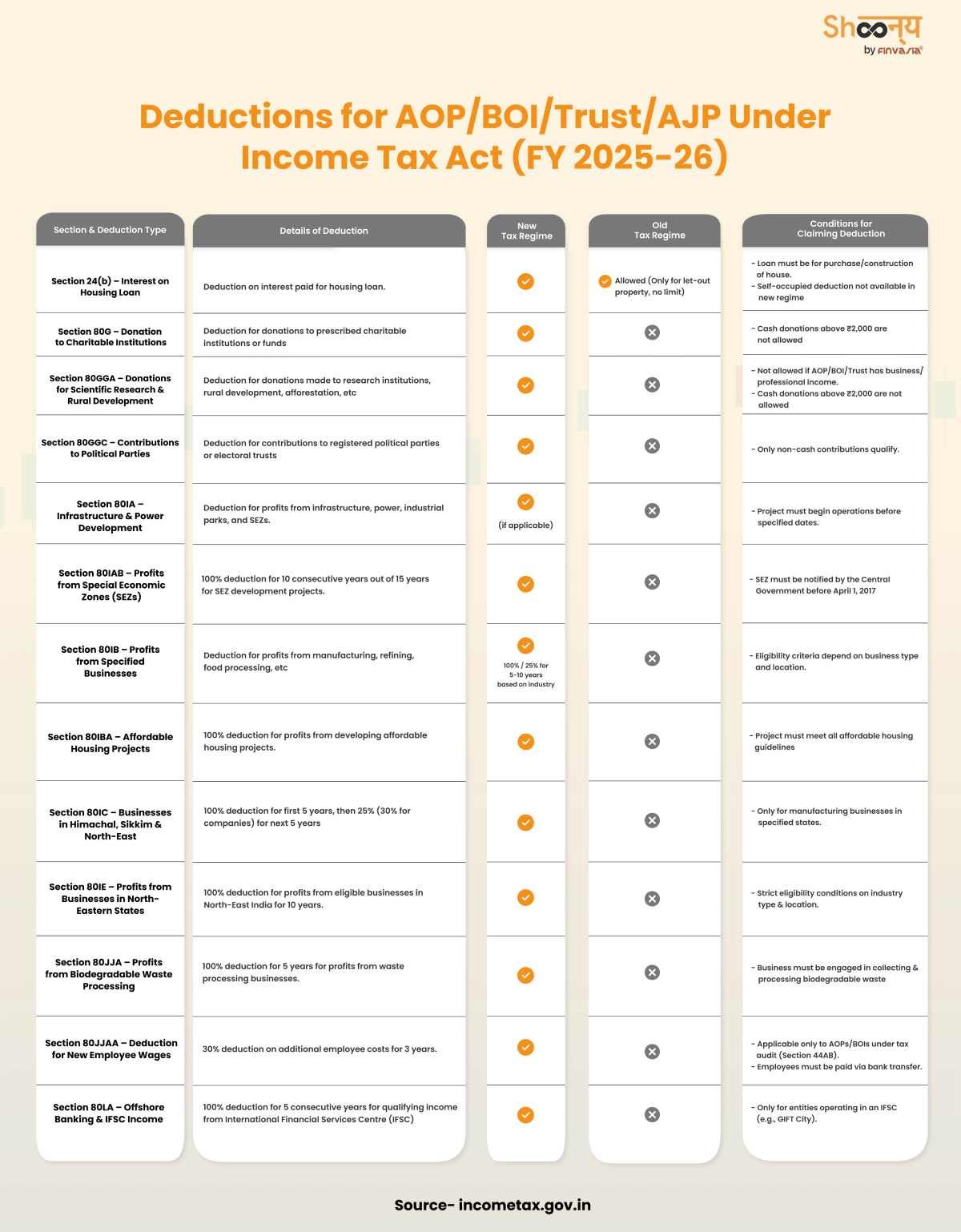

Tax Deductions For Non Company- AOP/BOI/Trust/AJP

Tax deductions help reduce your taxable income, which means you pay less tax. Different types of organisations, like AOPs, BOIs, and Trusts, can claim deductions under various sections of the Income Tax Act.

Types of Deductions you can claim while filing income tax for AOP/BOI/Trust/AJP.

1. House Property Deductions (Section 24(b))

If an AOP/BOI owns a house and has taken a home loan, they can claim deductions on the interest paid:

- Self-occupied property – Up to ₹2 lakh

- Rented property – No limit, full interest amount is deductible

2. Donations to Charitable Trusts & NGOs (Section 80G)

- Donations to approved charitable organisations can be 100% or 50% deductible.

- Cash donations above ₹2,000 are not allowed for deductions.

3. Scientific Research & Rural Development (Section 80GGA)

- Donations to scientific research or rural development organisations are 100% deductible.

- Donations must be made online; cash donations above ₹2,000 are not allowed.

4. Contributions to Political Parties (Section 80GGC)

- If an AOP/BOI donates to a political party or electoral trust, the full amount is deductible.

- Payment must be digital or through a cheque (no cash allowed).

5. Infrastructure & Industrial Business Deductions (Section 80IA, 80IAB, 80IB, 80IBA)

Organisations engaged in the following can claim a 100% tax deduction for 5–10 years:

- Infrastructure projects (roads, bridges, water supply, etc.)

- Special Economic Zones (SEZs)

- Affordable housing projects

- Industrial or power generation projects

6. Tax Benefits for Businesses in Special States (Section 80IC, 80IE)

- Businesses in Himachal Pradesh, Sikkim, Uttarakhand, and Northeast India get 100% tax exemption for 5-10 years.

7. Startups & New Businesses (Section 80IAC)

- Eligible startups registered under DPIIT can get a 100% tax deduction for 3 years.

8. Employment Benefits (Section 80JJAA)

- If an organisation hires new employees, they can claim a 30% deduction on salaries for 3 years.

9. Tax Benefits for Financial Companies (Section 80LA)

- Offshore banking units and financial service centers can claim 100% tax exemption for 5 years.

Tax Saving Options for AOP/BOI/Trust/AJP

Entities under non-company taxation, such as Association of Persons (AOP), Body of Individuals (BOI), Trusts, and Artificial Juridical Persons (AJP), can reduce their tax liability by using various deductions and exemptions.

- Deductions Under Section 80G

Donations made to eligible charitable organisations can be deducted from taxable income. This is especially beneficial for trust income tax calculations.

- Home Loan Interest Deduction (Section 24(b))

If an AOP/BOI/Trust/AJP owns a property, the interest paid on a home loan can be deducted from taxable income.

- Exemptions for Charitable and Religious Trusts

Under Section 11, charitable and religious trusts can claim exemptions on their income if they comply with the set conditions, reducing their taxation of trust liability.

- Employment Generation Incentive (Section 80JJA)

AOPs and BOIs engaged in employment generation can claim a 100% deduction of profits for five years.

- Tax Benefits for Startups (Section 80IAC)

If an AOP or BOI qualifies as a startup, it can avail of a 100% tax deduction for the first three years, reducing its overall income tax for non-company entities.

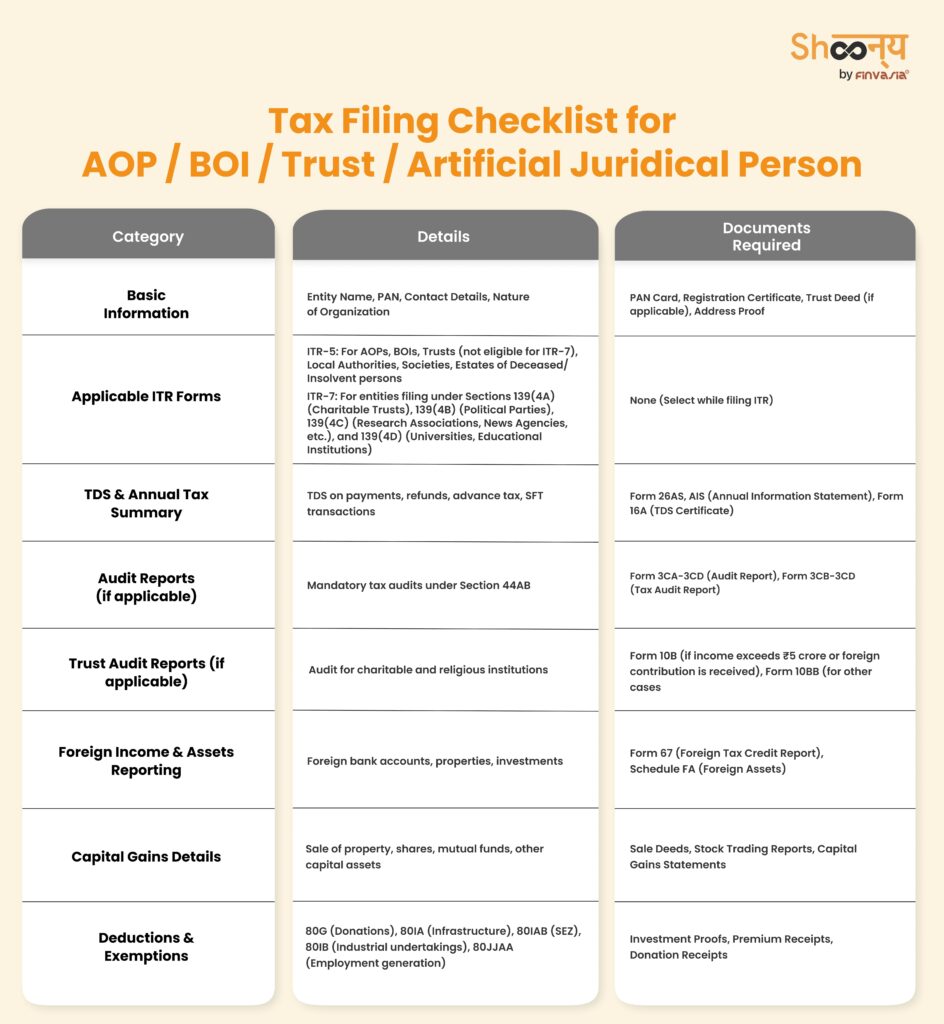

ITR Form for Non- Company

There are a number of forms available for non-company entities in India- Available for Association of Persons (AOP), Body of Individuals (BOI), Trusts, and Artificial Juridical Persons (AJP) for AY 2025-26:

Income Tax Return (ITR) Forms Applicable are:

- ITR-5

For AOPs, BOIs, AJPs, LLPs, cooperative societies, business trusts, and local authorities.

These are not for Charitable/religious trusts that must file ITR-7.

- ITR-7

For entities required to file returns under Sections 139(4A), 139(4B), 139(4C), or 139(4D), such as:

- Charitable/religious trusts

- Political parties

- Research associations, news agencies

- Universities, colleges, or educational institutions

ITR Forms for Non Company Taxation

- Form 26AS & AIS (Annual Information Statement)

- Provides details on tax deducted/collected, SFT transactions, refunds, and tax payments.

- Form 3CA-3CD & 3CB-3CD

- Audit reports for taxpayers whose accounts require auditing under Section 44AB.

- Form 10B & 10BB

- Audit report for charitable/religious trusts under Section 12A(1)(b) or 10(23C).

- Form 10B: If income exceeds ₹5 crore or includes foreign contributions.

- Form 10BB: For all other cases.

- Form 10-IEA & Form 10-IFA

- Form 10-IEA: Opting for the old tax regime instead of the new default tax regime under Section 115BAC.

- Form 10-IFA: Opting for concessional tax rates for new manufacturing cooperative societies under Section 115BAE.

Charitable Trust-Related ITR Forms

- Form 10

- Declaration for accumulation of income for a charitable/religious purpose.

- Form 10A

- Application for registration of charitable/religious trusts or institutions.

- Form 10BD

- Statement of donations received by a charitable/religious trust (to be filed by May 31 each year).

- Form 9A

- Option to carry forward income if the 85% application rule is not met under Section 11(1).

Tax Deduction & TDS-Related Forms

- Form 16A

- A quarterly TDS certificate is issued by the deductor to the deductee.

ITR Filing Checklist for Non-Company- AOP/BOI/Trust/AJP

Before you begin filing your ITR for AOP/BOI/Trust/AJP, make sure you have all the necessary documents and details ready. Here’s a quick checklist to help you stay organised and avoid mistakes.

How to File ITR for Non- Company- AOP/BOI/Trust/AJP

Filing income tax for non-company entities like Association of Persons (AOP), Body of Individuals (BOI), Trusts, and Artificial Juridical Persons (AJP) requires following a structured process.

Here’s how to do it online:

1. Register on the e-Filing Portal

Visit the official Income Tax Department e-filing portal https://incometaxindiaefiling.gov.in and create an account using your PAN, email, and mobile number.

2. Log In

Once registered, log in with your User ID (PAN), password, and captcha code.

3. Choose the Right ITR Form for AOP/BOI/Trust/AJP

The correct ITR form for non-company entities depends on the type of entity:

- ITR-5: Applicable for AOPs, BOIs, AJPs, LLPs, and cooperative societies.

- ITR-7: Required for charitable and religious trusts claiming exemptions under Section 11.

4. Pre-Fill Data

The portal can automatically fill in details like TDS, advance tax payments, and income from Form 26AS. Verify and update if needed.

5. Fill in Deductions and Exemptions

Entities can claim deductions under:

- Section 80G – Donations to eligible charities.

- Section 80JJA – Profits from waste management businesses.

- Tax exemptions under Section 11 – Applicable for charitable trusts to reduce trust income tax.

6. Review and Validate

Double-check income details, deductions, and tax-saving options for non-company entities before proceeding.

7. Calculate and Pay Tax

The portal will compute the income tax for AOP/BOI/Trust/AJP based on the applicable non-company tax slabs. Any outstanding tax must be paid online through net banking, UPI, or challan payment.

8. Submit the ITR

After ensuring all details are correct, submit the return and choose an e-verification method:

- Aadhaar OTP

- Net banking

- Digital signature

9. Get Your Acknowledgment

After submission, download the ITR-V acknowledgment and verify it within 30 days to complete the process.

Following these steps ensures smooth compliance with non-company taxation laws, helping AOPs, BOIs, Trusts, and AJPs file returns accurately while maximising deductions.

Income Tax For Non Company in India: Mistakes AOP, BOI, Trusts & AJPs Should Avoid

Mistakes to Avoid While Filing Income Tax for AOP/BOI/Trust/AJP

- Using the Wrong ITR Form

Filing the correct ITR form for non-company entities is crucial. AOP/BOI/Trust/AJP must use ITR-5 or ITR-7, depending on their tax status. Selecting the wrong form can delay processing or result in penalties.

- Missing the Filing Deadline

Entities under non-company taxation must file returns on time to avoid penalties and interest. Late filing can lead to additional tax liability under the non-company tax slab system.

- Incorrect Income Distribution

For AOPs (Association of Persons) and BOIs (Body of Individuals), if member shares are unknown, the taxation of AOP follows the maximum marginal tax rate. Misallocating income can increase tax liability.

- Not Claiming Deductions

Entities can reduce their income tax for non-company by claiming deductions like Section 80G (donations) and Section 24(b) (home loan interest).

- Ignoring Trust Tax Rules

The taxation of trust varies depending on whether it is charitable or private. The tax rate for trust differs based on its registration status, and missing exemptions can lead to higher trust income tax.

This ends our tax planning guide for AOP/BOI/Trust/AJP in India.

Don’t forget to keep a check on the tax slabs, and latest deductions for non company in India!

Income Tax for AOP/BOI/Trust/AJP: FAQs

The tax rate for AOP/BOI depends on whether the share of members is determined. If known, members are taxed individually; if unknown, the maximum marginal rate (30%) applies.

AJP (Artificial Juridical Person) refers to non-human legal entities like universities, temples, or other institutions that are taxed separately under the Income Tax Act of 1961.

An AOP (Association of Persons) is a group of individuals/entities earning income jointly, while a BOI (Body of Individuals) consists only of individuals earning collectively.

AOPs must file ITR-5, except for charitable trusts, which file ITR-7 if claiming exemptions under Section 11.

Co-operative societies are generally taxed, but specific exemptions apply under Sections 80P and 115BAD based on their nature and activities.

Yes, AOPs must deduct TDS on payments such as rent, professional fees, and contracts, as per applicable TDS sections under the Income Tax Act.

Public charitable trusts with Section 12A/80G registration may be exempt under Section 11, while private trusts are taxed at individual slab rates or a 30% maximum marginal rate.

Trusts registered under Section 12A/12AB must file ITR-7 on the Income Tax e-Filing portal, report income and expenses, and claim exemptions under Section 11 before verifying and submitting.

Source- Incometax.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.