Think of ETF investing as the “create your own pizza” aspect of the investment world. Just as you pick and choose your favourite toppings to build a personalised pizza, ETFs combine different financial ingredients to craft a unique investment blend. These ingredients include stocks, bonds, and other assets, carefully selected to create a well-rounded investment dish.

For instance, imagine you’re a pizza lover who enjoys a variety of flavours. Instead of ordering separate pizzas, you opt for a customisable pizza where you can have a slice of pepperoni, a slice of mushroom, and another slice of olives. Similarly, an ETF lets you have a slice of technology, a slice of healthcare, and even a slice of energy – all within a single investment.

This simplicity is the heart of ETFs. They offer you a diversified investment platter without the need to painstakingly choose and manage each individual piece.

Understanding ETFs: How To Invest in ETFS Online

Before we delve into the nitty-gritty, let’s grasp the essence of ETFs. Imagine ETFs as baskets that hold a mix of assets like stocks, bonds, or commodities. These baskets are traded on stock exchanges, just like individual stocks. Unlike mutual funds, which are priced at the end of each day, ETFs can be bought and sold throughout the trading day.

The ETF Process: From Creation to Investment

Ever wondered how ETFs came into existence? It’s a fascinating process where financial architects create these investment wonders. Think of it like assembling ingredients for a recipe. These ingredients, which represent various assets, are carefully combined to form ETF shares. These shares are then available for you to purchase, giving you instant exposure to a diversified portfolio.

You can choose an online trading platform, open a free demat account and start trading in ETFs.

How ETFs Work: Understanding the ETF Process

ETFs, or Exchange-Traded Funds, are like investment bundles. Imagine a basket holding various stocks or assets, like a mini stock market. When you buy an ETF share, you own a tiny piece of that basket. ETFs follow an index (list of stocks) or focus on a theme (like tech or energy). As the stocks in the basket change in value, the ETF’s price does, too. This lets you invest in multiple companies at once. ETFs trade on stock exchanges like regular stocks. They offer diversification and can be bought or sold throughout the trading day, providing an easy way to start investing in the stock market.

ETFs vs. Mutual Funds

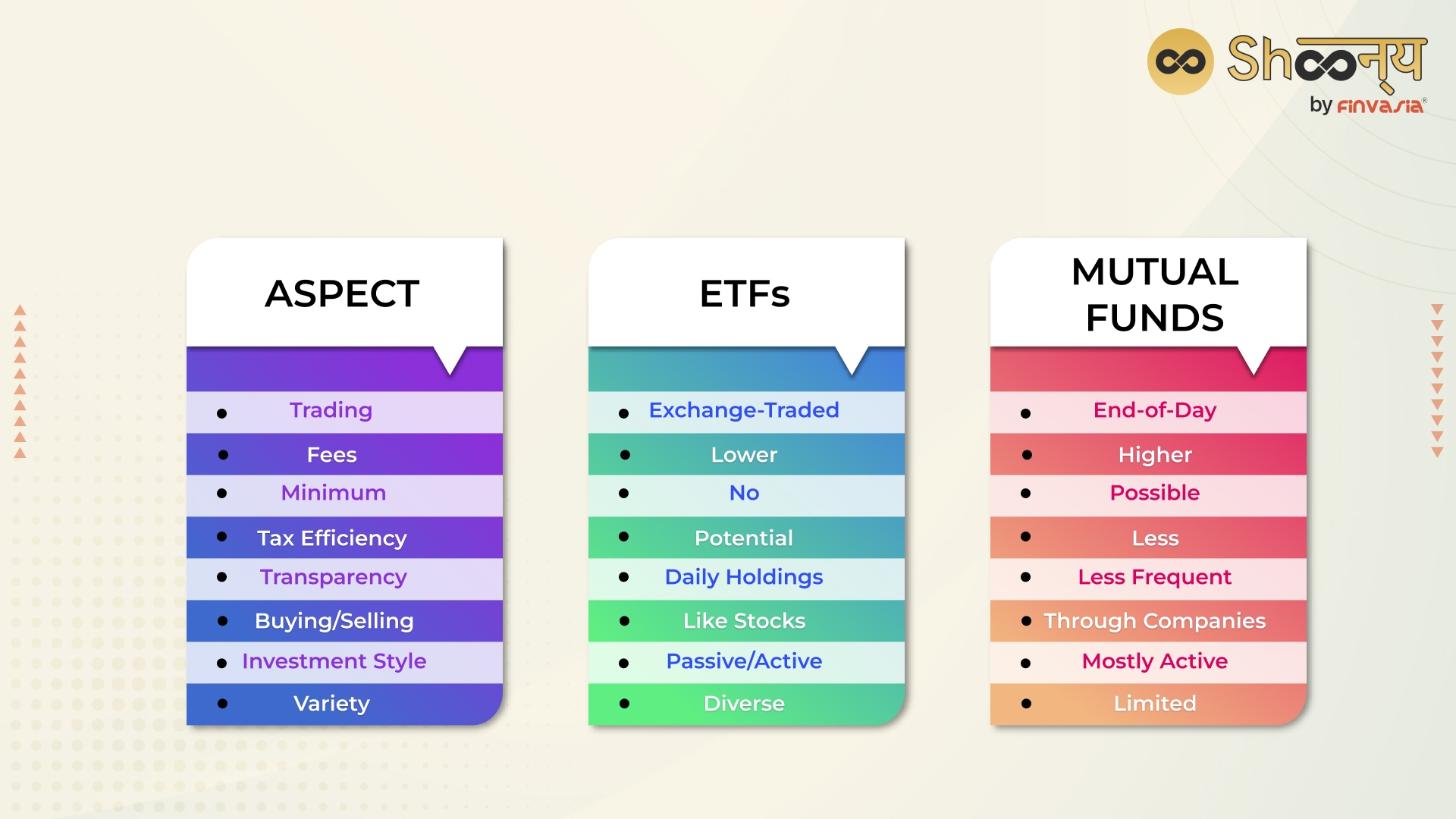

Certainly, here’s a concise table differentiating ETFs and Mutual Funds:

ETFs (Exchange-Traded Funds) trade on exchanges throughout the day, like stocks, while mutual funds are priced once a day. ETFs usually have lower fees, no minimum investments, and can be tax-efficient. Mutual funds are bought through fund companies, often with higher fees and potential capital gains taxes.

ETFs vs Index Mutual Funds: Making the Choice

While both aim to mirror market benchmarks, ETFs offer a unique advantage. They can be traded throughout the day, much like buying and selling items from a store whenever you please. On the other hand, index mutual funds are priced just once daily.

| Aspect | ETFs (Exchange-Traded Funds) | Index Mutual Funds |

| Trading | Like stocks on exchanges | Traded only at the end of the trading day |

| Price Changes | Throughout the trading day | Based on net asset value (NAV) |

| Buying/Selling | Bought/sold at market prices | Bought/sold at NAV price |

| Expense Ratios | Generally lower | Generally higher |

| Tax Efficiency | Often more tax-efficient | May have tax implications |

| Brokerage Commissions | May have brokerage commissions | Typically no brokerage fees |

| Trading Flexibility | More suitable for intraday trading | Better for long-term investing |

| Purchase Method | Bought using a brokerage account | Purchased through fund companies |

Remember, the choice between ETFs and Index Mutual Funds depends on your investment goals, preferences, and strategy.

Benefits of Investing in ETFs: Your Financial Arsenal

Why should you consider ETFs for your investment journey? The benefits are aplenty.

· With ETFs, you can achieve instant diversification by owning a piece of multiple assets.

· These assets are carefully selected to potentially cushion against market volatility.

· Additionally, ETFs often come with lower fees compared to other investment options, allowing you to keep more of your returns.

Bond Funds vs Bond ETFs: Deciphering Fixed-Income Investments

When it comes to fixed-income investments, bond funds and bond ETFs take the stage. Bond ETFs offer the advantage of real-time trading, just like buying and selling stocks. They provide a convenient way to invest in fixed-income securities without the need to manage individual bonds.

| Aspect | Bond Funds | Bond ETFs |

| Structure | Managed by professional portfolio managers | Traded on stock exchanges like individual stocks |

| Trading | Priced at the end of each trading day | Bought and sold throughout the trading day |

| Intraday Price | Price remains constant throughout the day | Prices fluctuate in real-time |

| Cost Efficiency | Generally higher expense ratios | Typically lower expense ratios |

| Diversification | Can offer a diversified mix of bonds | Provide exposure to a wide range of bonds |

| Transparency | Holdings disclosed less frequently | Real-time transparency in holdings and prices |

| Liquidity | Liquidity can be lower due to fixed pricing | High liquidity due to real-time trading |

| Tax Efficiency | Potential capital gains taxes on sales | Tax-efficient “in-kind” creation and redemption |

| Investment Size | Minimum investment amounts can vary | May require a brokerage account and trading |

| Flexibility | Offers simplicity and ease of investment | Provides flexibility through real-time trading |

Taxes on ETFs in India

Tax Rates: Holding onto ETFs for over a year lands you in the territory of long-term capital gains rates for taxation. These rates can reach up to 23.8%, which includes the 3.8% Net Investment Income Tax (NIIT) for high earners. In contrast, ETFs held for less than a year are subjected to ordinary income rates, reaching as high as 40.8%.

Dividends: The dividends that an ETF annually doles out to its investors can fall into two categories: qualified or nonqualified dividends. Qualified dividends enjoy a tax rate of no more than 15% (some investors even get away with zero taxation), while nonqualified dividends face ordinary income rates.

Taxable Events: The moment an investor sells an ETF and rakes in a capital gain, they find themselves in the crosshairs of the capital gains tax. Currently, the tax rates for long-term capital gains are divided into 0%, 15%, and 20%, contingent on your taxable income.

Why Invest in ETFs: The Indian Perspective

For investors in India, ETFs present a strategic avenue for growth. With diverse sectors and tax advantages, ETFs empower you to navigate the Indian market confidently.

- Diverse Exposure, One Investment: ETFs offer Indians a convenient way to access a wide range of stocks or bonds in a single investment, providing instant diversification.

- Cost-Effective Choice: With typically lower expense ratios compared to mutual funds, ETFs present an affordable option for Indian investors aiming to maximize returns.

- Market Flexibility: ETFs trade like stocks, allowing Indian investors to buy and sell throughout the trading day, offering agility in capitalizing on market movements.

- Tax Efficiency: ETFs in India often come with potential tax advantages, making them an attractive choice for investors looking to optimize their tax liabilities.

- Leveraging Sector Growth: Indians can tap into specific sectors’ growth potential through sector-based ETFs, aligning with India’s dynamic economic landscape.

Conclusion

ETF investing opens the door to the world of finance, offering a blend of simplicity and growth potential. By understanding the basics, processes, and benefits of ETFs, you’re equipped to make informed decisions that align with your financial goals. Remember, investing is a journey, and ETFs provide a reliable vehicle to confidently embark on that journey.

So, whether you’re looking to diversify your portfolio or take your first step into investing, ETFs offer a versatile and accessible pathway.

Start your ETF investment journey today with a free DEMAT account.

FAQs

Yes, investing in ETFs can be a good choice for beginners. They offer diversification, flexibility, and often lower fees compared to other investments.

To start buying ETFs, you’ll need a brokerage account. Choose an ETF that aligns with your goals, place an order through your broker, and the ETF shares will be added to your investment portfolio.

Yes, ETFs are suitable for beginners due to their simplicity and ability to provide exposure to a range of assets without the complexity of managing individual stocks.

Absolutely, ETFs are designed with beginners in mind. They offer an easy way to enter the world of investing and can be a valuable addition to your portfolio.

ETFs can be a good investment choice due to their potential for diversification, liquidity, and cost-effectiveness. However, it’s important to research and choose ETFs that align with your financial goals.

An ETF- Exchange-Traded Fund is an investment fund with a collection of assets, such as stocks, bonds, or commodities. ETF trades on stock exchanges and replicates the performance of a specific market index.

Yes, you may be subject to taxes on the gains earned from ETF investments. The tax implications depend on factors such as your country’s tax laws and your individual tax situation.

In India, ETFs are treated similarly to stocks for tax purposes. Capital gains tax is applicable based on the holding period – short-term gains (held for less than 1 year) are taxed at a higher rate than long-term gains.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.