Is SIP Safe for Your Money- Risks, Rewards, and Rules

Our parents saved through fixed deposits. Today’s generation looks at SIPs as the smarter way to build wealth. From young professionals in Bengaluru to families in Delhi, SIPs (Systematic Investment Plans) have become a go-to way for Indians to build wealth slowly and steadily.

Still, with constant headlines about market swings, global slowdowns, or friends warning about “risk,” it’s natural to pause and ask: “Is SIP really safe in 2025?”

The truth is, SIP isn’t a get-rich-quick scheme, but it also isn’t a gamble if you know how it works.

This guide answers the key questions about SIPs. Let’s explore how these systematic plans can keep your investments safer in 2025 and beyond!

What Is SIP?

The SIP full form in mutual fund is Systematic Investment Plan, which simply means investing a fixed amount in a disciplined, regular manner. “You don’t need to watch the market daily, but your money is invested regularly, whether the market is up or down. This strategy helps in rupee cost averaging.

To help you understand, you buy more units when prices are low and fewer units when prices are high, reducing the impact of market volatility over time.

A SIP is a simple way to invest in mutual funds regularly instead of putting in a big lump sum all at once. Think of it like a regular monthly savings account. You invest a fixed amount (say ₹100, 500, ₹1,000, or more) on a particular date, and that money automatically buys units of a mutual fund for you.

SIPs can be started in different types of mutual funds, such as equity, debt, hybrid, or ELSS, depending on your goals and the level of risk you’re willing to take.

Is SIP Safe or Not?

SIP is safe if you understand what you’re investing in and choose the right mutual fund for your goals. It’s important to remember that SIP is just a method of investing in mutual funds. However, it does not remove market risks completely.

When you invest through SIPs in equity mutual funds, your returns will move up and down with the stock market. For most investors in India, whether investment in SIP is good or bad depends on:

- Time Aspect: SIPs are suitable for long-term goals like retirement, a child’s education, or buying a house.

- Fund Selection: Picking the correct mutual fund category, like large-cap, index fund, balanced advantage, etc.

Is SIP Safe for Long Term?

If your goal is short-term, for instance, like a vacation in 6 months, then SIP is not safe for that purpose, because the market could be down when you need the money. But if you’re investing for 5, 10, 15 years or more, trends suggest that SIPs can be an effective way to build long-term wealth when approached consistently and wisely.

Are SIP Returns Taxable and Can SIP Save Tax?

Yes! SIP returns are taxable in India.

But again, how much tax you pay depends on the type of mutual fund you invest in and how long you hold your investment.

1. Equity Mutual Fund SIPs

- <12 months short-term capital gains tax of 15%.

- >12 months long-term capital gains tax of 10% on profits above ₹1 lakh per financial year.

2. Debt Mutual Fund SIPs (as per recent tax rules)

- No longer eligible for indexation benefits.

- All gains are added to your taxable income and taxed as per your income slab rate.

3. ELSS SIPs (Equity Linked Savings Scheme)

- Eligible for tax deduction under Section 80C up to ₹1.5 lakh in a FY.

- Provides a 3-year lock-in period.

- Gains are taxed like equity mutual funds.

For instance, if you start a ₹10,000 monthly SIP in an ELSS fund, your total investment in a year will be ₹1.2 lakh, all of which can reduce your taxable income (within the ₹1.5 lakh 80C limit).

Can SIP Be Started Online?

Yes, you can start your SIP digitally.

At Shoonya, we offer free Demat account opening, commission-free investing, and access to 5000+ direct mutual funds. With instant KYC and an easy dashboard, you can begin your SIP in just a few clicks.

- Sign up for a Shoonya account online and complete your KYC in minutes.

- Once your account is active, log in to the Shoonya mobile app (Android or iOS) or Shoonya.com.

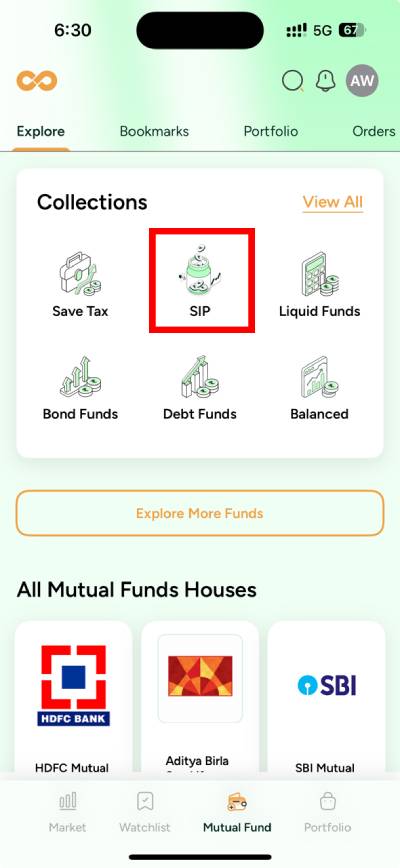

- From the dashboard, navigate to the Mutual Funds tab. Here, you can select SIP from Collections. Here you will view available schemes from top fund houses.

- Once decided, click on the Invest Now button and the amount you want to invest (starting as low as ₹100) and pick a convenient date.

Tip: To stop, modify, or switch your SIP, you can raise a request by mail.

Which SIP To Invest in?

The best SIP for you depends on your investment goal, time horizon, and risk appetite.

1. For Long-Term Wealth Creation (10+ years)

- Large-Cap Funds: Invest in top companies; relatively stable compared to mid/small caps.

- Index Funds: Track a market index like Nifty 50; low-cost and reliable.

- Flexi-Cap Funds: Invest across large, mid, and small-cap stocks for balanced growth.

2. For Medium-Term Goals (3–7 years)

- Hybrid or Balanced Advantage Funds: Mix of equity and debt for stability and moderate growth.

3. For Short-Term Goals (1–3 years)

- Debt Funds or Liquid Funds: Safer, lower returns, minimal volatility.

4. For Tax Saving

- ELSS (Equity Linked Savings Scheme): Eligible for Section 80C deduction up to ₹1.5 lakh per year, with a 3-year lock-in.

Does SIP Have a Lock-in Period?

It depends on the sort of mutual fund you pick.

- Regular Mutual Fund SIPs: No lock-in period. You can redeem your units anytime (subject to exit load, if applicable).

- ELSS (Tax-Saving) SIPs: Each instalment has a 3-year lock-in period because it’s eligible for tax benefits under Section 80C.

- Close-Ended Funds: If you invest in a close-ended scheme via SIP, your money will be locked until the scheme matures.

Does SIP Have an Exit Load?

An exit load is a minor fee levied by the mutual fund if you remove your investment before a defined term. It’s aimed at discouraging short-term withdrawals. For example, if a fund has a 1% exit load for redemptions within 12 months, units acquired in July 2025 and held until July 2026 will incur the cost.

Typical Exit Load Rules in India:

- Equity Funds: Often 1% if redeemed within 12 months.

- Debt Funds: Varies from nil to a few months’ lock-in with minor charges.

- ELSS Funds: No exit load, but a 3-year lock-in already applies.

Is SIP Better Than RD?

| Feature | SIP (Systematic Investment Plan) | RD (Recurring Deposit) |

| Returns | Market-linked; historically 10–15% over the long term for equity SIPs. Can fluctuate. | Fixed returns (5–7%) decided by the bank; no fluctuation. |

| Risk | Subject to market risk; value may rise or fall in the short term. | Risk-free; capital and interest are guaranteed. |

| Taxation | Gains taxed as per mutual fund rules (equity/debt). | Interest is fully taxable as per your income slab. |

| Liquidity | Can redeem anytime (subject to exit load in some cases). | Premature withdrawal is allowed but may incur a penalty. |

| Best For | Long-term wealth creation (retirement, child’s education, property purchase). | Short-term savings or guaranteed returns with zero risk. |

| Inflation Protection | Higher potential to beat inflation over the long term. | Limited, fixed returns may not always keep up with inflation. |

SIP Vs Mutual Fund

| Feature | SIP (Systematic Investment Plan) | Mutual Fund (General) |

| Definition | An investment method where you invest a fixed amount at regular intervals in a mutual fund. | An investment product that pools money from investors to invest in stocks, bonds, or other assets. |

| Investment Frequency | Regular (monthly, quarterly, etc.). | Can be a lump sum (one-time) or through SIP. |

| Risk | Same as the mutual fund chosen, market-linked. | Depends on the type of mutual fund (equity, debt, hybrid, etc.). |

| Returns | Market-linked; benefits from rupee cost averaging over time. | Market-linked; returns vary depending on when and how much you invest. |

| Best For | Investors who want disciplined, gradual investing without timing the market. | Investors who can invest a lump sum or prefer flexible investment schedules. |

| Example | Investing ₹5,000 every month in an equity mutual fund. | Investing ₹1,00,000 at once in the same equity mutual fund. |

Situations Where SIPs May Not Be a Good Option

The following are some cases where SIP may not work well:

- Short-Term Goals: Need money in 1–2 years? Equity SIPs are risky; you could opt for debt funds or FDs.

- Low Risk Tolerance: If market ups and downs stress you, you should avoid equity SIPs.

- Unstable Income: Fixed monthly SIPs can be hard; you might want to consider flexible SIPs.

- Want Guaranteed Returns: SIPs are market-linked; you should explore other options like RD/PPF for fixed growth.

- Quick Profit Mindset: SIP works for long-term wealth, not short-term gains.

Common Mistakes To Avoid While Investing in SIPs

- Stopping During Market Falls: It’s natural to worry when markets dip. But stopping your SIP during such times means you miss the chance to buy more units at lower prices.

- Chasing Past Performance: Just because a fund did well last year doesn’t mean it will always deliver the same results. Choose funds based on your goals and risk comfort, not only on past returns.

- Ignoring Portfolio Review: You must review your SIPs every 6–12 months helps you check if the fund is still aligned with your goals.

- Over-Diversifying: Too many SIPs can scatter your money. Stick to a few that match your goals instead of overloading yourself with a long list.

- No Goal Planning: Invest with a clear purpose and time frame. Define your goals, like retirement, education, or wealth creation and plan accordingly

Conclusion: Investment in SIP is Good or Bad

Even after understanding how SIPs work, you may still ask, “Is SIP safe.

The answer is, SIPs are not completely risk-free because they are linked to the performance of mutual funds and market movements. By investing regularly, you benefit from rupee cost averaging, which can reduce the impact of short-term volatility. The only demand is to remain disciplined, pick the right fund, and avoid panic-selling during market dips.

Is SIP Safe | FAQs

Yes. SIPs are market-linked, so their value can go up or down depending on the performance of the mutual fund you choose.

Yes, in the short term, SIPs can show losses during market downturns. Over the long term, they usually recover and grow if you stay invested.

No. SIPs are not risk-free. The risk level depends on the type of mutual fund; equity SIPs have higher risk, and debt SIPs have lower risk.

Yes. You can redeem your investment partially or fully at any time (except in ELSS funds, which have a 3-year lock-in). Exit load may apply in some funds.

Yes. You can start a SIP for 1 year, but short-term SIPs in equity funds may not deliver the best results due to market volatility.

You can begin your SIP journey with as little as ₹100 per month.

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.