Do you want to invest in mutual funds but don’t have a lot of money or time? You need to know what is SIP.

It’s a game-changer, allowing you to kickstart mutual fund investments with as little as ₹500.

Sounds crazy?

But, It’s true.

In this blog, we will understand what SIP is, what are its benefits, how it works, what are the risks involved, what are the types of SIP, how it is taxed, and how to start and select SIP investments.

What is SIP Investment

SIP stands for Systematic Investment Plan. SIP investment is a smart, disciplined and convenient way of investing in mutual funds regularly. Instead of putting a lump sum amount all at once, you contribute a small sum every month.

SIP in share market allows you to invest a fixed amount at regular intervals in a mutual fund scheme in which you wish to invest and earn a high return over time.

Let’s say you decide to invest Rs. 500 every month.

With SIP in mutual funds, you’re consistently putting that amount into your chosen stocks or mutual funds. It’s like making regular deposits into your investment account, regardless of whether the market is bullish or bearish.

How do SIP Investments Work? Let us Understand this with an Example.

Think of it like buying vegetables monthly.

Some days, tomatoes might be pricey, and you get fewer. On other days, they might be cheaper, and you get more. But because you buy regularly, over time, you end up with a good quantity.

SIP investment operates similarly.

Sometimes, you can buy more shares when prices are low and fewer when the prices are high. Over time, this strategy helps in reducing the impact of market volatility and steadily grows your investment.

Why is SIP in Mutual Funds Great for Beginners?

SIP investments help you start small, stay consistent, and watch your investments grow with some advantages:

- Mitigates Risks: Regular, smaller investments reduce the risk of putting all your money in at the wrong time.

- Affordable Entry: You don’t need a large sum to get started with SIP in share market.

You can start with ₹500.

- Consistent Growth: Regular SIP investments beat trying to time the unpredictable stock market.

How do You Invest in SIP?

SIP in mutual funds is a user-friendly investment.

You can choose the amount, duration and frequency of your SIP investment and set up a mandate with your bank to deduct the amount automatically from your account and invest it in the mutual fund.

SIP allows you to invest in different kinds of mutual funds, such as equity, debt, hybrid, or balanced funds, depending on your risk-taking capability and the returns that you expect from SIP investments.

1. Equity SIP

In Equity SIP, you invest your money in mutual funds that primarily invest in stocks or equities of companies.

Imagine you want to invest regularly in companies like Infosys, Reliance, or HDFC. Equity SIP allows you to do this by investing a fixed amount in these mutual funds every month.

2. Debt SIP

Debt SIP involves investing in mutual funds that invest in fixed-income securities, which include corporate bonds, government bonds, or other debt instruments.

If you prefer a more stable and less risky investment, Debt SIP might be suitable. It’s like lending money to the government or companies, and they pay you interest regularly.

3. Hybrid SIP

Hybrid SIP combines both equity and debt components in a single mutual fund. This provides a balanced approach, aiming to offer some growth potential while minimising risk.

Consider a mutual fund that invests part of your money in stocks for growth and part in bonds for stability. Hybrid SIP is like having a mix of both worlds to balance risk and return.

4. Tax-saving SIP (ELSS)

Tax-saving SIP, also known as Equity Linked Savings Scheme (ELSS), allows you to invest in equity mutual funds while offering tax benefits under Section 80C of the Income Tax Act.

Example

Suppose you want to save on taxes while aiming for long-term wealth creation. ELSS SIP lets you do this by investing in equity funds, and the invested amount is deductible from your taxable income.

5. Index SIP

Index SIP involves investing in mutual funds that aim to replicate the performance of a market index like Nifty or Sensex.

If you believe in the overall growth of the stock market and don’t want to pick individual stocks, Index SIP allows you to invest in a mutual fund that mirrors the performance of a market index.

How does SIP work?

SIP works in a simple and systematic way, as follows:

• You can choose a mutual fund scheme that suits your risk profile and investment objective and decide the amount, frequency, and duration of your SIP investment.

• You fill out a SIP application form and a bank mandate form and submit them to the mutual fund house or an online trading platform along with the required KYC documents.

• You get a confirmation when your SIP is registered.

• Your bank account is debited the SIP amount every month or quarter, as per your preference, and the amount is invested in the mutual fund scheme you have chosen.

• You must track the performance of your SIP investment online or offline and make changes or withdrawals as per your need.

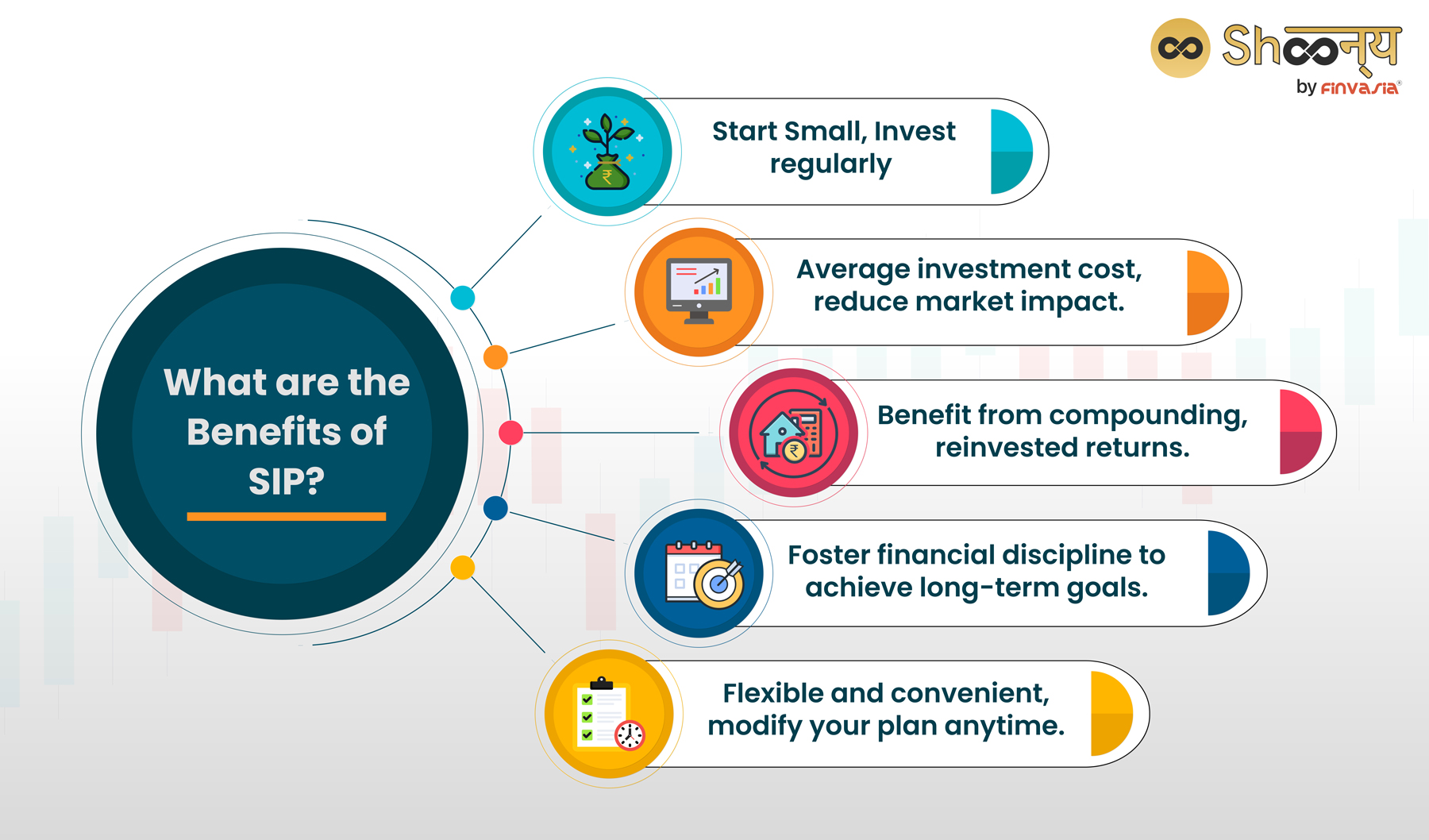

What are the Benefits of SIP?

SIP has many benefits for investors, such as

• Discipline: SIP helps you develop a habit of saving and investing regularly, which can help you achieve your long-term goals.

• Convenience: SIP is easy to kick-start and stop, and you can do it online or offline with just a few clicks or documents.

You don’t have to worry about timing the market or tracking the performance of your investments, as SIP does it for you automatically.

• Rupee Cost Averaging: SIP helps you reduce the impact of market fluctuations by averaging out the cost of your investments over time.

When the market is doing well, you get fewer units of the mutual fund. But when the market is bearish, you get more units. This means you end up buying more units when prices are low and less units when prices are high. As a result, your average cost per unit becomes lower.

• Compounding: SIP helps you grow your wealth faster by reinvesting the returns you earn from your investments. This creates a compounding effect, where you earn interest on interest, and your money multiplies over time.

• Flexibility: SIP gives you the freedom to choose the amount, frequency, and duration of your investment, as well as the type of mutual fund you want to invest in.

You can also increase or decrease your SIP amount or switch or stop your SIP anytime, as per your convenience and financial situation.

Is There Any Risk in SIP?

Just like other stock market investments, investing through SIP (Systematic Investment Plan) also includes certain risks because it relies on how well the chosen mutual fund scheme performs.

Various types of mutual funds come with varying levels of risk and potential returns. It’s essential to select a fund that aligns with your comfort level for risk and the duration you plan to invest.

- Generally, equity funds are more risky but have higher returns, while debt funds are less risky but have lower returns.

- Hybrid or balanced funds are somewhere in between, offering a mix of risk and return.

To minimise the risk associated with SIP, consider spreading your investments across various types of mutual funds and committing to a more extended investment period. This diversification and longer-term approach can help mitigate potential risks.

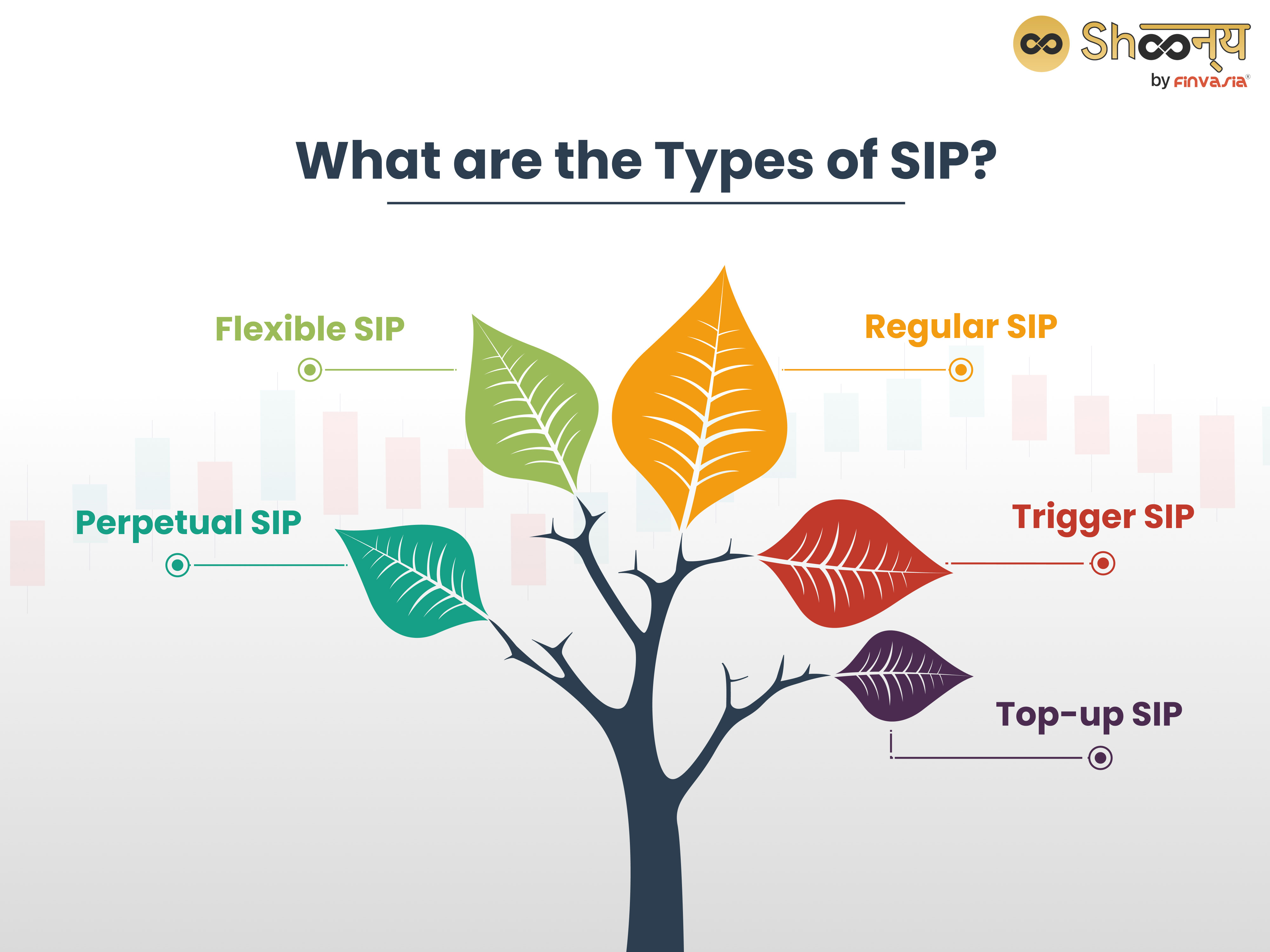

What are the Types of SIP?

- Regular SIP

This is the simplest type of SIP, where you invest a fixed amount at regular time intervals i.e. monthly, quarterly, or yearly. This helps you to accumulate a large corpus over time with small contributions.

So, imagine this as your go-to, regular investment routine. You decide to put ₹5,000 every month into an Equity Mutual Fund – a fixed amount, month after month.

It’s like setting aside a part of your monthly earnings for an investment adventure in the stock market.

When to Opt

Go for a Normal SIP if you’re into the whole “consistency is key” vibe. Perfect when you have a steady amount to spare each month for your long-term financial goals.

- Trigger SIP

This allows you to set a trigger for your SIP mutual fund investment, such as a specific date, NAV level, or market index. When the trigger is met, your SIP amount is automatically invested in the mutual fund of your choice. This helps you to take advantage of favourable market movements and optimise your returns.

Now, think of Trigger SIP as the cool, automated buddy.

You tell it, “Hey, invest an extra ₹2,000 in a Debt Mutual Fund if the market decides to take a nosedive by 10%.”

It’s like having a friend who automatically sends you a coffee when they sense you’re having a tough day.

When to Opt

Opt for it when you want your investments to respond to specific market conditions without you constantly watching.

- Top-up SIP

This SIP investment allows you to increase your investment amount periodically, such as every year or every quarter. Thus, you can invest more when your income increases and also benefit from the power of compounding.

Top-up SIP is like the growth spurt in your investment journey.

You begin with ₹3,000 monthly in an Index Mutual Fund and every year, you add an extra ₹500.

It’s like giving your investments an annual bonus.

Imagine your investment evolving over time, just like upgrading your phone every year.

When to Opt

When you foresee your income getting a boost over the years, Top-up SIP is your friend. Opt for it to level up your investments gradually.

- Perpetual SIP

This type of SIP does not have a fixed end date and continues until you stop it. This helps you to stay invested for the long term and achieve your financial goals.

Perpetual SIP is like setting and forgetting but in a good way.

You decide to invest ₹4,000 every month in a Hybrid Mutual Fund, and it just keeps going until you decide to hit the pause button.

It’s like having a subscription for financial growth that you can cancel whenever you want.

When to Opt

If you’re in for the long haul and don’t want the hassle of renewing your investment plan periodically, Perpetual SIP is the perfect SIP investment choice.

- Flexible SIP

This type of SIP gives you the flexibility to change your investment amount or frequency according to your convenience or market conditions. You can increase or decrease your SIP amount or pause or resume your SIP as per your wish.

Flexibility is the name of the game here. You have a Flexible SIP of ₹6,000 per month in an ELSS Mutual Fund. Depending on your financial vibe, you can adjust the monthly investment between ₹5,000 and ₹7,000.

It’s like having an adjustable workout plan for your finances.

When to Opt

Choose Flexible SIP if your income is a bit of a rollercoaster. Opt for it when you want to tweak your investment strategy based on how your finances are doing.

Is SIP tax-free?

SIP is not tax-free, as it depends on the type of mutual fund you invest in and the duration of your investment.

The tax treatment of SIP is as follows:

Equity funds: In case you invest in equity funds through SIP and redeem your investment after one year, you have to pay a long-term capital gains tax of 10% on the gains that exceed Rs. 1 lakh in a financial year.

If you redeem your investment before one year, you must pay a short-term capital gains tax of 15% on the gains.

• Debt funds: In case you invest in debt funds through SIP and redeem your investment after three years, you have to pay a long-term capital gains tax of 20% with indexation benefit on the gains.

Indexation benefit means adjusting the cost of your investment with inflation, which reduces your taxable gains.

If you redeem your investment before three years, you have to pay a short-term capital gains tax as per your income tax slab on the gains.

• ELSS funds: By opting for Systematic Investment Plans (SIP) in Equity Linked Savings Schemes (ELSS), you become eligible for a tax deduction of up to Rs. 1.5 lakh as per Section 80C of the Income Tax Act.

However, you have to stay invested for at least three years, as ELSS funds have a lock-in period of three years.

The gains from ELSS funds are taxed as equity funds.

How to Start a SIP investment?

Starting a SIP investment is very easy and simple, and you can do it online or offline, as follows:

Start SIP in Mutual Funds Online

You can start a SIP investment online through the mutual fund house or through an online trading platform.

You just need to register yourself, complete your KYC process, choose a mutual fund scheme, and set up a SIP mandate with your bank.

It is now easy to track and manage your SIP investment online and make changes or withdrawals as per your needs.

How to Start SIP in Mutual Funds Offline

To start an offline SIP in a mutual fund, follow these steps:

1. Scheme Selection:

· Choose a mutual scheme that aligns with your investment objectives.

· Visit the fund house’s office.

2. Application Form:

Fill out the application form with your name, address, chosen scheme, SIP amount, and tenure.

3. KYC Formalities:

· Complete the KYC (Know Your Customer) formalities.

· Fill out the relevant KYC-related form.

4. Document Submission:

You must submit the filled forms along with all the necessary documents.

5. Payment:

· Pay the SIP amount as per your investment plan.

· Ensure the correctness of the payment details.

6. Confirmation:

· Receive confirmation of payment receipt.

· Obtain units of the selected schemes.

By following these steps, you can initiate an offline SIP and start investing through SIP in mutual funds.

How Do You Select Mutual Funds for SIP?

Selecting mutual funds for SIP is an important decision, as it will determine the risk and return of your investment.

You should consider the following factors while selecting mutual funds for SIP:

• Your risk profile: You should choose a mutual fund scheme that matches your risk appetite and tolerance.

- If you are a conservative investor, one who doesn’t want to take any risks, you should opt for debt funds, which are less risky but have lower returns.

- If you are an aggressive investor (a risk taker), you should opt for equity funds, which are more risky but have higher returns.

- If you are a moderate investor(one who likes to play safe), you should opt for hybrid or balanced funds, which offer a mix of risk and return.

• Your investment objective: You should choose a mutual fund scheme that aligns with your investment goal and horizon.

- Let’s say you are investing for a short-term goal, such as buying a car or going on a vacation; you should opt for debt funds, which are more stable and liquid.

- If you are investing for a long-term goal, such as retirement or children’s education, you should opt for equity funds, which have the potential to generate higher returns over time.

- If you are investing for a medium-term goal, such as buying a house or starting a business, you should opt for hybrid or balanced funds, which offer a balance of growth and stability.

• The fund’s performance: You should choose a mutual fund scheme that has a consistent and superior track record of performance compared to its benchmark and peers.

You should look at the fund’s returns over different time periods, such as 1 year, 3 years, 5 years, and 10 years, and compare them with the category average and the benchmark index.

To sum up, SIP is a smart and convenient way to invest in mutual funds, but it is not tax-free. The tax you have to pay depends on the type of mutual fund you choose, how long you stay invested, and how much you earn from your investment. You should consider all these factors before choosing a SIP investment plan.

FAQs | SIP Investments

SIP (Systematic Investment Plan) and FD (Fixed Deposit) are different ways to invest. SIP involves regularly investing a fixed amount, benefiting from rupee cost averaging, compounding, and market cycles. FD, on the other hand, requires a lump sum investment for guaranteed returns and capital preservation. Whether SIP or FD is better depends on your investment goals.

Yes, you can invest 1000 ₹ per month in SIP. Many mutual fund schemes allow SIP starting with a minimum amount of 500 ₹ or 1000 ₹ per month.

Yes, you can withdraw your SIP investments anytime, except when there’s a lock-in period, such as with tax-saving ELSS funds. However, you need to be aware of the potential exit load and capital gains tax based on your investment type and duration.

SIP and lumpsum are both suitable for mutual fund investments, depending on your affordability, risk tolerance, and market conditions. SIP is ideal for investing small amounts regularly and

avoiding market timing. Lumpsum works well if you have a significant amount to invest and can time the market effectively.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.