What is an Option Chain | Meaning, Importance, and Uses

Have you ever wondered how investors make decisions in options trading? Have you heard about Option Chains and Option Charts? Now you may wonder, what is an Option chain, and how does it work? Options chains are like the dashboard of a car, giving you all the vital stats at a glance. From volatility to the last traded price, the call-put option chain shows it all.

Let’s understand how it works in detail.

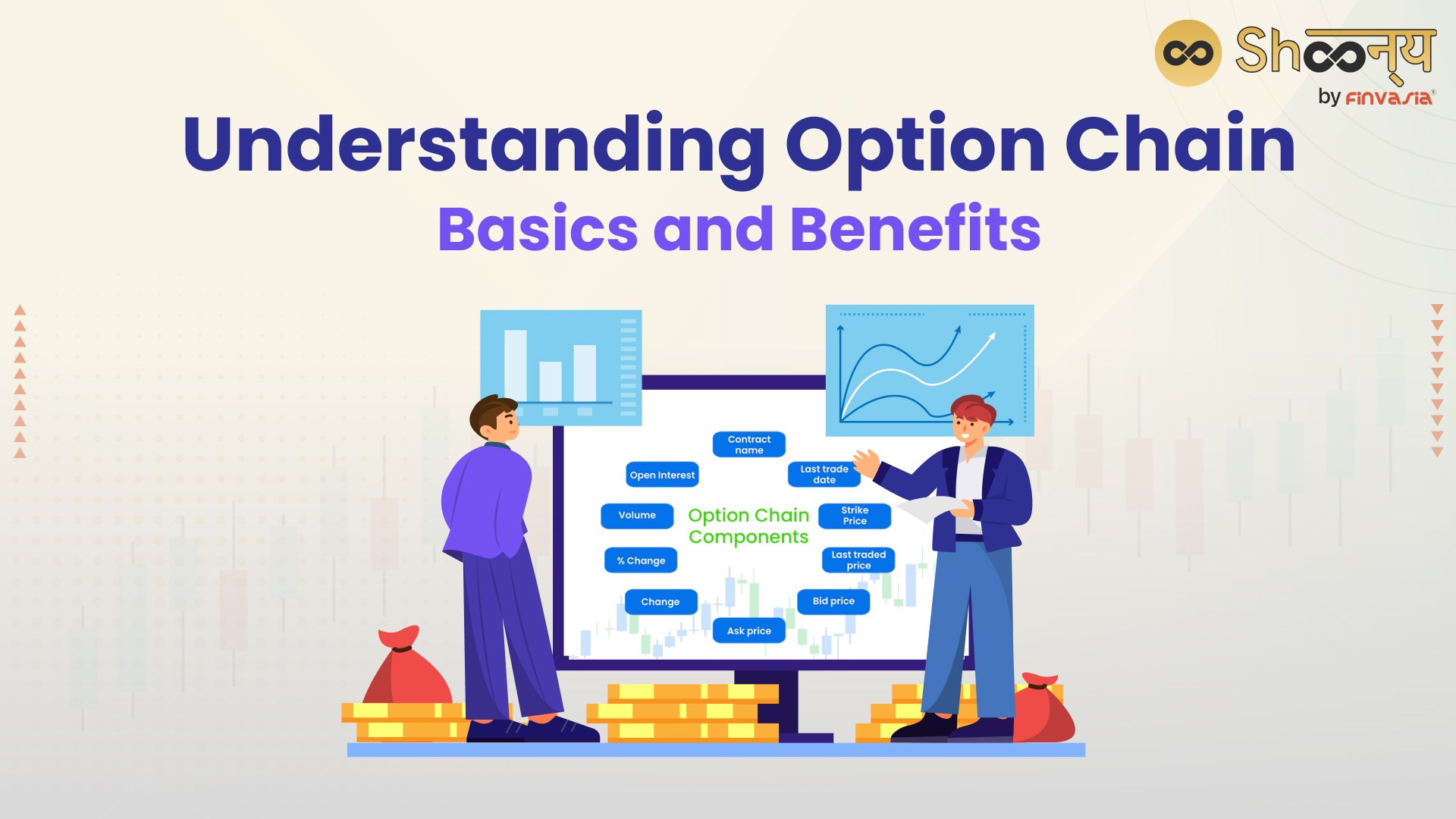

What is an Option Chain?

It is a vital tool in options trading that lists all available options contracts for a specific security.

It shows key information like strike prices, expiration dates, option type (call or put), and prices (premiums). Traders use this information to assess potential trading opportunities.

Options Chain on NSE

The National Stock Exchange (NSE) offers a robust option chain platform. Through the NSE option chain, market participants gain access to a wealth of information pertinent to options trading.

This includes diverse sectors such as equities, indices, and commodities. Traders leverage the NSE option chain to conduct thorough analyses, identify lucrative prospects, and execute trades with precision.

An option chain is like a menu of choices in the stock market.

Imagine you’re at a restaurant with different dishes listed on the menu. In the stock market, instead of dishes, you have options contracts.

Now, the option chain shows you all the available options for a particular stock.

It lists different strike prices and expiration dates.

Just like how a menu might show different dishes with various prices and descriptions, an option chain shows you different options with their strike prices and expiration dates.

For example, let’s say you’re interested in buying options for a company called ABC. You’d look at ABC’s option chain to see all the available options. It would list different strike prices and expiration dates, along with the prices of those options.

So, when you’re looking at it, you’re basically looking at all the possible choices you have for trading options on a specific stock.

It helps you decide which option contract suits your trading strategy best.

Call and Put Option Chain

Call and put options are two main types of options contracts in an option chain.

They do differ from each other. Call options grant the holder the right to buy the underlying asset at a set price within a specific time.

Put options give the holder the right to sell the asset at a set price within the designated time.

What is the Difference Between Call and Put Option

The disparity between call and put options lies in their inherent rights and obligations:

- Call Option

By purchasing a call option, the holder secures the right to buy the underlying asset. he can do this at the predetermined strike price within the specified timeframe.

This grants the holder the potential to capitalise on bullish market conditions without incurring the obligation to purchase the asset.

- Put Option

Conversely, acquiring a put option furnishes the holder with the right to sell the underlying asset. He can do it at the agreed-upon strike price during the stipulated timeframe.

This empowers the holder to profit from bearish market trends without the necessity of owning the asset outright.

The option chain separates call and put options. This makes it easier for traders to evaluate them and create strategies according to market conditions.

On the NSE Option Chain, you can find the call options on the left and put options on the right.

Uses of Option Chain

It serves as a pivotal tool for traders and investors across various dimensions:

- Identification of Trading Opportunities

By scrutinising the option chain, you can examine potential trading opportunities arising from favourable price differentials. You can also understand their volatility patterns and strategic positioning.

- Analysis of Support and Resistance Levels

Through the examination of strike prices and option premiums, traders ascertain critical support and resistance levels, pivotal for determining entry and exit points.

- Insight into Market Sentiment

It encapsulates market sentiment by reflecting the collective actions of options traders, thereby offering valuable insights into prevailing market dynamics.

- Formulation of Hedging Strategies

Armed with comprehensive data gleaned from the options chain, investors devise robust hedging strategies to mitigate risk exposure.

Options Chart| How Can You Read it?

Options charts reflect graphical representations of option-related data.

In an options chain, each column provides important information about the options market for a specific stock.

| Term | Description |

| Options Type | Indicates whether the option is a call (right to buy) or put (right to sell). |

| Strike Price | The price at which the call/put option can be exercised. |

| In-The-Money (ITM) | For calls, when the stock price is above the strike price; for puts, when it’s below. |

| At-The-Money (ATM) | When the stock price is equal to the strike price. |

| Out-of-The-Money (OTM) | For calls, when the stock price is below the strike price; for puts, when it’s above. |

| Open Interest (OI) | The total number of outstanding option contracts. |

| Change in Open Interest | The change in open interest from the previous trading day. |

| Volume | The number of options contracts traded in a day. |

| Implied Volatility (IV) | A measure of the market’s forecast of a likely movement in a security’s price. |

| Last Traded Price (LTP) | The price at which the last trade occurred. |

| Bid Price | The price a buyer is willing to pay for an option. |

| Bid Quantity | The number of options a buyer is willing to purchase at the bid price. |

| Ask Quantity | The number of options a seller is willing to sell at the ask price. |

| Ask Price | The price a seller is willing to accept for an option. |

These columns give a quick overview of the options market’s activity and sentiment for a particular stock at different strike prices.

Conclusion

In the end, an option chain is your compass in the options market. It guides you through the potential trades. It’s a snapshot of possibilities, from calls to puts. So, take this knowledge, apply it, and watch your trading skills flourish.

FAQs| What is Option Chain

An option chain lists all available options for security, displaying details such as strike prices and expiration dates. This aids traders in making the right decisions.

To trade options, you select from the option chain based on your strategy, either buying or selling the option and then managing the position until closure or expiration.

The “best” option chain depends on your trading requirements. For example, the NSE option chain is widely favoured for its comprehensive data and user-friendly interface.

OI, or Open Interest, represents the total number of outstanding option contracts yet to be settled. It reflects market activity and trader interest.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.