Understanding the Difference Between Forward and Future Contract

Are you also one of those traders who often get confused between forward and future contracts? Not a big deal! These derivatives trading contracts seem to confuse almost everyone. What are they, and what is the actual difference between forward and future contracts? Let us understand them today with a forward and future contract example.

However, before we jump onto the difference between forward and future contracts, you must understand derivatives trading. What is derivatives trading, and how are forward and future contracts related to it?

Let us take a look!

Derivative Trading

It is a type of financial trading that allows investors to speculate on price movements and manage their risk. In derivatives trading, you don’t buy or sell the actual asset (such as stocks, commodities, or currencies) itself. Instead, you buy or sell contracts based on the value of that asset. These contracts derive their value from the underlying asset.

Forward and future contracts are two types of derivatives. Investors use them for hedging, speculation, and arbitrage purposes.

They help investors manage the risk element by locking in prices for future transactions.

Now, let us understand the meaning of each in detail.

Forward Contract Meaning

Forward contracts are agreements made between a buyer and a seller to trade something in the future at a certain price. They are not conducted through an official trading platform. Also, both parties can change the terms of forward contracts.

There’s only one date when everything is settled: the end of the agreement.

Traders use forward contracts to make sure the price of what they’re trading doesn’t change unexpectedly.

Here comes the main part!

Since they’re private, there’s a risk that one party might default, causing counterparty risk.

Thus, in simple terms, a forward contract is a formal and customisable deal between two parties. It may be to buy or sell an asset on a future date and at a specific price.

Essentially, it’s like locking in a price for a future transaction, which can help manage risk and uncertainty.

Types of Forward Contracts

There are three main types of forward contracts in India:

- Closed Outright Forward| Currency Forward

A type of forward contract in which two parties agree to exchange currencies at a future date for a predetermined price. This helps protect against exchange rate fluctuations. - Flexible Forward

This forward contract allows the buyer to fix the exchange rate between two set dates for a specific amount. It offers flexibility in timing and amount exchanged. - Long-Dated Forward

This contract has a settlement date longer than one year. It is used to hedge long-term exposures like currency or interest rates, with maturities of up to 10 years.

Forward Contract Example

Suppose a farmer expects to harvest 1,000 bushels of wheat in six months. However, price fluctuations worry him.

Now, what can he do?

To reduce the risk element, he enters into a forward contract with a buyer. The agreement is to sell the 1,000 bushels at a fixed price of ₹500 per bushel in six months. Whether the market price rises or falls, both parties are bound to this agreement.

Future Contract Meaning

This type of contract in derivatives trading is a standardised agreement. Here, both parties enter into an agreement to buy or sell a specified asset at a predetermined price and date in the future.

But what’s the main difference between a forward and future contract?

Future contracts are commonly traded on organised exchanges. Here, parties may enter into future contracts for various commodities, currencies, interest rates, and stock market indices.

Now, what does a standardised contract mean?

This means that for future contracts, this element promotes liquidity and transparency in the market. It benefits both the participants of the contract.

The standardised nature of futures contracts ensures that all contracts within a particular market are identical regarding contract size, delivery date, and quality of the underlying asset.

- The market for futures is usually very active. Investors can easily join or leave whenever they want.

- These contracts are often used by people who speculate on price changes.

- They usually close their contracts before they’re due, so actual buying or selling rarely happens. Instead, they settle with cash.

Unlike forward contracts, futures contracts are highly regulated and traded publicly on exchanges, providing liquidity and transparency to the market.

Futures Contract Example

An investor believes that the price of crude oil will increase in the next three months. To capitalise on this prediction, he buys a futures contract for 100 barrels of oil at ₹4,000 per barrel.

Now, if the price of oil indeed rises, the investor can sell the futures contract at a higher price before its expiration date.

He will profit from the price difference without physically owning the oil.

Let us take a quick look at the difference between future and forward contracts in the market.

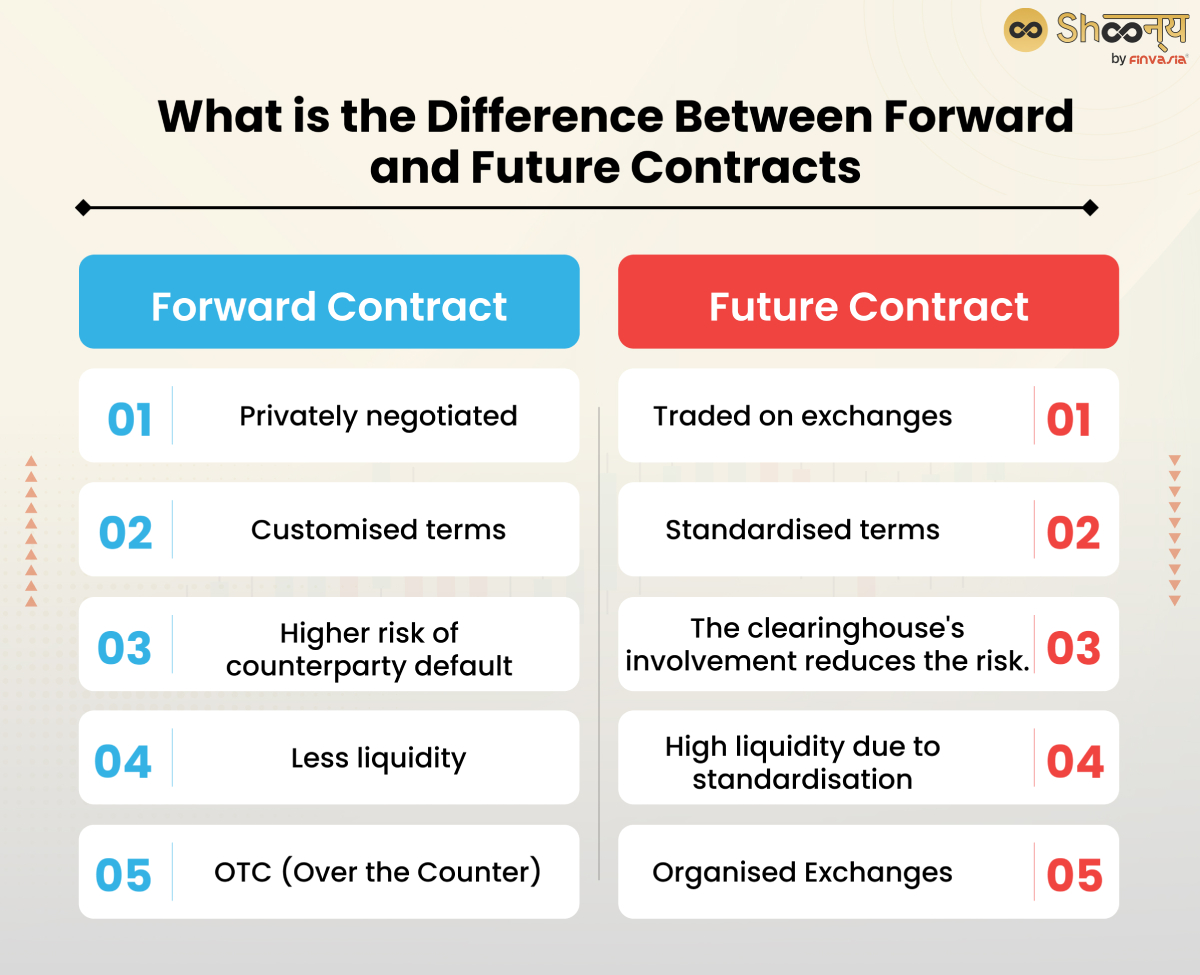

What is the Difference Between Forward and Future Contracts

| Aspect | Forward Contract | Futures Contract |

| Negotiation Process | Privately negotiated between parties. | Traded on exchanges, publicly accessible. |

| Customisation | Terms are customised to suit the needs of parties. | Terms are standardized by the exchange. |

| Risk Management | Higher counterparty risk; no clearinghouse involved. | The clearinghouse guarantees contract performance, minimizing counterparty risk. |

| Market Liquidity | Less liquid, not easily tradable. | Highly liquid, easily tradable on exchanges. |

| Regulation | Less regulated, traded over-the-counter (OTC). | Heavily regulated by market authorities. |

Negotiation Process

- Forward Contract

Negotiated privately between the two parties involved. This allows for flexibility in terms and conditions.

- Futures Contract

Traded on exchanges, making them accessible to the public and subject to the exchange’s rules and regulations.

Customisation

- Forward Contract

Parties can tailor the terms as per their specific needs and preferences. This allows greater flexibility.

- Futures Contract

These offer standardised terms as set by the exchange. This ensures uniformity and facilitates ease of trading.

Risk Management

- Forward Contract

Involves higher counterparty risk as there is no intermediary involved to guarantee contract performance.

- Futures Contract

Utilizes a clearinghouse that acts as an intermediary. This guarantees the performance of the contract and reduces counterparty risk.

Market Liquidity

- Forward Contract

Generally less liquid as they are not traded on exchanges and may not have readily available buyers or sellers.

- Futures Contract

Highly liquid due to being traded on exchanges, with a large number of buyers and sellers, ensuring ease of trading.

Regulation

- Forward Contract

Typically, they are less regulated as they are traded over-the-counter (OTC).

- Futures Contract

Subject to heavy regulation by market authorities and exchanges to ensure transparency, fairness, and stability in the market.

Things You Must Keep in Mind: Forward vs Future Contracts

- Forward and futures contracts are agreements where two parties agree to buy or sell an asset at a set price by a certain date.

- Forward contracts are private and flexible, settling at the end of the agreement and traded off-exchange (OTC).

- Futures contracts trade on exchanges, with daily price settlements until the contract’s end.

- Forward contracts have less oversight because they are privately negotiated.

- Forwards carry more counterparty risk compared to futures contracts.

Conclusion

The key difference between forward and future contracts stems from how they operate and are overseen. Forward contracts involve private negotiations, providing flexibility. However, futures contracts are standardised and traded on exchanges. They ensure liquidity and minimise risk through a clearinghouse.

FAQs | Difference Between Forward and Future Contract

Forward price is fixed at the contract’s beginning, while future price fluctuates daily on the exchange market.

A futures contract mandates buying or selling at a set date, whereas futures options grant the right, but not the obligation, to do so.

The forward rate is the agreed-upon future price in a forward contract, while the forward contract includes this rate and other exchange terms.

A forward contract is a customised agreement to buy or sell an asset at a predetermined price on a specified future date.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.