What Is an AMC and the Top 10 Asset Management Companies in India

Have you ever wondered how some people seem to have a knack for picking the best mutual funds in the market? How do they know which fund house to trust, and which fund scheme to invest in? There is one factor that can make a big difference in your investment decisions: the asset management companies in India (AMCs). How do you choose the best AMC for your investment needs?

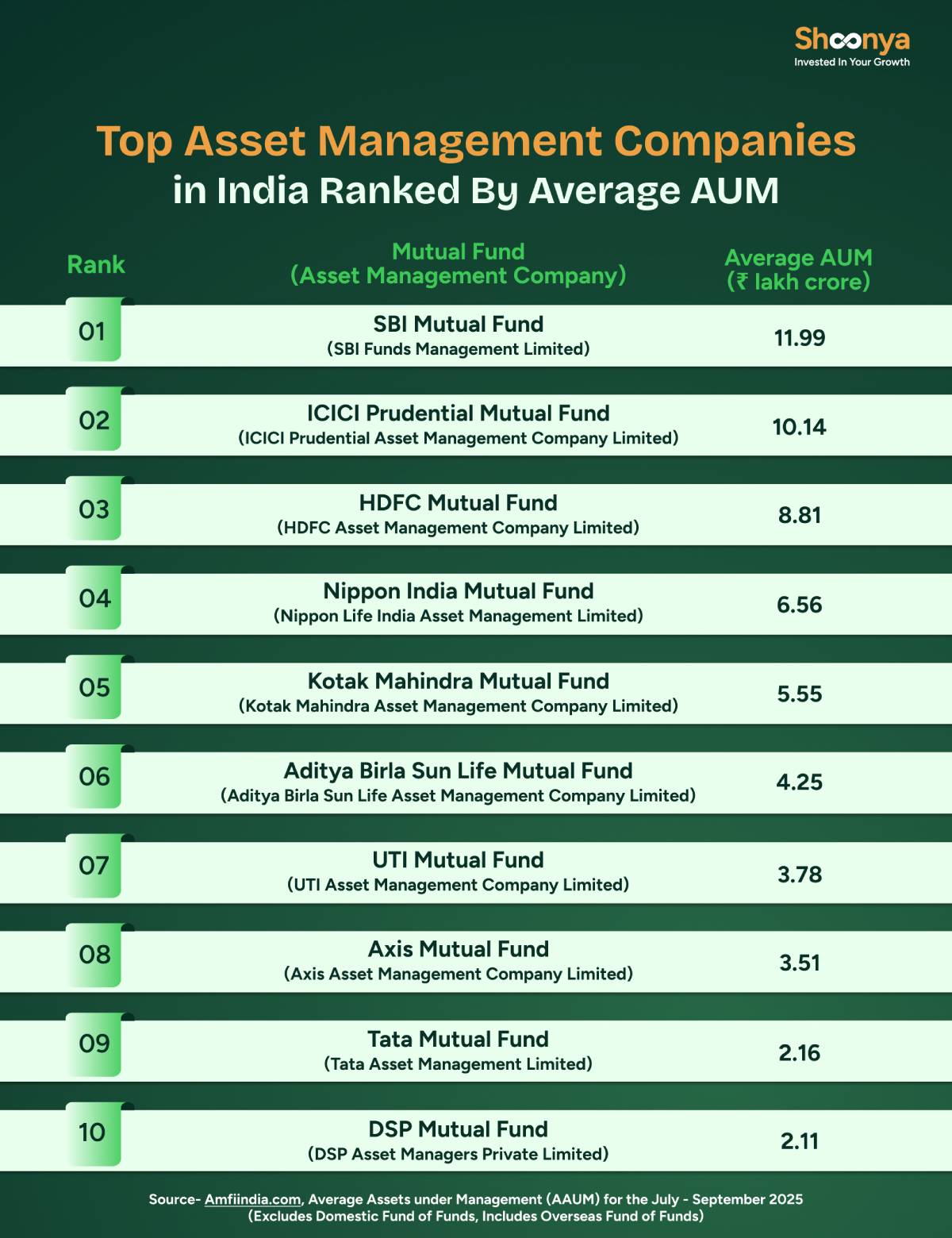

Let us explore the 10 top Asset Management Companies (AMCs) in India based on their Average Assets under Management (AAUM) for the July – September 2025 (Rs in Lakhs)

AMC Meaning

The AMC full form in mutual funds is Asset Management Company.

In India, AMCs are set up as trusts and are responsible for pooling money from multiple investors and investing it across various securities such as stocks, bonds, government securities, and commodities, based on the fund’s investment objective.

There are many AMCs in India that offer different types of mutual funds for various investment objectives and risk profiles.

Now comes the most important part- AUM!

AUM Meaning

AUM full form- assets under management. It refers to the total market value of investments such as stocks, bonds, and cash that a financial firm manages for its clients. It shows the size of a fund and reflects investor participation and confidence, but a higher AUM does not guarantee better returns.

AUM (Assets Under Management) is the total value of investments managed by an AMC (Asset Management Company).

Indian Mutual Fund Industry’s Growth in AUM

The Average Assets Under Management (AAUM) for November 2025 stood at ₹81.32 lakh crore. Mutual fund AUM increased from ₹12.95 lakh crore in November 2015 to ₹80.80 lakh crore in November 2025, marking more than a sixfold growth in ten years.

How are the Companies Ranked on the Basis of AUM?

Companies are ranked by Assets Under Management (AUM) by arranging them in descending order based on the total market value of investments they manage, with the highest AUM placed at the top.

Let us explore the top 10 AMC in India.

These top Asset Management Companies in India have been ranked on the basis of the Average Assets under Management (AAUM) for the July – September 2025.

| Rank | Mutual Fund (Asset Management Company) | Average AUM (₹ lakh crore) | Founding Year |

| 1 | SBI Mutual Fund (SBI Funds Management Limited) | 11.99 | 1987 |

| 2 | ICICI Prudential Mutual Fund (ICICI Prudential Asset Management Company Limited) | 10.14 | 1993 |

| 3 | HDFC Mutual Fund (HDFC Asset Management Company Limited) | 8.81 | 1999 |

| 4 | Nippon India Mutual Fund (Nippon Life India Asset Management Limited) | 6.56 | 1995 |

| 5 | Kotak Mahindra Mutual Fund (Kotak Mahindra Asset Management Company Limited) | 5.55 | 1996 |

| 6 | Aditya Birla Sun Life Mutual Fund (Aditya Birla Sun Life Asset Management Company Limited) | 4.25 | 1994 |

| 7 | UTI Mutual Fund (UTI Asset Management Company Limited) | 3.78 | 2003 |

| 8 | Axis Mutual Fund (Axis Asset Management Company Limited) | 3.51 | 2009 |

| 9 | Tata Mutual Fund (Tata Asset Management Limited) | 2.16 | 1995 |

| 10 | DSP Mutual Fund (DSP Asset Managers Private Limited) | 2.11 | 1997 |

Overview of the Top Asset Management Companies in India

The top 10 AMC in India include:

SBI Mutual Fund, Managed by SBI Funds Management Limited

Top Asset Management Company in India

SBI Mutual Fund, managed by SBI Funds Management Limited, stands as India’s largest asset management company with an average AUM of Rs 11,99,53,297.96 lakhs.

Established on June 29, 1987, it became the first non-UTI mutual fund in the country. Sponsored by the State Bank of India in a joint venture with Amundi, SBI Mutual Fund manages a wide range of equity, debt, and hybrid schemes and serves millions of investors through an extensive nationwide distribution network.

ICICI Prudential Mutual Fund, Managed by ICICI Prudential Asset Management Company Limited

One of the Top 10 Asset Management Companies in India

ICICI Prudential Mutual Fund holds the second position with an average AUM of Rs 10,14,75,811.28 lakhs.

Launched on October 12, 1993, as a joint venture between ICICI Bank and Prudential plc, the fund house offers a broad portfolio of equity, debt, and balanced schemes designed to meet diverse investor objectives across retail and institutional segments.

Explore the top 10 private banks in India!

HDFC Mutual Fund, Managed by HDFC Asset Management Company Limited

One of the Best Asset Management Companies in the Private Sector AMCs

HDFC Mutual Fund ranks third with an average AUM of Rs 8,81,42,880.70 lakhs.

Established on December 10, 1999, by HDFC Ltd in collaboration with Aberdeen, it is recognised as one of India’s most trusted private sector asset managers, with a strong focus on equity and hybrid investment strategies.

Nippon India Mutual Fund, Managed by Nippon Life India Asset Management Limited

4th Leading Asset Management Company in India

Nippon India Mutual Fund secures the fourth position with an average AUM of Rs 6,56,51,868.82 lakhs.

Incorporated on June 30, 1995, and later acquired by Nippon Life Insurance, the fund house evolved from Reliance Mutual Fund and now offers diversified investment solutions across multiple asset classes and market segments.

Kotak Mahindra Mutual Fund, Managed by Kotak Mahindra Asset Management Company Limited

5th Top AMC in India for Long-Term Wealth Creation

Kotak Mahindra Mutual Fund follows in fifth place with an average AUM of Rs 5,55,95,213.92 lakhs. Founded on June 23, 1998, as a wholly owned subsidiary of Kotak Mahindra Bank, it began with gilt funds and has since expanded into a comprehensive range of schemes focused on systematic and long-term wealth building.

Aditya Birla Sun Life Mutual Fund, Managed by Aditya Birla Sun Life Asset Management Company Limited

6th Best AMC in India with a Diversified Portfolio

Aditya Birla Sun Life Mutual Fund ranks sixth with an average AUM of Rs 4,25,17,127.32 lakhs.

Launched on December 23, 1994, as a joint venture between the Aditya Birla Group and Sun Life Financial, it maintains a strong presence across equity and debt segments and serves a wide investor base across India.

UTI Mutual Fund, Managed by UTI Asset Management Company Limited

Legacy Asset Management Company in India

UTI Mutual Fund holds the seventh position with an average AUM of Rs 3,78,41,328.86 lakhs.

Formed on February 1, 2003, with roots tracing back to the original Unit Trust of India established in 1963, it is backed by institutions such as SBI, Punjab National Bank, Bank of Baroda, and LIC, and is known for its long-standing presence in Indian capital markets.

Axis Mutual Fund, Managed by Axis Asset Management Company Limited

Fast-Growing Asset Management Company in India

Axis Mutual Fund ranks eighth with an average AUM of Rs 3,51,23,788.85 lakhs.

Registered with SEBI in 2009, it is a relatively younger asset management company that has built its reputation on disciplined investment processes, risk management, and consistent performance across schemes.

Tata Mutual Fund, Managed by Tata Asset Management Limited

Trusted Asset Management Company in India

Tata Mutual Fund places ninth with an average AUM of Rs 2,16,96,075.79 lakhs.

Launched in 1995 as part of the Tata Group, it is known for its emphasis on governance, ethical investment practices, and balanced exposure across equity and debt offerings.

Read: Tata Motors History!

DSP Mutual Fund, Managed by DSP Asset Managers Private Limited

Established AMC in India with Active Fund Management

DSP Mutual Fund completes the top ten with an average AUM of Rs 2,11,09,674.76 lakhs.

Established in 1996, DSP has earned recognition for its research-driven approach and active fund management strategies across multiple mutual fund categories.

New AMCs in India

Several new Asset Management Companies (AMCs) have entered, or are in the process of entering, India’s mutual fund industry in 2025.

Recently Registered or Launched AMCs

- Angel One Mutual Fund

Registered with SEBI in December 2025, Angel One Mutual Fund is among the newest and smallest AMCs by assets under management. - Groww Asset Management Limited

Groww entered the mutual fund space in 2025 as a technology-led player. It launched products such as the Groww Multi Asset Omni Fund of Funds and the Groww Nifty Metal ETF. - Jio BlackRock Asset Management Company

Jio BlackRock received in principle approval and began launching schemes by late 2025. Its initial offerings include the Jio BlackRock Liquid Fund and Money Market Fund. - White Oak Capital Asset Management Limited

White Oak Capital emerged as a new entrant in 2025, with a strong focus on equity-oriented strategies and alternative investment approaches.

Several players have received in principle approval from SEBI and are expected to launch operations by the end of 2025 or early 2026. These include Capitalmind, Choice International, Cosmea Financial Holdings, Zerodha AMC, and Navi Mutual Fund.

AMC- Asset Management Companies in India: FAQs

As of July to September 2025, SBI Mutual Fund is the largest AMC in the country based on Average Assets under Management (AAUM), with assets of Rs 11.99 lakh crore.

As of December 2025, India has 49 registered Asset Management Companies (AMCs), according to SEBI’s official list and recent industry reports.

An asset management company (AMC) is a company that handles money for people. They invest this money in stocks and bonds to make more money. People call them fund houses, money managers, or investment companies.

SBI Mutual Fund is India’s biggest asset management company based on Average Assets Under Management (AAUM). For July to September 2025, it managed around ₹11.99 lakh crore, ranking first among all AMCs in India.

SBI Mutual Fund is the largest asset management company in India by AAUM. It leads the industry with assets of approximately ₹11.99 lakh crore, ahead of ICICI Prudential and HDFC Mutual Fund.

The three largest asset managers in India are SBI Mutual Fund (₹11.99 lakh crore), ICICI Prudential Mutual Fund (₹10.14 lakh crore), and HDFC Mutual Fund (₹8.81 lakh crore) by AAUM.

AMC in India refers to Asset Management Companies such as SBI Mutual Fund, ICICI Prudential Mutual Fund, and HDFC Mutual Fund.

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.