Are you feeling the urge to jump into the stock market, but the rollercoaster ride of market volatility is giving you second thoughts? Well, you’re not alone. Investing in the Indian stock market can be both exciting and nerve-wracking, especially for beginners. But fear not! There’s a solution that can help you navigate these ups and downs with confidence: Balanced Advantage Funds (BAFs).

What are Balanced Advantage Funds (BAFs)?

BAFs are a type of hybrid mutual fund which tends to invest in a mix of equity and debt instruments. They are popularly known as Dynamic Asset Allocation Funds because they adjust their portfolio allocation between equity and debt based on market valuations. The goal of BAFs is to provide optimal returns with minimal risk by leveraging market fluctuations.

Imagine you’re planning a road trip, but you’re not sure whether to take a car or a motorcycle. You want to enjoy the flexibility of a motorcycle when the weather is good, but you also want the comfort and safety of a car when it’s raining.

Balanced Advantage Funds work somewhat like this. They are like seasoned road trip planners who constantly check the weather conditions. When the sun is shining (representing good market conditions), they might suggest using the motorcycle (equity) for its agility and speed to capture the thrill. But if they see dark clouds (representing market uncertainty), they’ll advise switching to the car (debt) for a smoother and safer ride.

In essence, Balanced Advantage Funds help you navigate the stock market’s ups and downs by adjusting your investment vehicle (equity and debt) based on the market’s current conditions. It’s like having a reliable travel companion who ensures you have an enjoyable journey, regardless of the weather.

How do Balanced Advantage Funds Work?

Balanced advantage funds work by maintaining a flexible blend of equities, debt, and arbitrage opportunities within their portfolio. They use predetermined models or criteria to gauge market conditions and valuations, adjusting their equity exposure accordingly.

- The primary goal is to purchase stocks when prices are low and sell them when they’re high, mitigating the inherent risks in stock investments.

- In India, these funds harness equity market growth potential while offering stability and income from the debt market.

- Additionally, they exploit arbitrage opportunities by capitalising on price discrepancies between cash and futures markets.

- This diversified approach allows them to adapt to economic cycles, increasing equity exposure during recovery phases and reducing it during slowdowns.

Balanced advantage funds are an ideal choice for investors seeking equity exposure with lower volatility and minimal monitoring requirements, providing consistent, steady returns over the long term.

Common Strategies to Adopt for Investing with Balanced Advantage Funds

BAFs typically follow either a pro-cyclical or counter-cyclical strategy for asset allocation.

A pro-cyclical approach increases equity exposure in rising markets and reduces it during market declines, assuming that market trends will persist. Conversely, a counter-cyclical strategy decreases equity exposure when markets rise and increases it when markets fall, based on the common belief that markets tend to revert to the mean.

Some BAFs also employ hedging techniques to reduce equity exposure risk. Hedging involves taking opposite positions in derivative instruments like futures or options to offset potential losses from the original position. This approach provides a safety net, ensuring that even in a falling market, losses can be mitigated by gains from the hedged position.

Who Should Invest in Balanced Advantage Funds?

BAFs are suitable for investors who desire to claim and enjoy the benefits of both equity and debt investments without the need to time the market. This makes them an excellent choice for novice investors and also those who prefer a hands-off approach to portfolio management.

While choosing the best-balanced advantage fund depends upon the time you dedicate to research before investing, If you’re someone who uses SIPs to build your portfolio, BAFs can complement your investment strategy.

BAFs build upon the advantages of SIP investments. While SIPs in equity-based mutual funds help you navigate market volatility, BAFs add an extra layer of security by dynamically adjusting to market conditions. This combination reduces overall investment volatility, ensuring more stable returns during market downturns and improved performance when the markets are bullish.

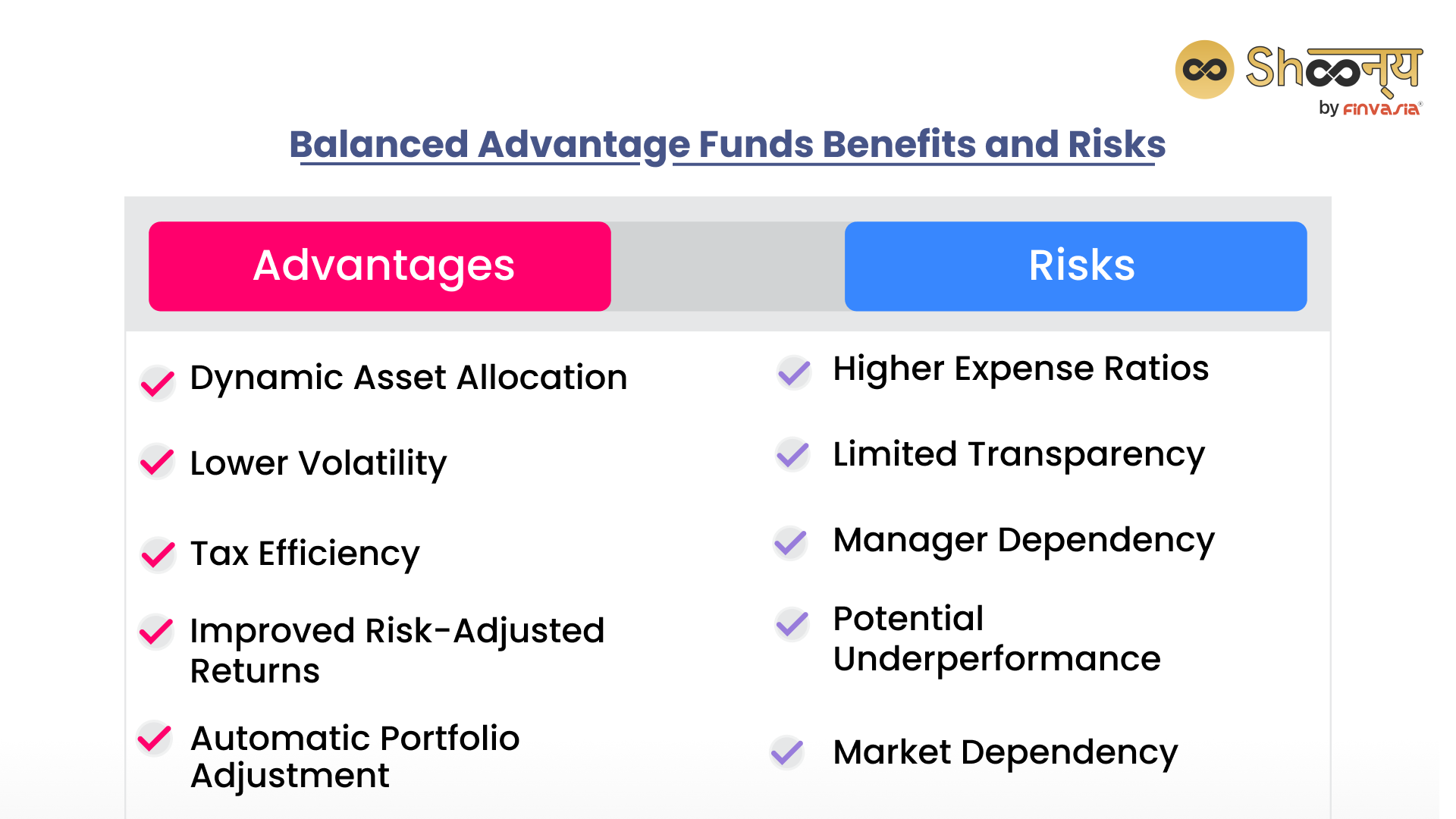

Exploring Balanced Advantage Fund Benefits

- Dynamic Returns: Balanced Advantage Funds (BAFs) are designed to deliver returns by leveraging both equity and debt markets. Depending on the prevailing stock market conditions, they can seamlessly shift between equity and debt investments. This strategy allows them to generate capital appreciation during favourable market phases and offer income from debt when markets turn unfavourable.

- Risk Reduction: BAFs are adept at minimising risk through their dynamic portfolio allocation. By amalgamating the diversification advantages of traditional equity-based mutual funds with their dynamic asset allocation approach, they effectively mitigate volatility. This unique feature empowers them to lock in profits during market upswings and increase investments during market downturns, enhancing overall risk management.

- Tax Efficiency: From a taxation perspective, BAFs are considered equity funds if they allocate at least 65% of their assets to equity or equity-related instruments. This classification brings significant tax benefits, particularly for long-term capital gains (realised after holding for a year and exceeding Rs. 1 lakh), which are subject to a favourable tax rate of 10%.

- Convenience: BAFs offer a hassle-free investment experience. They eliminate the need for investors to monitor market movements and constantly rebalance their portfolios. While traditional mutual fund portfolios often require periodic adjustments based on market performance and risk tolerance, BAFs autonomously handle these tasks, providing investors with added convenience and peace of mind.

Risks Involved in Balanced Advantage Funds

While BAFs offer a balanced approach to investing, there are still risks involved:

- Market Risk: BAFs maintain some level of equity exposure across all market conditions, subjecting their portfolios to market risks.

- Interest Rate Risk: The fixed income portion of BAFs may be affected by changes in interest rates. Prices of fixed-income instruments tend to move inversely to interest rate changes.

- Credit Risk: Fixed-income holdings in BAFs may expose investors to credit risk, which refers to the risk of the issuer failing to make interest or principal payments.

- Hedging Risk: The use of derivatives for hedging purposes may not always yield the desired results. The effectiveness of hedging strategies depends on market conditions.

In conclusion, Balanced Advantage Funds offer a unique investment opportunity for those who want to benefit from both equity and debt markets without the complexities of timing the market. They are particularly well-suited for new investors and those looking for a hands-off approach to portfolio management. By dynamically adjusting asset allocation, BAFs aim to provide stable returns with reduced risk, making them a valuable addition to any investment portfolio.

FAQs|Balanced Advantage Funds

A balanced advantage fund is a hybrid mutual fund that dynamically invests in both equity and debt instruments, adjusting its allocation based on market conditions to balance risk and return.

Balanced advantage funds can be beneficial for investors seeking a mix of equity and debt exposure without the hassle of timing the market. They offer lower volatility, tax efficiency, and improved risk-adjusted returns, but also come with drawbacks.

Balanced funds have fixed equity and debt allocations, while balanced advantage funds flexibly allocate based on market conditions. Balanced funds are for long-term investors, while balanced advantage funds suit medium-term investors.

Drawbacks include higher expense ratios, limited transparency in asset allocation strategy, reliance on the fund manager’s judgment, and potential underperformance in certain market scenarios.

The suitability of investing in a Balanced Advantage fund depends on your investment goals, risk tolerance, and preferences. Consider factors like performance, expenses, and strategy before investing.

Returns in a balanced advantage fund vary based on factors like asset allocation, market conditions, fund manager’s skill, and expenses. Past performance isn’t indicative of future results, so assess other aspects before investing.

The safety of lumpsum investment in a balanced advantage fund depends on your risk tolerance and investment horizon. While they offer dynamic allocation to mitigate risk, consider your goals and risk appetite for a well-informed decision.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.