Are you looking for the best companies to invest in India? Do you want to know which are the best investment companies with the highest market value, the best financial performance, and the most promising growth prospects? If yes, then you have come to the right place.

In this blog, we will explore the latest investment opportunities in India and discover the 10 best companies to invest in based on their market value.

We have curated a list with a detailed analysis of each company, including their business profile, key achievements, and their USPs.

Company Market Value

Market value, also known as market capitalization, is the total value of all the shares of a company in the stock market. It is calculated by multiplying the number of shares by the current share price. Market value is one of the most important indicators of a company’s size, performance, and growth potential. It reflects the market’s perception of the company’s future

earnings and prospects.

- A high market value means that the company is well-established, profitable, and has a strong competitive edge.

- A low market value means that the company is struggling, unprofitable, or facing challenges.

Therefore, market value is a crucial factor to consider before investing in a company.

However, market value alone is not enough to determine the best companies to invest in. There are other factors that need to be taken into account, such as the company’s history, business model, market analysis, risk tolerance, financial ratios, and future plans.

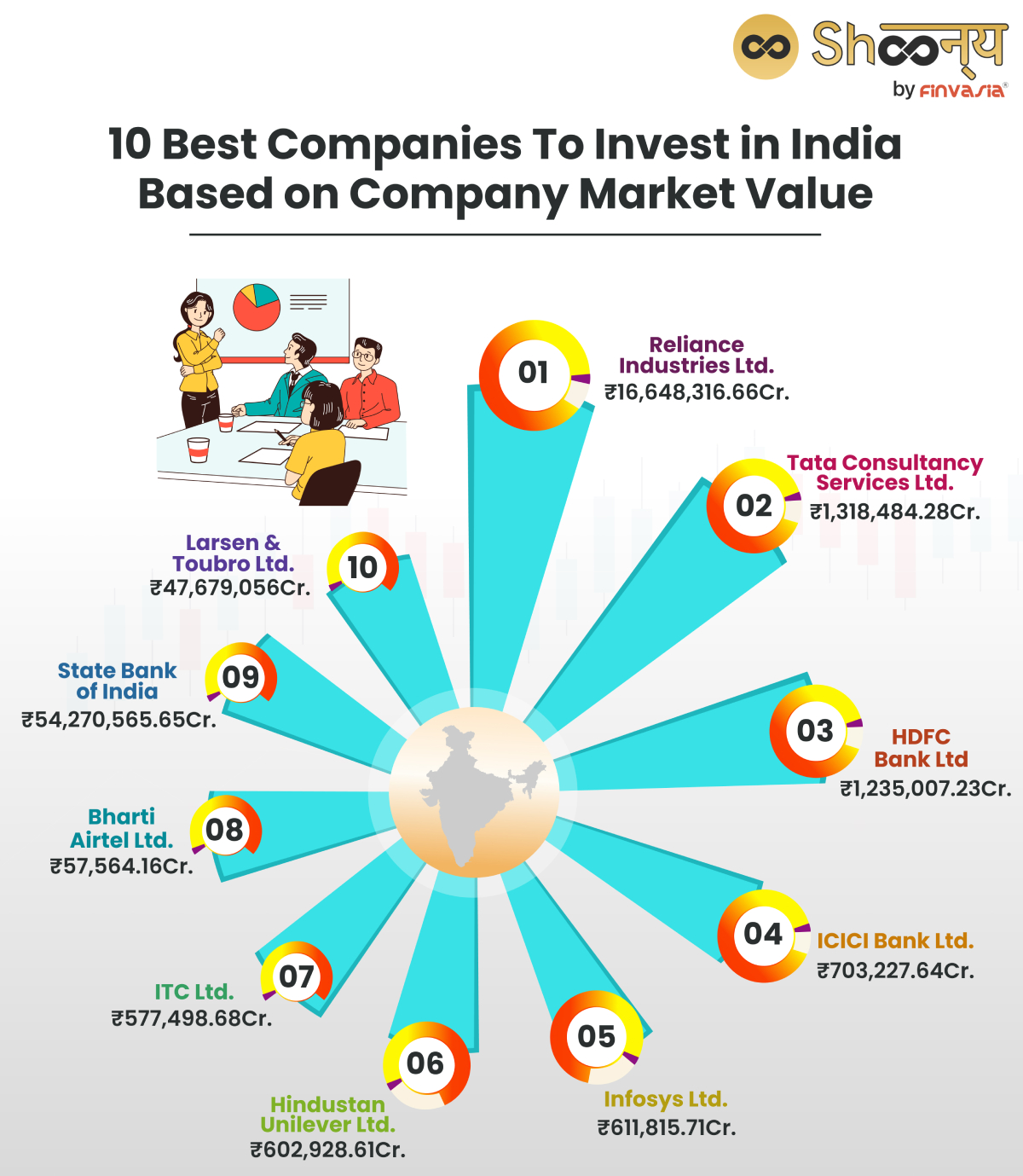

10 Best Companies To Invest in India Based on Company Market Value

Exploring the Best Investment Company in India: The data in the chart above is based on the market capitalization of the companies as of the provided date- 7th Dec 2023.- BSE.

List of Factors to Consider Before Investing in a Company

Before you choose the best company to invest in the share market, here are certain things you must take into consideration:

- Do Check out the Company History: Research the company’s background, including its longevity, profitability, growth trends, and leadership stability. Companies with a solid track record and consistent management are often more reliable and turn out to be the profit-making companies in India.

- Be Aware of the Business Model: Understand how the company generates revenue, its products or services, customer base, and competitive advantages. You must ensure while choosing the best investment company that it should have a clear value proposition, a loyal customer base, and a strong market position.

- Market Analysis: While comparing the best investment companies in India, analyze macroeconomic and industry conditions affecting the company. This includes economic state, interest rates, inflation, market trends, consumer demand, regulatory environment, and competition.

- Analyse Your Own Risk Tolerance: Assess your own risk appetite and consider the risk associated with the company’s business model, financial situation, growth prospects, and market exposure. Different companies carry different levels of risk and potential for growth.

- Financial Ratios: Examine the company’s financial statements and calculate key ratios such as EPS, P/E ratio, ROE, D/E ratio, and dividend yield. These ratios help evaluate financial health, profitability, efficiency, and valuation of the best companies to invest in india.

- Stability is the Essence: Stability is crucial. Look for companies that have demonstrated stable performance over the years. While fluctuations are normal, consistent instability may impact the investment company’s stocks.

- Market Sentiments: Assess market sentiments about the company. Positive sentiments can be a green signal to incest, while negative sentiments may indicate caution as when you plan to choose the right and the best company to invest in the stock market.

Overview of Best Investment Company in India

As per our curated list based on the latest data issued by BSE, here is a detailed analysis of the profit-making companies in India that will help you decide on the best company to invest in the share market in India.

1. Reliance Industries Ltd. (RIL)

- Business Profile: Diversified conglomerate with interests in energy, petrochemicals, telecom, retail, digital services, media, and entertainment.

- Founder: Dhirubhai Ambani (1966)

- Current Leadership: Mukesh Ambani (Chairman and MD)

- Products and Services: Reliance Industries Ltd. is a conglomerate that offers products and services in sectors such as telecom, retail, energy, biotech, and media. Some examples are Reliance Jio, Reliance Retail, Reliance Petroleum, Reliance Life Sciences, and more.

- Investment Prospects: Diversified portfolio, strong growth potential, innovation capabilities, leadership position in various sectors.

2. Tata Consultancy Services Ltd. (TCS)

- Business Profile: Indian multinational IT services and consulting company.

- Founder: J.R.D. Tata and F.C. Kohli (1968)

- Current Leadership: K Krithivasan Chief Executive Officer & Managing Director

- Products and Services: Tata Consultancy Services Ltd. is a IT services and consulting company that offers solutions in domains such as banking, automation, cloud, AI, and blockchain.

- Investment Prospects: Consistent financial performance, global leadership in IT services, diversified client base, strong brand value.

3. HDFC Bank Ltd.

- Business Profile: Indian banking and financial services company, a subsidiary of HDFC.

- Founder: Deepak Parekh (1994)

- Current Leadership: Sashidhar Jagdishan (CEO and MD)

- Products and Services: HDFC Bank Ltd. is a private-sector bank that offers banking and financial services such as savings accounts, credit cards, personal loans, home loans, fixed deposits, and mutual funds.

- Investment Prospects: Robust growth, high profitability, low non-performing assets, customer-centric approach.

4. ICICI Bank Ltd.

- Business Profile: Indian multinational banking and financial services company, subsidiary of ICICI.

- Founder: K.V. Kamath (1994)

- Current Leadership: Sandeep Bakhshi (CEO and MD)

- Products and Services: ICICI Bank Ltd. is another private sector bank that offers banking and financial services such as iMobile, PayLater, car loan, home loan, fixed deposit, and mutual fund.

- Investment Prospects: Strong growth, diversified portfolio, innovation capabilities, and customer loyalty.

5. Infosys Ltd.

- Business Profile: Indian multinational corporation providing IT services and consulting solutions.

- Founder: N.R. Narayana Murthy and others (1981)

- Current Leadership: Salil Parekh (CEO and MD)

- Products and Services: Infosys Ltd. is a technology consulting and digital solutions company that helps enterprises transform their business models, processes, and operations.

- Investment Prospects: Stable financial performance, global leadership in IT services, diversified client base, strong corporate governance.

6. Hindustan Unilever Ltd. (HUL)

- Business Profile: Indian consumer goods company, subsidiary of Unilever.

- Established: 1933

- Current Leadership: Rohit Jawa (Chairman and MD)

- Products and Services: Hindustan Unilever Ltd. is a consumer goods company that offers products in categories such as food, beverages, personal care, home care, and water purifiers.

- Investment Prospects: Dominant market position, diversified product portfolio, strong brand equity, long-term growth potential.

7. ITC Ltd.

- Business Profile: Indian multinational conglomerate with interests in FMCG, hotels, paperboards, agri-business, and IT.

- Established: 1910

- Current Leadership: Sanjiv Puri (Chairman and MD)

- Products and Services: ITC Ltd. is a conglomerate that offers products and services in sectors such as FMCG, hotels, paperboards, packaging, agri-business, and IT.

- Investment Prospects: Diversified business portfolio, resilient financial performance, strong brand loyalty, visionary leadership.

8. Bharti Airtel Ltd.

- Business Profile: Indian multinational telecommunications services company, subsidiary of Bharti Enterprises.

- Founder: Sunil Bharti Mittal (1995)

- Current Leadership: Gopal Vittal (CEO and MD)

- Products and Services: Bharti Airtel Ltd. is a telecommunication company that offers products and services such as mobile, broadband, digital TV, and enterprise solutions.

- Investment Prospects: Strong customer base, diversified service portfolio, innovation capabilities, and customer loyalty.

9. State Bank of India (SBI)

- Overview: State Bank of India (SBI) is an Indian multinational public sector bank and financial services statutory body headquartered in Mumbai, Maharashtra.

- Foundation: Founded on 1 July 1955, as a successor of the Imperial Bank of India, formed by the merger of three presidency banks in British India in 1921.

- Leadership: The current chairman is Dinesh Kumar Khara, who assumed charge on 7 October 2020.

- Product and Service: Offers a wide range of products and services including retail banking, corporate banking, investment banking, mortgage loans, private banking, wealth management, credit cards, finance, insurance, and more.

- Subsidiaries: Includes SBI Life Insurance, SBI Cards and Payment Services, SBI General Insurance, Jio Payments Bank, Yes Bank, and others.

- Investment Rationale: One of the largest and most trusted banks in India, with a dominant market share, a robust digital platform, and a consistent track record of growth and profitability.

10. Larsen & Toubro (L&T)

- Overview: Larsen & Toubro (L&T) is an Indian multinational conglomerate company with business interests in engineering, construction, manufacturing, technology, information technology, and financial services, headquartered in Mumbai, Maharashtra.

- Founders: Founded in 1938 by Danish engineers Henning Holck-Larsen and Soren Kristian Toubro.

- Leadership: The current chairman and managing director is S. N. Subrahmanyan, who assumed charge in July 2017.

- Global Operations: Operates in over 50 countries worldwide with capabilities across technology, engineering, construction, and manufacturing.

- Diversified Business Portfolio: Includes segments such as infrastructure, power, heavy engineering, defence, hydrocarbon, electrical and automation, metallurgical and material handling, information technology, realty, financial services, and others.

- Subsidiaries: Includes L&T Infotech, L&T Technology Services, L&T Finance Holdings, L&T Hydrocarbon Engineering, L&T Construction, and others.

- Investment Prospects: Leader in core sectors, proven execution excellence, strong order book, healthy balance sheet, focus on innovation and digitalisation, and a vision to create long-term value for all stakeholders.

Conclusion

We hope this article has simplified the process of selecting the best company to invest in India. Wishing you a secure and rewarding investment experience!

FAQs| Best Companies to Invest in India

When choosing the best stock it is important to consider factors like financial performance, valuation, and future prospects, examples of best-performing stocks in India include Reliance Industries, Tata Consultancy Services, HDFC Bank, Infosys, and Hindustan Unilever.

The best company to invest in depends on various criteria, such as history, business model, market analysis, risk tolerance, and investment amount. Companies like Reliance Industries, Larsen & Toubro, HDFC Bank, Infosys, and Hindustan Unilever are examples, each with unique value propositions and risk-reward profiles.

Market valuation, determined by multiplying shares by the current share price, is calculated using a straightforward formula. For example, if a company has 100 million shares at ₹500 each, the market valuation is ₹50,000 million.

A good market valuation is influenced by a company’s earnings, competitive advantage, dividend policy, and risk profile. Investors must assess these elements to calculate a company’s overall health and potential in the market.

Companies with high market valuations may offer higher returns and stability, but considerations such as expectations and competition intensify. Investors should consider these factors against their risk tolerance and preferences when making investment decisions.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.