Did you know that when a company needs to adjust its share structure, it can choose between a bonus issue and a stock split? These two strategies serve unique purposes and offer distinct outcomes for both investors and the company. A bonus issue often signals confidence in the company because bonus shares are more like rewarding investors without necessitating additional investment. Conversely, a stock split aims to make the stock more available to a wider range of investors by lowering the price per share. Today, let us understand the bonus issue vs. stock split in detail.

What is a Bonus Issue?

In India, a bonus issue, also known as a bonus share, refers to when a company allocates additional shares to its existing shareholders without any charge.

This means that if you already own shares in a company, you may receive extra shares without needing to pay anything extra for them.

In a bonus issue, the company decides to give its shareholders extra shares as a reward. These additional shares are given in proportion to the number of shares each shareholder already holds.

Example of a Bonus Issue

Let’s say you own 100 shares of a company, and the company announces a bonus issue of 1:1. This means for every one share you own, you’ll receive an additional share for free.

So, after the bonus issue, you’ll have 200 shares in total, but the total value of your investment remains the same.

Why Do Companies Issue Bonus Shares?

Companies in India often issue bonus shares to reward their shareholders for their loyalty and to enhance shareholder value.

Additionally, bonus issues can also increase the liquidity of the company’s shares in the market.

Pros and Cons of Bonus Issue

| Pros | Cons |

| – Increased liquidity | – Dilution of ownership |

| – Signal of company health | – Market perception |

| – Improved affordability | – Administration and regulatory requirements |

Before we jump to understand bonus issues vs stock splits, let us also see the meaning of stock splits.

What is a Stock Split?

A stock split in India is when a company splits its existing shares into multiple shares, but, at the same time, adjusts the face value of the shares.

Unlike a bonus issue, where shares are given for free, in a stock split, the number of shares increases, but the share price decreases proportionally.

In a stock split, the company splits its shares into smaller units to make them more accessible for investors.

However, the total value of your investment remains the same.

Example of a Stock Split

Suppose you own 100 shares of a company trading at ₹100 per share, and the company announces a 2-for-1 stock split. This means for every share you own, you’ll receive an additional share, and the face value of each share will reduce accordingly.

So, after the split, you’ll have 200 shares, but the face value per share will be ₹50.

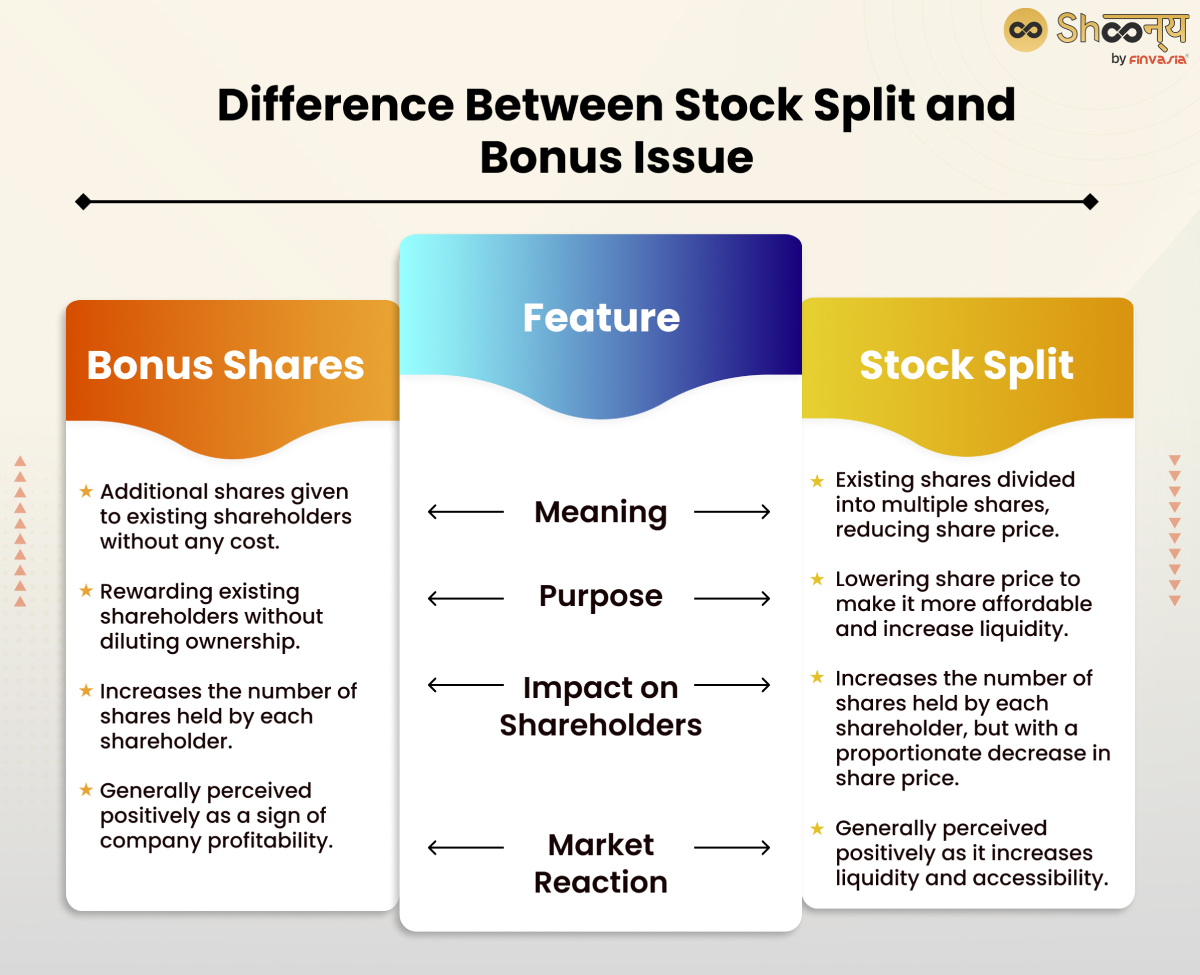

Difference Between Stock Split and Bonus Issue

| Feature | Bonus Shares | Stock Split |

| Meaning | Additional shares are given to existing shareholders without any cost. | Existing shares are divided into multiple shares, reducing the share price. |

| Purpose | Rewarding existing shareholders without diluting ownership. | Lowering the share price to make it more affordable and increase liquidity. |

| Impact on Shareholders | Increases the number of shares held by each shareholder. | Increases the number of shares held by each shareholder, but with a proportionate decrease in share price. |

| Market Reaction | Generally perceived positively as a sign of company profitability. | Generally perceived positively as it increases liquidity and accessibility. |

The main difference between a stock split and a bonus issue lies in their impact on the company’s share price and the face value of shares:

- Share Price: In a bonus issue, the share price usually increases because the total value of the company remains unchanged.

However, in a stock split, the share price decreases proportionally with the increase in the number of shares.

- Face Value: In a bonus issue, the face value of the shares remains the same.

However, in a stock split, the face value of each share decreases in proportion to the split ratio.

Bonus Shares:

- Shareholders receive additional shares for free.

- It rewards existing shareholders without diluting their ownership.

Stock Split:

- Existing shares are divided into multiple shares, reducing the share price.

- It makes the shares more affordable and increases liquidity.

Conclusion

Bonus issues and stock splits both aim to adjust a company’s share structure. But differ significantly in their approach and outcomes.

While bonus issues maintain the face value of shares and generally have a positive market perception, stock splits result in a proportional decrease in both share price and face value.

Understanding these key differences is crucial for investors to comprehend how these strategies affect their investments.

FAQs| Difference Between Stock Split and Bonus Issue

A bonus issue provides shareholders with extra shares for free, maintaining the same face value. Conversely, a stock split increases the number of shares, reducing the share price and face value proportionally.

A bonus issue occurs when a company rewards shareholders by distributing additional shares for free based on their existing shareholdings.

In a stock split, a company divides its current shares into more shares, thereby decreasing the share price to enhance accessibility without altering the company’s overall value.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.