Exploring the World of Brokers in the Stock Market: Types, Role, and Their Impact.

In the dynamic landscape of the Indian stock market, stockbrokers play a pivotal role. As financial market representatives, these experts facilitate transactions, provide market insights, and empower investors to navigate the complexities of stock trading. Let’s delve into the world of stockbrokers, from their historical origins to the role of brokers in the stock market and their evolving impact on the Indian investment landscape.

Brokers in the Stock Market: Who are They?

Imagine you’re at a big auction where people buy and sell things like rare toys and valuable artwork. Now, picture the stock market as a similar place, but instead of toys, people trade “stocks” or “shares” of companies.

A stock broker is like a helper at this auction. They assist you in buying or selling stocks in the stock market. They have access to the special area where all the trading takes place, called the stock exchange.

Different Types of Share Market Brokers

There are several types of brokers in stock market who facilitate buying and selling of securities. Here are the main types of brokers:

- Full-Service Brokers: These brokers offer a wide range of services, including research, advisory, portfolio management, and personalised assistance. They typically charge higher brokerage fees compared to other types of brokers due to the additional services they provide.

- Discount Brokers: Discount brokers offer trading services at a lower cost, often with a fixed brokerage fee or a very low percentage of the trade value. They provide a no-frills trading platform without the extensive research and advisory services offered by full-service brokers.

- Online Brokers: These brokers provide online trading platforms that allow investors to place orders, track their investments, and manage their portfolios electronically. Both full-service and discount brokers can fall under this category, but many discount brokers are specifically known for their online trading platforms.

- Traditional Brokers: Traditional brokers operate through physical offices and offer in-person assistance for trading and investment-related activities. While this model is becoming less common with the rise of online trading, some investors still prefer this personal touch.

- Bank-Based Brokers: Some large banks in India have their own brokerage arms. They offer trading services along with banking facilities, making it convenient for customers to manage their finances and investments in one place.

- Commodity Brokers: These brokers specialize in facilitating the trading of commodities such as gold, silver, agricultural products, and other raw materials in the commodity markets.

- Currency Brokers: Currency brokers focus on facilitating trading in foreign exchange (forex) markets, allowing investors to trade different currency pairs.

- Institutional Brokers: These brokers cater primarily to institutional investors such as mutual funds, insurance companies, and pension funds. They handle large volumes of trades and often provide customized solutions for their institutional clients.

- Retail Brokers: Retail brokers primarily serve individual retail investors. They offer services designed for small-scale investors who trade in relatively smaller quantities compared to institutional investors.

- Sub-Brokers: Sub-brokers are individuals or entities authorised by stockbrokers to provide trading services to clients. They operate under the umbrella of a main broker and earn a commission for the trades they execute.

Direct Market Access (DMA) Brokers: These brokers offer direct market access to clients, allowing them to place orders directly on the stock exchange’s trading platform. This can be beneficial for high-frequency traders and institutional investors who require faster execution and more control over their trades.

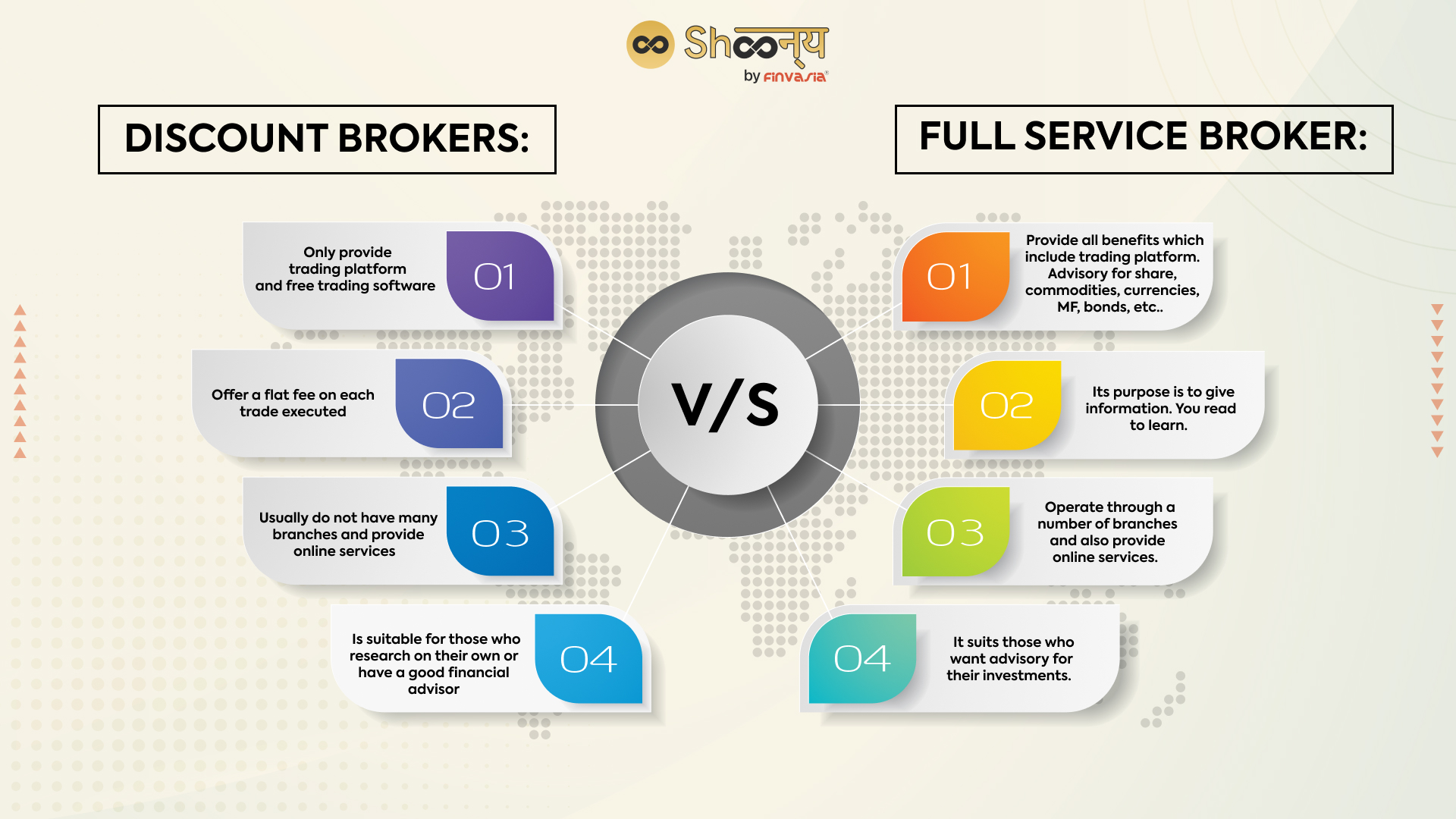

Discount Broker vs Full Service Broker

| Aspect | Discount Brokers | Full-Service Brokers |

| Services | Basic trading platform | Extensive services and research |

| Brokerage Fees | Low fixed fees or commissions | Higher brokerage fees |

| Research & Advice | Limited to none | Comprehensive research & advice |

| Personalized Support | Limited | Dedicated customer assistance |

| Trading Experience | Self-directed | Assisted trading and guidance |

| Investment Guidance | Limited | Professional investment advice |

| Portfolio Management | Usually not offered | Portfolio management services |

| Target Audience | Active traders and investors | Investors seeking guidance |

| Additional Services | Primarily online services | In-person and online services |

Exploring Other Broker Types

Outside the stock market, brokers operate in various industries. In real estate, brokers represent property sellers, determining values, listing properties, and advising on offers.

The Role of Brokers in the Stock Market

A stockbroker, often referred to simply as a broker, acts as an intermediary between investors and the securities market. Their primary responsibility involves executing buy and sell orders on behalf of clients. Investors rely on their expertise to make informed decisions in the stock market, benefiting from their deep understanding of market dynamics and trends.

Let’s take a quick look at the role of brokers in the stock market:

- Buying and Selling: Brokers are like helpers who assist people in buying and selling stocks (shares) of companies in the stock market.

- Middlemen: They act as middlemen between investors and the stock market. They connect buyers and sellers to make trading possible.

- Access to Stock Exchange: Brokers have special access to the stock exchange, which is like the marketplace for stocks. They can place orders to buy or sell stocks on behalf of investors.

- Order Placement: When you want to buy or sell stocks, you tell your broker what you want to do. They then place the order for you in the stock exchange.

- Executing Orders: Brokers ensure that your orders are placed correctly and at the right price. They make sure the transactions happen smoothly.

- Trading Platforms: Brokers provide online platforms where investors can log in to see their investments, place orders, and track their portfolio.

- Different Types: There are full-service brokers who offer a lot of help and advice, and discount brokers who focus more on the actual trading process.

- Fees: Brokers charge fees for their services. It’s important to understand the fees they charge before you start trading.

- Demat Account: Brokers help you open a “Demat” account, which holds your stocks electronically. It’s like a digital wallet for your shares.

Open a Free Demat Account Today!

- Safety and Regulations: Brokers work under regulations to ensure fair and safe trading in the stock market.

- Convenience: Brokers make it convenient for regular people to invest in stocks without needing to understand all the technical details of the stock market

Conclusion

Stockbrokers in the Indian market serve as indispensable guides for investors seeking to make informed decisions in the complex world of stocks. From traditional to discount brokers, their role has evolved, transforming the stock market into an accessible realm for various investors. Understanding the history, types, and impact of stockbrokers equips Indian investors with the insights they need to navigate the stock market with confidence.

FAQs| Brokers in Stock Market

There are two main types of stockbrokers in India: full-service brokers and discount brokers. Full-service brokers offer extensive services and advice, while discount brokers focus on low-cost trading with fewer services.

The four primary types of stocks to trade are common stocks, preferred stocks, growth stocks, and value stocks. Each type has different characteristics and potential for investors.

A broker in the Indian stock market is a person or firm that facilitates buying and selling of stocks on behalf of investors. They act as intermediaries between investors and the stock exchange.

A broker is an intermediary who helps investors buy and sell stocks in the indian stock market. There are different types of stock brokers, including full-service brokers who offer comprehensive services and discount brokers who focus on cost-effective trading.

Brokerage fees can vary depending on the type of broker and the services offered. Full-service brokers typically charge higher fees, while discount brokers often have lower fixed or zero fees or commissions.

Brokers make money through the fees they charge for their services. This can include brokerage fees, commissions on trades, and sometimes additional charges for specific services. You can always trading from zero commission online trading platforms in India.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.